Plant Phenotyping Market

Plant Phenotyping Market Size, Share & Trends Analysis Report, By Product Type (Equipment (By Automation Type (Fully Automated, Semi-Automated, and Manual), By Analysis System Type (Image Analysis Systems, Multispectral Scientific Cameras, Canopy Analysis Systems, Fluorometers, and Others), By Software (Data Acquisition, Image Analysis, and System Control), By Sensors (Image Sensors, NDVI Sensors, Temperature Sensors, and Others)), By Application (High-Throughput Screening, Trait Identification, Photosynthetic Performance, Morphology and Growth Assessment, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Plant phenotyping market is anticipated to grow at a significant CAGR of 9.5% during the forecast period. The rising demand for food security is a primary factor driving the deployment of innovative technologies to accelerate crop production. Plant phenotyping methods have been emerging significantly over the years. Hyperspectral imaging has been applied to detect abiotic, biotic, and quality traits in plants in indoor and outdoor growing conditions. Hyperspectral imaging can be applied from cellular to landscape scale for the identification of plant traits. Phenotyping is the foundation of the plant breeding selection process which is a labour-intensive and slow process, and measurements can be highly subjective. Modern plant phenotyping measures complex traits related to growth, yield, and adaptation to stress, with improved accuracy and precision which plays an important role in decision-making for the selection of crops or plants for a specific region.

The growing investments by market players for the expansion of their facilities are expected to drive the growth of the global plant phenotyping market during the forecast period. An increasing number of R&D activities for improving the effectiveness of plant phenotyping and the launch of new equipment with enhanced capacity are expected to strengthen the growth prospect of the global plant phenotyping market. For instance, in December 2019, Multi-sensor drone technology for plant phenotyping receives $4.5 million from the Advanced Research Projects Agency-Energy (ARPA-E), a division of the US Department of Energy. The technology was originally developed under the Transportation Energy Resources from Renewable Agriculture (TERRA) program, through a $6.6 million ARPA-E grant awarded in 2015.

Segmental Outlook

The global plant phenotyping market is segmented based on the product type and application. Based on the product type, the market is segmented into equipment, software, and sensors, Equipment includes automation type and analysis system type. Automation type is classified into fully automated, semi-automated, and manual. The analysis system type is classified into image analysis systems, multispectral scientific cameras, canopy analysis systems, fluorometers, and others. Software is segmented into data acquisition, image analysis, and system control. Sensors are classified into image sensors, NDVI sensors, temperature sensors, and others. Based on the application, the market is segmented into high-throughput screening, trait identification, photosynthetic performance, morphology and growth assessment, and others. Based on product type, the image analysis of plant phenotyping is anticipated to hold the fastest growth in the market. Image-based plant phenotyping is beginning to prove its value in crop breeding and precision agriculture, providing a quantitative basis for the description of plant-environment interactions. The growing use of commercially available digital cameras for plant phenotyping and the rising use of drones are some prime factors driving the growth of image-based plant phenotyping. The image analysis through cameras is easy to handle, transport, and use open-source software for image processing, demonstrating high potential for use in plant breeding programs. Low cost, time-saving, and ease of applicability in the field are other key factors driving the growth of image-based analysis for plant phenotyping. For instance, in June 2022, Texas A&M AgriLife researchers announced that they can predict corn southern rust epidemic outbreaks by utilizing unmanned aerial systems (UAS), or drones, early enough to support and prevent economic damage for growers.

Regional Outlook

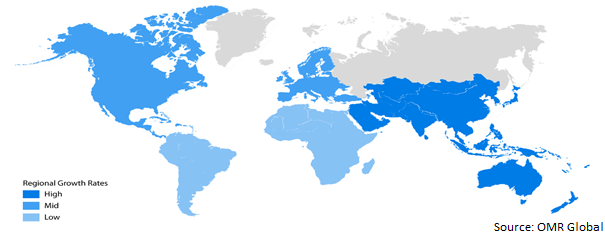

The global plant phenotyping market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa and Latin America). In July 2022, the Biotechnology and Biological Sciences Research Council announced $2.46 million for UK Plant and Crop Phenotyping Infrastructure Scoping Project.

