Pharmaceutical Dissolution Testing Services Market

Pharmaceutical Dissolution Testing Services Market Size, Share & Trends Analysis Report by Method (In-Vitro and In-Vivo), by Dosage Form (Capsules and Tablets), and by Dissolution Apparatus (Basket and Paddle) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Pharmaceutical dissolution testing services market is anticipated to grow at a CAGR of 7.5% during the forecast period. Dissolution is a well-defined test with both instrumentation and testing methodology specified in great detail by the USP [US Pharmacopeia). So, for existing formulations there is not a lot of opportunity for innovation. A considerable rise in pharmaceutical research expenditure is a key factor driving the growth of the pharmaceutical dissolution testing services. Due to increased R&D expenditure by pharmaceutical companies as well as an increase in the number of novel medications entering the preclinical stage of development, there has also been an increase in demand for pharmaceutical dissolution testing services. To meet the growing demand key players are opening or investing new facilities.

For instance, in April 2023, Roquette, a provider of pharmaceutical and nutraceutical excipients, opened its new pharmaceutical innovation center near Philadelphia. The new $25 million center will be an advanced training and collaboration hub for pharmaceutical and nutraceutical manufacturers across the globe. With a focus on optimizing patient experience with next-generation oral dosage forms, the US facility complements the cutting-edge research activities of Roquette’s existing pharma innovation centers in France and Singapore. Underpinning these training sessions and the center’s primary research projects is a suite of the latest pharmaceutical processing, testing, and manufacturing equipment.

In the same month, MilliporeSigma has invested $37.5 million to strengthen biosafety testing in Scotland. The investment includes a new 1200-m2 facility in Glasgow that will house molecular biology and sequencing services, and the company will add biosafety testing, analytical development, and viral clearance suites in its current buildings to expand testing capacity.

Segmental Outlook

The global pharmaceutical dissolution testing services market is segmented based on method, dosage form, and dissolution apparatus. Based on method, the market is segmented into in-vitro and in-vivo. Based on dosage form, the market is sub-segmented into capsules and tablets. Based on dissolution apparatus, the market is sub-segmented into basket and paddle.

In-Vitro Segment to Hold a Prominent Market Share in the Global Pharmaceutical Dissolution Testing Services Market

The in-vitro method segment to hold a considerable share in 2022 and is projected to exhibit a considerable CAGR during the forecast period. A significant increase in preclinical pipeline capacity along with the growing awareness about the benefits of in-vitro dissolution testing services is driving the segmental market growth. In addition, the traditional rising cost of animal tests as well as their socio-ethical problems is further contributing to the market growth. Significant developments in the in-vitro dissolution testing assays used to evaluate the security of medicines and the potential impacts of those drugs on cells and tissues are some other contributors to the market growth.

Regional Outlooks

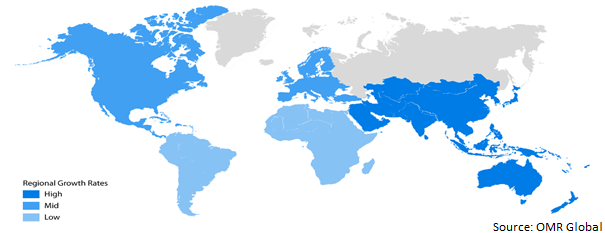

The global pharmaceutical dissolution testing services market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific region is anticipated to exhibit the highest CAGR in the global pharmaceutical dissolution testing services market. The rising investment by companies from developed economies in enhancing regional healthcare is a key promoter to the regional market growth. Additionally, the establishment of new facilities along with alliances formation with major laboratories is further contributing to the market growth.

Global Pharmaceutical Dissolution Testing Services Market Growth by Region 2023-2030

North America to Hold a Considerable Share in the Global Pharmaceutical Dissolution Testing Services Market

North America is expected to hold a considerable share in pharmaceutical dissolution testing services market in 2022. The regional market is driven by the presence of key pharmaceutical dissolution testing service providers. The rising investments in R&D for the development of novel therapeutics for chronic diseases are further contributing to the market growth. According to EFPIA member associations, the US invested $72,412 million in pharmaceutical R&D. Besides, the region has a relatively high disposable income, which enables people to afford expensive drugs and medical treatments. This creates a strong demand for pharmaceutical products in the region; which is further contributing to the regional market growth.

