Pharmaceutical Analytical Testing Outsourcing Market

Global Pharmaceutical Analytical Testing Outsourcing Market Size, Share & Trends Analysis Report by Product Type (API, Raw Materials, and Finished products), By Services (Bioanalytical services, Stability testing, Drug substance, Method development & Validation, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global pharmaceutical analytical testing outsourcing market is estimated to have a significant CAGR of over 8% during the forecast period. The market is mainly driven due to the increasing trend towards analytical drugs, growing investment for R&D in the pharmaceutical industry. Contract manufacturing organizations provide independent manufacturing services for pharmaceutical and biotechnological markets. The pharmaceutical contract manufacturing market is being driven by the increased outsourcing of large pharma companies to improve profit margins. According to PhRMA (2016), biopharmaceutical companies invested about $58 billion in R&D in the US in 2015. The pharmaceutical industry has not been able to tap the full potential of the US FDA approved plants until now due to a lack of incentives and policy direction from the government. Allowing contract manufacturing for an indefinite period is an effective initiative taken by the government to boost exports.

Segmental Outlook

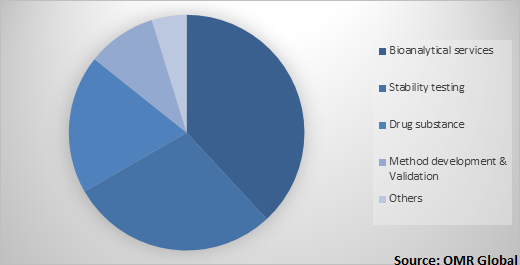

The global pharmaceutical analytical testing outsourcing market is segregated on the basis of product type and services. On the basis of product type, the market is further segmented into API, raw materials and finished products. The API segment is projected to have considerable growth in the global pharmaceutical analytical testing outsourcing market during the forecast period. Moreover, to evaluate a quality system used by the company, a program named USP’s Active Pharmaceutical Ingredient Verification Program is intended for drug manufacturers and brands globally. Based on the services, the global pharmaceutical analytical testing outsourcing market is further segmented into bioanalytical services, stability testing, drug substance, method development & validation, and others.

Global Pharmaceutical Analytical Testing Outsourcing Market Share by Services, 2018(%)

Global Pharmaceutical analytical testing outsourcing market to be driven by bioanalytical Services

The bioanalytical services segment projected to have considerable market share in the global pharmaceutical analytical testing outsourcing market owing to the growing development in analytical technologies. The advances in bioanalytical technologies disclose the explicit value of metabolomics tools in gene-function analysis, diagnostic platforms, biomarker discovery, and systems biology. Clinical development of drugs and devices, as well as approval, requires a vast amount of time and resources. During the clinical trial phase, regulations imposed by governing regulatory bodies further increase the amount of time and effort needed to reach approval. According to C3i solutions, it is estimated that the average length of time from the start of clinical testing to marketing is 7.5 years. Therefore, bioanalytical services have projected to adopt for the outsourcing of clinical testing of drugs that further propels the market growth.

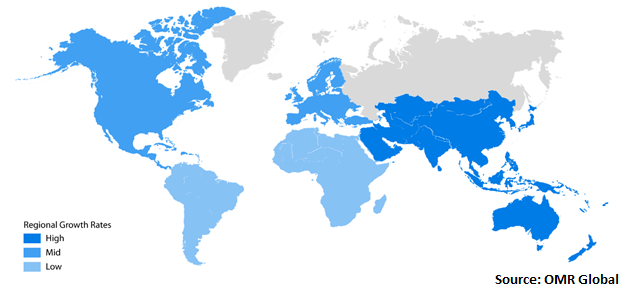

Regional Outlook

Geographically, the global pharmaceutical analytical testing outsourcing market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America is projected to have a significant market share in the global market. Pharmaceutical analytical testing outsourcing in North America is fueled by the increase in biotechnology companies. These companies are dedicated to developing drug compounds for a specific therapeutic area. However, these companies lack infrastructure in the areas of formulation, clinical and regulatory agency submission. With the biotechnology and pharmaceutical industries striving for cost minimization and profit maximization, outsourcing production has become an ever-increasing trend as they are striving for cost minimization and profit maximization.

Global Pharmaceutical analytical testing outsourcing Market Growth, by Region 2019-2025

Asia-Pacific to hold a considerable growth in the global pharmaceutical analytical testing outsourcing market

Geographically, Asia-Pacific is projected to have a significant market growth in the global pharmaceutical analytical testing outsourcing market. The major economies such as China, Australia, Japan, South Korea, India, and Singapore are significantly contributing to the growth of the market during the forecast period. The generics segment is the major factor driving the Indian pharmaceutical industry. The pharmaceutical industry in APAC has led by increasing pharmaceutical R&D investment and the presence of major pharmaceutical companies, including Ranbaxy Laboratories Ltd. and Dr. Reddy’s Laboratories Ltd in the region. This increases the demand for Indian pharmaceutical products. Moreover, the presence of some major contract manufacturing firms such as Piramal Pharma Solutions in the region is also expected to drive the global pharmaceutical analytical testing outsourcing market in the region.

Market Players Outlook

The key players in the Pharmaceutical analytical testing outsourcing market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Boston Analytical, Bioanalytical Systems, Inc., Charles River Laboratories International, Inc., CMIC, Inc, Cambrex Corp., Covance Inc., Dalton Pharma Services, Eurofins GSC Lux SARL, and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical analytical testing outsourcing market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pharmaceutical Analytical Testing Outsourcing Market by Product type

5.1.1. API

5.1.2. Raw Materials

5.1.3. Finished products

5.2. Global Pharmaceutical Analytical Testing Outsourcing Market by Services

5.2.1. Bioanalytical Services

5.2.2. Stability Testing

5.2.3. Drug Substance

5.2.4. Method Development & Validation

5.2.5. Others (Quality Testing)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Boston Analytical

7.2. Bioanalytical Systems, Inc.

7.3. Charles River Laboratories International, Inc.

7.4. CMIC, Inc

7.5. Cambrex Corp.

7.6. Covance Inc.

7.7. Dalton Pharma Services

7.8. Eurofins GSC Lux SARL

7.9. Element Materials Technology Group Ltd.

7.10. ICON plc

7.11. Intertek Group plc

7.12. KCAS Bioanalytical Services

7.13. NorthEast BioAnalytical Laboratories LLC.

7.14. Pace Analytical Services, LLC

7.15. Pharmaceutical Product Development, LLC

7.16. SGS SA

7.17. Toxikon Corp.

7.18. VxP Pharma, Inc.

7.19. WuXi AppTec Co., Ltd.

7.20. West Pharmaceutical Services, Inc.

1. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL API MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL RAW MATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FINISHED PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2018-2025 ($ MILLION)

6. GLOBAL BIOANALYTICAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL STABILITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DRUG SUBSTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL METHOD DEVELOPMENT & VALIDATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2018-2025 ($ MILLION)

15. EUROPEAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2018-2025 ($ MILLION)

21. REST OF THE WORLD PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2018-2025 ($ MILLION)

1. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SHARE BY SERVICES, 2018 VS 2025 (%)

3. GLOBAL PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PHARMACEUTICAL ANALYTICAL TESTING OUTSOURCING MARKET SIZE, 2018-2025 ($ MILLION)