Pharmaceutical Contract Manufacturing Market

Global Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis by Category (Human-Based Drugs and Animals Based Drugs), By Type (Sterile Manufacturing and Non-Sterile Manufacturing,), by Product (Over-The-Counter (OTC) Drugs, Active Pharmaceutical Ingredients (API), Finished Dosage Formulation and Others) and by services (Manufacturing Services, Non-Clinical Services, and Research & Development) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global market for pharmaceutical contract manufacturing is projected to have a considerable CAGR of around 6.9% during the forecast period. All pharmaceutical companies operate as outsourcing companies, dealing with the development and manufacturing of drugs, which leads to business scalability and revenue, which allows for the development of new drugs. The growing need for state-of-the-art processes and production technologies, which have proven highly effective in meeting regulatory requirements, is the most important factor driving the growth of CMOs in the pharmaceutical industry. The increasing number of cell therapy candidates, combined with their steady growth through the various stages of clinical development and their complicated manufacturing process, drives up demand for manufacturing services for these therapies. Therefore, this factor creates an opportunity for market growth. However, the dynamic changes seen in this sector, combined with extreme margin pressure, are expected to restrict growth significantly.

Impact of COVID-19 on global pharmaceutical contract manufacturing market

The recent COVID-19 pandemic has increased demand for pharmaceuticals and sparked the growth of vaccines, antiviral vaccines, antibody therapy, and other pharmaceutical products. Contract development and manufacturing organisations are growing as a result of the pandemic, as many larger manufacturing units hire contract development and manufacturing organisations for pharmaceutical drug development and production. Although many pharmaceutical companies, research institutes and contract research organisations, collaborate to turn research findings into effective pharmaceutical products. For instance, Thermo Fisher Scientific Inc. (U.S.) partnered with INOVIO Pharmaceuticals, Inc. (U.S.) in September 2020 to manufacture and commercialise INOVIO's DNA COVID-19 vaccine candidate INO-4800. This collaboration will enable Thermo Fisher Scientific Inc to meet emerging demand for a COVID-19 vaccine that is both effective and safe.

Segmental Outlook

The global pharmaceutical contract manufacturing market is segmented based on category, type, product and service. Based on the category the market is further classified into human-based drugs and animals-based drugs. On the basis of type, the market is further segregated into sterile manufacturing and non-sterile manufacturing. Further on the basis of product, the market is classified into over-the-counter (OTC) drugs, active pharmaceutical ingredients (API), finished dosage formulation and others (nutritional products and packaging) and based on services the market is segmented into manufacturing services, non-clinical services, and research & development.

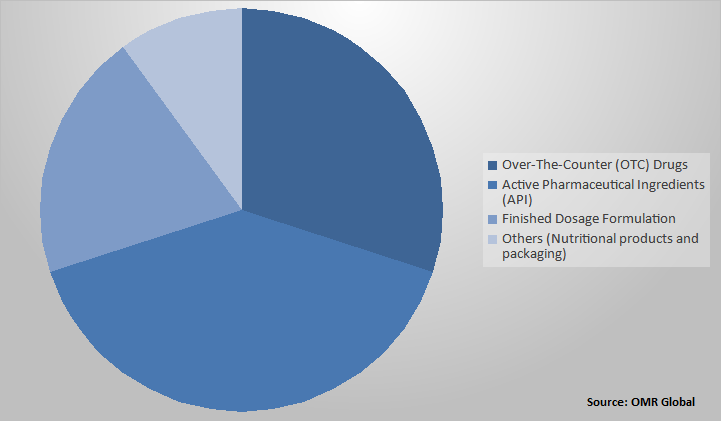

Global Pharmaceutical Contract Manufacturing Market Share by Products, 2020(%)

Global Pharmaceutical Contract Manufacturing Market to be driven by active pharmaceutical ingredients (API)

Among products, the active pharmaceutical ingredients (API), the segment is projected to hold a considerable share in the market owing to factors such as the rising prevalence of chronic diseases including cardiovascular diseases and cancer and increasing advancements in active pharmaceutical ingredient (API) manufacturing. The API segment is experiencing significant changes as a result of the supply chain disruption caused by COVID-19. Due to geopolitical situations and the desire to reduce dependence on China for API products, countries such as India are being preferred over China for API export. Furthermore, pharmaceutical firms benefit from API production outsourcing because it eliminates the need for costly manufacturing unit installation and labour force. However, unfavourable drug pricing policies in various countries, as well as high manufacturing costs, are expected to restrain the segment growth.

