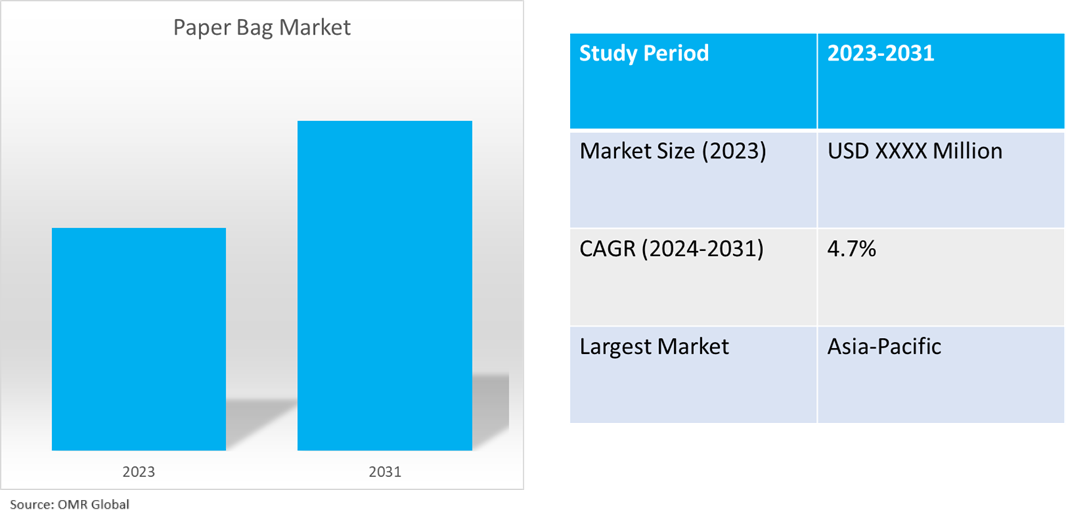

Paper Bag Market

Paper Bag Market Size, Share & Trends Analysis Report, by Material (Brown Kraft, White Kraft), by Product (Open Mouth, Pasted Valve, and Flat Bottom), and by Application (Pharmaceutical, Food and Confectionery, Consumer Goods, Agriculture, and Others) Forecast Period (2024-2031)

Paper bag market is anticipated to grow at a considerable CAGR of 4.7% during the forecast period (2024-2031). The paper bag industry is driven by increasing environmental awareness and government regulations against plastic usage. People are becoming more aware of the side effects of plastic bags, and thus are using paper bags. Stringent government regulations related to plastic bags are boosting the growth of the market. For instance, in the US, California, Thailand, Indonesia, China, and New York have banned single-use plastic bags. Further, India banned the manufacture, distribution, stocking, sale, and use of selected 19 single-use plastic items with effect from July 1, 2022. The ban covered plastic items like cutlery, straws, sticks, and thermocouples (only for decoration), while some single-use plastic items like carry bags and banners were regulated by the thickness of 120 microns and 100 microns, respectively.

Market Dynamics

Government Initiatives for promoting paper bags

Government initiatives in promoting the use of paper bags, coupled with numerous strategies such as partnership, initiatives, and collaboration, are adopted by key manufacturers including Amazon and DS Smith Plc. (UK), and AB Group Packaging drives the market growth in the UK. For instance, in October 2022, Amazon stopped packing products in single-use plastic delivery bags and switched to cardboard envelopes and recyclable paper bags in the UK for orders shipped from Amazon’s fulfillment centers. Amazon delivers the product to the customer in the manufacturer-supplied bag; this avoids the addition of unnecessary extra packaging, reduces the weight of outbound packaging per shipment by more than 38%, and eliminates more than 1.5 million tons of packaging material.

