Plasticizers Market

Plasticizers Market Size, Share & Trends Analysis Report by Type (Phthalate and Non-phthalate), and Application (Wires & Cables, Floorings & Wall Coverings, Films & Sheets, Coated Fabrics, Consumer Goods and Others) Forecast Period (2025-2035)

Industry Overview

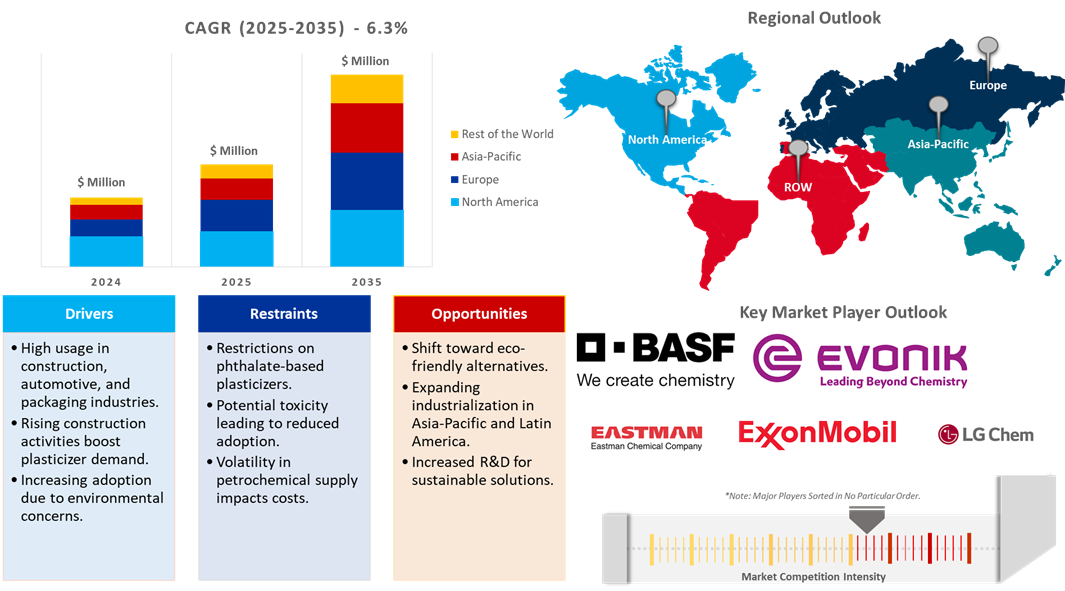

The plasticizers market was valued at $17,850 million in 2024 and is projected to reach $36,422 million in 2035, growing at a CAGR of 6.3% during the forecast period (2025-2035) driven by the growing infrastructure development, expanding construction sector, demand for bio-plasticizers, and increase in demand for flexible polyvinyl chloride (PVC). According to the European Plasticizer, in 2023, yearly the global consumption of plasticizers reached 10.8 million tons. The European plasticizer industry’s market value is $2.2 billion in 2023. By 2030, the industry aims to achieve 1 million tons per year of recycled PVC used in new products.

Market Dynamics

Growing Demand for Bio-based Plasticizers

The plasticizer industry is witnessing a move towards bio-based alternatives with mounting environmental issues and regulatory demands. Bio-based plasticizers from renewable raw materials such as plant oils or starch are hot commodities as producers and consumers redirect their focus on sustainability. They provide a more sustainable alternative in the form of lower petrochemical-based chemicals. In addition, the surge of momentum on environmentally sustainable products in industries including automotive, construction, and packaging continues to push the use of bio-based plasticizers. The shift is also in line with the global push toward reducing carbon footprints and enabling circular economies.

Surge in Plasticizers for Electric Vehicle (EV) Applications

The growth in electric vehicles (EVs) is accelerating new plasticizer demand, especially within the automotive industry. Vehicle manufacturers have turned their attention to producing electric and hybrid cars, and the need for premium materials that offer flexibility, durability, and high performance in harsh conditions has grown. Plasticizers are essential in such applications, as they are used to enhance the flexibility of many components, such as cables, connectors, and seals, that are key to EV functioning. The shift towards EVs is influencing the demand for more efficient and high-performance plasticizers that can fulfill electric and hybrid vehicle technical requirements, encouraging innovations and development in the plasticizer industry.

Market Segmentation

- Based on the type, the market is segmented into phthalate and non-phthalate.

