Polyamide Resins Market

Global Polyamide Resins Market Size, Share & Trends Analysis Report, By Product Type (Polyamide 6, Polyamide 6,6, Polyamide 6,12, Polyamide 11, and Others), By End-Use Industry (Inks, Paints, and Coatings, Automotive, Aerospace, Chemical, Electrical and Electronics, Textile, Packaging, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global polyamide resins market is estimated to grow at a CAGR of nearly 6% during the forecast period. Superior properties of polyamides and emerging demand for recycled polyamide resins are primarily contributing to the growth of the market. Polyamides (Nylon) possesses high temperature and electrical resistance properties. It shows excellent chemical resistance owing to the crystalline structure. Polyamides contain very good barrier and mechanical properties and can easily be flame retarded. All polyamides tend moisture absorption as it belongs to the amide chemical group. A comprehensive range of polyamides are semi-crystalline and are normally very strong materials with better chemical and thermal resistance.

Polyamides can be applied in high-temperature settings. The different types of polyamides offer a comprehensive range of properties with the melting point, specific gravity, and moisture content tend to reduce with the increasing number of polyamides. Generally, the flexibility and impact resistance of polyamides likely to increase with moisture content, whereas the toughness reduces. The degree of moisture content relies on temperature, part thickness, and crystallinity. Preconditioning can be used for the prevention of adverse effects associated with absorption of moisture during service. Polyamides tend to offer better resistance to several chemicals, although cannot be resistant to strong alkalis, acids, and alcohol.

Owing to these superior properties, it is being significantly used in automotive and electrical and electronics applications. There are nearly 30,000 components in a vehicle of which one-third are produced from plastic. Nearly 39 different kinds of basic plastics in a vehicle are used in automobiles. Most commonly used plastics in an automobile include polyamides, polyurethane, polypropylene, and polyvinyl chloride. Nylon offers superior mechanical properties and flexibility that has led its applications in the automotive industry.

In the automotive industry, it is used in the air intake, cooling fans, wire and cable jacketing, turbo air ducts, brake and power steering reservoirs, gears for windshield wipers and speedometers, and valve and engine covers. Nylon is also used in several electrical/electronic components such as plugs and antenna-mounting devices, switches, and sockets. Rising demand for engineering thermoplastics is also a major factor encouraging the adoption of polyamide resins. Polyamide resins are among the most important classes of engineered thermoplastics and are generally recyclable, which, in turn, is contributing to the market growth.

Market Segmentation

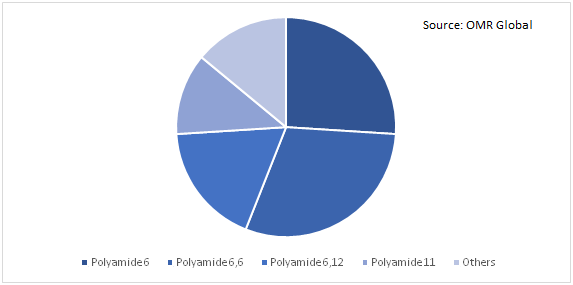

The global polyamide resins market is segmented based on product type and end-use industry. Based on product type, the market is classified into polyamide 6, polyamide 6,6, polyamide 6,12, polyamide 11, and others. Based on end-use industry, the market is segmented into inks, paints, and coatings, automotive, aerospace, chemical, electrical and electronics, textile, packaging, and others.

Polyamide 6,6 Find Significant Application in End-Use Industries

Polyamide 6/6 is the strongest of the nylons and possesses a superior balance of properties. It has up to 36,000 pounds per Square Inch (psi) tensile and 50,000 psi flexural strength; improved thermal conductivity and electrical conductivity, lower expansion; and better dimensional stability. It has static dissipative features when reinforced with carbon fiber. Owing to their high modulus, static electricity discharge, and good wear resistance characteristics, carbon fiber-reinforced polyamides have potential to replace die-cast metals, including those utilized in moving textile machine parts. Compared to Nylon 6, Nylon 6/6 has lower shrinkage and is normally preferred for molding.

Typical applications for molded nylon include terminal blocks, power-tool housings, grilles, and door handles, and more. It has a slightly higher melting point, with moisture absorption and slower permeability. Polyamide 6,6 has discovered its applications into automotive cooling systems, in which it enables consolidation of several parts that were produced from plastics and aluminum. It is also applied in headlamp bezels. Polyamide 6,6 is also a material of choice in electronic connectors. It has also potential applications in textile and packaging. Polyamide 6 and Polyamide 6,6 are the most cost-effective forms of polyamide compared to other polyamides, which is also a major cause for considerable adoption of these two polyamide resins in end-use industries.

