Piling Machine Market

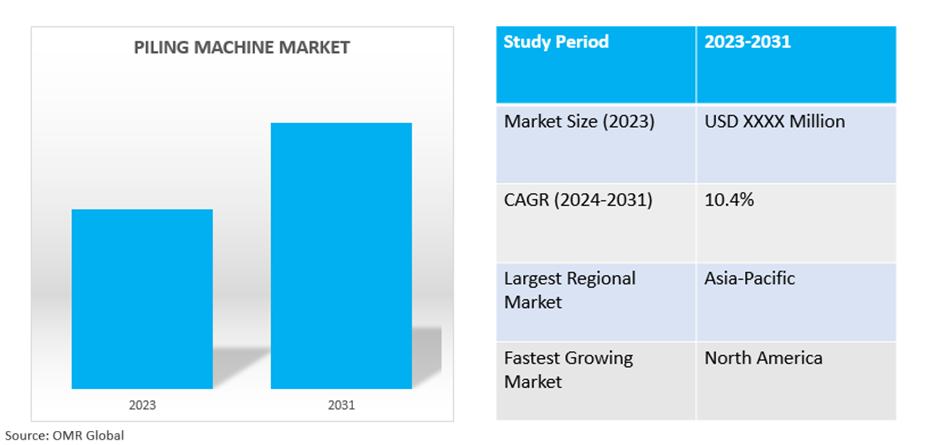

Piling Machine Market Size, Share & Trends Analysis Report by Product (Impact Hammer, Vibratory Drivers, Piling Rigs, and Others), and by Piling Method (Impact Driven, Drilled Percussive, Rotary Bored, Air-lift RCD Rig, Auger Boring, Continuous Flight Auger, and Others), Forecast Period (2024-2031)

Piling machine market is anticipated to grow at a CAGR of 10.4% during the forecast period (2024-2031). A piling machine also known as a pile driver or piling rig, is a specialized construction equipment used for driving piles (vertical structural elements) into the ground to provide support for various types of structures, such as buildings, bridges, and retaining walls. Major factors supporting the market growth include the increasing demand for infrastructure development and construction projects, growing urbanization, and increasing government investments.

Market Dynamics

Infrastructure Development Fueling Growth

Infrastructure development encompasses the construction and enhancement of physical structures and systems essential for the functioning of societies and economies. It includes projects such as building roads, bridges, airports, railways, ports, and utilities like water supply and sewage systems. Infrastructure development plays a crucial role in driving economic growth, improving living standards, and fostering social development. Governments and private sector entities invest in infrastructure to create employment opportunities, facilitate trade and commerce, enhance connectivity, and provide essential services to communities. Infrastructure projects are often long-term endeavors that require careful planning, financing, and execution to meet the evolving needs of populations and support sustainable development goals. For instance, in November 2021, Bauer Technologies Ltd, a subsidiary of the BAUER Group, secured a significant piling contract for the A465 improvement project between Dowlais Top and Hirwaun. This contract underscores the company's expertise and contribution to critical infrastructure enhancements.

The Impact of Technological Innovations

Technological advancements in the construction industry have revolutionized the way infrastructure projects are designed, planned, and executed. From innovative building materials to advanced construction machinery and digital tools, technology plays a pivotal role in improving efficiency, safety, and sustainability in construction practices. Building Information Modeling (BIM) such as enables project stakeholders to create virtual 3D models of infrastructure projects, facilitating collaborative design and coordination among architects, engineers, and contractors. Automation and robotics have led to the development of sophisticated construction equipment with enhanced capabilities, such as piling machines equipped with GPS and remote monitoring systems. Additionally, emerging technologies like drones, augmented reality (AR), and the Internet of Things (IoT) offer new opportunities for data collection, site monitoring, and project management, leading to better decision-making and project outcomes. For instance, in September 2022, Epiroc AB introduced the Hydrohammer IQ Series, a groundbreaking innovation in piling technology. The IQ Series boasts the ability to drive piles with 100.0% energy capacity constantly, with the option to escalate power output to 120.0% over a predefined period, based on soil conditions.

Market Segmentation

- Based on the product, the market is segmented into impact hammers, vibratory drivers, piling rigs, and others.

- Based on the piling method, the market is segmented into impact-driven, drilled percussive, rotary bored, air-lift RCD rig, auger boring, continuous flight auger, and others.

Piling Rigs is Projected to Emerge as the Largest Segment

The piling rigs segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes escalating demand for infrastructure development globally. As urbanization accelerates and populations expand, there's a pressing need for new buildings, roads, bridges, and other infrastructure to accommodate these developments. Piling rigs play a pivotal role in construction projects by facilitating the laying of deep foundations and stabilizing structures in various soil conditions.

Impact Driven Segment to Hold a Considerable Market Share

The impact driven segment commands a substantial market share due to market owing to its versatility, efficiency, and cost-effectiveness. Widely utilized in diverse construction projects, including building foundations and road construction, these machines offer quick setup and operation, enabling faster project completion. Their ability to handle various soil types and lower initial investment makes them accessible to a wide range of construction companies, particularly in emerging economies. Renowned for their durability and reliability, impact-driven piling machines are favored by contractors seeking equipment that ensures smooth project progress with minimal maintenance requirements.