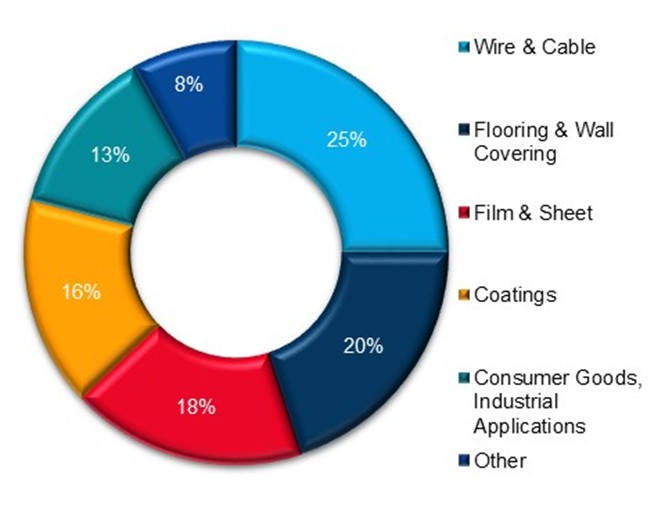

- Based on the application, the market is segmented into wires & cables, floorings & wall coverings, films & sheets, coated fabrics, consumer goods, and others (textiles & fabrics).

Phthalate Segment to Lead the Market with the Largest Share

The consistent requirement for phthalates is driving the development of the plasticizer market. Phthalates are widely used in the production of flexible polymers to increase their toughness, pliability, and durability. The plasticizers are used in the building, automobile, and medical sectors and are held accountable for improving the usability of PVC (polyvinyl chloride) products. The increasing uses of PVC in the production of wires, flooring, and medical equipment have helped increase phthalate consumption. Moreover, the availability and low cost of phthalates also facilitate their extensive utilization in the plastics industry. The plasticizer market is expanding even further as more industries come to depend on the advantages provided by phthalates in their production.

Wires & Cables: A Key Segment in Market Growth

The plasticizer market is increasingly gaining momentum in its critical usage in enhancing flexibility and durability within the material system. The potential growth in formulating techniques applied to medical equipment and high-voltage insulation materials makes for innovation development. Government policy aimed at incorporating safer and more nontoxic alternatives is gradually shaping industry expectations. Increasing investment in sustainable polymer technologies produces green plasticizers. New materials with higher performance characteristics are in high demand owing to the move towards electric mobility. The increasing scope of infrastructure projects globally is creating more demand for high-strength plasticized compounds. Breakthroughs in biodegradable plasticizers are being encouraged through research partnerships between academia and industry.

Regional Outlook

The global plasticizers market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Plasticizers in End-Use Industries in Asia-Pacific

Asia-Pacific plasticizer market is growing with major nations rapidly undergoing urbanization and industrialization. One of the major drivers of development is the increased need for flexible PVC in electronics, medical, and construction applications. With rising production in China and India, there is a rise in demand for high-performance plasticizers. The market expansion is accelerated further by government programs encouraging infrastructural investments. Moreover, demand for shoes and house commodities is triggered further by an emerging consumer goods sector. Developing chemical production coupled with investment in polymer research serves as an enabling element in producing novel products.

Europe Region Dominates the Market with Major Share

Europe holds a significant share owing to strict environmental laws that increase the adoption of non-phthalate and bio-based plasticizers driving the plasticizer market within Europe. A further expansion of the market is also facilitated by the increasing demand in the automotive and construction industries. The increasing use of sustainability and recyclability in plastic products triggers the producers to develop environmentally friendly alternative products. The technological advancements in polymer processing improve plasticizer's functionality in several applications. Demand is also developed owing to car manufacturers switching to robust and lightweight materials. Packaging sector expansion also constitutes a significant demand factor owing to the growing e-commerce and concern for food safety.

Europe’s Plasticizers Use

Market Players Outlook

The major companies operating in the global plasticizers market include BASF SE, Eastman Chemical Co., Evonik Oxeno GmbH & Co., Exxon Mobil Corp., and LG Chem, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, Evonik Oxeno is significantly expanding its production capacities for the INA-based plasticizers, ELATUR® CH (DINCH) and ELATUR® DINCD. These products established themselves as new standard plasticizers with Evonik Oxeno customers. Ensuring a reliable and secure supply of isononanol (INA)-based plasticizers for the European market.

