Perfluoropolyether Market

Perfluoropolyether Market Size, Share & Trends Analysis Report by Product (Pfpe-K, Pfpe-M, Pfpe-Z, Pfpe-Y, Pfpe-D), by Type (Oil, Grease), and by End-User (Automotive, Aerospace, Electronics, Chemicals & Petrochemical, Food Processing, Metal Processing, Medical Industry Equipment, Power Generation, Textile, Pulp and Paper, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Perfluoropolyether market is anticipated to grow at a significant CAGR of 6.7% during the forecast period. The rise in strong automobile industry expansion is boosting the demand for high-quality oils & greases, as it improves vehicle performance, and lowers total maintenance costs. These synthetic perfluoropolyether (PFPE) lubricants perform better than other lubrication. They prevent part failure in extreme conditions, increase service life of critical components, and reduce noise, vibration, and harshness (NVH) issues throughout the vehicle assemblies. Also, rising middle class income and a huge youth population will result in strong demand which will increase the demand for automobiles and hence fuels the demand for perfluoropolyether.

According to India Brand Equity Foundation (IBEF) latest report, automobile exports have reached 4.13 million vehicles in financial year 2021, growing at a CAGR of 3.47% during financial year 2016-2021. Two wheelers (79.38%), passenger vehicles (9.79%) and three wheelers (9.52%) made up the majority of exports from India, also around 3680 premium motorcycles were sold in India in the year 2021. Also according to the Observatory of Economic Complexity report, in 2020, cars were the world's 2nd most traded product, with a total trade of $645B. In 2020 the top importers of cars were US ($144B), Germany ($68.9B), China ($42B), France ($35.5B), and United Kingdom ($32.8B)

Segmental Outlook

The global perfluoropolyether market is segmented based on product, type and end-user. Based on product, the market is segmented into Pfpe-K, Pfpe-M, Pfpe-Z, Pfpe-Y, Pfpe-D . Based on type, the market is sub-segmented into oil, and grease. Based on end-user the market is segmented into automotive, aerospace, electronics, chemicals & petrochemical, food processing, metal processing, medical industry equipment, power generation, textile, pulp and paper, and others. The above mentioned segments can be customized as per the requirements. Based on product the type the PFPE-K is anticipated to grow at the fastest rate during the forecast period. PFPE-K offers cost-effectiveness and provides better film strength and shielding properties, enhancing wear prevention under heavier loads; these are the key factors augmenting the PFPE-K market share. These lubricants are widely used for gears, slides, and bearing applications when high temperature and compatibility with plastics are required.

The Oil Segment is Expected to hold the Significant Share in the Global Perfluoropolyether Market during the Forecast Period.

Based on type the oil segment is anticipated to hold a significant share in the global perfluoropolyether market during the forecast period owing to the rapidly expanding automotive industry and the growing knowledge about the use of high-performance lubricating oil in various engine oil applications. As lubricating oil increases the fuel efficiency and also lowers the viscosity of engines as lower viscosity oils can help reduce friction and so can boost fuel economy is boosting the demand for oil, due to which it is demanded in several industries. Furthermore, oil performs a important role in curbing the temperature of machinery during operation and helps in reducing the maintenance cost of engines too. Also, technological advancements have enabled manufacturers to design premium automobiles that encourage the use of synthetic lubricating oils in engines, which show healthy growth opportunities for perfluoropolyether. According to the European Automobile Manufacturers’ Association (ACEA) latest data in 2021, 79.1 million motor vehicles were produced across the globe, an increase of 1.3% compared to 2020. Which shows the increasing trend of automobiles across the globe and further boosting the demand for perfluoropolyether in the market as the automobile industries will need these lubricants to use in the vehicles for various applications.