The e-commerce industry, which is expanding due to e-commerce operations by some crucial players such as Big Basket, Ondoor, Myntra, and others in India, is supporting the demand for paper bags. In October 2021, Myntra eliminated single-use plastic from its packaging as part of its commitment to sustainability. Customers receive orders in eco-friendly packaging, using shredded materials, paper tapes, and paper covers and boxes instead of bubble wraps, plastic cello tapes, and poly covers. Additionally, in June 2024, Oerlemans Plastics plans to use paper shipping bags, and stocks four sizes (S to XL) made from FSC brown kraft paper with a permanent adhesive strip. This extension of their product line supports e-commerce, retail, and industry businesses in adopting sustainable packaging.

Market Segmentation

- Based on the material type, the market is segmented into brown kraft and white kraft.

- Based on the product type, the market is segmented into open mouth, pasted valve, and flat bottom.

- Based on the application, the market is segmented into pharmaceuticals, food and, confectionery, consumer goods, agriculture, and others (hospitals, correction facilities).

Food and Confectionary is Projected to Hold the Largest Segment

The growing trend of sustainability has been the main driver of the paper bag market in the food and confectionary sector. With the rise of eco-consciousness, more and more consumers are opting for paper bags over plastic. Another factor driving the paper bag market in food and confectionary is convenience. Paper bags are much easier to carry and transport than plastic bags, making them ideal for the food and confectionary sector. They can easily be used to carry food and other items without taking up too much space, making them an ideal choice for restaurants, bakeries, and other food-related businesses. The increasing demand for custom paper bags is also driving the paper bag market in the food and confectionary sector. Businesses want to stand out and make an impression on their customers, and custom paper bags are the perfect way to do this. These bags can be tailored to include a business’s branding, logo, and other design elements and can be used to promote a business’s products and services. Adeera Packaging offers custom paper bags with a logo that businesses use for brand promotion. These bags are made up of durable materials, these paper bags offer both durability and style, making them ideal for a wide range of uses, like Restaurants, Retail & Groceries, Medical, Sweets Shop, Electronics, E-commerce, etc.

Open Mouth Paper Bag to Hold a Considerable Market Share

The paper bag market, specifically the open-mouth paper bag segment, has seen significant growth in recent years due to increasing demand for sustainable packaging options. Open-mouth paper bags are commonly used for packaging and transporting animal feed, fertilizer, and other agricultural products. These bags are easy to fill, stack, and transport, which makes them an ideal choice for farmers and agricultural suppliers. Similarly, in the food industry, open-mouth paper bags are used for packaging and transporting a variety of food products, including flour, sugar, and other dry goods. In the industrial sector, these bags are used for packaging and transporting a wide range of products, including chemicals and other industrial materials.

One major player in the open-mouth paper bag segment is International Paper Co., a global company that produces a wide range of paper products, including bags. The company offers a variety of open-mouth paper bags for different applications, such as multi-wall bags for cement and other building materials and valve bags for food products such as flour and sugar. Another major player in the open-mouth paper bag market is Smurfit Kappa, a leading producer of paper-based packaging. The company offers a range of open-mouth paper bags for various industries, including food, agriculture, and chemicals.