Global Polyamide Resins Market Share by Product Type, 2019 (%)

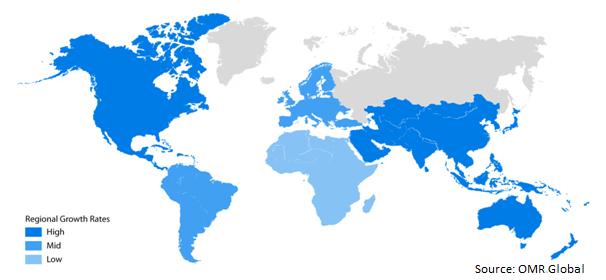

Regional Outlook

Geographically, in 2019, Asia-Pacific is estimated to witness potential share in the market. Expansion of automobile production facilities and electronics manufacturing base in the region have primarily led the demand for polyamide resins in the region. As per the India Brand Equity Foundation (IBEF), production of electronics hardware in India rose from $31.13 billion in 2014 to $65.53 billion in 2019. Further, as per the Department for Promotion of Industry and Internal Trade (DPIIT), during the period, April 2000-March 2020, the inflow of foreign direct investment (FDI) in electronics sector stood at $2.8 billion. It contributes to the adoption of thermoplastic resins including polyamide resins owing to its better electrical insulation, superior flow and dimensional stability. These properties enable the cost-efficient development of thinner and lighter components for new generation electrical and electronic devices.

Global Polyamide Resins Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include BASF SE, Arkema S.A., DuPont De Nemours, Inc., Koninklijke DSM N.V., and DOMO Chemicals GmbH. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. In January 2020, DOMO Chemicals acquired Performance Polyamides Business from Solvay in Europe. The acquired business comprises High-Performance Fibers in France; Engineering Plastics operations in Poland and France; Polymer and Intermediates operations in Poland Spain, and France. This acquisition is intended to strengthen the nylon-based engineering materials business of DOMO Chemicals.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global polyamide resins market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Arkema S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. DuPont de Nemours, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Koninklijke DSM N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. DOMO Chemicals GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Polyamide Resins Market by Product Type

5.1.1. Polyamide 6

5.1.2. Polyamide 6,6

5.1.3. Polyamide 6,12

5.1.4. Polyamide 11

5.1.5. Others

5.2. Global Polyamide Resins Market by End-Use Industry

5.2.1. Inks, Paints and Coatings

5.2.2. Automotive

5.2.3. Aerospace

5.2.4. Chemical

5.2.5. Electrical and Electronics

5.2.6. Textile

5.2.7. Packaging

5.2.8. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arkema S.A.

7.2. Ascend Performance Materials Operations LLC

7.3. BASF SE

7.4. Celanese Corp.

7.5. Cytech Coatings Pvt. Ltd.

7.6. DOMO Chemicals GmbH

7.7. DuPont de Nemours, Inc.

7.8. Ensinger GmbH

7.9. Evonik Industries AG

7.10. Gabriel Performance Products

7.11. Innotek Technology (China) Ltd.

7.12. Kermel

7.13. Koch Industries, Inc.

7.14. Koninklijke DSM N.V.

7.15. Kraton Corp.

7.16. Kuraray Co., Ltd.

7.17. Lanxess AG

7.18. Merck KGaA

7.19. Mitsubishi Chemical Corp.

7.20. MPD Industries Pvt. Ltd.

7.21. Nilit Ltd.

7.22. PolyOne Corp.

7.23. Radici Partecipazioni SpA

7.24. RI Chemical Corp.

7.25. RTP Co.

7.26. Thomas Swan & Co. Ltd.

7.27. Toray Industries, Inc.

7.28. Toyobo Co., Ltd.

7.29. Unitika Ltd.

1. GLOBAL POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL POLYAMIDE 6 RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL POLYAMIDE 6,6 RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL POLYAMIDE 6,12 RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL POLYAMIDE 11 RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

8. GLOBAL POLYAMIDE RESINS IN INKS, PAINTS, AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL POLYAMIDE RESINS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL POLYAMIDE RESINS IN AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL POLYAMIDE RESINS IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL POLYAMIDE RESINS IN ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL POLYAMIDE RESINS IN TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL POLYAMIDE RESINS IN PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL POLYAMIDE RESINS IN OTHER END-USE INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

20. EUROPEAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

22. EUROPEAN POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

26. REST OF THE WORLD POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD POLYAMIDE RESINS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL POLYAMIDE RESINS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL POLYAMIDE RESINS MARKET SHARE BY END-USE INDUSTRY, 2019 VS 2026 (%)

3. GLOBAL POLYAMIDE RESINS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD POLYAMIDE RESINS MARKET SIZE, 2019-2026 ($ MILLION)