In addition, according to the Observatory of Economic Complexity (OEC) report of 2020,lubricating products ranks 30th in the Product Complexity Index (PCI). In 2020 the top importers of lubricating products were China with ($1.6B), Germany ($556M), Mexico ($307M), Russia ($282M), and Canada ($272M) and the main exporters of these lubricant products were US ($1.36B), Japan ($999M), France ($755M), and Netherlands ($473M). These strong factors shows the increasing trend for oil lubricants in the forecast period across the globe.

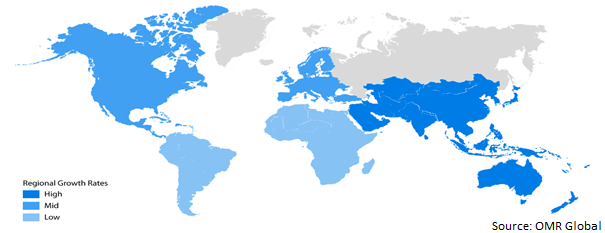

Regional Outlooks

The global perfluoropolyether market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to grow at the fastest rate duing the forecast period, owing to presence of huge well established aerospace industry and the growing investments there by Canada and the US in the aerospace sector in the region, which will create the demand for PFPE based oils & greases lubricants. It is also a significant reason that fuels aerospace applications demand for high-performance oils and lubricants, that offer a wide range of temperature & weather resistance properties. According to Aerospace Industries Association of Canada, the Canada government has decided to invest around $2 billion in aerospace industry, Canadian aerospace industry contributed over $24 billion in GDP and close to 200,000 jobs to the Canadian economy in 2021.

In addition, according to International Trade Administration (ITA), Canada remains one of the world’s largest aerospace markets and ranks first for civil flight simulator production, third in civil engine production, and fourth in civil aircraft production. Approximately 80% of Canada’s aerospace sector is civil oriented, and 20% is military oriented. Montréal is the world’s third largest aerospace hub after Seattle, Washington and Toulouse, France. In 2020 Canada aerospace production data shows total exports of 11,229 compared to 10,696 in 2019. These factors shows the increasing aerospace industry which further boost the demand for perfluoropolyether during the forecast period.

Global Perfluoropolyether Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Perfluoropolyether Market during the Forecast Period.

The Asia-Pacific region is anticipated to hold a considerable share in the global perfluoropolyether market during the forecast period, owing to the growing manufacturing sector and end use industries like electronics, chemical and others is fuelling the market. Lubricants are used to grease electronic gadgets such as computer hard drives and music center volume controls and others.

Lubricants are also used in conveyor and chain-driven machinery which helps the delicate electronic parts to function properly also especially those that create high temperatures during operating peaks. Manufacturers require a permanent lubricant for moving parts in sealed package devices such as DVD players, cell phones, digital cameras and camcorders and others to keep them functioning properly.

According to the Observatory of Economic Complexity (OEC), latest report 2021, import origins of electronic devices to Germany were mainly China (€5.73B), Taiwan (€3.37B), Malaysia (€3.07B), Japan (€2.05B). This shows that the manufacturing industry of electronics in Asia is increasing as most of the electronic devices import for Germany is from Asia-Pacific region, which further increasing the demand for perfluoropolyether across the Asia-Pacific region.

Market Players Outlook

The major companies serving the global perfluoropolyether market include Daikin Industries, Ltd., The Dow Chemical Co., DuPont de Nemours, Inc., ACG Group, The Chemours Company LLC and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance,

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global perfluoropolyether market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Daikin Industries, Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. The Dow Chemical Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. DuPont de Nemours, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. ACG Group

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. The Chemours Company LLC

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Perfluoropolyether Market by Product

4.1.1. PFPE-K

4.1.2. PFPE-M

4.1.3. PFPE-Z

4.1.4. PFPE-Y

4.1.5. PFPE-D

4.2. Global Perfluoropolyether Market by Type

4.2.1. Oil

4.2.2. Grease

4.3. Global Perfluoropolyether Market by End-Use

4.3.1. Automotive

4.3.2. Aerospace

4.3.3. Electronics

4.3.4. Chemicals & Petrochemical

4.3.5. Food Processing

4.3.6. Metal Processing

4.3.7. Medical Industry Equipment

4.3.8. Power Generation

4.3.9. Textile

4.3.10. Pulp and Paper

4.3.11. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Corning Inc.

