Pharmaceutical Glass Packaging Market

Global Pharmaceutical Glass Packaging Market Size, Share & Trends Analysis Report by Product Type (Bottles, Vials, Cartridges & Syringes, and Others), and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global pharmaceutical glass packaging market is anticipated to grow at a CAGR of 5.4% during the forecast period (2020-2026). The key factors that drive the growth of the market include the increased demand for glass packaging products as they do not react with medicine or drug. Glass packaging products are also non-reactive with other chemicals, clean, dust-free as well as recyclable, owing to which these glass products are highly preferred by the pharma companies. Increased awareness regarding various diseases has increased in the intake of several vaccinations and medications to prevent the disease. The market is also driven by increasing biopharmaceutical R&D and growing funding by national governments in the pharmaceutical industry.

Further, the outbreak of COVID-19 started in December 2019 and with time, the world has witnessed a colossal upsurge in the number of new positive cases. The total number of global confirmed cases of COVID-19 exceeded 32 million, while the number of global mortalities exceeded 900,000. Such a severe impact from COVID-19 burdened the biopharmaceutical players to develop a vaccine and contain the spread of the COVID-19 pandemic. The continuous research in the field of infectious diseases and vaccines is fueling the demand for the pharmaceutical glass packaging market over the forecast period.

Segmental Outlook

The global pharmaceutical glass packaging market is segmented on the basis of product type into bottles, vials, cartridges & syringes, and others such as ampoules. The demand for glass vials is projected to remain high during the forecast period due to its properties such as high inertness to the majority of chemicals. In addition, the vials prevent atmospheric gases such as oxygen and carbon dioxide from entering the container.

Glass Bottles to Exhibit Significant Growth during the Forecast Period

Glass bottles are extensively used for the packaging of medicines. These bottles are manufactured for meeting tight tolerance limits as they are often filled in high-speed lines. Glass is being considered as a viable alternative as the impact of glass on the environment is much less as compared to polyethylene terephthalate (PET), which makes it the most environment-friendly packaging medium. Moreover, the increasing prevalence of diabetes is significantly creating the demand for glass bottles for injectable pharmaceuticals. Glass cartridges with pen injection devices have been widely used in insulin with a standard size of 1.5 ml of the glass bottle.

Regional Outlook

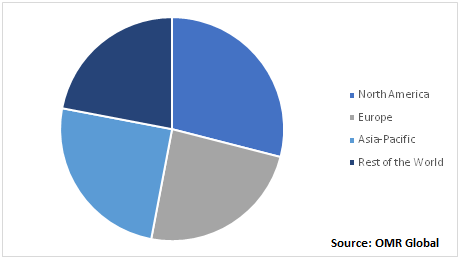

The global pharmaceutical glass packaging market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The North American region is likely to witness a significant growth rate over the forecast period owing to the presence of the key manufacturers in the region. The key players are continuously contributing to the growth of the pharmaceutical glass packaging market through several launches and innovations.

Besides, there are also a higher number of drug manufacturing companies in the region which substantially demands packaging products for the drugs. Further, the region has also been emphasizing on recycled glass packaging. As per the US Glass Packaging Institute (GPI), the US annually uses over 3.35 million metric tons of glass. It was also estimated that over 33% of this figure was accounted for to produce glass containers in 2019. The country also has the footprints of major recycling plants for all recyclable materials. Thus, this is augmenting the growth of the pharmaceutical glass packaging market in North America. Further, the Asia-Pacific region is estimated to grow significantly during the forecast period. The regional growth of the pharmaceutical glass packaging market is attributed to the increased demand for generic drugs from economies such as India and China.

Global Pharmaceutical Glass Packaging Market, by Region 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global pharmaceutical glass packaging market include Becton, Dickinson and Co., Corning Inc., DWK Life Sciences GmbH, Gerresheimer AG, Nipro Corp., Schott AG, and SGD SA. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global pharmaceutical glass packaging market. For instance, Becton, Dickinson, and Co., one of the key players in the healthcare industry manufacture and sells BD Hypak for vaccines glass pre-fillable syringe system. It is a glass pre-fillable syringe system specifically optimized for vaccinations.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical glass packaging market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Corning Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Nipro Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Gerresheimer AG

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Schott AG

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints/Challenges

4.3. Opportunities

5. Market Segmentation

5.1. Global Pharmaceutical Glass Packaging Market by Product Type

5.1.1. Bottles

5.1.2. Vials

5.1.3. Cartridges& Syringes

5.1.4. Others (Ampoules)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acme Vial and Glass Co. LLC

7.2. Agrado S.A.

7.3. Amposan S.A.

7.4. Arab Pharmaceutical Glass Co.

7.5. Ardagh Group S.A.

7.6. Beatson Clark Ltd.

7.7. Becton, Dickinson and Co.

7.8. Bormioli Pharma

7.9. BorosilCorporate AV

7.10. Corning Inc.

7.11. DWK Life Sciences GmbH

7.12. Gerresheimer AG

7.13. Hindustan National Glass & Industries Ltd.

7.14. Nipro Corp.

7.15. Owens-Illinois, Inc.

7.16. Piramal Enterprises Ltd.

7.17. Schott AG

7.18. SGD S.A

7.19. Shandong Pharmaceutical Glass Co., Ltd.

7.20. ?i?ecam Group

7.21. Stolzle-OberglasGmBH

7.22. West Pharmaceutical Services, Inc.

1. GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PHARMACEUTICAL GLASS BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PHARMACEUTICAL GLASS VIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PHARMACEUTICAL GLASS CARTRIDGES & SYRINGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

9. EUROPEAN PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. EUROPEAN PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

13. REST OF THE WORLD PHARMACEUTICAL GLASS PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

1. GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

5. UK PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD PHARMACEUTICAL GLASS PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)