Pharmaceuticals Market

Pharmaceuticals Market Size, Share, and Trends Analysis Report By API Type (Synthetic Chemical API and Natural Chemical API), By Drug (Prescription Drugs and OTC Drugs), By Application (Oncology, Ophthalmology, Cardiovascular Disease, Gastrointestinal Disorders, Diabetes, Endocrinology, Central Nervous System & Neurological Disorders, and Nephrology), Forecast Period (2023–2030) Update Available - Forecast 2025-2035

Pharmaceuticals market is anticipated to grow at a considerable CAGR of 6.7% during the forecast period. The pharmaceutical industry is driven by several factors, including advances in technology, changing demographics, and evolving regulatory requirements. One of the key drivers of the pharmaceutical market is research and development. Pharmaceutical companies invest heavily in R&D to develop new drugs and treatments that can improve health outcomes and address unmet medical needs. For instance, in March 2023, Iktos, a company specializing in artificial intelligence (AI) for new drug discovery, announced the completion of a €15.5 million ($16.6 million) Series A financing led by early investors M Ventures and Debiopharm Innovation Fund with participation from Omnes Capital.This funding will allow the company to expand its existing SaaS software offering and further develop its AI and drug discovery capabilities, as well as launch Iktos Robotics, a unique end-to-end drug discovery platform that combines AI and chemical synthesis automation to significantly accelerate drug discovery timelines. Iktos will also broaden the application of its solutions to biological products as part of the funding (peptides, antibodies, and others). This enables Iktos to be one of the first companies to provide the pharmaceutical industry with fully integrated drug discovery services.Another driver of the pharmaceutical market is demographic trends. As populations age, there is increasing demand for treatments for chronic conditions such as diabetes, heart disease, and cancer. This has led to a growing market for specialty drugs, which are targeted at specific patient populations.

Segmental Outlook

The global pharmaceuticals market is segmented by API type, drug, and application. Based onAPItype, the market is sub-segmented into synthetic chemical API and natural chemical API. Based on drug, the market is sub-segmented into prescription drugs and OTC drugs. Based onapplication, the market is sub-segmented into oncology, ophthalmology, cardiovascular disease, gastrointestinal disorders, diabetes, endocrinology, central nervous system & neurological disorders, and nephrology. Among drugs, the prescription drug segment is expected to account for the largest market share during the forecast period owing to consumers’ awareness of the prescribed drugs. For instance, according to the American Journal of Health-System Pharmacy, overall prescription drug spending in the US increased by 4-6% in 2019.

The Synthetic Chemical API Sub-Segment Holds a Prominent Share in the Global Pharmaceuticals Market

Based onAPI type, the market is sub-segmented into synthetic chemical API and natural chemical API. Among these, the synthetic chemical API is expected to hold a significant market share during the forecast period. The majority of drugs used in modern medicine are synthetic chemical APIs, which are designed and developed through chemical synthesis in a laboratory setting. The development of synthetic APIs has allowed for a more precise control of the chemical composition and properties of the drug, which can result in greater efficacy, safety, and consistency in manufacturing. Synthetic APIs can also be produced at a lower cost and with greater scalability compared to natural chemical APIs, which can be limited in availability and have a more variable composition.

Regional Outlook

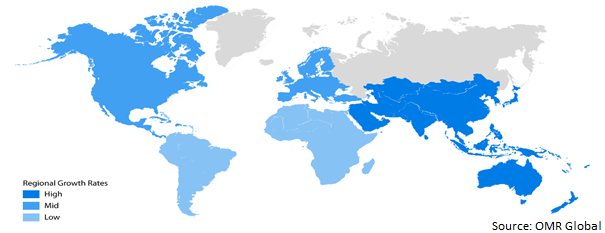

The global pharmaceuticals market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the North American region is expected to generate the highest market share, followed by the Asia-Pacific and European markets. The Asia-Pacific market is driven by a large pool of population, pharma manufacturers, and various governmentinitiatives to promote disease treatments such as the Central Government Health Scheme in India by the Ministry of AYUSH.

