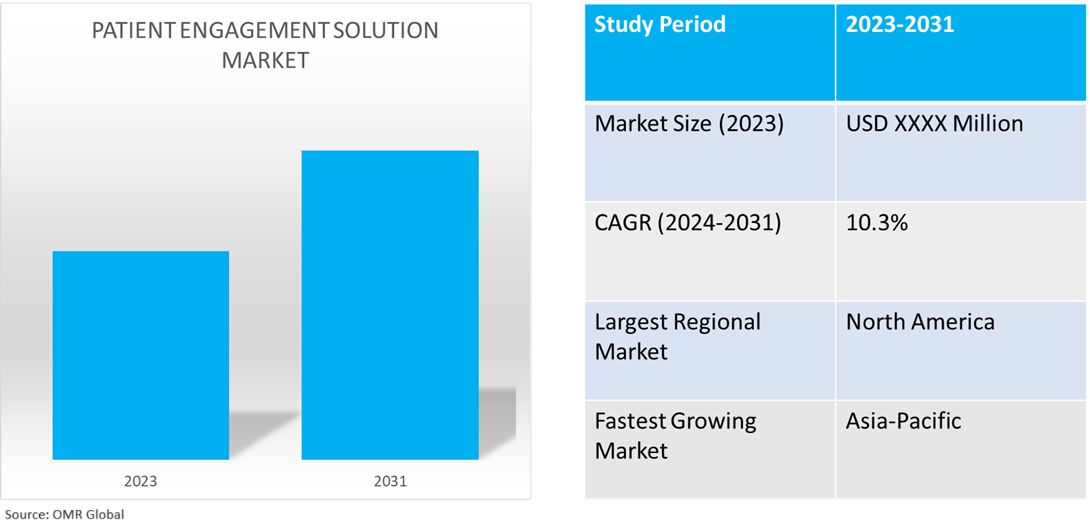

Patient Engagement Solutions Market

Patient Engagement Solution Market Size, Share & Trends Analysis Report by Delivery Mode (On-Premise, and Cloud), and by Application (Health Management, Home Health Management, Financial Health Management, and Social and Behavioral Management) Forecast Period (2024-2031)

Patient engagement solution market is anticipated to grow at a CAGR of 10.3% during the forecast period (2024-2031). The patient engagement solution includes a range of software, technologies, and solutions aimed at involving patients actively in their healthcare journey, fostering communication between patients and healthcare providers, and enhancing the overall patient experience and outcomes. The market growth is driven by a growing trend for virtual health and telemedicine, which includes remote consultation, constant efforts by healthcare providers to enhance disease management workflow, a shifting inclination towards value-based healthcare, and the increasing use of data analytics and related technologies to understand patient behavior in better way and preferences for more effective engagement strategies.

Market Dynamics

Rising Trend for Telehealth and Remote Consultation

The increasing demand for patient engagement solutions is driven by the widespread adoption of telehealth solutions among patients of all demographics and geographic locations. This trend has been significantly influenced by the post-pandemic shift in healthcare practices, prompting healthcare professionals and patients to transition to modern healthcare consultation and treatment solutions. Further, a variety of patient engagement solutions have been an enabler of the trend, including teleconsultation platforms, remote monitoring devices, patient portals, secure messaging, and communication tools, among others. For instance, according to the survey by National Survey Trends in Telehealth Utilization and Modality (2021–2022), the utilization of telehealth has changed since the significant increase during the early stages of the COVID-19 pandemic. During the study period from April 14, 2021, through August 2022, telehealth utilization was lower than earlier in the pandemic but remained above pre-pandemic levels. Throughout the study period, telehealth use rates ranged from 20.5% to 24.2%, with an average of 22.0% of adults reporting the use of telehealth in the last four weeks of the study. The lowest rates of telehealth use were observed among uninsured people (9.4%), young adults aged 18 to 24 (17.6%), and residents of the Midwest (18.7%). Conversely, the highest rates of telehealth visits were among those covered by Medicaid (28.3%).

Collective Advancement in Patient Engagement Solutions

The expansion of patient engagement solutions has been fueled by collective advancements in technology and service offerings. These include secure teleconsultation platforms, mobile apps for remote monitoring, integrated patient portals, behavioral analytics-based solutions, and wearable technology for real-time health data collection. Further, the innovations have empowered patients with convenient access to medical information, improved communication with healthcare providers, and enhanced care coordination, leading to better patient outcomes and satisfaction. As technology continues to evolve, these solutions are expected to further elevate the quality and accessibility of healthcare services globally. For instance, in March 2022, Uniphore, a prominent player in conversational automation, and SpinSci Technologies, a leading provider of digital patient engagement solutions, forged a strategic partnership to improve patients' interaction and involvement with healthcare providers. As per the agreement, Uniphore's conversational AI and automation technology will be incorporated into SpinSci's Patient Access Care solutions, which are seamlessly integrated with top electronic health records (EHR) systems. This collaboration aims to streamline operations for contact center agents and enhance self-service processes for patients.

