Pet Care Market

Pet Care Market Size, Share & Trends Analysis Report by Pet Type (Dog, Cat, Fish, and Others), by Product Type (Pet Food, Pet Grooming, and Pet Care), and by Distribution Channel (Online, and Offline) Forecast Period (2024-2031)

Pet care market is anticipated to grow at a CAGR of 5.6% during the forecast period (2024-2031). Increasing pet ownership, changes in demographics, a trend towards treating pets as family members, and a high focus on the health and wellness of pets are major factors driving the growth of the global pet care market. The increased awareness regarding pet care with the easy availability of pet care products is a key factor driving the global market. The market's expansion is also fueled by the growing demand for premium, organic, and natural pet products, as well as specialized services.

Market Dynamics

Increasing Pet Ownership

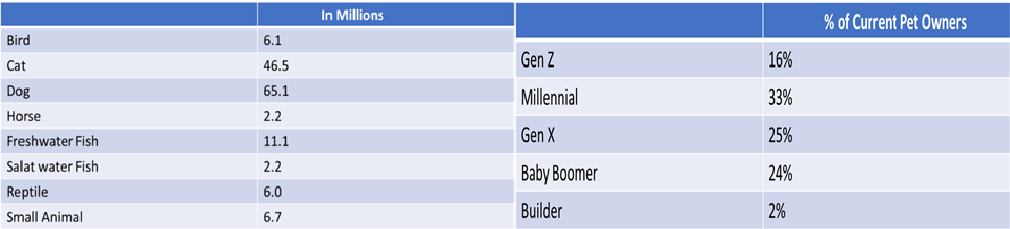

The rising trend of pet ownership is driving an increase in demand for pet care products among households. According to the 2023 American Pet Products Association, Inc. (APPA) National Pet Owners Survey, 66.0% of US households own a pet, which substitutes for 86.9 million households.

Number of US Households that Own a Pet Pet Ownership by Generation

Source American Pet Products Association, Inc. (APPA)

Increased Awareness of Pet Health

The growing awareness of pet health and wellness is leading to a preference for nutritious and organic pet foods. In April 2024, ProMach launched a Pet Care Solutions Group, offering specialized processing and packaging solutions for the pet care industry. The group, supported by industry experts from over a dozen brands, aims to ensure the freshness, taste, and shelf stability of pet food products.

Market Segmentation

- Based on pet type, the market is segmented into dog, cat, fish, and others (bird care, and small mammal care).

- Based on product type, the market is segmented into pet food, pet grooming, and pet care.

- Based on the distribution channel, the market is segmented online, and offline.

Dog Holds a Considerable Market Share

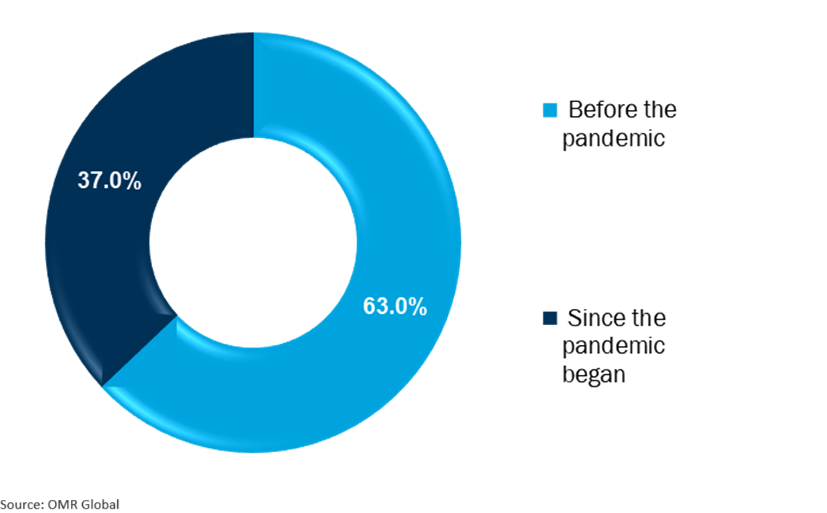

The increase in dog ownership that occurred in Australia during the pandemic can be attributed to a variety of demographic groups, including experienced pet owners, individuals with knowledge of pet care, and those new to the world of owning a pet. According to Animal Medicines Australia, in 2022, approximately 48.0% of households in Australia own a dog, which amounts to an estimated 6.4 million pet dogs across the country. On average, dog-owning households have 1.3 dogs, with the majority (75.0%) having only one dog and a significant portion (21.0%) having two dogs. Since the start of the pandemic, nearly 37.0% of dogs in Australia have been acquired, with various demographics represented among the new owners, including experienced pet owners (42.0%), individuals who grew up with family pets (20.0%), those who have lived with other people's pets (14.0%), and individuals with no prior pet experience (24.0%). Additionally, around 36.0% of these newly acquired dogs were born before the pandemic, with 14.0% being five years old or older.

