Pharmacy Automation Market

Global Pharmacy Automation Market Research By Product (Automated Packaging and Labeling Systems, Automated Medication Dispensing Systems, Automated Storage and Retrieval Systems, Table Top Counters and Other), and By End User (Retail Pharmacy, Hospital Pharmacy, Inpatient Pharmacy Units, Outpatient Pharmacy Units and Other) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global pharmacy automation market is growing at a considerable CAGR of 8.5% during the forecast period. Rising application and products to serve variety of pharmaceutical domains is one of the prime factors affecting and driving the market. Increasing innovations across the globe in pharmacy automation along with robotic automation providing optimum productivity is also estimated to be the key factors that are contributing significantly towards the growth of the market. However, high cost that is involved in pharmacy automation along with its maintenance is the major factors constraints that are hindering the growth of the global pharmacy automation market across the globe.

Further, growing adoption of pharmacy automation in emerging economies along with rising technologies advancement are some of the key factor that are creating opportunity for the market. New product launches in the market are likely to drive the growth of the global pharmacy automation market. For instance, in April 2021, KUKA AG had launched and added the new KR DELTA robot that is a robot type of the low payload category which will be providing its flexible application possibilities in pharmaceutical.

Impact of COVID-19 Pandemic on the Global Pharmacy Automation Market

The global pharmacy automation market is positively impacted owing to COVID-19 pandemic since December 2019. The COVID-19 pandemic had brought a lot of disruption across the globe. However, due to COVID-19 pandemic in order to reduces the transfer of infection the pharmacy had adopted the automation systems for fulling the demand related with various drugs safely which is acting as favorable factor for the market.

Segmental Outlook

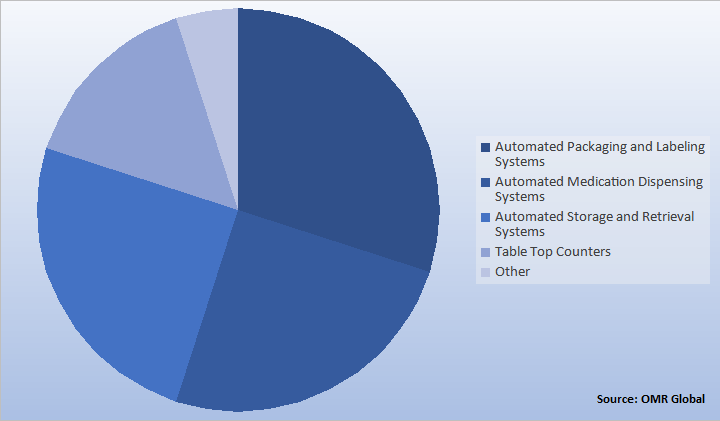

The market is segmented based on product and end user. Based on product, the market is segmented into automated packaging and labeling systems, automated medication dispensing systems, automated storage and retrieval systems, table top counters and other. By end user, the market is segmented into retail pharmacy, hospital pharmacy, inpatient pharmacy units, outpatient pharmacy units and other.

Global Pharmacy Automation Market Share by Product 2020 (%)

By product, the automated packaging and labeling systems hold significant share in the market owing to without human interruption the packaging of pharmaceutical medicines can be done conveniently along with preprinted labels added to the products. Additionally, it increases the efficiency along with reducing the cost with enabling contact less packaging and its proper verification.

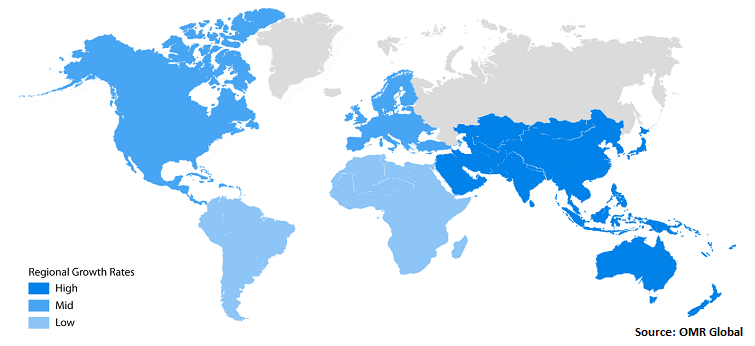

Regional Outlooks

The global pharmacy automation market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global pharmacy automation market. Some factors that are boosting the market growth in North America are increasing demand of pharmacy automated product and application. Additionally, increasing and improving healthcare system in the region along with presence of major number of pharmacy automation company that includes Becton, Dickinson, and Co., Parata, Baxter, Omnicell, Inc. among others in this region is also driving the growth of the market. More than 100,000 reports in the US are received every year that are related with suspected medication error by the U.S. Food and Drug Administration (FDA). So, in order to decrease the medication errors the pharmacy automation can play an important in the region.

Global Pharmacy Automation Market, by Region 2021-2027

Asia-Pacific will have Considerable Growth in the Global Pharmacy Automation Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. Increasing demand in health domain related with pharmacy automation is likely to drive the growth of the regional market. Additionally, favorable polices of government in this region especially in South Korea, China and India are supporting the growth of the market. Further, development in domestic healthcare infrastructure along with minimizing the medication errors are also some of the factors that are affecting and impacting the growth in this market.

