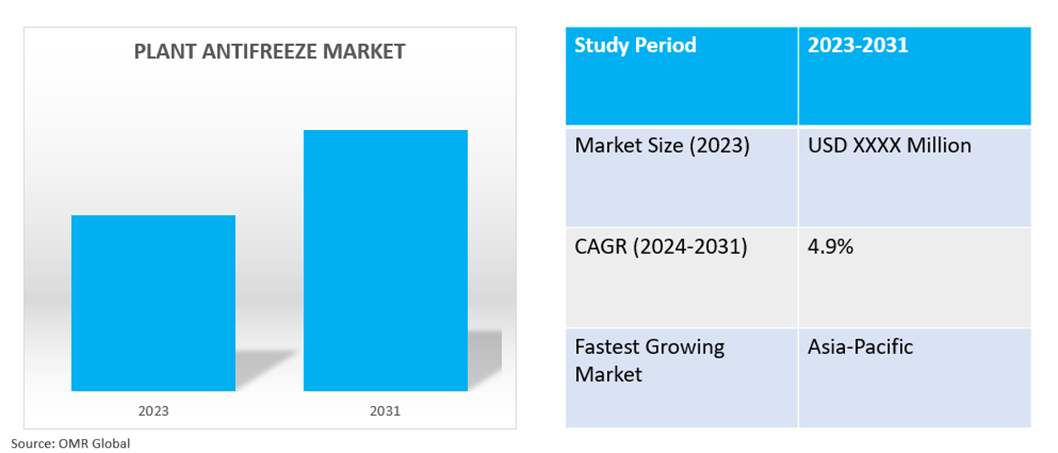

Plant Antifreeze Market

Plant Antifreeze Market Size, Share & Trends Analysis Report by Product (Ethylene Glycol, Propylene Glycol, Glycerin, and Methanol), and by Application (Cash Crops, Cereals, Horticulture Crops, and Turfs and Ornamentals Crops) Forecast Period (2024-2031)

Plant antifreeze market is anticipated to grow at a CAGR of 4.9% during the forecast period (2024-2031). The market growth is driven by rising industrialization, increase in disposable income, and growth and expansion of the agriculture sector & horticulture sector. Further, the rising demand for economical plant heating technology contributes to market growth. Plant antifreeze chemicals help plants withstand cold temperatures by lowering the freezing point of water in plant tissues. Compounds such as ethylene glycol and glycerin act as cryoprotectants, protecting plant cells from ice formation. They stimulate the production of antifreeze proteins, enhancing the plant's ability to tolerate freezing temperatures. These chemicals are valuable for safeguarding crops and ornamental plants from cold stress, preserving agricultural productivity and landscape aesthetics.

Market Dynamics

Protecting Crops from Irreversible Cold Damage

The threat of irreversible crop damage from cold temperatures impacts agricultural productivity, leading to reduced yield and quality. The risk can be mitigated by using plant antifreeze products, which protect crops by lowering the freezing point of intracellular fluids and enhancing cellular membrane stability. These products are applied via foliar sprays, soil drenches, or irrigation systems, with precise timing being crucial for proactive protection.

The Growth of Agriculture

The growing global population and changing dietary habits are expanding the agricultural sector, leading to increased demand for plant antifreeze products to enhance crop production and protect valuable crops from adverse weather conditions. As economies develop and incomes rise, there is a shift towards high-value crops, creating a greater need for crop protection solutions, including plant antifreeze products, to ensure the resilience of these valuable crops. Factors such as population growth, changing dietary preferences, globalization, technological advancements, and governmental support contribute to the expansion of the agriculture industry and the heightened importance of implementing crop protection measures.

Market Segmentation

Our in-depth analysis of the global plant antifreeze market includes the following segments by product and application.

- Based on product, the market is segmented into ethylene glycol, propylene glycol, glycerin, and methanol.

- Based on application, the market is segmented into cash crops, cereals, horticulture crops, and turfs and ornamentals crops.

Propylene Glycol is Dominating the Market

Propylene glycol is a versatile liquid dominating the plant antifreeze market. It is available in the form of a liquid that is colorless, odorless, and viscous. Thus, on mixing with other liquids such as water or alcohol, they form a uniform combination since they have the same ability to absorb moisture from the air into themselves. Additionally, propylene glycol has been approved by (the FDA) and is safe for consumption, however I approved quantities. It is utilized as an antifreeze for various sectors such as chemicals, food processors, and more.

Cereals Segment to Hold a Considerable Market Share

The cereals segment holds significant importance in global agriculture owing to the large production quantity of cereals and them being a staple food source. Global cereal production has been steadily increasing, driven by factors such as population growth and dietary preferences, necessitating a focus on maximizing both yield and quality. Plant antifreeze is very important in protecting grains that are prone to frosting. This can cause serious economic losses and reduce the quality of the food. These kinds of preventive measures are necessary for areas that are likely to have frost or instant temperature changes. In addition, the application of plant antifreeze is sustainable as it lowers the excess usage of pesticides, promoting more stable farming practices.

