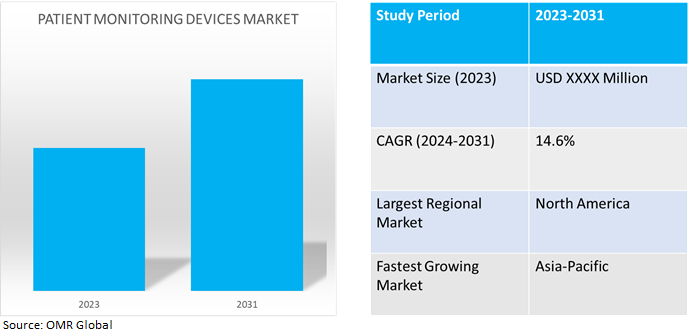

Patient Monitoring Devices Market

Patient Monitoring Devices Market Size, Share & Trends Analysis Report by Product (Blood Glucose Monitoring Systems, Cardiac Monitoring Devices, Multi-parameter Monitoring Devices., Respiratory Monitoring Devices, Temperature Monitoring Devices, Hemodynamic/Pressure Monitoring Devices, and Others).and by End-Users (Hospitals, Ambulatory Surgery Centers, Home Care Settings, and Others).Forecast Period (2024-2031).

Patient monitoring devices market is anticipated to grow at a significant CAGR of 14.6% during the forecast period (2024-2031).The growth of the patient monitoring devices market is attributed to the increasing demand for wireless monitoring devices and miniaturization and portability globally. Surgical treatment carried out within hospital or clinical confines requires the use of patient monitoring devices. The surgeon needs continuous access to the patient's vital signs to minimize the risk of an adverse event occurring during the procedure. Following an operation, a number of these similar monitoring devices are utilized by physicians, nurses, and other healthcare professionals to ensure a smooth post-operative recovery.

Market Dynamics

Data Analytics and Artificial Intelligence (AI)

Artificial intelligence (AI) in the healthcare sector evaluates large datasets, forecasts outcomes, and offers insightful information that helps physicians manage patients. It facilitates the automation of tedious processes, such as the processing of medical images, and aids in the identification of trends and connections in-patient data, which eventually results in more precise diagnoses and higher standards of care. Smart watches and biosensors are instances of wearable medical technology with AI/ML capabilities that continuously track a patient's vital signs, including blood pressure, glucose levels, and heart rate. Additionally, they can immediately inform patients and healthcare professionals of any abnormalities in real-time.

Increasing Integration with Smartphones and Apps

Devices for digital healthcare that reduce communication gaps between patients and clinicians. Apps for smartphones that track and produce vital data include oxygen levels and connected blood pressure devices. The majority of linked devices are designed with a variety of features, including high-resolution imaging and real-time monitoring. Thus, the patient's health is subsequently improved. Electronic medical records (EMRs), wearable technology, telehealth, telemedicine, and mobile health apps (mHealth) are all examples of the digital transformation in healthcare. The frequent use of mobile solutions, mobile apps, wearable technology, and wireless integration has made patient care more effective and creative.

Market Segmentation

Our in-depth analysis of the global patient monitoring devices market includes the following segments by product and end-users.

- Based on the product, the market is sub-segmented into blood glucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, and other (fetal & neonatal monitoring devices, weight monitoring devices).

- Based on end-users, the market is sub-segmented into hospitals, ambulatory surgery centers, home care settings, and others (clinics).

Blood Glucose Monitoring Systems is Projected to Emerge as the Largest Segment

Based on the product,the global patient monitoring devices market is sub-segmented into blood glucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, and other (fetal & neonatal monitoring devices, weight monitoring devices).Among these blood glucose monitoring systems sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the growing demand for continuous glucose monitoring (CGM)by offering a less invasive and more convenient approach compared to traditional finger-stick methods. For instance, in May 2022, Abbott announced USFDA cleared its next-generation FreeStyle Libre 3 system for use by people four years and older living with diabetes. The FreeStyle Libre 3 system is the most accurate 14-day continuous glucose monitor (CGM) with readings sent directly to a smartphone every minute.

Hospitals Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global patient monitoring devices market is sub-segmented into hospitals, ambulatory surgery centers, home care settings, and others (clinics).Among these, the hospitals sub-segment is expected to hold a considerable share of the market. With the growing demand for real-time health monitoring systems in hospitals for remote medical care, the IoT can provide efficient data connections from multiple locations. For instance, in October 2021, Honeywell introduced a real-time health monitoring system (RTHMS), a smart edge-to-cloud communication platform for remote and real-time monitoring of patients that acts as a bridge between caregiver and patient. By digitizing and automating critical tasks, RTHMS can reduce hospital administrative tasks by 35.0%.