Dog Population in Australia (%)

Source: Animal Medicines Australia

Pet Food Holds a Considerable Market Share

The demand for pet foods promoting health and wellness is increasing, with plant-based diets being seen as healthier alternatives to traditional meat-based options. For instance, in January 2024, PawCo Foods introduced two plant-based dog food products, LuxBites and InstaBites, using AI for nutrition optimization and palatability improvement. InstaBites is a shelf-stable, low-cost alternative to kibbles, while LuxBites is a premium fresh food with postbiotics and fermented protein.

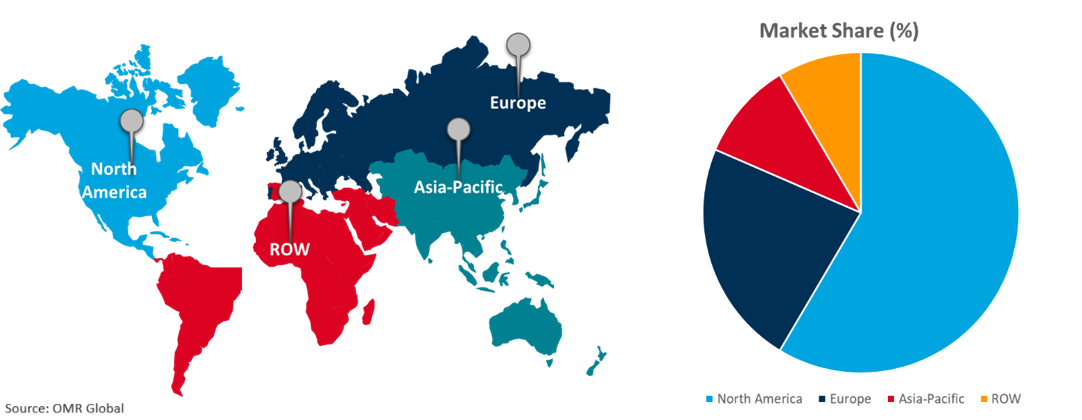

Regional Outlook

The global pet care market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Regulatory Environment In Asia-Pacific Region

The favorable regulatory environment plays an essential role in promoting consumer confidence and market growth by ensuring the quality and safety of pet care products. For instance, in October 2023, Scientific Remedies launched Affinity Advance, the flagship brand of Affinity Petcare, in India as part of a collaboration aimed at providing high-quality pet food to pet parents in India. Affinity Petcare, based in Spain, specializes in therapeutic nutrition.

Pet Care Market Growth by Region 2024-2031

North America Holds Major Market Share

Technological advancements such as wearable tech for pets, smart pet devices, and online pet services are expanding the market and driving consumer spending, which propels regional market growth. According to the American Pet Products Association (APPA), in March 2024, the total expenditures in the US pet industry reached $147.0 billion. These expenditures were divided into four major categories such as pet food and treats accounted for $64.4 billion; supplies, live animals, and over-the-counter medicine accounted for $32.0 billion; vet care and product sales accounted for $38.3 billion; and other services such as boarding, grooming, insurance, training, pet sitting, and walking accounted for $12.3 billion. The APPA additionally projected significant year-over-year growth in the sector before 2030.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the pet care market include Colgate-Palmolive Co., General Mills Inc., Nestlé Purina PetCare, Spectrum Brands Holdings, Inc., and The J.M. Smucker Co. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in July 2022, Emami acquired a 30.0% stake in pet-care start-up Cannis Lupus, focusing on natural, ayurvedic, and chemical-free products for pets. The company plans to scale up its business under the brand 'Fur Ball Story'.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pet care market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Colgate-Palmolive Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Mills Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nestlé Purina PetCare

