Pneumatic Tube System Market

Global Pneumatic Tube System Market Size, Share & Trends Analysis Report, By System Type (Single-Line, Multi-Line, and Point-to-Point), By Function (Semi-Automatic and Fully Automatic), By End-User (Medical, Commercial, and Industrial) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global pneumatic tube system market is estimated to grow at a CAGR of nearly 6.0% during the forecast period. The increasing trend towards automation in hospitals and rising demand for material handling technologies across industries are the major factors driving the demand for pneumatic tube systems. There is an emerging demand for automated material handling technologies across industries to leverage operational efficiency and safety in manufacturing plants. Pneumatic tube systems are considered as a reliable and efficient alternative to transporting materials within and between industrial plants. Pneumatic transport systems can be simply integrated with current manufacturing and robotic systems. Through leveraging operational facility, it can offer a faster return on investment. Superior management and constant communication are the basis of successful manufacturing operations.

Pneumatic tube system design enables manufacturers to transport components, materials, and paperwork safely and quickly across departments. The use of pneumatic systems can accelerate product testing and manufacturing, minimizing travel time and reducing the risk for human error. As a result, pneumatic tube systems can be integrated into several manufacturing settings, including food & beverage, chemicals, automotive, plastics, pharmaceuticals, and metal industry. Further, rising industrialization coupled with the increasing focus on automation in industrial processes is offering an opportunity for the adoption of these systems. For instance, in May 2015, the Chinese government introduced Made in China (MIC) 2025 initiative which comprises a range of state-backed programs that aims to accelerate productivity, modernize the Chinese economy, and make innovations in industrial processes.

The MIC 2025 plan signifies that the country’s manufacturing sector is large, however, it lacks in quality of industrial infrastructure, innovation capacity, degree of digitalization, and the effectiveness of resource utilization. Under the plan, the Chinese government seeks to carry out the task of upgrade infrastructure and leverage technological developments. MIC 2025 aims to move China in the manufacturing value chain through smart manufacturing and advanced manufacturing technologies. The trend towards modernization of industrial processes will facilitate the adoption of pneumatic tube systems across industrial facilities. Additionally, emerging demand for automated waste management is offering significant scope for the adoption of pneumatic tube systems for hygienic disposal of an increasing amount of waste.

Market Segmentation

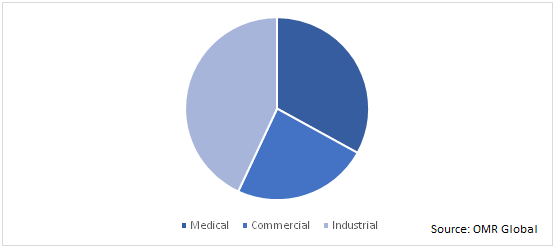

The global pneumatic tube system is segmented based on system type, function, and end-user. Based on system type, the market is classified into single-line, multi-line, and point-to-point. Based on function, the market is classified into semi-automatic and fully automatic. Based on end-user, the market is classified into medical, commercial, and industrial.

Medical is anticipated to hold significant share during the forecast period

The demand for pneumatic tube systems is anticipated to grow significantly in hospitals owing to its efficacy in transporting blood samples, medications, and urine samples. The collaboration of major departments in hospitals is important for the patients’recovery, for diagnosis of a condition and offer the right therapy for recovery. As a result, pneumatic tube system significantly enhances the cooperation among departments by transporting blood, pharmaceuticals, and specimens in a secured and transparent way. It not only freeing up clinicians’ time, however, also reduces distractions by offering workflow guidance and real-time status information. During the emergency, quick deliveries are required to save the lives of patients, which in turn, will likely accelerate the demand for pneumatic tube system in medical applications. It can be a basic inventory in hospitals with over 200 beds, as an appropriate solution to deliver medications and important samples when long distances to be covered.