Segmental Outlook

- Based on delivery mode, the market is segmented into on-premise and cloud.

- Based on application, the market is segmented into health management, home health management, financial health management, and social and behavioral management.

Cloud holds a Major Share Based on Delivery Mode

Cloud-based patient engagement solutions lead the market owing to their scalability, accessibility, and cost-efficiency. The segmental growth can be attributed to the growing demand for telehealth solutions, a lesser requirement for infrastructure deployment, flexibility and real-time data access, and advancements in integrated cloud-based patient engagement solutions. For instance, in March 2023, Fujitsu revealed the introduction of a fresh cloud-based platform that enables individuals to securely gather and utilize health-related information to drive digital innovation in the healthcare sector. This latest solution is a key component of Fujitsu's continuous endeavors to support the development of a thriving society in line with its "Healthy Living" vision within Fujitsu Uvance for establishing a sustainable environment.

Offline is the Preferred Patient Engagement Solution Application

The health management segment dominates within patient engagement solutions owing to its substantial impact on clinical outcomes and general health. It encompasses key areas such as monitoring chronic conditions, adhering to medication, and providing preventive care, all of which are crucial for improving patient health results. The segmental growth can be attributed to the growing demand for chronic disease management, the shift towards value-based care, and the rising trend for personalized healthcare management. Further, the focused approach of healthcare management resource optimization leads to better health results and cost savings compared to approaches that solely focus on home health, financial health, or social and behavioral management.

Regional Outlook

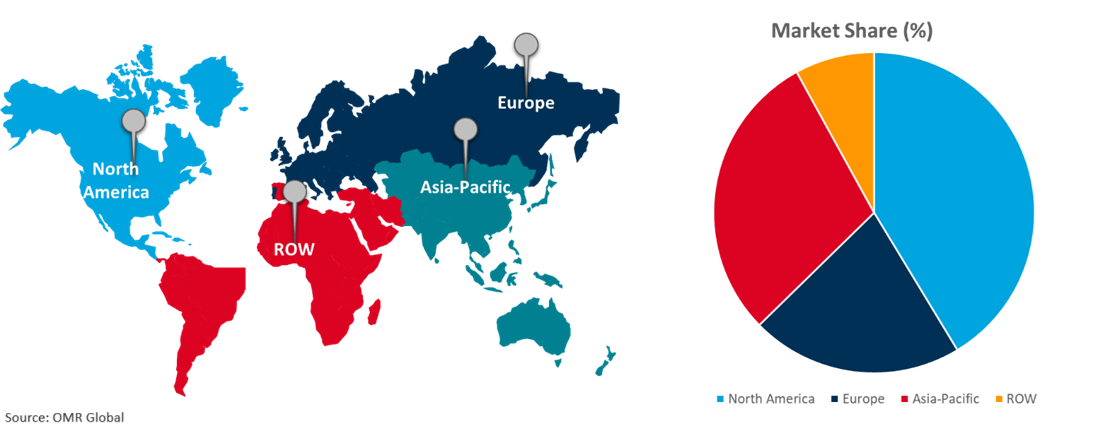

The global patient engagement solution market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Dominates the Global Patient Engagement Solution Market

North America is projected to dominate the patient engagement solution market in the future, attributed to the ongoing investment in modernizing healthcare infrastructure, the growing demand for telehealth services in the region, the rising investment in digitization of healthcare services, and the presence of major patient engagement solution providers such as Oracle, IBM, and Athenahealth, among others. For instance, in February 2022, the Health Resources and Services Administration (HRSA), under the Department of Health and Human Services (HHS), allocated close to $55.0 million to 29 HRSA-funded health centers. The purpose of this funding is to enhance healthcare access and improve quality for underserved communities by utilizing virtual care methods such as telehealth, remote patient monitoring, digital patient tools, and health information technology platforms. This financial support is an extension of the over $7.3 billion in funding from the American Rescue Plan that has been directed towards community health centers in the last year to address the effects of COVID-19.

Global Patient Engagement Solution Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Patient Engagement Solution Market

- The Asia-Pacific countries are extensively investing in solutions, services, and products promoting digital healthcare, such as remote monitoring devices, patient engagement suites, and AI-based automated response and feedback systems.

