Plastic Market

Plastic Market Size, Share & Trends Analysis Report by Product (Thermoplastics (Polyethylene, Polypropylene, Polyvinyl Chloride, Polyethylene Terephthalate, Polystyrene, and Others (Polyamide, ABS, PBT) and Thermoset Plastics (Polyurethane, Epoxy Resins, Phenolic Resins, Acrylic Resins, Other), and By Application (Packaging, Construction, Electricals & Electronics, Automotive, Medical Device, and Others) Forecast Period (2025-2035)

Industry Overview

Plastics market size was estimated at $540 billion in 2024, is projected to grow to $943 billion with a CAGR of 5.1% during the forecast period (2025–2035). Rising demand for plastics in various applications, including construction, automotive, and electrical and electronics industries is fueling the market growth. The expansion of the construction industry across emerging economies such as Brazil, China, India, and Mexico is also addressing a substantial demand for plastics. However, due to rising environmental concerns associated with the disposal of plastics are hampering market growth.

Market Dynamics

Rising Demand for Sustainable Packaging Solutions

The increasing demand for sustainable packaging solutions in the packaging sector due to environmental concerns surrounding plastic waste and pollution has prompted regulatory changes and industry initiatives focusing on sustainability. This has accelerated research and development in biodegradable polymers, recyclable plastics, and more efficient recycling technologies, which dominate plastic consumption. Increasing e-commerce activities and consumer preference for convenience drive innovations in recyclable and biodegradable plastics, accelerating the demand for sustainable packaging. For instance, Coca-Cola’s company goal is to use 35% to 40% recycled material in primary packaging (plastic, glass, and aluminum), including increasing recycled plastic use to 30% to 35% globally by 2035, leveraging PET and bio-based packaging for their products. Furthermore, as per the global plastic outlook, Asia is the region with the largest biobased plastics production capacity (45%), followed by Europe (25%), North America (18%), and South America (12%) (European Bioplastics, 2019.

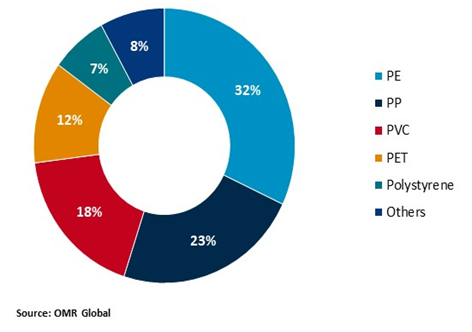

Plastic Industry Share by Products And Applications, 2024

Growing Demand for Plastic in the Construction and Automotive Industries

Simultaneously, rising demand for PVC and polycarbonates is critical in construction for pipes, insulation, and windows, with the sector expected to grow through 2035 (Global Construction Perspectives, 2024). As per (International Energy Agency (IEA), in the automotive industry, lightweight plastics such as PP and ABS can reduce vehicle weight by 10% and enhance fuel efficiency. Also, Tesla’s Cybertruck uses ultra-hard thermoplastic polyurethane for exterior panels, highlighting material innovation. Additionally, increasing urbanization and the proliferation of smart technologies have boosted the use of high-performance plastics in construction, electrical insulation, and electronic components.

Market Segmentation

- Based on the product, the market is segmented into (Thermoplastics (Polyethylene, Polypropylene, Polyvinyl Chloride, Polyethylene Terephthalate, Polystyrene, and Others (Polyamide, ABS, PBT) and Thermoset Plastics (Polyurethane, Epoxy Resins, Phenolic Resins, Acrylic Resins, Other).

- Based on the application, the market is segmented into (Packaging, Construction, Electricals & Electronics, Automotive, Medical Devices, and Others).

PE and PP Lead Product Demand in the Packaging Sector to Propel Market Growth

The PE and PP dominant segment is expected to remain the largest market share, owing to its versatility in films, bottles, industrial applications, food packaging, and automotive components. As per the Flexible Packaging Association (FPA), in 2023, ChemPMC estimates that the US and Canada consumed 2.5 million metric tons of Low-Density Polyethylene (LDPE), 4.8 million metric tons of Linear Low-Density Polyethylene (LLDPE), and 6.8 million metric tons of HDPE (High Low-Density Polyethylene). Additionally, Europe produces 92% of the net demand for HDPE, and the European Union’s biggest trading partner for HDPE and PP in primary forms is Saudi Arabia, which accounts for 42% of HDPE and PP imports combined.

Regional Outlook

The global plastic industry is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Region to Lead the Global Plastic Industry

The Asia-Pacific region is anticipated to dominate the global plastic industry, driven by rapid industrialization, urbanization, and the growing demand for packaged food products. Countries such as China and India are experiencing significant growth in the food & beverage and pharmaceutical industries, which is driving the demand for plastic.

Growing Demand for Bio-based Plastic in Europe.

