Pharmaceutical Filtration Market

Pharmaceutical Filtration Market Size, Share & Trends Analysis Report by Technique (Microfiltration, Ultrafiltration, Nanofiltration, and Others), by Application (Final Product Processing, Raw Material Filtration, Cell Separation, Water Purification, and Air Purification) Forecast Period (2024-2031)

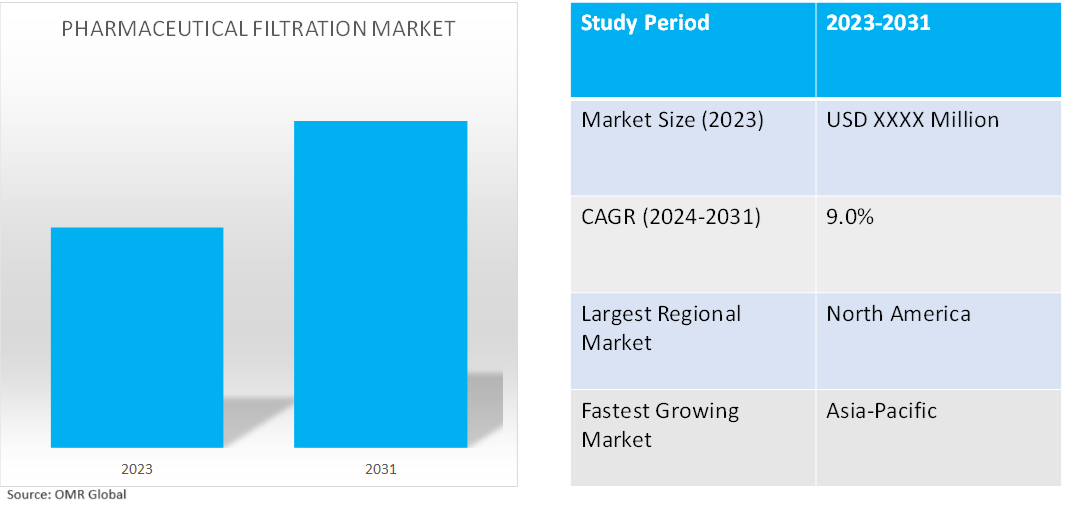

Pharmaceutical filtration market is anticipated to grow at a significant CAGR of 9.0% during the forecast period (2024-2031). The market growth is attributed to the growing prevalence of chronic disease, growing funding for biopharmaceutical R&D, and increasing technological developments in the sterilizing process. According to the National Center for Biotechnology Information (NCBI), global pharmaceutical market revenue was $1,143 billion in 2017 and reached $1,462 billion in 2021.

Market Dynamics

Growing Adoption of Single-Use Systems in Pharmaceutical Industry

Single-use filtration systems are growing increasingly common owing to their benefits in decreasing cross-contamination, less cleaning requirements, and enhanced flexibility and efficiency. In biopharmaceutical processing of medicinal pharmaceuticals, single-use systems hold great promise as they offer substantial benefits over conventional reusable stainless-steel systems and partially disposable systems. Single-use systems, which eliminate the chemicals and resources (such as water and energy) required to sterilize reusable systems, encourage sustainability. They seem to be the antithesis of a global movement away from throwaway items and processes. Single-use parts are meant to be thrown away after just one use. It is not always required to prepare items before use as many disposable systems come pre-cleaned and sterilized for the user. As a result, the customer location no longer requires cleaning and sterilizing procedures.

Increasing Biopharmaceutical Production Globally

The demand for advanced filtering methods that can handle these complex compounds and ensure high purity levels is driven by the increase in the manufacture of biologics, such as monoclonal antibodies, vaccines, and cell and gene therapies. In the biopharmaceutical sector, filtration is extremely important as it ensures the sterility of desired products by eliminating impurities. Certain sterilization techniques cannot be used on pharmaceutical items owing to their extreme sensitivity, which makes filtration an essential step in the process. Many pharmaceutical compounds, including hormones, enzymes, and antibiotics, are purified via filtration. Endotoxins, host cell proteins, and other pollutants are eliminated during this process, which also guarantees the final product's integrity and purity.

Market Segmentation

- Based on the technique, the market is segmented into microfiltration, ultrafiltration, nanofiltration, and others (ion exchange).

- Based on the application, the market is segmented into final product processing, raw material filtration, cell separation, water purification, and air purification.

Microfiltration is Projected to Hold the Largest Share

The primary factors supporting the growth include the capacity to purge biopharmaceutical goods of a variety of contaminants. Additionally, the method eliminates particles and contaminants without appreciably affecting the stability or biological activity of the filtered medium. Furthermore, makers of microfiltration systems are taking strategic actions that support the market. For instance, in April 2023, Meissner Corp., a manufacturer of advanced microfiltration and single-use systems to produce pharmaceutical drugs, biologics, and cell and gene therapies, invested nearly $250 million in a new manufacturing facility in Athens, Georgia.