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pet Care Market by Pet Type

4.1.1. Dog

4.1.2. Cat

4.1.3. Fish

4.1.4. Others (Bird Care, and Small Mammal)

4.2. Global Pet Care Market by Product Type

4.2.1. Pet Food

4.2.2. Pet Grooming

4.2.3. Pet Care

4.3. Global Pet Care Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Blue Buffalo Company, Ltd.

6.2. Cargill Inc.

6.3. heristo aktiengesellschaft

6.4. Mars, Inc.

6.5. Merrick Pet Care, Inc.

6.6. Petco Animal Supplies Stores, Inc.

6.7. Petmate Perks

6.8. PetSmart LLC

6.9. Spectrum Brands Holdings, Inc.

6.10. Sunshine Mills Inc.

6.11. Symrise Group

6.12. Tail Blazers

6.13. The Hartz Mountain Corp.

6.14. The J.M. Smucker Co.

6.15. Unicharm Corp.

6.16. WATT Global Media

6.17. Wellness Pet Company, Inc.

1. Global Pet Care Market Research And Analysis By Pet Type, 2023-2031 ($ Million)

2. Global Dog Care Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Cat Care Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Fish Care Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Other Pet Care Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Pet Care Market Research And Analysis By Product Type 2023-2031 ($ Million)

7. Global Pet Food Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Pet Grooming Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Others Pet Care Products Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Pet Care Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

11. Global Online Pet Care Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Offline Pet Care Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Pet Care Market Research And Analysis By Region, 2023-2031 ($ Million)

14. North American Pet Care Market Research And Analysis By Country, 2023-2031 ($ Million)

15. North American Pet Care Market Research And Analysis By Pet Type, 2023-2031 ($ Million)

16. North American Pet Care Market Research And Analysis By Product Type, 2023-2031 ($ Million)

17. North American Pet Care Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

18. European Pet Care Market Research And Analysis By Country, 2023-2031 ($ Million)

19. European Pet Care Market Research And Analysis By Pet Type, 2023-2031 ($ Million)

20. European Pet Care Market Research And Analysis By Product Type, 2023-2031 ($ Million)

21. European Pet Care Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

22. Asia-Pacific Pet Care Market Research And Analysis By Country, 2023-2031 ($ Million)

23. Asia-Pacific Pet Care Market Research And Analysis By Pet Type, 2023-2031 ($ Million)

24. Asia-Pacific Pet Care Market Research And Analysis By Product Type, 2023-2031 ($ Million)

25. Asia-Pacific Pet Care Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

26. Rest of The World Pet Care Market Research And Analysis By Region, 2023-2031 ($ Million)

27. Rest of The World Pet Care Market Research And Analysis By Pet Type, 2023-2031 ($ Million)

28. Rest of The World Pet Care Market Research And Analysis By Product Type, 2023-2031 ($ Million)

29. Rest of The World Pet Care Market Research And Analysis By Distribution Channel, 2023-2031 ($ Million)

1. Global Pet Care Market Share By Pet Type, 2023 Vs 2031 (%)

2. Global Dog Pet Care Market Share By Region, 2023 Vs 2031 (%)

3. Global Cat Pet Care Market Share By Region, 2023 Vs 2031 (%)

4. Global Fish Pet Care Market Share By Region, 2023 Vs 2031 (%)

5. Global Others Pet Care Market Share By Region, 2023 Vs 2031 (%)

6. Global Pet Care Market Share By Product Type, 2023 Vs 2031 (%)

7. Global Pet Food Market Share By Region, 2023 Vs 2031 (%)

8. Global Pet Grooming Market Share By Region, 2023 Vs 2031 (%)

9. Global Others Pet Care Products Market Share By Region, 2023 Vs 2031 (%)

10. Global Pet Care Market Share By Distribution Channel, 2023 Vs 2031 (%)

11. Global Online Pet Care Market Share By Region, 2023 Vs 2031 (%)

12. Global Offline Pet Care Market Share By Region, 2023 Vs 2031 (%)

13. Global Pet Care Market Share By Region, 2023 Vs 2031 (%)

14. US Pet Care Market Size, 2023-2031 ($ Million)

15. Canada Pet Care Market Size, 2023-2031 ($ Million)

16. UK Pet Care Market Size, 2023-2031 ($ Million)

17. France Pet Care Market Size, 2023-2031 ($ Million)

18. Germany Pet Care Market Size, 2023-2031 ($ Million)

19. Italy Pet Care Market Size, 2023-2031 ($ Million)

20. Spain Pet Care Market Size, 2023-2031 ($ Million)

21. Rest Of Europe Pet Care Market Size, 2023-2031 ($ Million)

22. India Pet Care Market Size, 2023-2031 ($ Million)

23. China Pet Care Market Size, 2023-2031 ($ Million)

24. Japan Pet Care Market Size, 2023-2031 ($ Million)

25. South Korea Pet Care Market Size, 2023-2031 ($ Million)

26. Rest Of Asia-Pacific Pet Care Market Size, 2023-2031 ($ Million)

27. Latin America Pet Care Market Size, 2023-2031 ($ Million)

28. Middle East And Africa Pet Care Market Size, 2023-2031 ($ Million)