The strong growth of bio-based plastics in Europe is a significant driver of this market, as per the European Commission. According to European Bioplastic, Bioplastics currently represent roughly half a percent of the almost 414 million tonnes of plastics produced annually. Overall global plastics production continues to rise steadily. This development is driven by rising demand combined with the emergence of ever more sophisticated applications and products. In line, global bioplastics production capacity is set to increase significantly from around 2.47 million tonnes in 2024 to approximately 5.73 million tonnes in 2029.

Market Players Outlook

The major companies operating in the global plastic market include BASF, Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., and SABIC (Saudi Basic Industries Corporation), among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, BASF introduced the new Elastollan 1400 (Thermoplastic Polyurethane) TPU series. The new TPU series provides exceptional hydrolysis and microbe resistance and combines stable processing behavior with good compression set properties. The material delivers outstanding burst pressure performance and can be processed by extrusion and injection molding. The aging stability of Elastollan 1400 ensures long-lasting performance – a versatile option for a wide range of applications.

- In September 2022, Dow and Mura Technology announced the next phase of their collaboration to address global plastic waste and promote circularity. Mura plans to develop a new advanced recycling facility at Dow’s Böhlen site in Germany, marking the first such facility to be located within a Dow site. This project is part of a broader initiative to expand advanced recycling infrastructure across the US and Europe.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plastic market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Plastic Market Sales Analysis – Product | Application ($ Million)

• Plastic Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Plastic Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Plastic Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Plastic Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Plastic Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Plastic Market Revenue and Share by Manufacturers

• Plastic Industry Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Dow Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Exxon Mobil Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. LyondellBasell Industries Holdings B.V.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. SABIC (Saudi Basic Industries Corporation)

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Plastic Market Sales Analysis By Product ($ Million)

6.1 Thermoplastics

6.1.1. Polyethylene (PE)

6.1.2. Polypropylene (PP)

6.1.3. Polystyrene (PS)

6.1.4. Polyvinyl Chloride (PVC)

6.1.5. Polyethylene Terephthalate (PET)

6.1.6. Others

6.2. Thermoset Plastics

6.2.1. Polyurethane (PUR)

6.2.2. Epoxy Resins

6.2.3. Phenolic Resins

6.2.4. Acrylic Resins

6.2.5. Other

7. Global Plastic Market Sales Analysis By Application ($ Million)

7.1. Packaging

7.2. Construction

7.3. Electricals & Electronics

7.4. Automotive

7.5. Medical Device

7.6. Others (Consumer Goods)

8. Regional Analysis

8.1. North American Plastic Market Sales Analysis – Product | Application ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Plastic Market Sales Analysis – Product | Application ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Plastic Market Sales Analysis – Product | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Plastic Market Sales Analysis – Product | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ALPLA Group

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. BASF SE

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Borealis AG

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Braskem S.A.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Berry Global Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Chevron Phillips Chemical Company LLC.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Covestro AG

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Dow Inc.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. DuPont de Nemours, Inc.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Exxon Mobil Corp

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Formosa Plastics Corp,

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Far Eastern New Century Corp

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. INEOS AG

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Indorama Ventures Public Company Limited.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Lanxess AG

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. LG Chem.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. LyondellBasell Industries Holdings B.V.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Mitsubishi Chemical Group of Companies

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. NOVA Chemicals Corporate.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Reliance Industries Limited.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. SABIC (Saudi Basic Industries Corporation)

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Shell Group of Companies

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Sinopec (China Petroleum & Chemical Corporation)

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. TORAY INDUSTRIES, INC.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. TotalEnergies

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

1. Global Plastic Industry Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Thermoplastics Plastic Industry Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Thermoplastics Plastic Industry Research And Analysis By Type, 2024-2035 ($ Million)

4. Global Polyethylene Industry Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Polypropylene Industry Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Polyvinyl Chloride Industry Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Polyethylene Terephthalate Industry Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Polystyrene Industry Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Other Thermoplastics Plastic Industry Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Thermoset Plastics Industry Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Thermoset Plastics Industry Research And Analysis By Type, 2024-2035 ($ Million)

12. Global Polyurethane (PUR) Industry Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Epoxy Resins Industry Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Phenolic Resins Industry Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Acrylic Resins Industry Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Other Thermoset Plastics Industry Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Plastic Industry Research And Analysis By Application, 2024-2035 ($ Million)

18. Global Plastic In Packaging Industry Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Plastic In Construction Industry Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Plastic In Electrical & Electronics Industry Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Plastic In Automotive Industry Research And Analysis By Region, 2024-2035 ($ Million)

22. Global Plastic In Medical Device Industry Research And Analysis By Region, 2024-2035 ($ Million)

23. Global Plastic In Other Industry Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Plastic Industry Research And Analysis By Region, 2024-2035 ($ Million)