Final Product Processing to Hold a Considerable Market Share

The factors supporting segment growth include increasing the final product's safety and efficacy by eliminating any impurities or pollutants and enabling it to conform with regulatory criteria, Furthermore, the manufacturing of biologics and vaccines must adhere to stringent regulatory guidelines set forth by the US FDA, EMA, Japanese Ministry of Health, and others. These guidelines require multiple steps in the final product processing for quality, purity, and safety; noncompliance may result in the termination of approval or damage to the manufacturing facility's reputation.

Regional Outlook

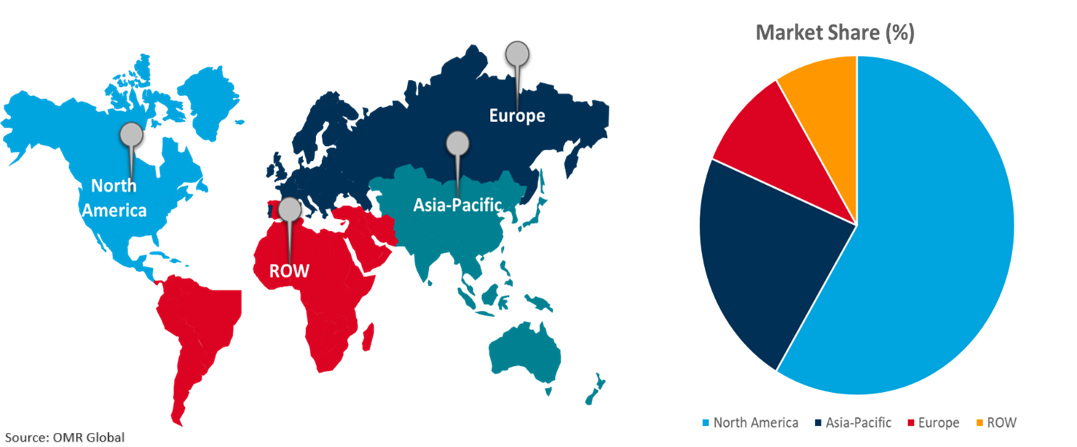

Global pharmaceutical filtration market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Pharmaceutical Filtration in Asia-Pacific

The regional growth is attributed to the increase in the total volume of biopharmaceutical manufacturing in developing nations such as China and India. The regional biopharmaceutical industry is growing, the government and pharmaceutical and biotechnology companies are investing more in research and development which is promoting the adoption of single-use technologies. Additionally, the regional market players are launching multiple products, and end-users are scrutinizing purity requirements. These factors are collectively responsible for the growth of the regional market.

Global Pharmaceutical Filtration Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of pharmaceutical filtration offering companies such as 3M, Danaher Corp., Parker Hannifin Corp., and others. The market growth is attributed to the increasing accessibility of novel products and the region's well-developed healthcare infrastructure. Additionally, the US healthcare coverage rules enable patients to receive the appropriate treatment, which in turn encourages academic institutions and biopharma manufacturing companies to search for novel treatments. Key players in the market continue to invest in pharmaceutical filtration to enable biotech customers to continue to innovate therapies. For instance, in May 2023, 3M Co. invested nearly $150.0 million to advance capabilities in biopharma filtration technology. The new investment accelerates 3M's development and delivery of vital filtration equipment designed for bioprocessing, biological, and small molecule pharmaceutical manufacturing applications, which enable biotech customers to continue to innovate therapies used for the treatment of conditions such as rheumatoid arthritis, multiple sclerosis, and certain cancers.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global pharmaceutical filtration market include 3M, Danaher Corp., Merck KGaA, Parker Hannifin Corp., and Sartorius AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In May 2022, Merck invested more than €440 million ($463.6 million) and expanded its membrane and filtration manufacturing in Ireland. Significantly increases membrane-manufacturing capacities and enables the construction of new filtration manufacturing facility. Supports Merck’s strategy to invest in products and technologies across its portfolio that are key to manufacturing novel therapies, vaccines, and diagnostics.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the pharmaceutical filtration market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danaher Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Merck KGaA

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Parker Hannifin Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Sartorius AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pharmaceutical Filtration Market by Technique

4.1.1. Microfiltration

4.1.2. Ultrafiltration

4.1.3. Nanofiltration

4.1.4. Others (Ion Exchange)

4.2. Global Pharmaceutical Filtration Market by Application

4.2.1. Final Product Processing

4.2.2. Raw Material Filtration

4.2.3. Cell Separation

4.2.4. Water Purification

4.2.5. Air Purification

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ADVANTEC MFS, Inc.

