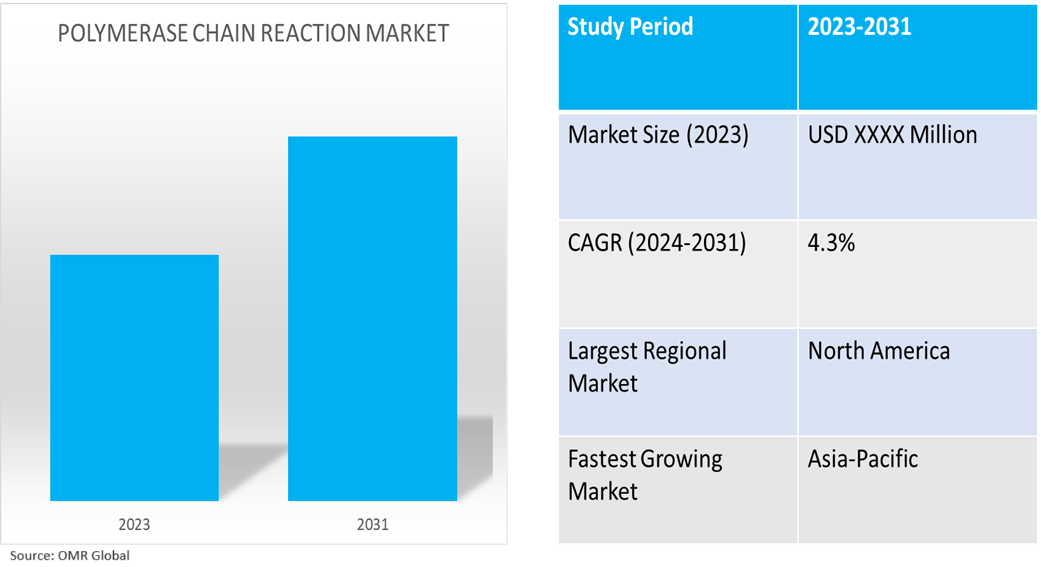

Polymerase Chain Reaction (PCR) Market

Polymerase Chain Reaction (PCR) Market Size, Share & Trends Analysis Report by Application (Dermatology, Ophthalmology, Dentistry, Oncology, Wound Healing, and Others), by Product (Instruments, Reagents and Consumables, and Software) and by End-User (Pharmaceutical and Biotechnology Industries, Clinical Diagnostics Labs and Hospitals, and Academic and Research Organizations) Forecast Period (2024-2031)

Polymerase chain reaction (PCR) market is anticipated to grow at a significant CAGR of 4.3% during the forecast period (2024-2031). The demand for PCR-based diagnostics is rising due to the prevalence of infectious diseases and emerging pathogens. Innovations such as real-time and digital PCR are making these tests more accessible, even in remote areas. Personalized medicine benefits from PCR's genetic analysis capabilities, while investments from pharmaceutical and biotech companies, government support, and early diagnosis awareness drive market growth. The integration with other technologies and automation of PCR systems additionally bolsters industry growth. Nonetheless, high costs, regulatory complexities, the need for skilled professionals, and competition from new diagnostic technologies like CRISPR-based assays and isothermal amplification methods present significant challenges to the global PCR market.

Market Dynamics

Increasing Prevalence of Infectious Diseases

The global rise in infectious diseases, including COVID-19 and influenza, has heightened the demand for accurate diagnostic tools, driving market growth. According to the National Center for Biotechnology Information, in January 2023, infectious diseases continue to be a major health concern globally, responsible for over 52 million mortalities annually, which represents 33.0% of total mortalities globally. Half of the global population remains vulnerable to new and recurring infectious diseases, with recent data showing approximately 14 million mortalities among children under 5 years old, 70.0% of which are due to vaccine-preventable diseases, predominantly in developing countries. Despite global efforts and advancements in awareness programs, significant challenges persist in the prevention and control of infectious diseases, particularly in Pakistan, where the burden of these diseases has seen minimal change over the years.

Growing Demand for Personalized Medicine

The development of personalized medicine, which entails customizing medicines based on individual genetic profiles to improve patient outcomes, is being driven by PCR's ability to examine genetic information. For instance, in November 2023, Roche launched the LightCycler PRO System, a next-generation qPCR technology designed to advance clinical needs in molecular diagnostics and address public health challenges. The system combines gold-standard technology for quality, precision, and reliability, enabling accurate patient diagnosis and effective clinical decisions. It complements Roche's molecular PCR testing portfolio, enabling users to develop their tests and enabling over 200 LightMix Modular research assays and over 60 LightMix CE-IVD assays from TIB Molbiol.