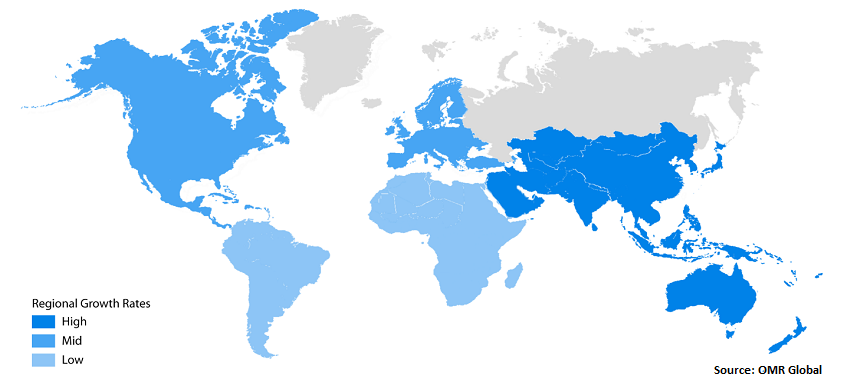

Regional Outlook

Geographically, the global pharmaceutical contract manufacturing market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Europe is projected to grow at a significant CAGR during the forecast period. The market growth is attributed due to the region's large number of clinical trials, large API production base, modern manufacturing capabilities, the existence of leading pharmaceutical companies, and expansion in the generics market. The key players operating in the region are Aenova Group, Baxter BioPharma Solutions, Boehringer Ingelheim, Catalent Inc., Famar S.A. among others.

Global Pharmaceutical Contract Manufacturing Market Growth, by Region 2021-2027

North America to hold a considerable share in the global Pharmaceutical Contract Manufacturing market

Geographically, North America is projected to hold a significant market share in the global pharmaceutical contract manufacturing market. This expansion is being fueled by an increase in the number of companies outsourcing projects in this region's developing economies. Additionally, because of rising healthcare costs, the US has a substantial market share in the pharmaceutical contract manufacturing sector. Furthermore, the rise in the prevalence of chronic conditions such as diabetes and cancer has increased the demand for injectable drug delivery in the US fueling the growth of the pharmaceutical contract manufacturing market.

Market Players Outlook

The key players in the pharmaceutical contract manufacturing market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Baxter International Inc, Pfizer Inc., Boehringer Ingelheim International GmbH., Amgen Inc., among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In January 2021, Novartis International AG announced that it has signed an initial agreement to use its manufacturing capacity and capabilities to combat the COVID-19 pandemic by assisting in the manufacturing of the Pfizer-BioNTech COVID-19 Vaccine. Novartis will use its sterile manufacturing facilities at its Stein, Switzerland, site under the terms of the agreement. With this expansion, the company will use its manufacturing capabilities to support the global supply of COVID-19 vaccines and therapeutics.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Pharmaceutical Contract Manufacturing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Pharmaceutical Contract Manufacturing Industry

• Recovery Scenario of Global Pharmaceutical Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pharmaceutical Contract Manufacturing Market by Category