25. North American Plastic Industry Research And Analysis By Country, 2024-2035 ($ Million)

26. North American Plastic Industry Research And Analysis By Product, 2024-2035 ($ Million)

27. North American Plastic Industry Research And Analysis By Application, 2024-2035 ($ Million)

28. European Plastic Industry Research And Analysis By Country, 2024-2035 ($ Million)

29. European Plastic Industry Research And Analysis By Product, 2024-2035 ($ Million)

30. European Plastic Industry Research And Analysis By Application, 2024-2035 ($ Million)

31. Asia-Pacific Plastic Industry Research And Analysis By Country, 2024-2035 ($ Million)

32. Asia-Pacific Plastic Industry Research And Analysis By Product, 2024 Vs 2035 ($ Million)

33. Asia-Pacific Plastic Industry Research And Analysis By Application, 2024-2035 ($ Million)

34. Rest Of The World Plastic Industry Research And Analysis By Region, 2024-2035 ($ Million)

35. Rest Of The World Plastic Industry Research And Analysis By Product, 2024-2035 ($ Million)

36. Rest Of The World Plastic Industry Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Plastic Market Share By Product, 2024 Vs 2035 (%)

2. Global Thermoplastics Plastic Industry Share By Region, 2024 Vs 2035 (%)

3. Global Thermoplastics Plastic Industry Share Analysis By Region, 2024 Vs 2035 (%)

4. Global Polyethylene Industry Share Analysis By Region, 2024 Vs 2035 (%)

5. Global Polypropylene Industry Share Analysis By Region, 2024 Vs 2035 (%)

6. Global Polyvinyl Chloride Industry Share By Region, 2024 Vs 2035 (%)

7. Global Polyethylene Terephthalate Industry Share Analysis By Region, 2024 Vs 2035 (%)

8. Global Polystyrene Industry Share Analysis By Region, 2024 Vs 2035 (%)

9. Global Other Thermoplastics Plastic Industry Share Analysis By Region, 2024 Vs 2035 (%)

10. Global Thermoset Plastics Industry Share Analysis By Region, 2024 Vs 2035 (%)

11. Global Thermoset Plastics Industry Share Analysis By Type, 2024 Vs 2035 (%)

12. Global Polyurethane (PUR) Industry Share Analysis By Region, 2024 Vs 2035 (%)

13. Global Epoxy Resins Industry Share Analysis By Region, 2024 Vs 2035 (%)

14. Global Phenolic Resins Industry Share Analysis By Region, 2024 Vs 2035 (%)

15. Global Acrylic Resins Industry Share Analysis By Region, 2024 Vs 2035 (%)

16. Global Other Thermoset Plastics Industry Share Analysis By Region, 2024 Vs 2035 (%)

17. Global Plastic Industry Share Analysis By Application, 2024 Vs 2035 (%)

18. Global Plastic In Packaging Industry Share Analysis By Region, 2024 Vs 2035 (%)

19. Global Plastic In Construction Industry Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Plastic In Electrical & Electronics Industry Share Analysis By Region, 2024 Vs 2035 (%)

21. Global Plastic In Automotive Industry Share Analysis By Region, 2024 Vs 2035 (%)

22. Global Plastic In Medical Device Industry Share Analysis By Region, 2024 Vs 2035 (%)

23. Global Plastic In Other Industry Share Analysis By Region, 2024 Vs 2035 (%)

24. Global Plastic Industry Share Analysis By Region, 2024 Vs 2035 (%)

25. US Plastic Market Size, 2024-2035 ($ Million)

26. Canada Plastic Market Size, 2024-2035 ($ Million)

27. UK Plastic Market Size, 2024-2035 ($ Million)

28. France Plastic Market Size, 2024-2035 ($ Million)

29. Germany Plastic Market Size, 2024-2035 ($ Million)

30. Italy Plastic Market Size, 2024-2035 ($ Million)

31. Spain Plastic Market Size, 2024-2035 ($ Million)

32. Russia Plastic Market Size, 2024-2035 ($ Million)

33. Rest Of Europe Plastic Market Size, 2024-2035 ($ Million)

34. India Plastic Market Size, 2024-2035 ($ Million)

35. China Plastic Market Size, 2024-2035 ($ Million)

36. Japan Plastic Market Size, 2024-2035 ($ Million)

37. South Korea Plastic Market Size, 2024-2035 ($ Million)

38. Australia and New Zealand Plastic Market Size, 2024-2035 ($ Million)

39. ASEAN Plastic Market Size, 2024-2035 ($ Million)

40. Rest Of Asia-Pacific Plastic Market Size, 2024-2035 ($ Million)

41. Rest Of The World Plastic Market Size, 2024-2035 ($ Million)

42. Latin America Plastic Market Size, 2024-2035 ($ Million)

43. Middle East And Africa Plastic Market Size, 2024-2035 ($ Million)

FAQS

The size of the Plastic market in 2024 is estimated to be around $540 billion.

Asia-Pacific holds the largest share in the Plastic market.

Leading players in the Plastic market include BASF, Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., and SABIC (Saudi Basic Industries Corporation), among others.

Plastic market is expected to grow at a CAGR of 5.1% from 2025 to 2035.

Growing demand across packaging, automotive, and construction sectors is driving the growth of the plastic market.