At present, Europe holds the largest share of the market followed by the North America and Asia Pacific region. The growing demand for food security, the rapid development of technology, and the rising demand for identifying plants and crops suitable for a specific region are key factors driving the market growth in the region. Additionally, there is growing research and experiments to find a low-cost scalable method to enhance plant phenotyping in the Europe and North American regions. For instance, in March 2022, the US Drone2Phenome group launched a survey to understand and identify the best ways to leverage drones in research and agriculture globally. The Drone2Phenome (D2P) group developed a survey to understand barriers and identify the best ways to support people leverage drones in their work and research in agriculture and livestock around the world.

Global Plant Phenotyping Market Growth, By Region 2022-2028

Market Players Outlook

The major companies serving the global Plant Phenotyping market include BASF SE, Keygene, and LemnaTec GmbH, among others. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in May 2022, BASF announced the acquisition of CropDesign. The Belgian biotech enterprise will become part of BASF Plant Science. The acquisition complements BASF Plant Science's existing gene discovery activities and extends its leading position in access to agronomically important genetic traits." CropDesign specializes in traits for yield-enhancement, drought tolerance and improved nutrient use efficiency of crops such as maize and rice.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plant phenotyping market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Company A

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Key Strategy Analysis

4. Market Segmentation

4.1. Global Plant Phenotyping Market By Product Type

4.1.1. Equipment

4.1.1.1. Automation Type

4.1.1.1.1. Fully automated

4.1.1.1.2. Semi-automated

4.1.1.1.3. Manual

4.1.1.2. Analysis System Type

4.1.1.2.1. Image Analysis Systems

4.1.1.2.2. Multispectral Scientific Cameras

4.1.1.2.3. Canopy Analysis Systems

4.1.1.2.4. Fluorometers

4.1.1.2.5. Others

4.1.2. Software

4.1.2.1. Data Acquisition

4.1.2.2. Image Analysis

4.1.2.3. System Control

4.1.2.4. Others

4.1.3. Sensors

4.1.3.1. Image Sensors

4.1.3.2. NDVI Sensors

4.1.3.3. Temperature Sensors

4.1.3.4. Others

4.2. Global Plant Phenotyping Market By Application

4.2.1. High-Throughput Screening

4.2.2. Trait Identification

4.2.3. Photosynthetic Performance

4.2.4. Morphology and Growth Assesment

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Delta-T Devices Ltd.

6.2. Heinz Walz Gmbh

6.3. Keygene

6.4. LemnaTec Gmbh

6.5. Phenospex B. V.

6.6. Plant-DiTech LTD

6.7. PSI (Photon Systems Instruments) spol. s r.o.

6.8. Qubit Systems

6.9. Qubit Systems Inc.

6.10. WPS B.V.

1. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL PLANT PHENOTYPING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY AUTOMATION TYPE, 2021-2028 ($ MILLION)

4. GLOBAL FULLY AUTOMATED PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SEMI-AUTOMATED PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL MANUAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY ANALYSIS BY SYSTEM TYPE, 2021-2028 ($ MILLION)

8. GLOBAL IMAGE ANALYSIS PLANT PHENOTYPING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL PLANT PHENOTYPING MULTISPECTRAL SCIENTIFIC CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL PLANT PHENOTYPING CANOPY ANALYSIS SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL PLANT PHENOTYPING FLUOROMETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL OTHER PLANT PHENOTYPING ANALYSIS SYSTEM TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY SOFTWARE, 2021-2028 ($ MILLION)

14. GLOBAL PLANT PHENOTYPING DATA ACQUISITION SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL PLANT PHENOTYPING IMAGE ANALYSIS SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL PLANT PHENOTYPING SYSTEM CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL OTHER PLANT PHENOTYPING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY SENSORS, 2021-2028 ($ MILLION)