Regional Outlook

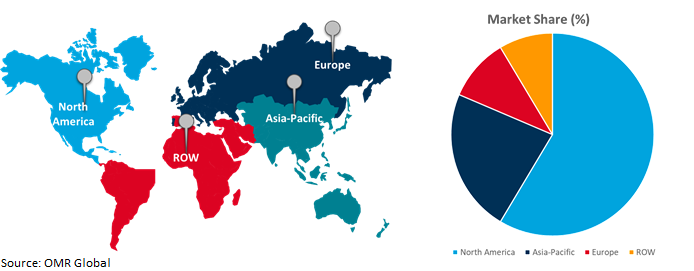

The global patient monitoring devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Patient Monitoring Devices Adoption in Asia-Pacific

- The regional growth is attributed to the increasing lygrowing numbers of aging people who are more likely to develop chronic illnesses, and rising disposable incomes encouraging the use of monitoring devices.

- The increasing number of blood glucose patients in the region drives the demand for patient monitoring devices. According to the World Health Organization Report 2022, In Asia-Pacific, about 227 million people live with type 2 diabetes and about half of them are undiagnosed and unaware.

Global Patient Monitoring Devices Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and patient monitoring device providers such as GE Healthcare, Edward Lifesciences, Masimo Corp., Natus Medical, and others. The growth is attributed to the increasing aging population in the region driving the growth of patient monitoring devices in the region. According to the National Institute of Health (NIH), in May 2023, demand for healthcare is rapidly increasing due to the aging population in the US. As of 2021, approximately 54.0 million Americans are over the age of 65. This number is expected to increase to 85.7 million by 2050.Furthermore, the Government in the region increasing healthcare access and quality for underserved populations through virtual care such as telehealth, remote patient monitoring, digital patient tools, and health information technology platforms.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global patient monitoring devices market include Abbott Laboratories, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Medtronic plc, and Siemens Healthineers among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2022, GE Healthcare and AMC Health collaborated for remote patient monitoring to provide patients with chronic and post-acute care in the home. The combination of GE Healthcare’s acute patient monitoring capabilities in the hospital setting, along with AMC Health’s expertise in RPM solutions leveraging an FDA Class II 510(k)-cleared platform with analytics.

Recent Development

- In September 2021, Tabula Rasa launched the Remote Patient Monitoring Service, which uses biosensors and artificial intelligence to monitor patients’ vital signs and alert healthcare providers if necessary. Patients receive a monitoring device and biosensors, like thermometers, oximeters, and blood pressure machines when they sign up for the service.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global patient monitoring devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Koninklijke Philips N.V.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Medtronic plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Patient Monitoring Devices Market by Product

4.1.1. Blood Glucose Monitoring Systems

4.1.2. Cardiac Monitoring Devices

4.1.3. Multi-parameter Monitoring Devices.

4.1.4. Respiratory Monitoring Devices

4.1.5. Temperature Monitoring Devices

4.1.6. Hemodynamic/Pressure Monitoring Devices

4.1.7. Other (Fetal & Neonatal Monitoring Devices, Weight Monitoring Devices)

4.2. Global Patient Monitoring Devices Market by End-Users

4.2.1. Hospitals

4.2.2. Ambulatory Surgery Centers

4.2.3. Home Care Settings

4.2.4. Others (Clinics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Baxter International Inc.

6.2. Becton, Dickinson, and Company

6.3. Boston Scientific Corp.

6.4. Criticare Systems, Inc.

6.5. Drägerwerk AG & Co. KGaA

6.6. Edwards Lifesciences Corp.

6.7. GE HealthCare Technologies Inc.

6.8. Hill-Rom Holdings, Inc.

6.9. LivaNova, PLC

6.10. Masimo Corp.

6.11. Mindray Medical International Ltd.

6.12. Natus Medical Inc.

6.13. Nihon Kohden Corp.

6.14. Nonin Medical, Inc.

6.15. OMRON Healthcare Co., Ltd.

6.16. OSI Systems, Inc.

6.17. Siemens Healthineers

6.18. Smiths Medical, Inc.

1. GLOBAL PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL PATIENT BLOOD GLUCOSE MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PATIENT CARDIAC MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PATIENT MULTI-PARAMETER MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PATIENT RESPIRATORY MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PATIENT TEMPERATURE MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PATIENT HEMODYNAMIC/PRESSURE MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER PATIENT MONITORING DEVICES PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

10. GLOBAL PATIENT MONITORING DEVICES FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PATIENT MONITORING DEVICES FOR AMBULATORY SURGERY CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PATIENT MONITORING DEVICES FOR HOME CARE SETTINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PATIENT MONITORING DEVICES FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. NORTH AMERICAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

18. EUROPEAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

24. REST OF THE WORLD PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. REST OF THE WORLD PATIENT MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL PATIENT MONITORING DEVICES MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL PATIENT BLOOD GLUCOSE MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PATIENT CARDIAC MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PATIENT MULTI-PARAMETER MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PATIENT RESPIRATORY MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PATIENT TEMPERATURE MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PATIENT HEMODYNAMIC/PRESSURE MONITORING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHER PATIENT MONITORING DEVICES PRODUCT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PATIENT MONITORING DEVICES MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

10. GLOBAL PATIENT MONITORING DEVICES FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PATIENT MONITORING DEVICES FOR AMBULATORY SURGERY CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PATIENT MONITORING DEVICES FOR HOME CARE SETTINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PATIENT MONITORING DEVICES FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

16. UK PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA PATIENT MONITORING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)