Petroleum Jelly Market

Petroleum Jelly Market Size, Share & Trends Analysis Report by Grade (Industrial, Medical, and Cosmetics), and by End-User (Pharmaceuticals, Cosmetics and Personal Care, Food, Textile, and Others) Forecast Period (2024-2031)

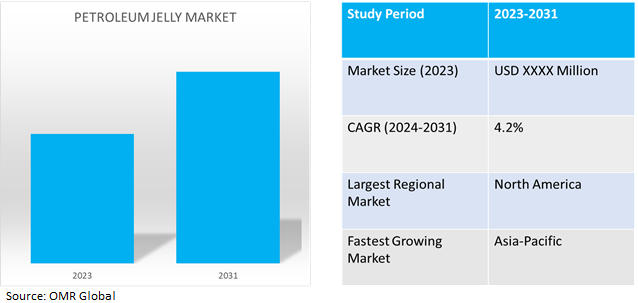

Petroleum jelly market is anticipated to grow at a considerable CAGR of 4.2% during the forecast period (2024-2031). The market growth is driven by rising consumption of personal care and cosmetic products, growing production of petroleum products, increasing dermatological application of petroleum jelly, and industrial usage (lubricant, electric insulator). Further, the market trend is primarily influenced by rising applications in the pharmaceutical industry and the expansion of the online sales channel. Moreover, the market is expected to be impacted by the shift towards plant-based alternatives, especially in the pharmaceutical and packaging industries.

Market Dynamics

Rising Prevalence of Skin Disease

The prevalence of skin-related diseases has increased exponentially in the last few decades which has positively impacted the cosmetics and dermatology industry. Petroleum jelly-based products such as moisturizers, ointments, creams shampoos, and lubricants are used in high volumes globally to cure and prevent dermatological diseases. For instance, as per the National Institute of Health, skin diseases are the fourth most common cause of all human diseases, affecting almost one-third of the world's population. Also, skin conditions contribute to 1.7% of the global burden of disease worldwide. The prevalence of skin disease was 61.2% by 2018, the most common skin disease categories were dandruff (38.4%), followed by pityriasis Alba (34.6%), and any type of dermatitis (16.5%).

Growing Production and Exports of Petroleum Products

As petroleum jelly is a byproduct of the crude oil industry, its demand and supply are highly related to petroleum industry production and exports. The production and export of crude oil have recently seen an upward trajectory post-reduction in war tension globally. For instance, as per the Observatory of Economic Complexity (OEC) in 2022, India exported $90.5 million in petroleum jelly, making it the first largest exporter of petroleum jelly in the world. In the same year, petroleum jelly was the 670th most exported product in India. The main destinations of petroleum jelly exports from India were Nigeria$24.7 million, Cote d'Ivoire $7.3 million, the US$5.3 million, the UAEtes$4.9 million, and UK$3.9million.

Market Segmentation

Our in-depth analysis of the global petroleum jelly market includes the following segments by grade and end user.

- Based on grade, the market is segmented into industrial, medical, and cosmetics.

- Based on end users, the market is segmented into pharmaceuticals, cosmetics and personal care, food, and textiles.

Medical Grade remains as the Largest Segment

Medical-grade petroleum jelly is in high demand due to its application in both the cosmetics and pharmaceutical industries, used as a topical skin protectant to treat dry, rough, scaly, itchy skin, and minor skin irritations. Moreover, demand for personal care products including moisturizers, shampoos, ointments, and others is expected to grow in the future, making the sub-segment a substantial contributor to the demand.

Cosmetics and Personal Care are the biggest End User

The growing end-user for the petroleum jelly market has remained the cosmetics and personal care industry comprising of wide product portfolio that requires petroleum jelly as an integral component. Products such as shaves, after-sun products, anti-aging creams, antiperspirant/deodorant, around-eye cream, baby lotion, baby oil, and many others comprise of petroleum jelly. Also, the demand for the end-user industry has comparatively increased more than others, showing positive signs for the future.

