Period Panties (Menstrual Underwear) Market

Period Panties (Menstrual Underwear) Market Size, Share & Trends Analysis Report by Style (Boy Short, Bikini, Brief, Hipsters, Others), by Product Type (Reusable and Disposable), and by Distribution Channel (Retail Pharmacy, Hospital Pharmacy, E-commerce Channels, Brick & Mortar, Supermarket/Hypermarket) Forecast Period (2024-2031)

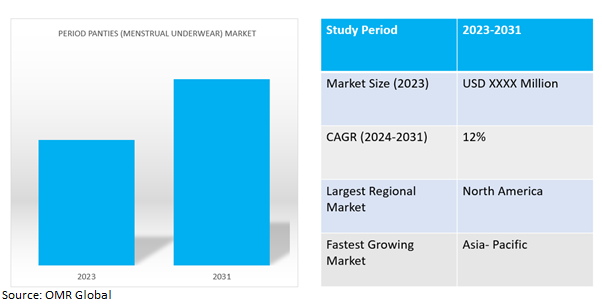

Period panties (menstrual underwear) market is anticipated to grow at a significant CAGR of 12.0% during the forecast period (2024-2031).Period panties, commonly referred to as menstrual underwear, serve women during their periods. They are crafted from absorbent materials that have moisture-wicking technology which guarantees that no leaks are experienced thus ensuring security. They are found in different dressing styles such as briefs and hipsters, some can be reused while others hence minimization of wastage when compared to disposable pads. For one to go for these types of underwear means opting for an easy mode of managing menses apart from being environmentally friendly.

Market Dynamics

A Sustainable Alternative to Traditional Menstrual Products

Period panties have gained immense popularity in recent years.These panties are made of soft, breathable fabrics that offer superior comfort compared to traditional menstrual products such aspads or tampons. They are designed to fit seamlessly and provide an all-day comfortable experience that eliminates the need for constant changes. Another advantage of period panties is that they are an eco-friendly choice as they reduce the waste generated from the disposal of pads or tampons. Period panties provide a safe alternative instead of pads and tampons which bring with them discomforts like chafing and leakages.

Increasing Awareness of using eco-friendly products

With the increasing environmental concerns there exist high demand for people prefer disposable products. There is a growing preference for sustainable menstrual products such as period pantiesasthey are cheaper and have a low carbon footprint. This is being accelerated by campaigns, education programs, and social media advocacy campaigns among others that are raising awareness on the significance of using such in protecting our environment; especially in reducing plastic pollution with disposables filling landfills or water bodies like oceans thereby posing danger to our marine life forms which are crucial for ecosystem balance. Due to their contribution towards pollution caused by plastics as well as overflowing garbage, many individuals have become more informed about how dangerous these items truly are when it comes to menstrual hygiene considering that it’s not only about waste but also about health issues.

Market Segmentation

Our in-depth analysis of the global period panties (menstrual underwear) market includes the following segments by style, product type, and distribution channel:

- Based on style, the market is sub-segmented into boy shorts, bikinis, briefs, hipsters, and others.

- Based on product type, the market is bifurcated into reusable and disposable.

- Based on distribution channels, the market is augmented into online and offline

Brief Segment to Exhibit considerable Growth

The growing demand for brief period paties is anticipated to drive the growth of this market segment. Looking towards the market demand, manufacturers are starting to use softer and more breathable fabrics like cotton and nylon, which consumers have been demanding for a while now. They're also adding some really cool design features like jacquard and lace designs, which make briefs both stylish and functional. And on top of that, some briefs are being developed with specific benefits like high waist control, which can provide shaping and support. All of this has led to an increase in demand for briefs, as people look for undergarments that are comfortable and also give them confidence.

Offline Stores Key Players in the Period Underwear Market

Offline distribution channelsdominates the market in 2022. These brick-and-mortar establishments are really important for consumers, offering a huge selection of brands and styles of period underwear. They allow customers to browse through various options before making a purchase, often with the help of knowledgeable staff who make the shopping experience more enjoyable. Supermarkets are especially good at driving sales by offering discounts and other incentives to customers. And it's really convenient for people to find period underwear alongside their everyday essentials. This kind of offline shopping experience is still really popular because it offers a wide range of products and the immediate gratification of in-person shopping. Plus, it gives brands the chance to showcase their products and build trust with consumers through strategic placement and promotion in stores.

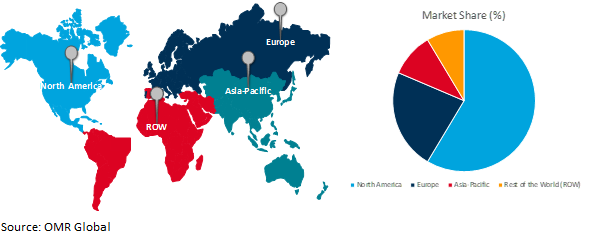

Regional Outlook

The global panties (menstrual underwear)market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to see rapid growth

- The rapid growth of innovative menstrual products in the Asia-Pacific region, driven by increasing education and changing cultural attitudes towards menstruation. The region's large population, especially in countries like China and India, presents a vast consumer base for menstrual hygiene products. Moreover, the growing middle class in many Asia-Pacific countries is driving demand for premium menstrual products such as period panties. It's exciting to see this progress towards better menstrual hygiene and more accessible products for women in the region.