Regional Outlook

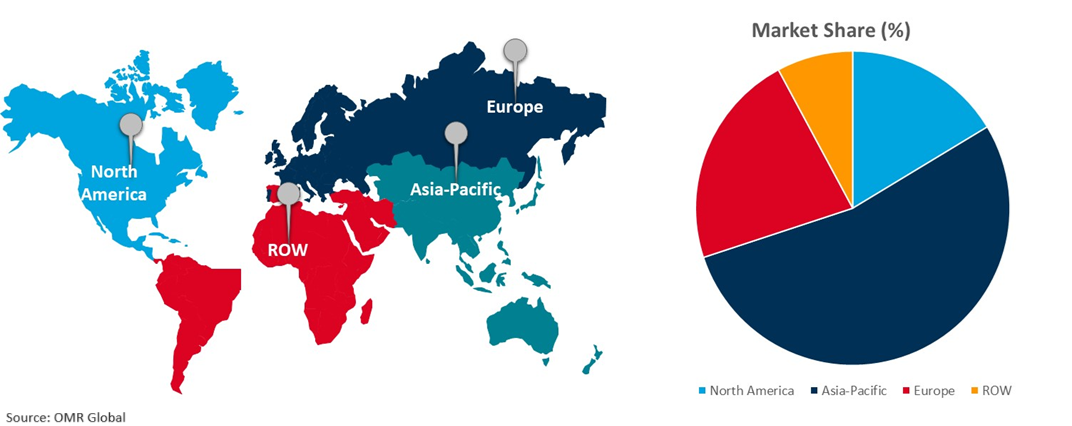

The global paper bag market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

Initiatives Toward Sustainability and Plastic Packaging Bans Drive Growth in Asia-Pacific

- Factors such as initiatives towards sustainability, initiatives to reduce carbon footprint, and plastic packaging ban policy are attributing the growth to the paper bags market during the forecast period. For instance, the Government of China launched a strategic plan in 2023 to build a zero-waste city. Moreover, public spaces in Shanghai are filled with pro-environmental media and slogans. Through this powerful pro-environmental publicity, consumers in Shanghai are therefore more involved in reducing plastic bag usage than consumers in Sanya and Yangzhou.

Global Paper Bag Market Growth by Region 2024-2031

Europe Holds Major Market Share

The European region is anticipated to hold a prominent share of the paper bag market owing to the increasing awareness among consumers about paper carrier bags as sustainable and efficient packaging, coupled with the reused and recycled properties offered by them, has created a demand for the paper bag market in the European region. According to Eurosac (European Federation of Multiwall Paper Sack Manufacturers) through a collaboration of Europe's leading kraft paper manufacturers and producers launched a paper bag platform and issued guidelines to ensure high-quality paper carrier bags. These guidelines detail the necessary parameters for resistance and durability, emphasizing that a high-quality bag should carry at least 6 kg and be reusable up to five times. They covered the selection of materials, the production process, and the importance of quality certification per European standard EN13590. By adhering to these guidelines, retailers can ensure product protection and enhance their sustainable brand image. Additionally, paper bags, made from sustainably sourced materials, serve as strong brand ambassadors.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global paper bag market include International Paper, Holmen, Mondi Plc., Smurfit Kappa Group Plc, and WestRock Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In March 2023, Valmet plans to deliver a TwinRoll wash press to Holmen Paper AB’s Braviken mill in Sweden, to enhance the separation between the thermomechanical pulp (TMP) mill and the paper machine, leading to a cleaner system, improved durability, and reduced chemical use.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the paper bag market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. International Paper Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Holmen AB

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mondi Plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Smurfit Kappa Group Plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. WestRock Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Paper Bag Market by Material Type

4.1.1. Brown Kraft

4.1.2. White Kraft

4.2. Global Paper Bag Market by Product Type

4.2.1. Open Mouth

4.2.2. Pasted Valve

4.2.3. Flat Bottom

4.3. Global Paper Bag Market by Application

4.3.1. Pharmaceutical

4.3.2. Food and Confectionery

4.3.3. Consumer Goods

4.3.4. Agriculture

4.3.5. Others (Hospitals, Correction Facilities)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AB Group Packaging

6.2. American Paper Bag

6.3. Baumann Paper

6.4. Flormartbags Exclusive Packaging SRL

6.5. Gilchrist Bag Manufacturing LLC

6.6. Grupo Consist, SA

6.7. Georgia-Pacific LLC.

6.8. Hotpack Global

6.9. Huhtamaki Oyj

6.10. Novolex

6.11. OJI Holding Corporation (Japan)

6.12. Paper Bag Manufacturer’s Inc.

6.13. PKBAG KURNIA

6.14. Ronpak, Inc.

6.15. United Bags, Inc.

1. Global Paper Bag Market Research and Analysis by Material Type, 2023-2031 ($ Million)

2. Global Brown Kraft Paper Bag Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global White Kraft Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Paper Bag Market Research And Analysis By Product Type, 2023-2031 ($ Million)

5. Global Open Mouth Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Pasted Valve Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Flat Bottom Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Paper Bag Market Research And Analysis By Application, 2023-2031 ($ Million)

