Polyethylene Terephthalate (PET) Market

Polyethylene Terephthalate (PET) Market Size, Share & Trends Analysis Report by Application (Sheets and Films, Consumer Goods, Food and Beverage Packaging, and Others), End-Use Industry (Electrical and Electronics, Packaging, Automotive, Construction, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Polyethylene terephthalate (PET) market is anticipated to grow at a CAGR of 4.2% during the forecast period. The key factor contributing to the market’s growth is the advantages of PET. It has a unique combination of properties such as resistance to oil, grease, and alcohols; low gas permeability; various solvents; high strength; and moisture barrier properties, making it a popular choice for various industries such as packaging, textiles, automotive, and electronics, which is fueling the growth of the PET market. Additionally, the market is expected to grow due to increased technical advances and developments in packaging applications, notably weight reduction. However, severe environmental regulations that limit the use of PET, as well as increased demand for ecologically friendly alternatives such as high-density polyethylene (HDPE), are expected to impede market development.

Segmental Outlook

The global PET market is segmented by application and end-use industry. Based on application, the market is sub-segmented into sheets and films, consumer goods, food and beverage packaging, and others. Based on end-use industry, the market is sub-segmented into electrical and electronics, packaging, automotive, construction, and others.

The Food and Beverage Packaging Segment Holds a Prominent Share in the Global Polyethylene Terephthalate (PET) Market

Based on application, the market is divided into sheets and films, consumer goods, food and beverage packaging, and others Of these, the food and beverage packaging segment is anticipated to hold the largest market share owing to the increasing food industry.PET is a popular material for food and beverage packaging, owing to its physicochemical qualities, including its stiffness and glass-like clarity. It also preserves food freshness and improves shelf life. Additionally, PET can be molded into beverage and food packaging boxes and jugs. It is available as a homopolymer and a copolymer, making it an adaptable material for beverage packaging.

Regional Outlooks

The global PETmarket is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

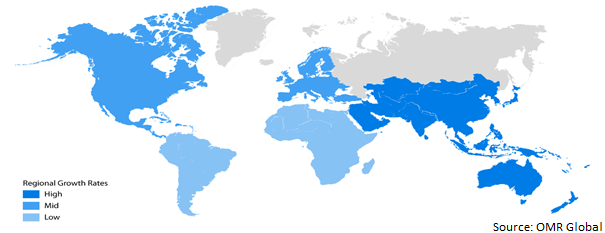

Global Polyethylene Terephthalate (PET) Market Growth, by Region (2023-2030)

The Asia-Pacific Region is Expected to Dominate the Global Polyethylene Terephthalate (PET)Market

Population expansion, rising disposable income, urbanization in developing nations, and rising demand for fast-moving consumer products are driving the Asia-Pacific PET market. China is a significant producer of PET resins, with PetroChina Group and Jiangsu Sangfangxiang standing among the world's top volume producers, with capacities exceeding 2 million tons. Additionally, the usage of engineering plastic products in the packaging industry (PET containers, bottles, and others) is rapidly expanding owing to their benefits over traditional packaging plastics. Due to rising exports and domestic consumption, China's need for packing materials is expanding in industries such as food and beverage, consumer products, and others. Besides, PET is a flexible substrate material for various electronics applications. Hence, the electronics industry’s growth in the region, especially in India and China, is also expanding the market. China is a strong, favorable market for electronics producers due to the country’s low labor costs and flexible policies. Such factors are expected to increase the PET resin’s demand in the region during the forecast period.

Market Players Outlook

The major companies serving the global PET market include Alpek S.A.B. de C.V., DuPont, Far Eastern New Century, Indorama Ventures, Jiangsu Sanfangxiang Group, Lanxess, M&G Chemicals, Nan Ya Plastics Corporation, PET Processors LLC, and others. The market players are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new product launches, to stay competitive in the market. For instance,in February 2022, Alpek S.A.B. de C.V., a Mexican chemical manufacturing company, acquired OCTAL Holding SAOC, a materials sector company. This acquisition moves Alpek into the high-value PET sheet business area, reduces the gap toward meeting its ESG targets, and strengthens its capacity to meet the expanding PET resin demands of its clients.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Polyethylene Terephthalate (PET) market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Polyethylene Terephthalate (PET) Market by Application

4.1.1. Sheets and Films

4.1.2. Consumer Goods

4.1.3. Food and Beverage Packaging

4.1.4. Others

4.2. Global Polyethylene Terephthalate (PET) Market by End-Use Industry

4.2.1. Electrical and Electronics

4.2.2. Packaging

4.2.3. Automotive

4.2.4. Construction

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alpek S.A.B. de C.V.

6.2. DuPont

6.3. Far Eastern New Century

6.4. Indorama Ventures

6.5. Jiangsu Sanfangxiang Group

6.6. Lanxess

6.7. M&G Chemicals

6.8. Nan Ya Plastics Corporation

6.9. PET Processors LLC

6.10. RTP Company

6.11. SABIC

6.12. Tray-Pak Corporation

6.13. The Dow Chemicals Company

6.14. Verdeco Recycling Inc.

6.15. Voridian (Eastman Chemicals) Inc.

6.16. Quadrant AG

1. GLOBAL POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

2. GLOBAL SHEETS AND FILMS POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CONSUMER GOODS PACKAGING POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FOOD AND BEVERAGE PACKAGING POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL OTHERS POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL POLYETHYLENE TEREPHTHALATE (PET)MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2022-2030 ($ MILLION)

7. GLOBAL ELECTRICAL AND ELECTRONICS POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL PACKAGING POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL AUTOMOTIVE POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL CONSTRUCTION POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL OTHERS POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. NORTH AMERICAN POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. NORTH AMERICAN POLYETHYLENE TEREPHTHALATE (PET )MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2022-2030 ($ MILLION)

15. EUROPEAN POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. EUROPEAN POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. EUROPEAN POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. REST OF THE WORLD POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. REST OF THE WORLD POLYETHYLENE TEREPHTHALATE (PET )MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2022-2030 ($ MILLION)

1. GLOBAL POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

2. GLOBAL SHEETS AND FILMS POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CONSUMER GOODS POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL FOOD AND BEVERAGE PACKAGING POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL OTHERS POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY END-USE INDUSTRY, 2022 VS 2030 (%)

7. GLOBAL ELECTRICAL AND ELECTRONICS POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL PACKAGING POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL AUTOMOTIVE POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL CONSTRUCTION POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL OTHERS POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL POLYETHYLENE TEREPHTHALATE (PET) MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. US POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

14. CANADA POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

15. UK POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

18. ITALY POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

19. SPAIN POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF EUROPE POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

21. INDIA POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

22. CHINA POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

23. JAPAN POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

24. SOUTH KOREA POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD POLYETHYLENE TEREPHTHALATE (PET) MARKET SIZE, 2022-2030 ($ MILLION)