Regional Outlook

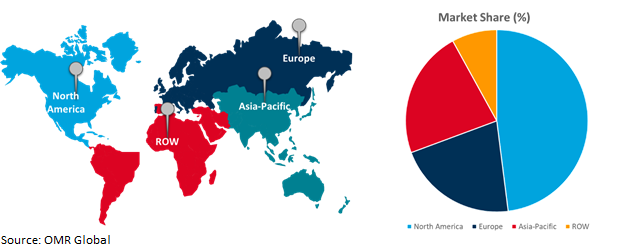

The globalPetroleum Jelly market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America leads the Global Market

North American petroleum jelly market has been the largest region in the market globally attributed to growing demand in the pharmaceuticals and cosmetics industry, rising petroleum production and exports in the region. The increasing industrial applications including telecommunication, and automotive has also contributed towards regional dominance. For instance, according to the Personal Care Products Council (PCPC) report in 2022, the personal care industry grew in the US, generating a trade surplus of $2.6 billion in 2022. This accounts for the second largest surplus in the manufacturing sector, and has generated a trade surplus every year between 1990 and 2022.

Global Petroleum Jelly Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing Petroleum Jelly Market

- Increasing application of petroleum jelly in the massive manufacturing sectors like automotive, electronics, and semiconductor industries for lubrication and coating applications are some of the driving factors for market growth in the region.

- Asia-Pacific is also witnessing a constant rise in disposable income and population and changing consumer lifestyles creating huge demand for personal care and pharmaceuticals products in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global petroleum jelly market include Unilever, Shell Group, Sasol Ltd, , and Sonneborn LLC (HF Sinclair Corp.) among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, VisualDx, a web-based clinical decision support system, announced a partnership with Vaseline to improve health equity by enhancing provider education on skin color. Vaseline will broaden access to the VisualDx platform to empower clinicians to best identify, diagnose, and treat conditions for all patients regardless of skin tone.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global petroleum jelly market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Sasol Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Shell Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sonneborn LLC (HF Sinclair Corp.)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Unilever PLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Petroleum Jelly Market by Grade

4.1.1. Industrial

4.1.2. Medical

4.1.3. Cosmetic

4.2. Global Petroleum Jelly Market by End-User

4.2.1. Pharmaceuticals

4.2.2. Cosmetic & Personal Care

4.2.3. Food

4.2.4. Textile

4.2.5. Others (Leather)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East and Africa

6. Company Profiles

6.1. Adinath Chemicals

6.2. Calumet Specialty Products Partners, L.P.

6.3. Hangzhou Oleochemicals Co., Ltd.

6.4. Lodha Chemicals (Lodha Petro)

6.5. Navid Noor Polymer

6.6. Nippon Siero Co., Ltd.

6.7. Petrobras

6.8. PetroNaft Co.

6.9. Raj Petro Specialities Pvt. Ltd.

6.10. Shimi Taghtiran Co.

6.11. Sovereign Chemicals & Cosmetics

6.12. Sun Chem Group

6.13. Unisynth Group

6.14. Shimi Taghtiran Co.

1. GLOBAL PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

2. GLOBAL INDUSTRIAL PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MEDICAL PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL COSMETICS PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

6. GLOBAL PETROLEUM JELLY FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PETROLEUM JELLY ANALYSIS FOR COSMETIC & PERSONAL CARE MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PETROLEUM JELLY FOR FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PETROLEUM JELLY FOR TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PETROLEUM JELLY FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

15. EUROPEAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

17. EUROPEAN PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. REST OF THE WORLD PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD PETROLEUM JELLY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL PETROLEUM JELLY MARKET SHARE BY GRADE, 2023 VS 2031 (%)

2. GLOBAL INDUSTRIAL PETROLEUM JELLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MEDICAL PETROLEUM JELLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL COSMETICS PETROLEUM JELLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PETROLEUM JELLY MARKET SHARE BY END-USER, 2023 VS 2031 (%)

6. GLOBAL PETROLEUM JELLY FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PETROLEUM JELLY FOR COSMETIC & PERSONAL CARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PETROLEUM JELLY FOR FOOD MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PETROLEUM JELLY FOR TEXTILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PETROLEUM JELLY FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PETROLEUM JELLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

14. UK PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA PETROLEUM JELLY MARKET SIZE, 2023-2031 ($ MILLION)