Plastic Bottles and Containers Market

Global Plastic Bottles and Containers Market Size, Share & Trends Analysis Report By Raw Material (PET, PP, LDPE, HDPE, and Other), By End-Use Vertical (Beverages, Food, Cosmetics, Chemical & Pharmaceutical and Others) Forecast Period 2020-2026 Update Available - Forecast 2025-2035

The plastic bottles and containers market is anticipated to grow at a CAGR of 5.5% during the forecast period. Plastic bottles and containers are made from various grades of high- and low-density plastics for storage purposes. Plastic bottles and containers are rugged & resilient and are safe to handle which makes them suitable a considerable option for packaging. Hence, the high demand for various plastic bottles and containers in its application sector for the packaging purpose will significantly drive the market growth during the forecast period.

Growth in the cosmetic industry due to increasing disposable income and increasing usage of ready to eat food all across the globe are some of the factors driving the market growth. However, plastic is one of the major sources of pollution whether it is marines, land, or air pollution. Hence, government regulation to curb plastic waste is one of the major challenges for the plastic bottles and container market in the near future. The government is setting targets to reduce plastic waste by introducing recycling targets. Result of this, the overall cost of the plastic products can increase, and the manufacturers can shift to alternatives of the plastic. It a restricting factor for the potential growth of the market in the near future.

Segmental Outlook

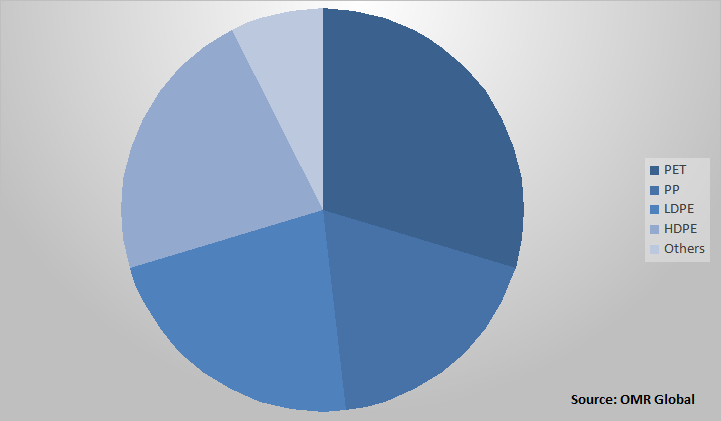

The global plastic bottles and containers market is segmented based on the raw material and end-use vertical. Based on the raw material, the market is sub-segmented into PET, PP, LDPE, HDPE, and others. Further, based on the end-use vertical the market is sub-segmented into beverages, food, cosmetics, chemical & pharmaceuticals, and others. Beverage includes alcohol, water, soft drinks, fruit drinks, and dairy products. Food includes both packaged food and raw fruits and vegetables. Other segment includes household products.

The PET segment will be the fastest-growing segment by raw material

The PET segment is anticipated to grow with a significant CAGR in the plastic bottles and containers market owing to its lightweight and easy to handle properties. Moreover, plastic bottles and containers manufacturers all across the globe are also preferring to use PET due to their low production cost. Additionally, the use of PET can reduce up to 90% weight hence, making the final product more economical for transportation purposes. In addition to this, the containers made from PET are transparent and hence they are widely used for food packaging purposes. This is also expected to significantly drive the growth of the PET segment in the plastic bottles and containers market.

Global plastic bottles and containers market share by raw material, 2020 (%)