6.2. Amazon Filters Ltd.

6.3. Cole-Parmer Instrument Company, LLC

6.4. Donaldson Company, Inc.

6.5. Eppendorf AG

6.6. ESG FILTRATION LTD. (SUEZ Water Technologies & Solutions)

6.7. Filtration Group Corp.

6.8. GE Healthcare (Cytiva)

6.9. Graver Technologies

6.10. GVS Group

6.11. Meissner Filtration Products, Inc.

6.12. Membrane Solutions LLC

6.13. Porvair Filtration Group

6.14. Purilogics LLC

6.15. Repligen Corp.

6.16. Saint-Gobain Performance Plastics

6.17. Sterlitech Corp.

6.18. Thermo Fisher Scientific Inc.

6.19. Wolftechnik Filtersysteme GmbH & Co. KG

1. Global Pharmaceutical Filtration Market Research And Analysis By Technique, 2023-2031 ($ Million)

2. Global Pharmaceutical Microfiltration Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Pharmaceutical Ultrafiltration Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Pharmaceutical Nanofiltration Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Other Pharmaceutical Filtration Technique Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Pharmaceutical Filtration Market Research And Analysis By Application, 2023-2031 ($ Million)

7. Global Pharmaceutical Filtration for Final Product Processing Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Pharmaceutical Raw Material Filtration Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Pharmaceutical Filtration In Cell Separation Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Pharmaceutical Filtration In Water Purification Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Pharmaceutical Filtration In Air Purification Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Pharmaceutical Filtration Market Research And Analysis By Region, 2023-2031 ($ Million)

13. North American Pharmaceutical Filtration Market Research And Analysis By Country, 2023-2031 ($ Million)

14. North American Pharmaceutical Filtration Market Research And Analysis By Technique, 2023-2031 ($ Million)

15. North American Pharmaceutical Filtration Market Research And Analysis By Application, 2023-2031 ($ Million)

16. European Pharmaceutical Filtration Market Research And Analysis By Country, 2023-2031 ($ Million)

17. European Pharmaceutical Filtration Market Research And Analysis By Technique, 2023-2031 ($ Million)

18. European Pharmaceutical Filtration Market Research And Analysis By Application, 2023-2031 ($ Million)

19. Asia-Pacific Pharmaceutical Filtration Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific Pharmaceutical Filtration Market Research And Analysis By Technique, 2023-2031 ($ Million)

21. Asia-Pacific Pharmaceutical Filtration Market Research And Analysis By Application, 2023-2031 ($ Million)

22. Rest Of The World Pharmaceutical Filtration Market Research And Analysis By Region, 2023-2031 ($ Million)

23. Rest Of The World Pharmaceutical Filtration Market Research And Analysis By Technique, 2023-2031 ($ Million)

24. Rest Of The World Pharmaceutical Filtration Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Pharmaceutical Filtration Market Research And Analysis By Technique, 2023 Vs 2031 (%)

2. Global Pharmaceutical Microfiltration Market Share By Region, 2023 Vs 2031 (%)

3. Global Pharmaceutical Ultrafiltration Market Share By Region, 2023 Vs 2031 (%)

4. Global Pharmaceutical Nanofiltration Market Share By Region, 2023 Vs 2031 (%)

5. Global Others Pharmaceutical Filtration Technology Market Share By Region, 2023 Vs 2031 (%)

6. Global Pharmaceutical Filtration Market Research And Analysis By Application, 2023 Vs 2031 (%)

7. Global Pharmaceutical Filtration for Final Product Processing Market Share By Region, 2023 Vs 2031 (%)

8. Global Pharmaceutical Raw Material Filtration Market Share By Region, 2023 Vs 2031 (%)

9. Global Pharmaceutical Filtration In Cell Separation Market Share By Region, 2023 Vs 2031 (%)

10. Global Pharmaceutical Filtration In Water Purification Market Share By Region, 2023 Vs 2031 (%)

11. Global Pharmaceutical Filtration In Air Purification Market Share By Region, 2023 Vs 2031 (%)

12. Global Pharmaceutical Filtration Market Share By Region, 2023 Vs 2031 (%)

13. US Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

14. Canada Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

15. UK Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

16. France Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

17. Germany Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

18. Italy Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

19. Spain Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

20. Rest Of Europe Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

21. India Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

22. China Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

23. Japan Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

24. South Korea Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

26. Rest Of The World Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

27. Latin America Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)

28. Middle East And Africa Pharmaceutical Filtration Market Size, 2023-2031 ($ Million)