Pharmaceutical Excipient Market

Global Pharmaceutical Excipient Market Size, Share & Trends Analysis Report, By Product (Solubilizer & Surfactants/Emulsifiers, Polyols, Carbohydrates, and Specialty Excipients), By Formulation (Oral Formulation, Topical Formulations, Parenteral Formulations, and Other Formulations), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global pharmaceutical excipient market is estimated to grow at a considerable CAGR of around 7% during the forecast period. The market growth is primarily attributed to the growth in pharmaceutical and bio-pharmaceutical industries, the recent patent expires that increase the demand for pharmaceutical excipients and rapid advancements in nanotechnology. Many drugs are on the verge of losing their patents in the coming years. The patent cliff results inlosing patent protection of branded drug sales worth hundreds of billions of dollars.

With the expiration of patents, generic drug manufacturers create their own replicas in around 80% less cost than the originals. The patent expiry propels the pharma companies to use functionality excipients in order to try and extend patents. Excipients are becoming an important role in manufacturing tablets as they provide enhanced functionality to pharmaceuticals, aid in drug development, and improve patent life, at a lower cost.

Segmental Outlook

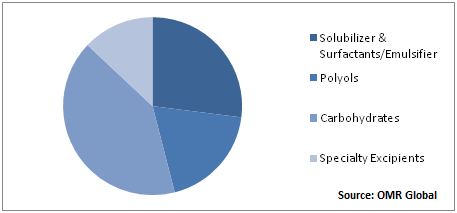

The global pharmaceutical excipient market is segmented on the basis of product and formulations. Based on the product, the market is segmented into solubilizers & surfactants/emulsifiers, polyols, carbohydrates, and specialty excipients. Solubilizers & Surfactants/Emulsifiers covered in the report include triglycerides, esters, and others. in addition, polyols include mannitol, sorbitol, and others. Carbohydrates including sucrose, dextrose, starch, and others are estimated to hold a prominent share in the market. The segment holds a major share as it is easily available that too at a reasonable cost which in turn has resulted in the wide usage of carbohydrates such as sucrose as a bulking and stabilizing agent in the majority of the lyophilized monoclonal antibody-based formulations.

Global Pharmaceutical Excipient Market Share by Product, 2018 (%)

Carbohydrate-based excipients is estimated to contribute a significant share in the global pharmaceutical excipients market in 2018. The wide-adoption of starch, sucrose, and dextrose across drug formulations has resulted in the prominent share of the segment in the market. In addition, carbohydrates are being rapidly adopted as bulking agents for the lyophilization of biomolecules. Additionally, they are widely used as organic excipients due to their filling and taste-masking properties.

Formulation Insights of Pharmaceutical Excipients Market

Based on formulations, the market is segmented into oral formulations, topical formulations, parenteral formulations, and other formulations. Oral formulations held a remarkable share in the market owing to it being the most common route of drug delivery. In addition, the pharmaceutical excipients market for topical formulations is estimated to exhibit a considerable CAGR during the forecast period.

Regional Outlook

The global pharmaceutical excipients market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World.North America is estimated to have a significant share in 2018 owing to the increasing demand for pharmaceutical and biopharmaceutical production along with the need for maintaining the quality of high-grade raw materials used for developing pharmaceuticals and biopharmaceuticals.

Europe is further estimated to hold a prominent share in the global pharmaceutical excipients market owing to the presence of a large number of major pharmaceutical companies in the region with large production capacities that result in high consumption of excipients.In addition, the increasing focus on superior pharmaceutical products, generics, and biosimilars tends to increase the demand for novel excipients, which, in turn, tend to drive the regional growth of the market in the near future.

Asia-Pacific is estimated to exhibit a considerable growth rate during the forecast period. China,Japan, and India are the major contributors to the Asia-Pacific market in 2018. Increasing incidences of chronic disease coupled with the growing geriatric population tend to increase the demand for low-cost drugs in the near future. This, in turn, will increase the demand for excipients for drug development and formulations.

Market Players Outlook

Some of the players operating inthe global pharmaceutical excipient market include BASF SE, Merck KGaA, Evonik Industries AG, Colorcon Inc., Croda International PLC, Roquette Frères,Archer Daniels Midland Co., and others.Due to increasing competition in the market, the players are focusing on the development of new products that tend to fuel market growth in the near future.