Market Player Outlook

Key players of the global pharmacy automation market are Capsa Healthcare, Deenova S.r.l, Parata, Swisslog Healthcare, and Omnicell Inc., among others. To survive in the market, these players adopt different marketing strategies such as product launches and acquisition. For instance, in December 2020, one of the global suppliers of integrated solutions in healthcare named as Swisslog Healthcare had set forth a digital representation of their automation academy at the American society. There solutions for pharmacy automation are been utilized by more than 3,000 hospitals across the globe which the visitors can view with the support of the site.

In November 2020, Omnicell Inc. had introduced its latest portfolio of medication management solutions. This new solutions are made in order to support the hospitals along with health systems in order to enlarge their medication inventory visibility along with supply chain management capabilities for achieving their goals.

In August 2020, Capsa Healthcare had done the acquisition of robopharma that will support in development for its current and additional solutions which will be provided for automation solutions in pharmaceutical.

In October 2019, one of the providers of pharmacy automation named as Parata had introduced its new generation of vial-filling robot, Max 2. This Parata Max 2 will support in improving the workflow as it provides automating labeling, filling, and capping of vials. Additionally, it also reduces the costs along with medication errors by automating around 80% of oral solids with exactness for drugs and doses in a pharmacy.

In February 2019, Touchpoint Medical had done the acquisition of one of the suppliers of self-service and computerized distribution systems in hospital for medication along with medical supplies named as Health tech. Through this Touchpoint Medical can enhance its portfolio by adding health tech offering of packaged solution including the medical vending equipment along with software for their served customers in the Northern European medical market.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global pharmacy automation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Pharmacy Automation Industry

• Recovery Scenario of Global Pharmacy Automation Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pharmacy Automation Market By Product

5.1.1. Automated Packaging And Labeling Systems

5.1.2. Automated Medication Dispensing Systems

5.1.3. Automated Storage And Retrieval Systems

5.1.4. Table Top Counters

5.1.5. Other

5.2. Global Pharmacy Automation Market By End User

5.2.1. Retail Pharmacy

5.2.2. Hospital Pharmacy

5.2.3. Inpatient Pharmacy Units

5.2.4. Outpatient Pharmacy Units

5.2.5. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accu-Chart

7.2. AmerisourceBergen Corp.

7.3. Baxter

7.4. BECTON, DICKINSON AND CO.

7.5. Capsa Healthcare

7.6. Deenova S.r.l

7.7. KUKA AG

7.8. Medacist Solutions Group, LLC.

7.9. Parata

7.10. Pearson Medical Technologies, LLC.

7.11. ScriptPro LLC

7.12. Swisslog Healthcare

7.13. TOUCHPOINT MEDICAL

7.14. Omnicell Inc.

7.15. Yuyama.com

1. GLOBAL PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL PHARMACY AUTOMATION MARKET BY PRODUCT, 2020-2027 ($ MILLION)

3. GLOBAL AUTOMATED PACKAGING AND LABELLING SYSTEMS MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL AUTOMATED MEDICATION DISPENSING SYSTEMS MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEMS MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL TABLE TOP COUNTERS SYSTEMS MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL PHARMACY AUTOMATION MARKET BY END USER, 2020-2027 ($ MILLION)

9. GLOBAL RETAIL PHARMACY MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL HOSPITAL PHARMACY MARKET BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL INPATIENT PHARMACY UNITS MARKET BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL OUTPATIENT PHARMACY UNITS MARKET BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL OTHER MARKET BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

17. NORTH AMERICAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BYEND USER, 2020-2027 ($ MILLION)

18. EUROPEAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRIES, 2020-2027 ($ MILLION)

19. EUROPEAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

20. EUROPEAN PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRIES, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

24. REST OF THE WORLD PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

25. REST OF THE WORLD PHARMACY AUTOMATION MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)?

1. IMPACT OF COVID-19 ON GLOBAL PHARMACY AUTOMATION MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PHARMACY AUTOMATION MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL PHARMACY AUTOMATION MARKET, 2021-2027 (%)

4. GLOBAL PHARMACY AUTOMATION MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL PHARMACY AUTOMATION MARKET SHARE BY END USER, 2020 VS 2027 (%)

6. GLOBAL PHARMACY AUTOMATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL AUTOMATED PACKAGING AND LABELLING SYSTEMS MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL AUTOMATED MEDICATION DISPENSING SYSTEMS MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEMS MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL TABLE TOP COUNTERS MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL OTHER MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL RETAIL PHARMACY MARKET BY REGION, 2020 VS 2027 (%)

13. GLOBAL HOSPITAL PHARMACY MARKET BY REGION, 2020 VS 2027 (%)

14. GLOBAL INPATIENT PHARMACY UNITS MARKET BY REGION, 2020 VS 2027 (%)

15. GLOBAL OUTPATIENT PHARMACY UNITS MARKET BY REGION, 2020 VS 2027 (%)

16. GLOBAL OTHER MARKET BY REGION, 2020 VS 2027 (%)

17. US PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

19. UK PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

20. FRANCE PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

22. ITALY PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

23. SPAIN PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF EUROPE PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

25. INDIA PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

26. CHINA PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

27. JAPAN PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD PHARMACY AUTOMATION MARKET SIZE, 2020-2027 ($ MILLION)