Global Pneumatic Tube System Market Share by End-User, 2019 (%)

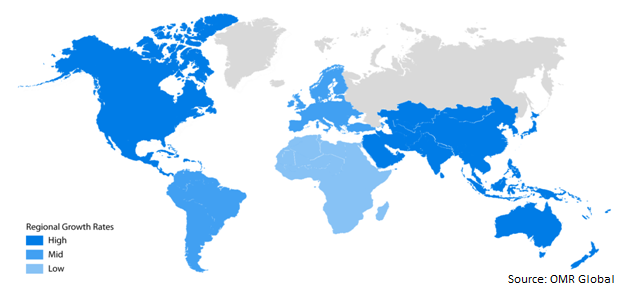

Regional Outlook

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America is expected to hold a potential share in the market owing to the increasing adoption of pneumatic tube systems in hospitals and a significant rise in pharmaceutical manufacturing in the region. According to the Eurostat, in 2018 North America accounted for 48.9% of the pharmaceutical sales globally. The region has the largest share in pharmaceutical manufacturing. This, in turn, contributes to the demand for pneumatic tube system in pharmaceutical manufacturing processes in the region for safe and quick transportation of materials during the manufacturing process.

Global Pneumatic Tube System Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Aerocom Systems, Inc., Swisslog Holding AG (Kuka AG), Eagle Pneumatic, Inc., Pevco, and SIEBTECHNIK GmbH. These companies are offering a range of pneumatic tube systems for several industries, including chemical, pharmaceutical, food and beverage, and automotive industry. Aerocom pneumatic tube systems for manufacturing industry include AC3000, AC2U, and AC660. AC3000 systems can connect more than 1,000 stations and up to 64 independent operating zones. Owing to the augmented reporting and audit trail safety features, it is appropriate for production facilities, processing plants, organizations with hot sampling needs, and other industrial plants. The AC660 is an appropriate solution for hot and cold climates. It features a unique ability to prioritize and queuemultiple carriers.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pneumatic tube system market. Based on the availability of data and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Aerocom Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Kuka AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Eagle Pneumatic, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pevco

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. SIEBTECHNIK GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Pneumatic Tube System Market by System Configuration

5.1.1. Single-Line

5.1.2. Multi-Line

5.1.3. Point-to-Point

5.2. Global Pneumatic Tube System Market by Function

5.2.1. Semi-Automatic

5.2.2. Fully Automatic

5.3. Global Pneumatic Tube System Market by End-User

5.3.1. Medical

5.3.2. Commercial

5.3.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aerocom Systems, Inc.

7.2. Air-Log International GmbH

7.3. Eagle Pneumatic, Inc.

7.4. Hamilton Security Solutions

7.5. Hanazeder Electronic GmbH

7.6. Hanter Ingenjörsteknik AB

7.7. Ing. Sumetzberger GmbH

7.8. Kelly Systems, Inc.

7.9. Lamson Group Pty Ltd.

7.10. Oppent S.p.A.

7.11. PES Installations Pvt. Ltd.

7.12. Pevco

7.13. Quirepace Ltd.

7.14. SIEBTECHNIK GmbH

7.15. Swisslog Holding AG (Kuka AG)

7.16. Telecom bedrijfscommunicatie b.v.

1. GLOBAL PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM CONFIGURATION, 2019-2026 ($ MILLION)

2. GLOBAL SINGLE-LINE PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL MULTI-LINE PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL POINT-TO-POINT PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

6. GLOBAL SEMI-AUTOMATIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FULLY AUTOMATIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

9. GLOBAL PNEUMATIC TUBE SYSTEM IN MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PNEUMATIC TUBE SYSTEM IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PNEUMATIC TUBE SYSTEM IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM CONFIGURATION, 2019-2026 ($ MILLION)

15. NORTH AMERICAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

16. NORTH AMERICAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. EUROPEAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM CONFIGURATION, 2019-2026 ($ MILLION)

19. EUROPEAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

20. EUROPEAN PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM CONFIGURATION, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

25. REST OF THE WORLD PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM CONFIGURATION, 2019-2026 ($ MILLION)

26. REST OF THE WORLD PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2019-2026 ($ MILLION)

27. REST OF THE WORLD PNEUMATIC TUBE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL PNEUMATIC TUBE SYSTEM MARKET SHARE BY SYSTEM CONFIGURATION, 2019 VS 2026 (%)

2. GLOBAL PNEUMATIC TUBE SYSTEM MARKET SHARE BY FUNCTION, 2019 VS 2026 (%)

3. GLOBAL PNEUMATIC TUBE SYSTEM MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL PNEUMATIC TUBE SYSTEM MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

7. UK PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD PNEUMATIC TUBE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)