Palm Oil Market

Palm Oil Market Size, Share & Trends Analysis Report by Nature (Organic and Conventional), by Product Type (Crude Palm Oil, Refined Bleached Deodorized (RBD) Palm Oil, Palm Kernel Oil, and Fractionated Palm Oil), and by End-User (Food & Beverage, Personal Care & Cosmetics, Biofuel & Energy, Pharmaceuticals, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Palm oils market is anticipated to grow at a considerable CAGR of 4.8% during the forecast period (2023-2030). The market is driven by exponentially growing demand from the food and beverage, pharmaceuticals, biofuel and energy, personal care, and cosmetics industries. The primary source of palm oil is the Elaeis guineensis tree, which is native to West and Southwest African coastal countries such as Angola, Gabon, Liberia, Sierra Leone, Nigeria, and others. It's been used in these areas for a long time. The production of palm oil is dominated by Indonesia and Malaysia, which together accounted for 85–90% of total palm oil produced. Indonesia is the largest palm oil producer as well as exporter. The country exports the product internationally. Indonesian smallholders are expected to double their production and manage 60% of the country’s oil palm plantation area by 2030. The Indonesia government also supports the cultivators of palm oil plant. It is a major source of income for small and medium scale producers in the region. The industry is majorly responsible for development and upliftment of the cultivators in the region.

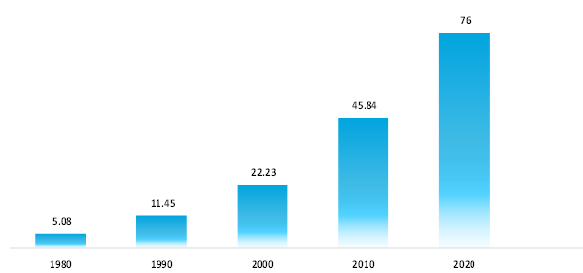

Global oil palm production in tons, 1980-2020 (Million Tons)

Source: Our World in Data

Segmental Outlook

The global palm oil market is segmented on the basis of nature, product type, and end-user. Based on the nature, the market is bifurcated into organic and conventional. Based on the product type, the market is sub-segmented into crude palm oil, RBD palm oil, palm kernel oil, and fractionated palm oil. Based on the end-user, the market is sub-segmented into food & beverage, personal care & cosmetics, biofuel & energy, pharmaceuticals, and others. Among the nature, organic sub-segment is anticipated to hold a considerable share of the market due to the increasing consumer awareness of the adverse impacts of agrochemicals used in conventional crop production on the environment and human health has increased demand for organic products.

Biofuel & Energy Sub-Segment is Anticipated to Hold a Considerable Share of the Global Palm Oil Market

Among the end-user, the biofuel and energy sub-segment is expected to hold a considerable share of the market and is further anticipated to grow at a considerable CAGR over the forecast period due rise in demand for biofuels across the geographies. In recent years, biodiesel has grown in favor among consumers as a viable alternative to diesel. In terms of feedstock, palm oil is promoted as the traditional feedstock for biodiesel production and is regarded as a more cost-effective option to soybean. Several laws and mandates that have been implemented in various countries are predicted to influence the market's end-user trend in the long run. For instance, in 2020 Indonesia implemented the B30 programme, which mandates fossil gasoil to be blended with 30% palm oil-based fuel. This mandate is anticipated to enhance the country's usage of palm oil. Similarly, France eliminated the biofuel tax, which would incline its economy towards biofuels or biodiesel.

Regional Outlook

The global palm oil market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, North America to hold a significant share of the global palm oils market. The escalating demand for palm oil to manufacture ice-creams, margarine, confectionary fats, non-dairy creamer and salad dressing is positively influencing the market growth.