6.2. ECCO Gleittechnik GmbH

6.3. FluoroTech USA

6.4. Halocarbon, LLC

6.5. HUSK-ITT Corp.

6.6. IKV Tribology Ltd.

6.7. LUBRILOG SAS

6.8. M&I Materials Ltd.

6.9. Metalubgroup

6.10. Miller-Stephenson, Inc.

6.11. Setral Chemie GmbH

6.12. The Solvay Group

6.13. Whitmore Manufacturing LLC

1. GLOBAL PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL PFPE-K PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PFPE-M PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL PFPE-Z PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL PFPE-Y PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL PFPE-D PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

8. GLOBAL OIL PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL GREASE PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

11. GLOBAL PERFLUOROPOLYETHER FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL PERFLUOROPOLYETHER FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL PERFLUOROPOLYETHER FOR ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL PERFLUOROPOLYETHER FOR CHEMICALS & PETROCHEMICALMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL PERFLUOROPOLYETHER FOR FOOD PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL PERFLUOROPOLYETHER FOR METAL PROCESSINGMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL PERFLUOROPOLYETHER FOR MEDICAL INDUSTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL PERFLUOROPOLYETHER FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL PERFLUOROPOLYETHER FOR TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL PERFLUOROPOLYETHER FOR PULP AND PAPER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL PERFLUOROPOLYETHER FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

23. NORTH AMERICAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. NORTH AMERICAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

25. NORTH AMERICAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

26. NORTH AMERICAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

27. EUROPEAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. EUROPEAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

29. EUROPEAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

30. EUROPEAN PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

33. ASIA-PACIFIC PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

34. ASIA-PACIFIC PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

36. REST OF THE WORLD PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

37. REST OF THE WORLD PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

38. REST OF THE WORLD PERFLUOROPOLYETHER MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. GLOBAL PERFLUOROPOLYETHER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL PFPE-K PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL PFPE-M PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL PFPE-Z PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL PFPE-Y PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL PFPE-D PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL PERFLUOROPOLYETHER MARKET SHARE BY TYPE, 2021 VS 2028 (%)

8. GLOBAL OIL PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL GREASE PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL PERFLUOROPOLYETHER MARKET SHARE BY END-USE, 2021 VS 2028 (%)

11. GLOBAL PERFLUOROPOLYETHER FOR AUTOMOTIVE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL PERFLUOROPOLYETHER FOR AEROSPACE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL PERFLUOROPOLYETHER FOR ELECTRONICSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL PERFLUOROPOLYETHER FOR CHEMICALS & PETROCHEMICALMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL PERFLUOROPOLYETHER FOR FOOD PROCESSINGMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL PERFLUOROPOLYETHER FOR METAL PROCESSINGMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL PERFLUOROPOLYETHER FOR MEDICAL INDUSTRY EQUIPMENTMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL PERFLUOROPOLYETHER FOR POWER GENERATIONMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL PERFLUOROPOLYETHER FOR TEXTILEMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL PERFLUOROPOLYETHER FOR PULP AND PAPERMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL PERFLUOROPOLYETHER FOR OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22. GLOBAL PERFLUOROPOLYETHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

23. US PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

24. CANADA PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

25. UK PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

26. FRANCE PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

27. GERMANY PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

28. ITALY PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

29. SPAIN PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF EUROPE PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

31. INDIA PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

32. CHINA PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

33. JAPAN PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

34. SOUTH KOREA PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF ASIA-PACIFIC PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF THE WORLD PERFLUOROPOLYETHER MARKET SIZE, 2021-2028 ($ MILLION)