- Japanese joint venture that has developed the world's first "smart" underwear for women's health. The underwear, developed by femtech startup Bé-A Japan and wearable device developer Mitsufuji, uses conductive fibers in the crotch to detect the amount of menstrual blood absorbed, which is then sent to the cloud via a compact transmitter and can be viewed on the wearer's smartphone. The product not only helps identify potential menstrual disorders but also aims to increase awareness about menstruation and change society's perception of it as a "women's problem." Bé-A Japan plans to start testing the panties to put the new technology to practical use next year.

Global Period Panties (Menstrual Underwear) Market Growth by Region 2024-2031

North America Holds Major Market Share

The period underwear market in North America is dominated by prominent companies such as Knix Wear, Thinx, and Saalt. There is a substantial demand for menstrual underwear due to increased awareness about period hygiene products among North American consumers. The future of the period underwear market in North America looks promising with a projected increase in demand expected in the coming years, the various initiatives and campaigns to raise awareness and destigmatize conversations surrounding menstruation. The market is poised for further expansion, providing ample opportunities for innovation and growth in the future.

For instance, in February 2022, Kimberly-Clark Corporation acquired a majority stake in Thinx, the leader in the reusable period and incontinence underwear category. The investment aims to build Kimberly-Clark's portfolio of period and light bladder leakage solutions and drive category growth with retail partners. With more consumers staying and working from home, market trends show a growing demand for additional solutions for period and bladder leak needs. The terms of the transaction have not been disclosed.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global period panties market include Thinx Inc., Victoria's Secret,Neione, Ruby Love (PANTYPROP INC), and Modibodi Pvt. Ltd.,among others. These players are adopting different growth strategies such as new product launches, mergers and acquisitions, and join ventures to remain competitive in the market place.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global period panties (menstrual underwear) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Current Industry Analysis and Growth Potential Outlook

1.2. Research Methods and Tools

1.3. Market Breakdown

1.3.1. By Segments

1.3.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Thinx Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Victoria's Secret

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Neione

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Ruby Love (PANTYPROP INC)

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Modibodi Pvt. Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Period Panties (Menstrual Underwear) Market by Style

4.1.1. Boy Short

4.1.2. Bikini

4.1.3. Brief

4.1.4. Hipsters

4.1.5. Others (Hi-Waist)

4.2. Global Period Panties (Menstrual Underwear) Market by ProductType

4.2.1. Reusable

4.2.2. Disposable

4.3. Global Period Panties (Menstrual Underwear) Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.5. Latin America

5.6. The Middle East & Africa

6. Company Profiles

6.1. Anigan

6.2. Clovia

6.3. Fannypants LLC

6.4. Flux

6.5. Harebrained

6.6. Knix Wear, Inc.

6.7. Luna Pads International

6.8. Pantyprop

6.9. Period Panteez

6.10. Proof

6.11. Rael

6.12. Saalt, LLC

6.13. The Period Company

6.14. WUKA

6.15. Yashram Lifestyle

6.16. Whisper

1. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY STYLE, 2023-2031 ($ MILLION)

2. GLOBAL BOY SHORTPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BIKINIPERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BRIEFPERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HIPSTERS PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHERS PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

8. GLOBAL REUSABLE PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DISPOSABLE PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

11. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) VIA ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) VIA OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY STYLE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

18. EUROPEAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY STYLE, 2023-2031 ($ MILLION)

20. EUROPEAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFICPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY STYLE, 2023-2031 ($ MILLION)

24. ASIA-PACIFICPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFICPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

26. REST OF THE WORLD PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY STYLE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKETSHARE BY STYLE, 2023 VS 2031 (%)

2. GLOBAL BOY SHORTPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BIKINIPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BRIEFPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HIPSTERSPERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHERS PERIOD PANTIES (MENSTRUAL UNDERWEAR) MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHAREBY PRODUCT TYPE, 2023 VS 2031 (%)

8. GLOBAL REUSABLE PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DISPOSABLE PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SHAREBY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

11. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) VIA ONLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR) VIA OFFLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKETSHARE BY REGION, 2023 VS 2031 (%)

14. US PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

16. UK PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC PERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION) 2023-2031 ($ MILLION) 2023-2031 ($ MILLION)2023-2031 ($ MILLION)2023-2031 ($ MILLION) 2023-2031 ($ MILLION) 2023-2031 ($ MILLION)

27. LATIN AMERICAPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICAPERIOD PANTIES (MENSTRUAL UNDERWEAR)MARKET SIZE, 2023-2031 ($ MILLION)