9. Global Paper Bag For Pharmaceuticals Market Research And Analysis By Region, 2023-2031 ($ MILLION)

10. Global Bottled Paper Bag For Food And Confectionery Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Paper Bag For Agriculture Market Research And Analysis By Region, 2023-2031 ($ MILLION)

12. Global Paper Bag For Consumer Goods Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Paper Bag For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Paper Bag Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Paper Bag Market Research And Analysis By Product, 2023-2031 ($ Million)

17. North American Paper Bag Market Research And Analysis By Application, 2023-2031 ($ Million)

18. European Paper Bag Market Research And Analysis By Country, 2023-2031 ($ Million)

19. European Paper Bag Market Research And Analysis By Product, 2023-2031 ($ Million)

20. European Paper Bag Market Research And Analysis By Application, 2023-2031 ($ Million)

21. Asia-Pacific Paper Bag Market Research And Analysis By Country, 2023-2031 ($ Million)

22. Asia-Pacific Paper Bag Market Research And Analysis By Product, 2023-2031 ($ Million)

23. Asia-Pacific Paper Bag Market Research And Analysis By Application, 2023-2031 ($ Million)

24. Rest Of The World Paper Bag Market Research And Analysis By Region, 2023-2031 ($ Million)

25. Rest Of The World Paper Bag Market Research And Analysis By Product, 2023-2031 ($ Million)

26. Rest Of The World Paper Bag Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Paper Bag Market Research and Analysis by Product, 2023 Vs 2031 (%)

2. Global Brown Kraft Paper Bag Market Research and Analysis by Region, 2023 Vs 2031 (%)

3. Global White Kraft Paper Bag Market Research And Analysis by Region, 2023 Vs 2031 (%)

4. Global Paper Bag Market Research And Analysis By Product Type, 2023 Vs 2031 (%)

5. Global Open Mouth Paper Bag Market Research And Analysis By Region, 2023 Vs 2031 (%)

6. Global Pasted Valve Paper Bag Market Research And Analysis By Region, 2023 Vs 2031 (%)

7. Global Flat Bottom Paper Bag Market Research And Analysis By Region, 2023 Vs 2031 (%)

8. Global Paper Bag Market Research And Analysis By Application, 2023 Vs 2031 (%)

9. Global Paper Bag For Pharmaceuticals Market Research And Analysis By Region, 2023 Vs 2031 (%)

10. Global Bottled Paper Bag For Food And Confectionery Market Research And Analysis By Region, 2023 Vs 2031 (%)

11. Global Paper Bag For Agriculture Market Research And Analysis By Region, 2023 Vs 2031 (%)

12. Global Paper Bag For Consumer Goods Market Research And Analysis By Region, 2023 Vs 2031 (%)

13. Global Paper Bag For Other Application Market Research And Analysis By Region, 2023 Vs 2031 (%)

14. Global Paper Bag Market Share By Region, 2023 Vs 2031 (%)

15. US Paper Bag Market Size, 2023-2031 ($ Million)

16. Canada Paper Bag Market Size, 2023-2031 ($ Million)

17. UK Paper Bag Market Size, 2023-2031 ($ Million)

18. France Paper Bag Market Size, 2023-2031 ($ Million)

19. Germany Paper Bag Market Size, 2023-2031 ($ Million)

20. Italy Paper Bag Market Size, 2023-2031 ($ Million)

21. Spain Paper Bag Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Paper Bag Market Size, 2023-2031 ($ Million)

23. India Paper Bag Market Size, 2023-2031 ($ Million)

24. China Paper Bag Market Size, 2023-2031 ($ Million)

25. Japan Paper Bag Market Size, 2023-2031 ($ Million)

26. South Korea Paper Bag Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Paper Bag Market Size, 2023-2031 ($ Million)

28. Rest Of The World Paper Bag Market Size, 2023-2031 ($ Million)

29. Latin America Paper Bag Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Paper Bag Market Size, 2023-2031 ($ Million)