- In June 2023, KLJ Group invested $145 million and commissioned a Plasticizers & Phthalic Anhydride manufacturing unit (BIS approved). KLJ Group's commitment to increasing its product base and meeting the growing demands of the market can be attested to by this integrated plant facility.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plasticizers market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Plasticizers Market Sales Analysis – Type| Application ($ Million)

• Plasticizers Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Plasticizers Industry Trends

2.2.2. Market Recommendations

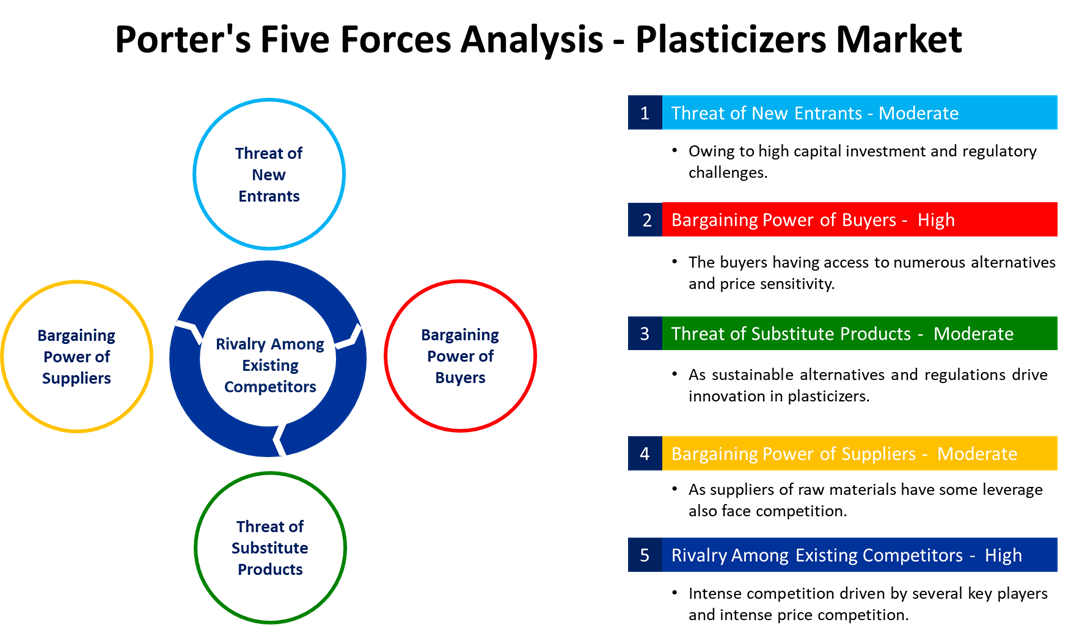

2.3. Porter's Five Forces Analysis for the Plasticizers Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Plasticizers Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Plasticizers Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Plasticizers Market Revenue and Share by Manufacturers

• Plasticizers Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Eastman Chemical Co.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Evonik Oxeno GmbH & Co.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Exxon Mobil Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. LG Chem

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Plasticizers Market Sales Analysis by Type ($ Million)

5.1. Phthalate

5.2. Non-phthalate

6. Global Plasticizers Market Sales Analysis by Application ($ Million)

6.1. Wires & Cables

6.2. Floorings & Wall Coverings

6.3. Films & Sheets

6.4. Coated Fabrics

6.5. Consumer Goods

6.6. Others (Textiles & Fabrics)

7. Regional Analysis

7.1. North American Plasticizers Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Plasticizers Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for North America

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Plasticizers Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Plasticizers Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. ACS Technical Products

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Avient Corp.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Baerlocher GmbH

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. BASF SE

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Cargill, Inc.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. DIC Corp.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Eastman Chemical Co.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Emery Oleochemicals Group

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Evonik Oxeno GmbH & Co.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Exxon Mobil Corp.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Ferro Corp.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Goldstab Organics PVT. LTD.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. INEOS Group

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Kao Corp.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. KLJ Group

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. LANXESS

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. LG Chem Ltd.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Matrìca S.p.A.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Perstorp Holding AB

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Polynt S.p.A.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Roquette Frères

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. SABIC

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. The Solvay Group

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. The Chemical Co. (ChemFlexx)

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Velsicol Chemical LLC

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

1. Global Plasticizers Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Phthalate Plasticizers Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Non-Phthalate Plasticizers Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Plasticizers Market Research And Analysis By Application, 2024-2035 ($ Million)