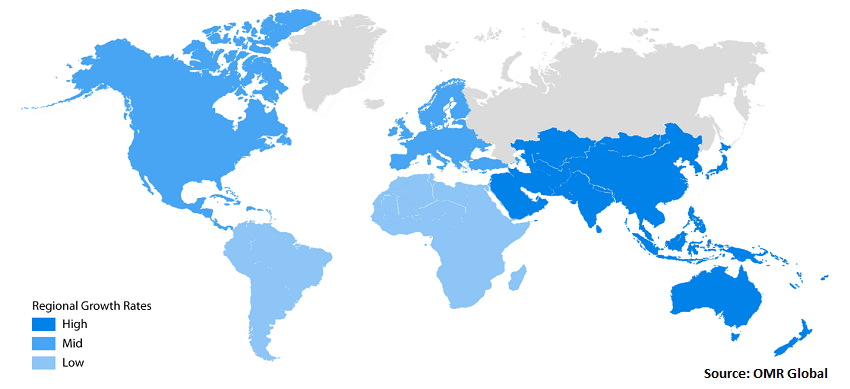

Regional Outlooks

The global plastic bottles and containers market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the largest market share in the plastic bottles and containers market during the forecast period. It is due to the excessive consumption rate of packaged food beverages across the region. According to the American Institute of Graphic Arts’s (AIGA) case study, every second, 1,500 bottles of water are consumed in the US that equates to 50 billion bottles consumed in a year. Moreover, the stringent environmental regulations in the region will significantly promote the use of recyclable plastic bottles and containers. In addition to this, the growing consumer base in the personal care industry is also attributed to contributing considerably to the plastic bottles and containers market across the region.

Global Plastic Bottles and Containers Market Growth, by Region 2020-2026

Asia-Pacific will augment with the fastest growth rate in the plastic bottles and containers market

Asia-Pacific is anticipated to hold the fastest growth rate in the plastic bottles and containers market owing to increasing demand from the highly populated countries such as India and China. The rapidly growing food and beverage industry of the region will also foster the growth market. Moreover, the established pharmaceutical production industry in countries such as Myanmar, India, Vietnam, and China are also expected to drive the growth of the plastic bottles and containers market. Besides, the rules and regulations related to plastic waste are lenient in these emerging economies as compared to developed economies, due to which low cost of plastic bottles and containers can be manufactured in the region.

Market Players Outlook

The key players of the plastic bottles and containers market include Amcor PLC, Chemco Group of Companies, RESILUX NV, Takemoto Packaging. Inc., Zhenghao Plastic & Mold Co., Ltd., KHS Group, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including merger & acquisition, collaborations with government, funding to the start-ups, and new product launches to stay competitive in the market. For instance, in March 2018, considering the growing preference for lightweight plastic over glass containers within the food industry KHS Group launched a new lightweight, wide-neck PET container. These newly launched containers were intended for the storage of sauce, dressing, and dairy products.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plastic bottles and containers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Business Functions and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amcor PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Gerresheimer AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Resilux NV

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Takemoto Packaging. Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Alpha Packaging Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Plastic Bottles and Containers Market by Raw Material

5.1.1. PET (Polyethylene Terephthalate)

5.1.2. PP (Polypropylene)

5.1.3. LDPE (Low-Density Polyethylene)

5.1.4. HDPE (High-Density Polyethylene)

5.1.5. Other

5.2. Global Plastic Bottles and Containers Market by End-Use Vertical

5.2.1. Beverages

5.2.2. Food

5.2.3. Cosmetics

5.2.4. Pharmaceutical& Chemicals

5.2.5. Others(Household)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AG Poly Packs Private Ltd.

7.2. Alpha Packaging Inc.

7.3. Altium Packaging LLC

7.4. Amcor PLC

7.5. Chemco Group of Companies

7.6. Comar LLC

7.7. Gerresheimer AG

7.8. Gil Plastic Products ltd.

7.9. Graham Packaging Co. LP

7.10. Greiner Packaging GmbH

7.11. Hitech Group

7.12. Kang-Jia Co., Ltd

7.13. KHS Group

7.14. Ningbo Jazz Packaging Co., Ltd

7.15. Resilux NV

7.16. RPC M&H PLASTICS UK

7.17. Star Plastic Industries

7.18. Takemoto Packaging. Inc.

7.19. The Plastic Bottles Company

7.20. Zhenghao Plastic & Mold Co., Ltd.

1. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL PET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PP MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL LDPE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL HDPE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USE VERTICAL, 2019-2026 ($ MILLION)

8. GLOBAL BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL COSMETIC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PHARMACEUTICAL & CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICA PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

16. NORTH AMERICAN PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USE VERTICAL, 2019-2026 ($ MILLION)

17. EUROPE PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPE PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

19. EUROPE PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USE VERTICAL, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USE VERTICAL, 2019-2026 ($ MILLION)

23. REST OF THE WORLD PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

24. REST OF THE WORLD PLASTIC BOTTLES AND CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USE VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET SHARE BY RAW MATERIAL, 2019 VS 2026 (%)

2. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET SHARE BYEND-USE VERTICAL, 2019 VS 2026 (%)

3. GLOBAL PLASTIC BOTTLES AND CONTAINERS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC PLASTIC BOTTLES AND CONTAINERS MARKET SIZE, 2019-2026 ($ MILLION)