Polymer Emulsion Market

Global Polymer Emulsion Market Size, Share & Trends Analysis Report, by Product Type (Acrylics, Polyurethane (PU) Dispersions, Styrene Butadiene (SB) Latex, Vinyl Acetate and Other Polymer Emulsions), by Application (Adhesives & Carpet Backing, Building and Construction, Paper & Paperboard Packaging, Paints & Coatings, and Other Applications), and Forecast, 2019-2025. Update Available - Forecast 2025-2035

Polymer emulsion market is growing rapidly owing to increasing application in construction, packaging and textile industry. Emulsion polymer is a colloidal dispersion of discrete polymer particles in water with a particle diameter of 0.01-1.0 microns. Various types of polymer which are used polymerization are acrylates, styrene-butadiene copolymers, acrylonitrile-butadiene copolymers, and ethylene-vinyl acetate. Emulsion polymers find its applications in various industrial applications such as adhesives, inks, paints, coatings, and drug delivery system along with many others. Emulsion polymers by the process of emulsion polymerization which is a complex heterogeneous process and involves various components such as sodium stearate.

The most common type of emulsion polymer is polyvinyl acetate which has a significant impact on various industries which includes adhesives, paints, and coatings. The rising number of industrial applications of emulsion polymer in paints, coatings, paper, and textile tends to drive the market share of polymer emulsion market. Emulsion based paintings and coatings are flame resistant which provides safety to the structure. Growing manufacturers and consumer awareness with regard to the adverse effects of volatile organic compound (VOC) emissions present in most solvent-based products along with the government stringent regulations towards effects of VOC on the environment has led to the increasing demand for polymer emulsion.

Segmental Outlook

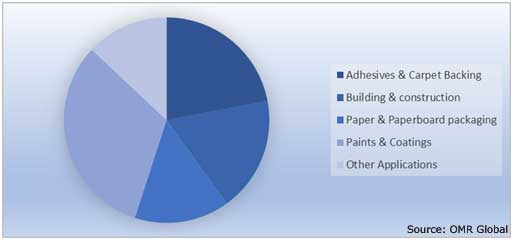

The global polymer emulsion market is segmented on the basis of product type and application. on the basis of product type, the market is segmented into acrylics, PU dispersions, SB Latex, vinyl acetate, and other polymer emulsions. Further, on the basis of application, the market is segmented into adhesives and carpet backing, building and construction, paper and paperboard packaging, paints and coatings, and other applications. The growing consumer preference for the construction of green buildings along with the rising construction activities in the emerging economies has made emulsion polymer the preferred solution among contractors and construction service providers. Additionally, the increasing demand for adhesives and carpet backing from paper and paperboard industry may surge the market share of polymer emulsion. However, the increasing raw material cost may hamper the market growth.

Global Polymer Emulsion Market Share by Application, 2018(%)

Acrylic segment is estimated to have a significant market size

Acrylic polymer emulsion is prepared by polymerization of acrylic polymer droplets in water. Acrylic segment is expected to register significant share over the forecast period owing to the versatile nature due to the acrylic ester functionality. Acrylic polymer emulsion possesses properties such as low volatile organic compound emission rate and higher durability as compared to various solvent-based polymer emulsion. The acrylic polymer emulsion is the preferred solution for numerous applications in end-user industries such as building and construction and paint and coatings.

The acrylic polymer emulsion serves as a replacement for solvent-based emulsion due to the harmful effects of solvent-based emulsion on the environment. The rising demand for acrylic polymer emulsion from the manufacturers of adhesives primarily in label application and medical tapes has led to the increased market share of acrylic polymer emulsion.

Adhesives and Carpet Backing segment is projected to have significant growth

Adhesives and carpet backing segment is expected to register significant growth over the forecast period owing to its wide usage in paper and paperboard packaging which includes boxes, folding cartons, and paper bags. Moreover, water-based polymer emulsion adhesives eliminate the use of solvent-based adhesives. The emulsion adhesives are also used in ventilation, and flameproof lighting eliminating the special precautions which are required for the use of solvent-based adhesives. Various types of emulsion adhesives used are polyvinyl acetate (PVA), ethylene-vinyl acetate (EVA), acrylics and styrene-butadiene (SB) latex.