5.1.1. Human-Based Drugs

5.1.2. Animals Based Drugs

5.2. Global Pharmaceutical Contract Manufacturing Market by Type

5.2.1. Sterile Manufacturing

5.2.2. Non-Sterile Manufacturing

5.3. Global Pharmaceutical Contract Manufacturing Market by Product

5.3.1. Over-The-Counter (OTC) Drugs

5.3.2. Active Pharmaceutical Ingredients (API)

5.3.3. Finished Dosage Formulation

5.3.4. Others (Nutritional products and packaging)

5.4. Global Pharmaceutical Contract Manufacturing Market by Services

5.4.1. Manufacturing Services

5.4.2. Non-Clinical Services

5.4.3. Research and Development

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aenova Holding GmbH

7.2. Ajinomoto Co., Inc.

7.3. Almac Group Ltd.

7.4. Amgen Inc.

7.5. Aurobindo Pharma Ltd.

7.6. Baxter International Inc.

7.7. BDR Pharmaceuticals International Pvt. Ltd.

7.8. BiologicsMD, Inc.

7.9. Boehringer Ingelheim International GmbH

7.10. Cadence Inc.

7.11. Chunghwa Chemical & Pharmaceutical Co., Ltd.

7.12. Ciron Drugs & Pharmaceuticals Pvt. Ltd.

7.13. Confab Laboratories Inc.

7.14. Daito Pharmaceutical Co., Ltd.

7.15. Eli Lilly And Co.

7.16. F. Hoffmann-La Roche Ltd.

7.17. GlaxoSmithKline PLC

7.18. Hisamitsu Pharmaceutical Co., Inc.,

7.19. Ligand Pharmaceuticals, Inc.

7.20. Merck & Co., Inc.

7.21. Novartis International AG

7.22. Outlook Therapeutics, Inc.

7.23. Pfizer Inc.

7.24. PhytoHealth Corp.

7.25. Piramal Enterprises Ltd.

7.26. Procter & Gamble Co.

7.27. Radius Health Inc.

7.28. Sanofi S.A.

7.29. Tarsa Therapeutics, Inc.

7.30. Teva Pharmaceuticals Industries Ltd.

1. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY,2020-2027 ($ MILLION)

2. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR HUMAN-BASED DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

3. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR ANIMALS BASED DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

4. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

5. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION 2020-2027($ MILLION)

6. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR NON-STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

7. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

8. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR OVER-THE-COUNTER (OTC) DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR ACTIVE PHARMACEUTICAL INGREDIENTS (API)MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR FINISHED DOSAGE FORMULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING FOR OTHERS (NUTRITIONAL PRODUCTS AND PACKAGING) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

13. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL PHARMACEUTICAL CONTRACT NON-CLINICAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL PHARMACEUTICAL CONTRACT RESEARCH AND DEVELOPMENT SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

17. NORTH AMERICAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY,2020-2027 ($ MILLION)

19. NORTH AMERICAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT,2020-2027 ($ MILLION)

21. NORTH AMERICAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

22. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY,2020-2027 ($ MILLION)

24. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

25. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

26. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY,2020-2027 ($ MILLION)

29. ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

30. 26. ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

31. 26. ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

32. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

33. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY,2020-2027 ($ MILLION)

34. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

35. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

36. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 (%)

4. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY CATEGORY,2020 VS 2027 (%)

5. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY TYPE,2020 VS 2027 (%)

6. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BYPRODUCT, 2020 VS 2027 (%)

7. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

8. GLOBAL PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL HUMAN-BASED DRUGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL ANIMALS BASED DRUGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL STERILE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL NON-STERILE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL OVER-THE-COUNTER (OTC) DRUGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL ACTIVE PHARMACEUTICAL INGREDIENTS (API)MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL FINISHED DOSAGE FORMULATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL OTHERS(NUTRITIONAL PRODUCTS AND PACKAGING) MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL. MANUFACTURING SERVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL NON-CLINICAL SERVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL RESEARCH AND DEVELOPMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%) RESEARCH AND DEVELOPMENT

20. US PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

21. CANADA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

22. UK PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

23. FRANCE PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

24. GERMANY PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

25. ITALY PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

26. SPAIN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

27. REST OF EUROPE PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

28. INDIA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

29. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

30. JAPAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

31. SOUTH KOREA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

32. REST OF ASIA-PACIFIC PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)

33. REST OF THE WORLD PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027($ MILLION)