Peptide Therapeutics Market

Global Peptide Therapeutics Market Size, Share & Trends Analysis Report by Route of Administration (Oral and Parenteral), by Application (Cancer, Gastrointestinal Disorders, Central Nervous System Disorders, Respiratory Disorders, and Others), Forecast 2020-2026 Update Available - Forecast 2025-2031

The global peptide therapeutics market is projected to grow at a significant CAGR of around 9.0% during the forecast period. Peptides are composed of short chains of amino acid monomers linked together via peptide bonds and occur naturally in the human body. Peptides are very specific in activity when compared to small molecules when used as a drug candidate. Generally having fewer side effects, peptides have become popular candidates for drug design. During the past decade, peptides have gained a wide range of applications in medicine and biotechnology, and therapeutic peptide research is also currently experiencing a renaissance for commercial reasons.

The primary factor that drives the growth of the market include the incidences of cancer along with other metabolic disorders across the globe. Additionally, the rising demand for cost-efficient and effective drugs, along with the rapid R&D activities in order to manufacture novel drugs for the treatment are also likely to contribute to the growth of the market during the forecast period.

However, limitations linked with the peptides, inadequate resources, and stringent regulations by the government are some of the factors that may challenge the growth of the market during the forecast period. Nevertheless, the presence of the key players continuously contributing to the growth of the market along with numerous government initiatives to successfully detect and treat cancer, which is providing opportunities for the growth of the market growth.

Segmental Outlook

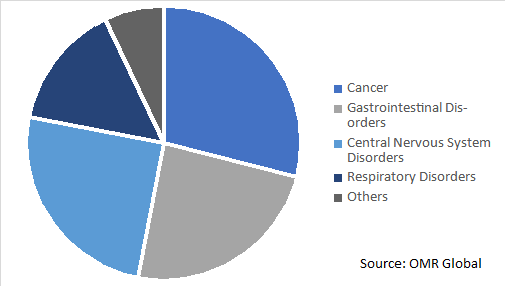

The global peptide therapeutics market is segmented on the basis of route of administration and application. Based on the route of administration, the market is bifurcated into oral and parenteral. Based on the application, the market is segmented into cancer, gastrointestinal disorders, central nervous system disorders, respiratory disorders, and others. Peptide therapeutics for cancer tend to contribute a considerable share to the market growth.

Global Peptide Therapeutics Market, by Segment 2019 (%)

Cancer Segment to Contribute Considerably to the Market Growth

Amongst the application segment of the market, cancer is projected to be a major shareholding segment. The segmental growth of the market is attributed to the increased incidence of cancer across the globe and cancer is the leading cause of mortality in both developed as well as developing countries. Further, governments and private investments in R&D of cancer treatment, and reduction in the cost of treatment are some other factors that drive the segmental growth of the market during the forecast period. The increasing cases of cancer coupled with the increasing prescription of peptide therapeutics for the treatment of cancer gives a boost to the segmental growth of the market.

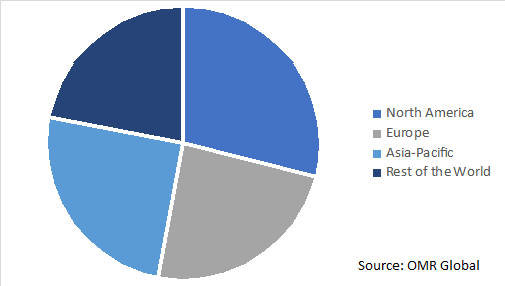

Regional Outlook

The global peptide therapeutics market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is estimated to contribute significantly to the market during the forecast period. The growth of the region is backed by several factors including the presence of advanced healthcare infrastructure in the region. Further, the presence of the key players, increasing prevalence of cancer, and the adoption of technologically advanced products in countries such as the US and Canada further give a boost to the regional growth of the market.

According to the American Cancer Society in 2017, it was estimated that there were 600,920 cancer deaths in the US. The Asia Pacific is projected to exhibit the fastest growth in the global peptide therapeutics market over the forecast period. This is mainly attributed to the developing healthcare infrastructure along with the increasing medical tourism in the economies such as India.

Global Peptide Therapeutics Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global peptide therapeutics market include Amgen Inc., Eli Lilly and Co., Pfizer, Inc., Bristol-Myer Squibb Co., AstraZeneca Plc, F. Hoffmann-La Roche Ltd., GlaxoSmithKline Plc, Merck & Co. Inc., Novartis International AG, Novo Nordisk A/S, Takeda Pharmaceutical Co. Ltd., Teva Pharmaceuticals Industries Ltd., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global Peptide Therapeutics market. For instance, in September 2018, Merck & IRBM signed a new agreement in the peptide therapeutics area, continuing their long-standing history of collaboration that began in 2010.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global peptide therapeutics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Amgen Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Eli Lilly and Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Pfizer Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Bristol-Myers Squibb Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Peptide Therapeutics Market by Route of Administration

5.1.1. Oral

5.1.2. Parenteral

5.2. Global Peptide Therapeutics Market by Application

5.2.1. Cancer

5.2.2. Gastrointestinal Disorders

5.2.3. Central Nervous System Disorders

5.2.4. Respiratory Disorders

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amgen, Inc.

7.2. AstraZeneca Plc

7.3. Bachem Holding AG

7.4. Bristol-Myers Squibb Co.

7.5. CordenPharma InternationalGmbH

7.6. Eli Lilly and Co.

7.7. F. Hoffmann-La Roche Ltd.

7.8. GlaxoSmithKline Plc

7.9. Lonza Group AG

7.10. Merck & Co. Inc.

7.11. Novartis International AG

7.12. Novo Nordisk A/S

7.13. Pfizer, Inc.

7.14. PolyPeptide Group

7.15. Sanofi SA

7.16. Takeda Pharmaceutical Co. Ltd.

7.17. Teva Pharmaceuticals Industries Ltd.

7.18. Xenetic Biosciences, Inc.

1. GLOBAL PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

2. GLOBAL PEPTIDE THERAPEUTICS VIA ORAL ROUTE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PEPTIDE THERAPEUTICS VIA PARENTERAL ROUTE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL PEPTIDE THERAPEUTICS FOR CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PEPTIDE THERAPEUTICS FOR GASTROINTESTINAL DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL PEPTIDE THERAPEUTICS FOR CENTRAL NERVOUS SYSTEM DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PEPTIDE THERAPEUTICS FOR RESPIRATORY DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL PEPTIDE THERAPEUTICS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

13. NORTH AMERICAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

16. EUROPEAN PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

21. REST OF THE WORLD PEPTIDE THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL PEPTIDE THERAPEUTICS MARKET SHARE BY ROUTE OF ADMINISTRATION, 2019 VS 2026 (%)

2. GLOBAL PEPTIDE THERAPEUTICS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL PEPTIDE THERAPEUTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD PEPTIDE THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)