Roquette is one of the major players in the market with an extensive product line. Roquette offers the broadest range, including sorbitol, maltitol, mannitol, xylitol, and isosorbide. In the early 1950s, Roquette planned to produce NEOSORB Sorbitol on a large scale.More polyols were subsequently added to the list which includes PEARLITOL mannitol, SWEETPEARL maltitol, LYCASIN, and POLYSORB maltitol syrup, XYLISORB xylitol, and POLYSORB isosorbide. Finally, Roquette set up polyol production units in the US, France, South Korea and, more recently, China

Recent Developments

- In November 2019, Merck developed a new filtration-based manufacturing process resulting in a new, highly purified sucrose grade with reduced levels of nanoparticle impurities (NPI). The new product, Sucrose EMPROVE EXPERT Ph Eur, ChP, JP, NF, is the ideal choice for the high-risk applications of manufacturing and formulating biomolecules.

- In May 2019, Colorcon expanded its product line of direct compression solutions by launching StarTab, a starch-based tableting excipient. StarTab is the third starch-based excipient of the company after StarCap 1500 and Starch 1500. StarTab is expected to enhance the stability of moisture sensitive active pharmaceutical ingredients.

- In December 2018, Roquette completed the acquisition of a majority stake in Crest Cellulose, from Pravesha Industries, Pharma packaging company in India. This will reinforce Roquette’s position as a major supplier to the pharmaceutical industry and one of the leaders in superior natural-based pharmaceutical excipients. The addition of Crest Cellulose’s production capabilities to Roquette’s strong expertise and track-record in the pharmaceutical excipients market will create new opportunities for both customers of both companies.

- In December 2018, Merck expanded its collaboration with Kuraray Europe for exclusively supplying pharmaceutical polyvinyl alcohol (PVA) grades and improvements to benefit the pharmaceutical market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical excipient market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Merck KGaA

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Evonik Industries AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Archer Daniels Midland Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. BASF SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Croda International Plc

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pharmaceutical ExcipientMarket by Product

5.1.1. Solubilizer & Surfactants/Emulsifier

5.1.2. Polyols

5.1.3. Carbohydrates

5.1.4. Specialty Excipients

5.2. Global Pharmaceutical Excipient Market by Formulation Type

5.2.1. Oral Formulation

5.2.2. Topical Formulation

5.2.3. Parenteral Formulation

5.2.4. Other Formulations

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABITECCorp.

7.2. Air Liquide S.A

7.3. Archer Daniels Midland Co

7.4. BASF SE

7.5. ClariantAG

7.6. Colorcon, Inc.

7.7. Croda International Plc

7.8. DFE Pharma

7.9. Evonik Industries AG

7.10. IMCDN.V.

7.11. Innophos Holdings, Inc.

7.12. Lubrizol Corp.

7.13. Meggle AG

7.14. Merck KGaA

7.15. Pharmonix Biological Pvt. Ltd.

7.16. Roquette Frères

7.17. Sigachi Industries Pvt. Ltd.

7.18. Signet Chemical Corp. Pvt. Ltd.

7.19. Spectrum Chemical Manufacturing Corp.

7.20. SPI Pharma

7.21. WACKER Chemie AG

1. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY PRODUCT 2018-2025 ($ MILLION)

2. GLOBAL SOLUBILIZER & SURFACTANT PHARMACEUTICAL EXCIPIENTMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL POLYOLSPHARMACEUTICAL EXCIPIENTMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CARBOHYDRATEPHARMACEUTICAL EXCIPIENTMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL SPECIALTY PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

7. GLOBAL PHARMACEUTICAL EXCIPIENT FOR ORAL FORMULATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL PHARMACEUTICAL EXCIPIENT FOR TOPICAL FORMULATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PHARMACEUTICAL EXCIPIENT FOR PARENTERAL FORMULATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PHARMACEUTICAL EXCIPIENT FOR OTHER FORMULATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

14. NORTH AMERICAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY FORMULATIONS, 2018-2025 ($ MILLION)

15. EUROPEAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. EUROPEAN PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY FORMULATIONS, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY FORMULATIONS, 2018-2025 ($ MILLION)

21. REST OF THE WORLD PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

22. REST OF THE WORLD PHARMACEUTICAL EXCIPIENT MARKET RESEARCH AND ANALYSIS BY FORMULATIONS, 2018-2025 ($ MILLION)

1. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET SHARE BY FORMULATIONS, 2018 VS 2025 (%)

3. GLOBAL PHARMACEUTICAL EXCIPIENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PHARMACEUTICAL EXCIPIENT MARKET SIZE, 2018-2025 ($ MILLION)