19. GLOBAL PLANT PHENOTYPING IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL PLANT PHENOTYPING NDVI SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL PLANT PHENOTYPING TEMPERATURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL OTHER PLANT PHENOTYPING SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

23. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. GLOBAL PLANT PHENOTYPING FOR HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

25. GLOBAL PLANT PHENOTYPING FOR TRAIT IDENTIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

26. GLOBAL PLANT PHENOTYPING FOR PHOTOSYNTHETIC PERFORMANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

27. GLOBAL PLANT PHENOTYPING FOR MORPHOLOGY AND GROWTH ASSESSMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

28. GLOBAL PLANT PHENOTYPING FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

29. GLOBAL PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

30. NORTH AMERICAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. NORTH AMERICAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

32. NORTH AMERICAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

33. EUROPEAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. EUROPEAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

35. EUROPEAN PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

36. ASIA-PACIFIC PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

37. ASIA-PACIFIC PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

38. ASIA-PACIFIC PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

39. REST OF THE WORLD PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

40. REST OF THE WORLD PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

41. REST OF THE WORLD PLANT PHENOTYPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL PLANT PHENOTYPING MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL PLANT PHENOTYPING EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL PLANT PHENOTYPING MARKET SHARE BY AUTOMATION TYPE, 2021 VS 2028 (%)

4. GLOBAL FULLY AUTOMATED PLANT PHENOTYPING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL SEMI-AUTOMATED PLANT PHENOTYPING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL MANUAL PLANT PHENOTYPING MARKET SHARE GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL PLANT PHENOTYPING MARKET SHARE BY ANALYSIS SYSTEM TYPE, 2021 VS 2028 (%)

8. GLOBAL PLANT PHENOTYPING IMAGE ANALYSIS SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL PLANT PHENOTYPING MULTISPECTRAL SCIENTIFIC CAMERAS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL PLANT PHENOTYPING CANOPY ANALYSIS SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL PLANT PHENOTYPING FLUOROMETERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL OTHER PLANT PHENOTYPING ANALYSIS SYSTEMS MARKET SHARE GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL PLANT PHENOTYPING MARKET SHARE BY SOFTWARE, 2021 VS 2028 (%)

14. GLOBAL PLANT PHENOTYPING DATA ACQUISITION SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL PLANT PHENOTYPING IMAGE ANALYSIS SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL PLANT PHENOTYPING SYSTEM CONTROL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL PLANT PHENOTYPING SENSORS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL PLANT PHENOTYPING NDVI SENSORS SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL PLANT PHENOTYPING TEMPERATURE SENSORS SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL OTHER PLANT PHENOTYPING SENSORS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL PLANT PHENOTYPING MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

22. GLOBAL PLANT PHENOTYPING MARKET SHARE FOR HIGH-THROUGHPUT SCREENING BY GEOGRAPHY, 2021 VS 2028 (%)

23. GLOBAL PLANT PHENOTYPING MARKET SHARE FOR TRAIT IDENTIFICATION BY GEOGRAPHY, 2021 VS 2028 (%)

24. GLOBAL PLANT PHENOTYPING MARKET SHARE FOR PHOTOSYNTHETIC PERFORMANCE BY GEOGRAPHY, 2021 VS 2028 (%)

25. GLOBAL PLANT PHENOTYPING MARKET SHARE FOR MORPHOLOGY AND GROWTH ASSESSMENT BY GEOGRAPHY, 2021 VS 2028 (%)

26. GLOBAL PLANT PHENOTYPING MARKET SHARE FOR OTHER APPLICATIONS BY GEOGRAPHY, 2021 VS 2028 (%)

27. GLOBAL PLANT PHENOTYPING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

28. US PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

29. CANADA PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

30. UK PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

31. FRANCE PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

32. GERMANY PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

33. ITALY PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

34. SPAIN PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF EUROPE PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

36. INDIA PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

37. CHINA PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

38. JAPAN PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

39. SOUTH KOREA PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

40. REST OF ASIA-PACIFIC PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)

41. REST OF THE WORLD PLANT PHENOTYPING MARKET SIZE, 2021-2028 ($ MILLION)