Regional Outlook

Moreover, the polymer emulsion market further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World (RoW). Asia-Pacific region is expected to significant growth over the forecast period owing to the rising investment from foreign investment in the construction sector in emerging economies such as India and China. Increasing disposable income along with the consumer preference for water-based solvent formulations has increased the demand for polymer emulsion in the Asia Pacific region. Moreover, stringent government regulations towards the emission of VOC in the environment coupled with the demand for green buildings may surge the market share of polymer emulsions.

Polymer Emulsion Market Growth, by Region 2019-2025

Market Players Outlook

The major players that contribute to the growth of the polymer emulsion market include DuPont de Nemours, Inc., Akzo Nobel N.V., Apcotex Industries Ltd., BASF SE, Kansai Nerolac Paints Ltd., and others. These market players are contributing to the market by adopting various market approaches including product type launch & approvals, merger & acquisition, partnerships collaborations, and others for gaining a strong position in the market.

Recent Developments

- In February 2019, Arofine Polymers Ltd. launched two new products. Acrotech-UV-275, high gloss low order UV curable overprint medium for offline application on conventional roller coating or varnishing machine, and Arocryl 852, lamination emulsion with higher rheological properties which is suitable for dry lamination application. Expansion of product portfolio would allow the company to capture more customer and increase their market share.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global polymer emulsion market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. DuPont de Nemours, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Akzo Nobel N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Apcotex Industries Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. BASF SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Arkema Group

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Polymer Emulsion Market by Product Type

5.1.1. Acrylics

5.1.2. Polyurethane (PU) Dispersions

5.1.3. Styrene Butadiene (SB) Latex

5.1.4. Vinyl Acetate

5.1.5. Other Polymer Emulsions

5.2. Global Polymer Emulsion Market by Application

5.2.1. Adhesives and Carpet Backing

5.2.2. Building and Construction

5.2.3. Paper and Paperboard Packaging

5.2.4. Paints and Coatings

5.2.5. Other Applications

6. REGIONAL ANALYSIS

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. COMPANY PROFILES

7.1. Akzo Nobel N.V.

7.2. Apcotex Industries, Ltd.

7.3. Arkema Group

7.4. Arofine Polymers, Ltd.

7.5. Asian Paints, Ltd.

7.6. BASF SE

7.7. Berger Paints India, Ltd.

7.8. British Paint

7.9. Celanese Corp.

7.10. Clariant, Ltd.

7.11. DIC Corp.

7.12. DuPont de Nemours, Inc.

7.13. Kamsons Chemicals Pvt. Ltd.

7.14. Kansai Nerolac Paints, Ltd.

7.15. Lubrizol Corp.

7.16. Mallard Creek Polymers, Inc.

7.17. Snowcem Paints

7.18. Speciality Industrial Polymers & Coatings Pvt. Ltd.

7.19. Sumitomo Chemical Co., Ltd.

7.20. Synthomer PLC

7.21. Trinseo S.A.

7.22. Visen Industries, Ltd.

7.23. Wacker Chemie AG

1. GLOBAL POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ACRYLICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PU DISPERSIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SB LATEX MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL VINYL ACETATE FACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER POLYMER EMULSIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

8. GLOBAL ADHESIVES AND CARPET BACKING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PAPER AND PAPERBOARD COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PAINTS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. EUROPEAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

19. EUROPEAN POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. REST OF THE WORLD POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

24. REST OF THE WORLD POLYMER EMULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL POLYMER EMULSION MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL POLYMER EMULSION MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL POLYMER EMULSION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

6. UK POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

11. REST OF EUROPE POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD POLYMER EMULSION MARKET SIZE, 2018-2025 ($ MILLION)