Polycarbonate Resins Market

Global Polycarbonate Resins Market Size, Share & Trends Analysis Report, By Application (Electrical and Electronics, Automotive, Consumer Goods, Construction, Packaging, Medical, Optical Media, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global polycarbonate resins market is estimated to grow at a CAGR of nearly 5.2% during the forecast period. The major factors encouraging the market growth include superior properties of polycarbonate resins and significant application in the automotive industry. Polycarbonate (PC) holds excellent toughness, very good dimensional stability, transparency, and thermal stability. This makes polycarbonates one of the most significantly used engineering thermoplastics. Electrical components, headlamp lenses, compact discs, baby feeding bottles, riot shields, safety helmets, and vandal-proof glazing, are all typical applications of polycarbonate. As per the British Plastics Federation, polycarbonate remains one of the emerging engineering plastics owing to the increasing new applications.

Polycarbonates can maintain rigidity up to 140°C and toughness down to -20°C or special grades even lower. It is an amorphous polymer, which, in turn, shows high dimensional stability and excellent mechanical properties, and is thermally resistant up to 135°C. Polycarbonate resins are widely used in automotive interior and exterior applications. Such materials have been approved to global OEM standards and offer efficient properties including high transparency, UV stability, ductility, and toughness. High-flow polycarbonate resin grades are optimized for thin-wall design in automotive applications. Polycarbonate resin allows automakers to produce stronger, lighter, and more durable components. Typical polycarbonate blend applications comprise dashboards, automotive lighting, interior cladding, headlamp lenses, and exterior parts such as body panels and bumpers.

The vehicles interior design has a major impact on the purchasing decision of consumers. To meet the expectation of consumers, current automotive interior designs significantly feature improved functionality of component while keeping stylish, luxurious appearance. Polycarbonate resins and blends provides a suitable combination of surface quality and durability at high temperature and high mechanical performance which is required to ensure innovations for the performance of interiors. Polycarbonates enable to produce more appealing interiors whether required for structural components including colorful, high/low-gloss or leather-like interior surfaces, instrument panels, light guides, or decorative film based back injected parts. Therefore, polycarbonate resins are significantly used in automotive applications as an engineered plastic to increase mechanical strength and enhance the appearance of vehicles.

Market Segmentation

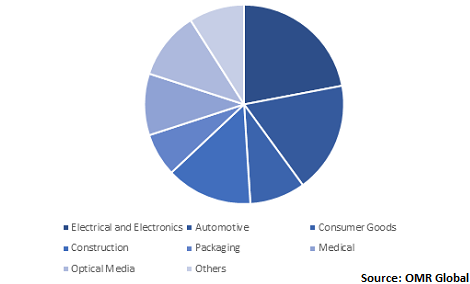

The global polycarbonate resins market is classified based on applications, which is further segmented into electrical and electronics, automotive, consumer goods, construction, packaging, medical, optical media, and others.

Polycarbonate Resins Find Significant Applications in Electrical and Electronics

Polycarbonate resins have potential applications in electrical and electronics as it holds better electrical resistance. It is used in several electrical and electronic devices, such as housings, smartphones, battery boxes, connectors, and more. Polycarbonate resins also possess superior heat resistance and insulation properties. Additionally, its flame retarding characteristics are gradually multiplying its areas of application in electrical components and hardware. Novel applications, such as smart grid electric systems and 3D printing is expected to offer potential opportunity for polycarbonate resins in electrical and electronics. The electrical industry is shifting towards smarter power management, which is expected to fuel the adoption of thermoplastics that possess better signal transmission properties. This makes thermoplastics compatible with smart circuit breakers, socket, smart switch, and smart metering solutions.

Global Polycarbonate Resins Market Share by Application, 2019 (%)

Regional Outlook

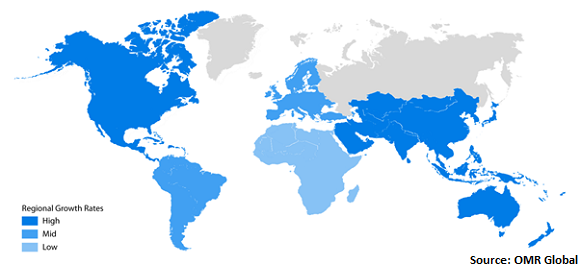

Geographically, in 2019, Asia-Pacific held the largest share in the market owing to the significant production base of electrical and electronics products and the presence of some crucial polycarbonate resin manufacturers such as Mitsubishi Chemical Corp., Samyang Holdings Corp., and Teijin Ltd. in the region. Samyang Kasei is the first polycarbonate resin manufacturing company in South Korea, produces 120,000 tons in a year. Significant rise in the construction industry is expected to further accelerate the adoption of polycarbonate resins in the region. Polycarbonate is known as an appropriate alternative to glass in several glazing applications, including security windows, agricultural houses, skylights, industry or public building, facades, and shelters as it holds beneficial properties of high impact strength, resistance to UV light, transparency, and weatherability.

Global Polycarbonate Resins Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include SABIC (Saudi Basic Industries Corp.), Covestro AG, Mitsubishi Chemical Corp., Teijin Ltd., and Idemitsu Kosan Co., Ltd. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in October 2019, SABIC declared the introduction of the first polycarbonate based on certified renewable feedstock. It will offer SABIC and its customers with a solution that can reduce both CO2 emissions and the utilization of fossil feedstock during production.

Customers can utilize this polycarbonate resin on their current equipment, under the same process conditions. SABIC’s polycarbonate based on the International Sustainability and Carbon Certification PLUS (ISCC PLUS) certified feedstock will be developed initially at its production facilities in the Netherlands, with its availability across the globe in the future. This polycarbonate resin may be used for applications in all segments, including building & construction, automotive, electronics and electrical, consumer, and healthcare.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global polycarbonate resins market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. SABIC (Saudi Basic Industries Corp.)

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Covestro AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mitsubishi Chemical Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Teijin Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Idemitsu Kosan Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Polycarbonate Resins Market by Application

5.1.1. Electrical and Electronics

5.1.2. Automotive

5.1.3. Consumer Goods

5.1.4. Construction

5.1.5. Packaging

5.1.6. Medical

5.1.7. Optical Media

5.1.8. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. CHIMEI Corp.

7.2. Covestro AG

7.3. Elix Polymers SLU

7.4. Formosa Chemicals & Fibre Corp.

7.5. Idemitsu Kosan Co., Ltd.

7.6. LG Chem, Ltd.

7.7. Lotte Chemical Corp.

7.8. Mitsubishi Chemical Corp.

7.9. Roquette Frères S.A.

7.10. SABIC (Saudi Basic Industries Corp.)

7.11. Samsung SDI Co., Ltd.

7.12. Samyang Holdings Corp.

7.13. Teijin Ltd.

7.14. Thai Polycarbonate Co., Ltd.

7.15. Trinseo S.A.

1. GLOBAL POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL POLYCARBONATE RESINS IN ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL POLYCARBONATE RESINS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL POLYCARBONATE RESINS IN CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL POLYCARBONATE RESINS IN CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL POLYCARBONATE RESINS IN PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL POLYCARBONATE RESINS IN MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL POLYCARBONATE RESINS IN OPTICAL MEDIA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL POLYCARBONATE RESINS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. EUROPEAN POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. REST OF THE WORLD POLYCARBONATE RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL POLYCARBONATE RESINS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL POLYCARBONATE RESINS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

5. UK POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD POLYCARBONATE RESINS MARKET SIZE, 2019-2026 ($ MILLION)