5. Global Plasticizers For Wires & Cables Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Plasticizers For Floorings & Wall Coverings Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Plasticizers For Films & Sheets Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Plasticizers For Coated Fabrics Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Plasticizers For Consumer Goods Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Plasticizers For Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Plasticizers Market Research And Analysis By Region, 2024-2035 ($ Million)

12. North American Plasticizers Market Research And Analysis By Country, 2024-2035 ($ Million)

13. North American Plasticizers Market Research And Analysis By Type, 2024-2035 ($ Million)

14. North American Plasticizers Market Research And Analysis By Application, 2024-2035 ($ Million)

15. European Plasticizers Market Research And Analysis By Country, 2024-2035 ($ Million)

16. European Plasticizers Market Research And Analysis By Type, 2024-2035 ($ Million)

17. European Plasticizers Market Research And Analysis By Application, 2024-2035 ($ Million)

18. Asia-Pacific Plasticizers Market Research And Analysis By Country, 2024-2035 ($ Million)

19. Asia-Pacific Plasticizers Market Research And Analysis By Type, 2024-2035 ($ Million)

20. Asia-Pacific Plasticizers Market Research And Analysis By Application, 2024-2035 ($ Million)

21. Rest Of The World Plasticizers Market Research And Analysis By Region, 2024-2035 ($ Million)

22. Rest Of The World Plasticizers Market Research And Analysis By Type, 2024-2035 ($ Million)

23. Rest Of The World Plasticizers Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Plasticizers Market Share By Type, 2024 Vs 2035 (%)

2. Global Phthalate Plasticizers Market Share By Region, 2024 Vs 2035 (%)

3. Global Non-Phthalate Plasticizers Market Share By Region, 2024 Vs 2035 (%)

4. Global Plasticizers Market Share By Application, 2024 Vs 2035 (%)

5. Global Plasticizers For Wires & Cables Market Share By Region, 2024 Vs 2035 (%)

6. Global Plasticizers For Floorings & Wall Coverings Market Share By Region, 2024 Vs 2035 (%)

7. Global Plasticizers For Films & Sheets Market Share By Region, 2024 Vs 2035 (%)

8. Global Plasticizers For Coated Fabrics Market Share By Region, 2024 Vs 2035 (%)

9. Global Plasticizers For Consumer Goods Market Share By Region, 2024 Vs 2035 (%)

10. Global Plasticizers For Other Application Market Share By Region, 2024 Vs 2035 (%)

11. Global Plasticizers Market Share By Region, 2024 Vs 2035 (%)

12. US Plasticizers Market Size, 2024-2035 ($ Million)

13. Canada Plasticizers Market Size, 2024-2035 ($ Million)

14. UK Plasticizers Market Size, 2024-2035 ($ Million)

15. France Plasticizers Market Size, 2024-2035 ($ Million)

16. Germany Plasticizers Market Size, 2024-2035 ($ Million)

17. Italy Plasticizers Market Size, 2024-2035 ($ Million)

18. Spain Plasticizers Market Size, 2024-2035 ($ Million)

19. Russia Plasticizers Market Size, 2024-2035 ($ Million)

20. Rest Of Europe Plasticizers Market Size, 2024-2035 ($ Million)

21. India Plasticizers Market Size, 2024-2035 ($ Million)

22. China Plasticizers Market Size, 2024-2035 ($ Million)

23. Japan Plasticizers Market Size, 2024-2035 ($ Million)

24. South Korea Plasticizers Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Plasticizers Market Size, 2024-2035 ($ Million)

26. ASEAN Economies Plasticizers Market Size, 2024-2035 ($ Million)

27. Rest Of Asia-Pacific Plasticizers Market Size, 2024-2035 ($ Million)

28. Latin America Plasticizers Market Size, 2024-2035 ($ Million)

29. Middle East And Africa Plasticizers Market Size, 2024-2035 ($ Million)

FAQS

The size of the Plasticizers market in 2024 is estimated to be around $17,850 million.

Europe holds the largest share in the Plasticizers market.

Leading players in the Plasticizers market include BASF SE, Eastman Chemical Co., Evonik Oxeno GmbH & Co., Exxon Mobil Corp., and LG Chem, among others.

Plasticizers market is expected to grow at a CAGR of 6.3% from 2025 to 2035.

The Plasticizers Market is growing due to rising demand for flexible PVC in construction, automotive, and packaging industries, along with increasing adoption of bio-based and phthalate-free alternatives driven by environmental regulations.