Polyimide Films Market

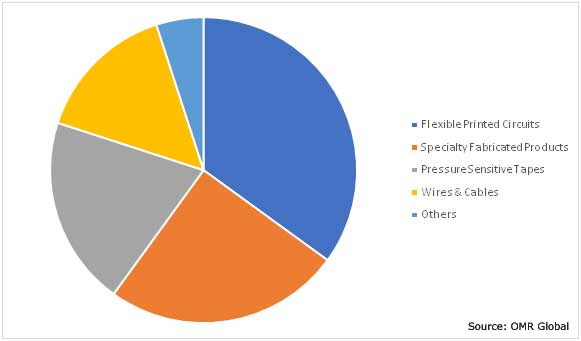

Polyimide Films Market Size, Share & Trends Analysis Report by Application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure Sensitive Tapes, Wires & Cables, and Others), by End-User (Electronics, Automotive, Aerospace, Energy, and Others) and Forecasts, 2019 – 2025 Update Available - Forecast 2025-2035

Polyimide is a polymer of imide monomers which possesses high heat-resistance property that enables to find diverse application in various end-use industries such as electronics, automotive, aerospace, and energy among others. The global polyimide films market is expected to witness significant growth over the forecast period. The growth of the market is backed by rapid urbanization and industrialization across emerging economies of the globe. Moreover, expanding automotive, consumer electronics, and aerospace industry is further leading to the increased demand for polyimide films due to better thermal and mechanical properties of polyimide films when compared to other polymers.

Increasing Automobile Sales and Production is Driving the Demand for Polyimide Films

Polyimide films possess great mechanical, electrical, temperature and chemical resistance which makes them optimal for demanding industries where performance is critical or harsh exposure conditions exist such as the automotive industry. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Asia-Pacific is the largest automobile vehicle producing region. In 2017, about 56% of the total passenger cars were sold in Asia-Pacific. China, India, Japan, South Korea are the major economies driving the growth of the region. The total sales of vehicles in 2016 in Asia-Pacific were nearly 47.3 million which is equal to 49% of the global sales. In 2017, Asia-Pacific has shown a growth rate of 4.3% and 7.5% in 2016 and 2017 respectively for all vehicle sales. China is the leading contributor in terms of vehicles sales in the region. China has observed 29.1 million in 2017 vehicle sales and 28 million vehicle sales in 2016, followed by 5.2 million and 4 million vehicle sales in Japan and India respectively. Apart from these economies, Australia, South Korea, Indonesia, Malaysia, Thailand are the major economies which have significant automobile sales in 2017.

Segmental Outlook

The global polyimide films market is segmented on the basis of application and end-user. On the basis of application, the market is segregated into flexible printed circuits, specialty fabricated products, pressure sensitive tapes, wires & cables, and others. On the basis of end-user, the market is segmented into electronics, automotive, aerospace, energy, and other sectors.

Global Polyimide Films Market Share by End-User, 2018 (%)

Increasing Consumer Electronics Market is Boosting the Flexible Printed Circuits Segment Growth

Consumer electronics include smartphones, tablets, wearable devices, televisions, and others. Technology and its adoption across the wide range of consumer electronics have evolved rapidly in recent years. The consumer electronics industry has been following a new trend called flexible printed circuits to manage the rising burden on chips. This technology includes the assembling of electronic circuits by mounting electronic devices on the flexible plastic substrate. This technology is largely being used in various applications that can be beneficial from their favorable dielectric properties, lightweight, robust, conformable nature, and high circuit density. The recent development in organic and inorganic based electronics using flexible plastic substrate provides benefits in terms of being able to develop displays that are thinner, lighter and can be rolled easily when not in use.

Regional Outlook

The report analyzes the global polyimide films market on the basis of region into North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe are expected to contribute significantly to the market growth in 2018. Major economies contributing to the market growth of Europe include UK, Germany, France, Italy, Spain, and others.