Market Segmentation

- Based on the application, the market is segmented into research applications, clinical diagnostics applications, forensic applications, and others (biotechnology, and environmental testing).

- Based on the product, the market is segmented into instruments, standard PCR systems, real-time PCR systems, digital PCR systems, reagents and consumables, and software.

- Based on the end-user, the market is segmented into pharmaceutical and biotechnology industries, clinical diagnostics labs and hospitals, and academic and research organizations.

Clinical Diagnostics Application is Projected to Hold the Largest Segment

The primary factors supporting the growth include the market growth of advanced diagnostics is driven by increased awareness among healthcare providers and patients on the benefits of a rapid and accurate diagnosis. For instance, in July 2024, Danaher launched two new centers of innovation in diagnostics, DH Diagnostics LLC Centers, to accelerate drug development and commercialization of companion diagnostics. The Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP) Labs consolidate technology and tests across numerous Danaher divisions under one roof to minimize handoffs and advance the commercialization of patient-specific treatment.

Reagents and Consumables Segment to Hold a Considerable Market Share

The growth of healthcare facilities and laboratories, especially in emerging markets, is accelerating the adoption of PCR technologies for diagnostic purposes. For instance, in March 2021, PCR Biosystems introduced IsoFast Bst Polymerase reagents for rapid, robust, and sensitive DNA and RNA amplification. These reagents eliminate the need for high-temperature denaturation steps, allowing faster results without specialized equipment. It can be used for whole genome amplification, multiple displacement amplification, and isothermal amplification, with consistent results and sensitivities.

Regional Outlook

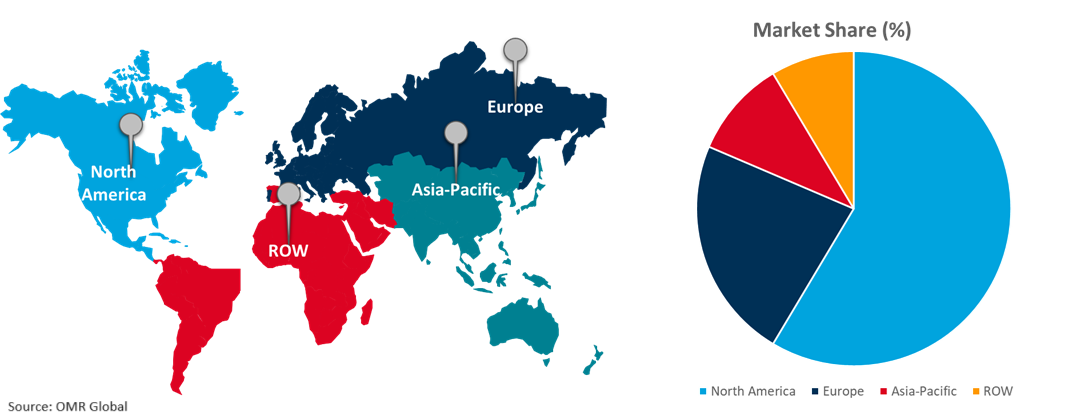

The global PCR market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Expansion of Healthcare Infrastructure in the Asia-Pacific Region

- The rise in healthcare spending is facilitating the construction of new hospitals, diagnostic centers, and laboratories, thereby enhancing access to advanced diagnostic tools such as PCR. According to the India Brand Equity Foundation (IBEF), in July 2024, the regional growth is attributed to expanding India's healthcare spending increased from 1.6% of GDP in FY21 to 2.1% of GDP in FY23 and 2.2% of GDP in FY22. The hospital market is expected to grow from its 2023 valuation of $98.98 billion to $193.59 billion by 2032. In FY24, premiums for health insurance increased to $31.84 billion. 634,561 foreign visitors visited India in 2023, boosting the market's worth to $7.69 billion by 2024.