Market Players Outlook

The major companies serving the global pharmaceutical dissolution testing services market include Intertek Group Plc., Avivia BV, Almac Group, Agilent Technologies, Inc., and Catalent, Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2022, Agilent Technologies Inc. opened the Dissolution Centre of Excellence (CoE) facility in Craven Arms, the UK. The newly modernized premises will house the core of Agilent’s dissolution business, including R&D, quality, support, applications, marketing, and more. This investment allows all Agilent dissolution activities to be consolidated under one roof, facilitating the cooperation of all business segments and driving the mission of innovation for the next generation of dissolution products and services.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical dissolution testing services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Agilent Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Intertek Group Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pharmaceutical Dissolution Testing Services Market by Method

4.1.1. In-Vitro

4.1.2. In-Vivo

4.2. Global Pharmaceutical Dissolution Testing Services Market by Dosage Form

4.2.1. Capsules

4.2.2. Tablets

4.3. Global Pharmaceutical Dissolution Testing Services Market by Dissolution Apparatus

4.3.1. Basket

4.3.2. Paddle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Almac Group

6.2. AMRI

6.3. Avivia BV

6.4. Boston Analytical

6.5. Cambrex

6.6. Catalent, Inc.

6.7. Charles River Laboratories

6.8. Pace Analytical Life Sciences

6.9. SGS SA

6.10. SOTAX

6.11. Thermofisher Scientific Inc.

1. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY METHOD, 2022-2030 ($ MILLION)

2. GLOBAL IN-VITRO PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL IN-VIVO PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY DOSAGE FORM, 2022-2030 ($ MILLION)

5. GLOBAL CAPSULES-BASED PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL TABLETS-BASED PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY DISSOLUTION APPARATUS, 2022-2030 ($ MILLION)

8. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES IN BASKET MARKET BY REGION,2022-2030 ($ MILLION)

9. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES IN PADDLE MARKET BY REGION,2022-2030 ($ MILLION)

10. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY METHOD, 2022-2030 ($ MILLION)

13. NORTH AMERICAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2022-2030 ($ MILLION)

14. NORTH AMERICAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DISSOLUTION APPARATUS, 2022-2030 ($ MILLION)

15. EUROPEAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. EUROPEAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY METHOD, 2022-2030 ($ MILLION)

17. EUROPEAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2022-2030 ($ MILLION)

18. EUROPEAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DISSOLUTION APPARATUS, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY METHOD, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DISSOLUTION APPARATUS, 2022-2030 ($ MILLION)

23. REST OF THE WORLD PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY METHOD, 2022-2030 ($ MILLION)

24. REST OF THE WORLD PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2022-2030 ($ MILLION)

25. REST OF THE WORLD PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY DISSOLUTION APPARATUS, 2022-2030 ($ MILLION)

1. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SHARE BY METHOD, 2022 VS 2030 (%)

2. GLOBAL IN-VITRO PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022 VS 2030 (%)

3. GLOBAL IN-VIVO PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022 VS 2030 (%)

4. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SHARE BY DOSAGE FORM, 2022 VS 2030 (%)

5. GLOBAL CAPSULES-BASED PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022 VS 2030 (%)

6. GLOBAL TABLETS-BASED PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET BY REGION, 2022 VS 2030 (%)

7. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SHARE BY DISSOLUTION APPARATUS, 2022 VS 2030 (%)

8. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES IN BASKET MARKET BY REGION, 2022 VS 2030 (%)

9. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES IN PADDLE MARKET BY REGION, 2022 VS 2030 (%)

10. GLOBAL PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA MARKET PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

13. UK PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OFASIA-PACIFIC PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF WORLD PHARMACEUTICAL DISSOLUTION TESTING SERVICES MARKET SIZE, 2022-2030 ($ MILLION)