Regional Outlook

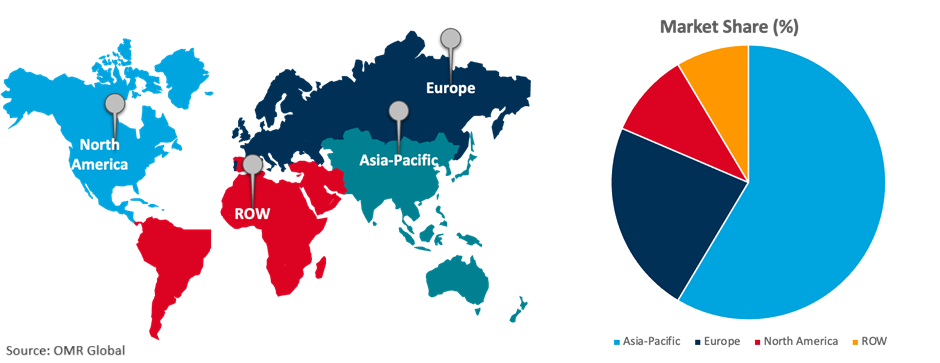

The global piling machine market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America’s Ascendancy in the Global Piling Machine Market

North America is the fastest-growing market in the global piling machine market owing to the region experiencing a resurgence in infrastructure development projects, urbanization, and construction of commercial and residential buildings. Growing government initiatives to support environmental sustainability by investing in modern machinery for construction is also supporting market growth. For instance, in December 2021, Junttan Oy finalized the acquisition of Canadian Pile Driving Equipment, Inc., a longstanding authorized distributor of Junttan Oy products since 2007. This strategic acquisition further solidifies the company's presence and position in the North American market, strengthening its foothold in the region's construction equipment sector.

Global Piling Machine Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to rapid urbanization, extensive government infrastructure investments, and a thriving construction industry. With ambitious initiatives like China's Belt and Road Initiative and India's Smart Cities Mission, demand for piling machines surges to support large-scale construction projects. The region's growing population and rising middle class drive the need for new infrastructure, while technological advancements by leading manufacturers cater to specific soil conditions. For instance, in March 2021, Sany India, a global leader in the Construction Equipment (CE) industry, unveiled its first 'Made in India' Piling Rig, the 'SR235,' tailored for the Indian market. Designed to tackle a range of applications, from soft soil to hard rock, the SR235 signifies Sany India's dedication to meeting local construction needs.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global piling machine market include Epiroc Mining India Pvt. Ltd., Liebherr-International Deutschland GmbH, IQIP, International Construction Equipment, and ABI Maschinenfabrik und Vertriebsgesellschaft mbH, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2022, ABI GmbH collaborated with Trimble, introducing the Trimble Ready factory option for fresh ABI MOBILRAM-Systems and DELMAG Drill Rigs, enhancing their functionality and compatibility with Trimble's advanced technologies.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global piling machine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Epiroc AB

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Liebherr-International Deutschland GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IQIP

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Piling Machine Market by Product

4.1.1. Impact Hammer

4.1.2. Vibratory Drivers

4.1.3. Piling Rigs

4.1.4. Others (Hydraulic Press-in Piling Machines, Diesel Hammer Piling Machines and Hydraulic Vibratory Piling Machines)

4.2. Global Piling Machine Market by Piling Method

4.2.1. Impact Driven

4.2.2. Drilled Percussive

4.2.3. Rotary Bored

4.2.4. Air-lift RCD Rig

4.2.5. Auger Boring

4.2.6. Continuous Flight Auger

4.2.7. Others (Hydraulic Push Piles, Sheet Piles, Vibratory Sheet Pile Drivers, Jacked Piles, Helical Piles and Timber Piles)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ABI Maschinenfabrik und Vertriebsgesellschaft mbH

6.2. BAUER Group

6.3. Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.)

6.4. BSP TEX

6.5. Casagrande S.p.A

6.6. Changsha Tianwei Engineering Machinery Manufacturing Co., Ltd.

6.7. Dieseko Group

6.8. Fundex Equipment

6.9. International Construction Equipment

6.10. Junttan Oy

6.11. Kejr, Inc.

6.12. MKT Manufacturing Inc.

6.13. Sany Group

6.14. SINOVO Group

6.15. Soilmec S.p.A

6.16. TONTI TRADING S.R.L.

6.17. WATSON DRILL RIG

6.18. XCMG Group

1. GLOBAL PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL IMPACT HAMMER PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL VIBRATORY DRIVERS PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PILING RIGS PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PILING METHOD, 2023-2031 ($ MILLION)

7. GLOBAL PILING MACHINE FOR IMPACT DRIVEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PILING MACHINE FOR DRILLED PERCUSSIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PILING MACHINE FOR ROTARY BORED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PILING MACHINE FOR AIR-LIFT RCD RIG MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PILING MACHINE FOR AUGER BORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PILING MACHINE FOR CONTINUOUS FLIGHT AUGER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PILING MACHINE FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. NORTH AMERICAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PILING METHOD, 2023-2031 ($ MILLION)

18. EUROPEAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PILING METHOD, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC PILING MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PILING METHOD, 2023-2031 ($ MILLION)

24. REST OF THE WORLD PILING MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. REST OF THE WORLD PILING MACHINE MARKET RESEARCH AND ANALYSIS BY PILING METHOD, 2023-2031 ($ MILLION)

1. GLOBAL PILING MACHINE MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL IMPACT HAMMER PILING MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL VIBRATORY DRIVERS PILING MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PILING RIGS PILING MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHERS PILING MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PILING MACHINE MARKET SHARE BY PILING METHOD, 2023 VS 2031 (%)

7. GLOBAL PILING MACHINE FOR IMPACT DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PILING MACHINE FOR DRILLED PERCUSSIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PILING MACHINE FOR ROTARY BORED MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PILING MACHINE FOR AIR-LIFT RCD RIG MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PILING MACHINE FOR AUGER BORING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PILING MACHINE FOR CONTINUOUS FLIGHT AUGER MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PILING MACHINE FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL PILING MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

17. UK PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA PILING MACHINE MARKET SIZE, 2023-2031 ($ MILLION)