Global Polyimide Films Market Growth, 2019-2025

Asia-Pacific dominates the global market in 2018

Asia-Pacific is expected to dominate the global polyimide films market in terms of market size in 2018. Large population base coupled with increasing disposable income is fueling the demand for various personal electronics such as smartphones and tablets; thereby, leading to the demand for polyimide films. Moreover, rapidly evolving consumer electronics and automotive industry in the region is primarily augmenting the demand for polyimide films for various applications. The highest growth of the region is further attributed to the growth of the market in China and Japan. As per the International Trade Union Federation (ITUF), China is the largest producer of electronic and electronic components across the globe. The abundance of low-cost labor has made the market competitive in terms of many low-cost and labor-intensive manufacturing ability in international markets. Due to which, manufactured products constitute a significant share of the country’s trade. A substantial amount of China’s imports is comprised of parts or components that are assembled into finished products, such as consumer electronic products and computers, and then exported. Owing to these facts, the nation is expected to share the largest market share of polyimide films in Asia-Pacific. Furthermore, the presence of key consumer electronic producers such as Motorola, Sony, and Renesas in Japan are also prevailing the growth of the market. According to the International Trade Administration, Japan’s electronics industry is the third largest across the globe.

Market Players Outlook

The global polyimide films market consists of several market players that are designing and marketing various types of polyimide films to cater to a wide range of customers across the globe. Some of the major players of the market include DuPont-Toray Co. Ltd., Kaneka Corp., BASF SE, Arkema SA, Arakawa Chemical Industries, Ltd., SKC Kolon Pi, Inc., Kolon Industries Inc., and 3M Co. among others. These players adopt strategies in order to stay competitive in the market. Strategies such as mergers and acquisitions, partnerships and collaborations, product launches, and geographical expansion are frequently adopted strategies by the players.

Recent Developments

In April 2018, Taimide Tech. began the Phase-2 construction of its Tongluo Branch. This would enable the company to increase the production capacity of the branch in order to meet the increasing demand for polyimide films.

In July 2018, Kolon Industries began the mass production of Kolon CPI, the company’s colorless polyimide film product. Through this strategic move, the company has opened its market of foldable smartphone cover windows.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global polyimide films market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. DuPont-Toray Co. Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Kaneka Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Arkema SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. BASF SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. 3M Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Polyimide Films Market by Application

5.1.1. Flexible Printed Circuits

5.1.2. Specialty Fabricated Products

5.1.3. Pressure Sensitive Tapes

5.1.4. Wires & Cables

5.1.5. Others (Motors/Generators)

5.2. Global Polyimide Films Market by End-Use Industry

5.2.1. Electronics

5.2.2. Automotive

5.2.3. Aerospace

5.2.4. Energy

5.2.5. Others (Healthcare)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Arakawa Chemical Industries, Ltd.

7.3. Arkema SA

7.4. BASF SE

7.5. Boyd Corp.

7.6. Dunmore Corp.

7.7. DuPont-Toray Co. Ltd.

7.8. Evertech Envisafe Ecology Co., Ltd.

7.9. FLEXcon Co., Inc.

7.10. I.S.T Corp.

7.11. Kaneka Corp.

7.12. Kolon Industries Inc.

7.13. Mitsubishi Gas Chemical Company Inc.

7.14. Nitto Denko Corp.

7.15. Parafix Tapes & Conversions Ltd.

7.16. Polyonics, Inc.

7.17. Saint-Gobain Group

7.18. SKC Kolon Pi, Inc.

7.19. Taiflex Scientific Co. Ltd.

7.20. Taimide Tech. Inc.

7.21. UBE Industries Ltd.

7.22. Von Roll Holding AG

1. GLOBAL POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL POLYIMIDE FILMS IN FLEXIBLE PRINTED CIRCUITS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL POLYIMIDE FILMS IN SPECIALTY FABRICATED PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL POLYIMIDE FILMS IN PRESSURE SENSITIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL POLYIMIDE FILMS IN WIRES & CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL POLYIMIDE FILMS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

8. GLOBAL POLYIMIDE FILMS IN ELECTRONICS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL POLYIMIDE FILMS IN AUTOMOTIVE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL POLYIMIDE FILMS IN AEROSPACE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL POLYIMIDE FILMS IN ENERGY INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL POLYIMIDE FILMS IN OTHER END-USE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. NORTH AMERICAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

17. EUROPEAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

23. REST OF THE WORLD POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. REST OF THE WORLD POLYIMIDE FILMS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL POLYIMIDE FILMS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL POLYIMIDE FILMS MARKET SHARE BY END-USE INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL POLYIMIDE FILMS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD POLYIMIDE FILMS MARKET SIZE, 2018-2025 ($ MILLION)