- The region is also one of the fastest-growing in terms of healthcare expenditures, with countries such as China, India, and Japan driving growth for the solution attributable to the aging population, chronic disease prevalence, and technological penetration.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global patient engagement solution market include Athena Health, Inc., McKesson Corp., and Oracle Corp., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in April 2024, Matrix Medical Network and Linkwell Health announced a partnership aimed at enhancing patient experience and increasing engagement with Matrix's services. In this collaboration, Linkwell Health will assist Matrix by providing omnichannel engagement journeys, anchored in behavioral science and powered by their activation platform, to encourage health plan members to take charge of their health.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global patient engagement solution market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Athena Health, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. McKesson Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Oracle Corp

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Patient Engagement Solutions Market by Delivery Mode

4.1.1. On-Premise

4.1.2. Cloud

4.2. Global Patient Engagement Solutions Market by Application

4.2.1. Health Management

4.2.2. Home Health Management

4.2.3. Financial Health Management

4.2.4. Social and Behavioral Management

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Abbott Laboratories

6.2. AbleTo, Inc.

6.3. Clarify Health Solutions, Inc.

6.4. Epic Systems Corp.

6.5. GetWellNetwork, Inc.

6.6. Kyruus, Inc.

6.7. Optum, Inc.

6.8. Press Ganey Associates LLC

6.9. IBM Corp.

6.10. Lincor, Inc.

6.11. Medecision

6.12. NXGN Management, LLC.

6.13. Oneview Healthcare

6.14. Orion Health Group Ltd.

6.15. Wolters Kluwer N.V.

1. Global Patient Engagement Solutions Market Research And Analysis By Delivery Mode, 2023-2031 ($ Million)

2. Global On-Premise Patient Engagement Solutions Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Cloud-Based Patient Engagement Solutions Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Patient Engagement Solutions Market Research And Analysis By Application, 2023-2031 ($ Million)

5. Global Patient Engagement Solutions In Health Management Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Patient Engagement Solutions In Home Health Management Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Patient Engagement Solutions In Financial Health Management Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Patient Engagement Solutions In Social And Behavioral Management Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Patient Engagement Solutions Market Research And Analysis By Region, 2023-2031 ($ Million)

10. North American Patient Engagement Solutions Market Research And Analysis By Country, 2023-2031 ($ Million)

11. North American Patient Engagement Solutions Market Research And Analysis By Delivery Mode, 2023-2031 ($ Million)

12. North American Patient Engagement Solutions Market Research And Analysis By Application, 2023-2031 ($ Million)

13. European Patient Engagement Solutions Market Research And Analysis By Country, 2023-2031 ($ Million)

14. European Patient Engagement Solutions Market Research And Analysis By Delivery Mode, 2023-2031 ($ Million)

15. European Patient Engagement Solutions Market Research And Analysis By Application, 2023-2031 ($ Million)

16. Asia-Pacific Patient Engagement Solutions Market Research And Analysis By Country, 2023-2031 ($ Million)

17. Asia-Pacific Patient Engagement Solutions Market Research And Analysis By Delivery Mode, 2023-2031 ($ Million)

18. Asia-Pacific Patient Engagement Solutions Market Research And Analysis By Application, 2023-2031 ($ Million)

19. Rest Of The World Patient Engagement Solutions Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Rest Of The World Patient Engagement Solutions Market Research And Analysis By Delivery Mode, 2023-2031 ($ Million)

21. Rest Of The World Patient Engagement Solutions Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Patient Engagement Solutions Market Share By Delivery Mode, 2023 Vs 2031 (%)

2. Global On-Premise Patient Engagement Solutions Market Share By Region, 2023 Vs 2031 (%)

3. Global Cloud Based Patient Engagement Solutions Market Share By Region, 2023 Vs 2031 (%)

4. Global Patient Engagement Solutions Market Share By Application, 2023 Vs 2031 (%)

5. Global Patient Engagement Solutions In Health Management Market Share By Region, 2023 Vs 2031 (%)

6. Global Patient Engagement Solutions In Home Health Management Market Share By Region, 2023 Vs 2031 (%)

7. Global Patient Engagement Solutions In Financial Health Management Market Share By Region, 2023 Vs 2031 (%)

8. Global Patient Engagement Solutions In Social And Behavioral Management Market Share By Region, 2023 Vs 2031 (%)

9. Global Patient Engagement Solutions Market Share By Region, 2023 Vs 2031 (%)

10. US Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

11. Canada Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

12. UK Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

13. France Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

14. Germany Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

15. Italy Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

16. Spain Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

17. Rest Of Europe Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

18. India Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

19. China Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

20. Japan Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

21. South Korea Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

22. Rest Of Asia-Pacific Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

23. Latin America Patient Engagement Solutions Market Size, 2023-2031 ($ Million)

24. Middle East And Africa Patient Engagement Solutions Market Size, 2023-2031 ($ Million)