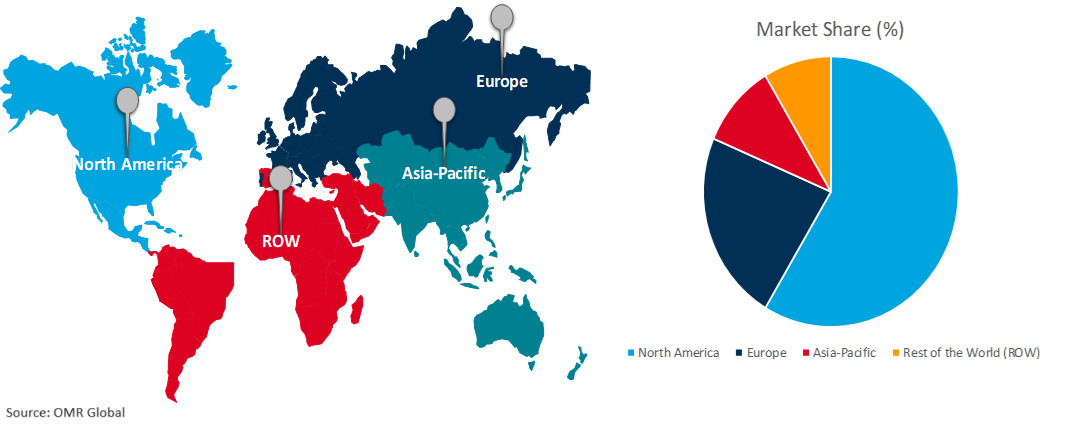

Regional Outlook

The global plant antifreeze market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Become Fastest Growing Region

The Asia-Pacific region has become the fastest-growing region in the global plant antifreeze market driven by increasing awareness of plant health, urbanization pressure on arable land, technological advancements, and supportive government initiatives. These factors create fertile ground for innovation and investment, solidifying the region's role as a key driver of growth in the global agricultural sector.

Global Plant Antifreeze Market Growth by Region 2024-2031

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global plant antifreeze market include Bayer AG, Dow Chemical Co., DuPont de Nemours, Inc., Sumitomo Chemical Co., Ltd., and Tate & Lyle plc, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plant antifreeze market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bayer AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. The Dow Chemical Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DuPont de Nemours, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sumitomo Chemical Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tate & Lyle plc

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Plant Antifreeze Market by Product

4.1.1. Ethylene Glycol

4.1.2. Propylene Glycol

4.1.3. Glycerin

4.1.4. Methanol

4.2. Global Plant Antifreeze Market by Application

4.2.1. Cash Crops

4.2.2. Cereals

4.2.3. Horticulture Crops

4.2.4. Turfs and Ornamentals Crops

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ADAMA Agricultural Solutions Ltd.

6.2. Ashland Inc.

6.3. Chevron Philips Chemical Co. LLC

6.4. CropAid International Ltd.

6.5. Exxon Mobil Corp.

6.6. Gharda Chemicals Ltd.

6.7. Huntsman International LLC

6.8. LUKOIL Lubricants Europe

6.9. Meister Media Worldwide, Inc.

6.10. Nufarm Americas Inc.

6.11. Sinopec Corp. (China Petroleum & Chemical Corp.)

6.12. Syngenta Crop Protection AG

6.13. TotalEnergies Lubrifiants

1. GLOBAL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL ETHYLENE GLYCOL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PROPYLENE GLYCOL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GLYCERIN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL METHANOL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL PLANT ANTIFREEZE FOR CASH CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PLANT ANTIFREEZE FOR CEREALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PLANT ANTIFREEZE FOR HORTICULTURE CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PLANT ANTIFREEZE FOR TURFS AND ORNAMENTALS CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. EUROPEAN PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. REST OF THE WORLD PLANT ANTIFREEZE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL PLANT ANTIFREEZE MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL ETHYLENE GLYCOL PLANT ANTIFREEZE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PROPYLENE GLYCOL PLANT ANTIFREEZE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GLYCERIN PLANT ANTIFREEZE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL METHANOL PLANT ANTIFREEZE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PLANT ANTIFREEZE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

7. GLOBAL PLANT ANTIFREEZE FOR CASH CROPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PLANT ANTIFREEZE FOR CEREALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PLANT ANTIFREEZE FOR HORTICULTURE CROPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PLANT ANTIFREEZE FOR TURFS AND ORNAMENTALS CROPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PLANT ANTIFREEZE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA PLANT ANTIFREEZE MARKET SIZE, 2023-2031 ($ MILLION)