Global Pharmaceuticals Market Growth, by Region (2023-2030)

The North American Region is Expected to Dominate the Global Pharmaceuticals Market

North America has one of the highest healthcare expenditures in the world, with a significant portion of the spending allocated to prescription drugs. This creates a strong demand for pharmaceutical products in the region.According to the Centers for Medicare & Medicaid Services (CMS), in 2020, national healthcare spending in the US was $4.0 trillion, which represented 17.7% of the country's gross domestic product (GDP). Of this total, prescription drug spending accounted for $370.7 billion, or 9% of total healthcare spending.Besides, the region has a relatively high disposable income, which enables people to afford expensive drugs and medical treatments. This creates a strong demand for pharmaceutical products in the region.The region also has a robust research and development infrastructure. It is home to many top universities, research institutions, and pharmaceutical companies, which invest heavily in the research and development of new drugs. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), in 2019, the research-based biopharmaceutical industry in the US invested an estimated $83 billion in research and development, making it the highest R&D investment of any industry in the country.

Market Players Outlook

The major companies serving the global pharmaceutical market include Lupin Pharmaceuticals Inc., Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and the launch of drugs to stay competitive in the market. For instance, in March 2023, Lupin Limited (Lupin) announced the official launch of its new regional reference laboratory in Hyderabad, Telangana, India. Lupin Diagnostics' network expansion is part of the organization’s strategy to strengthen and expand its presence in South India. This laboratory joins Lupin Diagnostics' existing network of more than 380 LupiMitra collection centers and 23 laboratories across India.

The Report Covers -

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceuticalsmarket. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pharmaceuticals Market by API Type

4.1.1. Synthetic Chemical API

4.1.2. Natural Chemical API

4.2. Global PharmaceuticalsMarket by Drug

4.2.1. Prescription Drugs

4.2.2. OTC Drugs

4.3. Global PharmaceuticalsMarket by Application

4.3.1. Oncology

4.3.2. Ophthalmology

4.3.3. Cardiovascular Disease

4.3.4. Gastrointestinal Disorders

4.3.5. Diabetes

4.3.6. Endocrinology

4.3.7. Central Nervous System & Neurological Disorders

4.3.8. Nephrology

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott Laboratories

6.2. AbbVie Inc.

6.3. Albemarle Corp.

6.4. AstraZeneca

6.5. Aurobindo Pharma

6.6. Baxter

6.7. Bayer AG

6.8. Boehringer Ingelheim International GmbH

6.9. Bristol-Myers Squibb Company

6.10. Eli Lilly and Company

6.11. F.Hoffmann-La Roche Ltd.

6.12. GlaxoSmithKline plc

6.13. Lupin Pharmaceuticals Inc.

6.14. Merck & Co. Inc.

6.15. Novartis AG

6.16. Pfizer Inc.

6.17. Sanofi

6.18. Teva Pharmaceutical Industries Ltd.

1. GLOBAL PHARMACEUTICALS MARKETRESEARCH AND ANALYSIS BY API TYPE, 2022-2030 ($ MILLION)

2. GLOBAL PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL SYNTHETIC CHEMICAL API PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL NATURAL CHEMICAL API PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL PHARMACEUTICALS RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

6. GLOBAL PRESCRIPTION DRUGS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL OTC DRUGS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

9. GLOBAL ONCOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL OPHTHALMOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL CARDIOVASCULAR DISEASE PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL GASTROINTESTINAL DISORDERS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL DIABETES PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL ENDOCRINOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL CENTRAL NERVOUS SYSTEM & NEUROLOGICAL DISORDERS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL NEPHROLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY API TYPE, 2022-2030 ($ MILLION)

20. NORTH AMERICAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

21. NORTH AMERICAN PHARMACEUTICALS MARKETRESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. EUROPEAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APITYPE, 2022-2030 ($ MILLION)

24. EUROPEAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

25. EUROPEAN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY API TYPE, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

30. REST OF THE WORLD PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

31. REST OF THE WORLD PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APITYPE, 2022-2030 ($ MILLION)

32. REST OF THE WORLD PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

33. REST OF THE WORLD PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL PHARMACEUTICALS MARKET SHARE BY API TYPE, 2022 VS 2030 (%)

2. GLOBAL SYNTHETIC CHEMICAL API PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL NATURAL CHEMICAL API PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY DRUG, 2022-2030 ($ MILLION)

5. GLOBAL PRESCRIPTION DRUGS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL OTC DRUGS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

8. GLOBAL ONCOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL OPHTHALMOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL CARDIOVASCULAR DISEASE PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL GASTROINTESTINAL DISORDERS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL DIABETES PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL ENDOCRINOLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL CENTRAL NERVOUS SYSTEM & NEUROLOGICAL DISORDERS PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL NEPHROLOGY PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL PHARMACEUTICALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

19. UK PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD PHARMACEUTICALS MARKET SIZE, 2022-2030 ($ MILLION)