Global Palm Oil Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Palm Oil Market

Among all regions, the Asia-Pacific region is expected to grow at a prominent CAGR over the forecast period, globally. Indonesia and Malaysia as the leading producer of palm oil in the region. This region has dominated the market for years due to several factors. First off, the environment in Asia-Pacific is ideal for cultivating oil palm, which needs a tropical region with high temperatures and frequent rain. Second, the area has a plentiful labor supply, particularly in rural regions, making it economical to grow extensive plantations. The governments in the area actively promote the palm oil sector with a range of incentives, subsidies, and regulations designed to encourage palm oil production and export. Indonesia produces more than 30 million tons of palm oil per year, generating 4.5% of its GDP and giving employment to 3 million people. The reason for Indonesia's higher production is due to its large land area, competitive labor cost and favorable climatic conditions. Additionally, Indonesia has been actively expanding its oil palm cultivation through land conversion and agricultural policies that support the industry. Moreover, the presence of key market players such as Kuala Lumpur Kepong Berhad and Kulim (Malaysia) Berhad within the Asia-Pacific region also boosts the market growth.

Market Players Outlook

The major companies serving the palm oils market include Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corp. Berhad, ADM, Kuala Lumpur Kepong Berhad, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2021, Kuala Lumpur Kepong Bhd (KLK) has completed its acquisition of a 56.2% stake in IJM Plantations Bhd (IJMP), thus making it a subsidiary of the KLK group.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global palm oil market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Wilmar International Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IOI Corp. Berhad

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sime Darby Plantation Berhad

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Palm Oil Market by Nature

4.1.1. Organic

4.1.2. Conventional

4.2. Global Palm Oil Market by Product Type

4.2.1. Crude Palm Oil

4.2.2. Refined Bleached Deodorized (RBD) Palm Oil

4.2.3. Palm Kernel Oil

4.2.4. Fractionated Palm Oil

4.3. Global Palm Oil Market by End-User

4.3.1. Food & Beverage

4.3.2. Personal Care & Cosmetics

4.3.3. Biofuel & Energy

4.3.4. Pharmaceuticals

4.3.5. Others (Industrial and Animal feed)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADM

6.2. Kuala Lumpur Kepong Berhad

6.3. United Plantations Berhad

6.4. Kulim (Malaysia) Berhad

6.5. IJM Corporation Berhad

6.6. PT Sampoerna Agro, Tbk

6.7. Univanich Palm Oil Public Company Ltd.

6.8. PT. Bakrie Sumatera Plantations tbk

6.9. Asian Agri

6.10. FUJI OIL CO., LTD.

6.11. PT Indofood Sukses Makmur Tbk

6.12. Boustead Holdings Berhad.

6.13. Siat Group

6.14. Golden Agri-Resources Ltd

6.15. Musim Mas

1. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022-2030 ($ MILLION)

2. GLOBAL ORGANIC PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CONVENTIONAL PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

5. GLOBAL CRUDE PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL RBD PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

8. GLOBAL PALM OIL FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL PALM OIL FOR PERSONAL CARE & COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL PALM OIL FOR BIOFUEL & ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL PALM OIL FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL PALM OIL FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN PALM OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

18. EUROPEAN PALM OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022-2030 ($ MILLION)

20. EUROPEAN PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

21. EUROPEAN PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

22. ASIA- PACIFIC PALM OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

26. REST OF THE WORLD PALM OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. REST OF THE WORLD PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY NATURE, 2022 VS 2030 (%)

2. GLOBAL ORGANIC PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL CONVENTIONAL PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022 VS 2030 (%)

5. GLOBAL CRUDE PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

6. GLOBAL RBD PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

7. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2022 VS 2030 (%)

8. GLOBAL PALM OIL FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL PALM OIL FOR PERSONAL CARE & COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL PALM OIL FOR BIOFUEL & ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL PALM OIL FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL PALM OIL FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

13. GLOBAL PALM OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

14. US PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

16. UK PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD PALM OIL MARKET SIZE, 2022-2030 ($ MILLION)