Global PCR Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the growing prevalence of chronic diseases necessitating regular diagnostic testing, wherein PCR technology is essential for detecting genetic markers and pathogens, which is propelling the market's expansion. According to the National Center for Chronic Disease Prevention and Health Promotion, in February 2024, an estimated 129 million people in the US have at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the US Department of Health and Human Services. Five of the top ten leading causes of death in the US are associated with preventable and treatable chronic diseases, and their prevalence has steadily increased over the past two decades, a trend that is expected to persist. Currently, 42.0% of Americans have two or more chronic conditions, and 12.0% have at least five, significantly impacting both personal health and the US healthcare system, with about 90.0% of the annual $4.1 trillion healthcare expenditure attributed to managing these conditions and mental health.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global PCR market include Abbott Laboratories, Inc., Agilent Technologies, Inc., F.Hoffmann-La Roche AG, Siemens AG., and Thermo Fisher Scientific among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In May 2023, Nuclein and Minute Molecular Diagnostics merged to develop a rapid, low-cost qPCR system. The combined company plans to enhance commercialization by expanding its molecular diagnostic test portfolio.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the polymerase chain reaction (PCR) market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Agilent Technologies, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. F. Hoffmann-La Roche AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Thermo Fisher Scientific, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Polymerase Chain Reaction Market by Application

4.1.1. Research

4.1.2. Clinical Diagnostics

4.1.3. Forensic

4.1.4. Other (Biotechnology, and Environmental Testing)

4.2. Global Polymerase Chain Reaction Market by Product

4.2.1. Instruments

4.2.1.1. Standard PCR System

4.2.1.2. Real Time PCR System

4.2.1.3. Digital PCR System

4.2.2. Reagents and Consumables

4.2.3. Software

4.3. Global Polymerase Chain Reaction Market by End-User

4.3.1. Pharmaceutical and Biotechnology Industries

4.3.2. Clinical Diagnostics Labs and Hospitals

4.3.3. Academic and Research Organizations

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Abbott laboratories

6.2. Agilent Technologies, Inc.

6.3. Amplyus, LLC

6.4. Becton, Dickinson and Co.

6.5. BioMérieux, Inc.

6.6. Bio-Rad laboratories, Inc.

6.7. BJS Biotechnologies

6.8. Eppendorf AG

6.9. F. Hoffmann-La Roche AG

6.10. GE Healthcare

6.11. Illumina, Inc.

6.12. Merck KGaA

6.13. PerkinElmer, Inc.

6.14. Promega Corp.

6.15. QIAGEN N.V.

6.16. Shimadzu Crop.

6.17. Siemens AG

6.18. Thermo Fisher Scientific, Inc.

6.19. ZAGENO, Inc.

1. Global Polymerase Chain Reaction Market Research And Analysis By Application, 2023-2031 ($ Million)

2. Global Polymerase Chain Reaction For Research Application Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Polymerase Chain Reaction For Clinical Diagnostics Application Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Polymerase Chain Reaction For Forensic Application Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Polymerase Chain Reaction For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Polymerase Chain Reaction Market Research And Analysis By Product, 2023-2031 ($ Million)

7. Global PCR Instruments Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global PCR Reagents And Consumables Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global PCR Software Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Polymerase Chain Reaction Market Research And Analysis By End-User, 2023-2031 ($ Million)

11. Global Polymerase Chain Reaction For Pharmaceutical And Biotechnology Industries Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Polymerase Chain Reaction For Clinical Diagnostics Labs And Hospitals Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Polymerase Chain Reaction For Academic And Research Organizations Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Polymerase Chain Reaction Market Research And Analysis By Region, 2022-2030 ($ Million)

15. North American Polymerase Chain Reaction Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Polymerase Chain Reaction Market Research And Analysis By Application, 2023-2031 ($ Million)

17. North American Polymerase Chain Reaction Market Research And Analysis By Product, 2023-2031 ($ Million)

18. North American Polymerase Chain Reaction Market Research And Analysis By End-User, 2023-2031 ($ Million)

19. European Polymerase Chain Reaction Market Research And Analysis By Country, 2023-2031 ($ Million)

20. European Polymerase Chain Reaction Market Research And Analysis By Application, 2023-2031 ($ Million)

21. European Polymerase Chain Reaction Market Research And Analysis By Product, 2023-2031 ($ Million)

22. European Polymerase Chain Reaction Market Research And Analysis By End-User, 2023-2031 ($ Million)

23. Asia-Pacific Polymerase Chain Reaction Market Research And Analysis By Country, 2023-2031 ($ Million)

24. Asia-Pacific Polymerase Chain Reaction Market Research And Analysis By Application, 2023-2031 ($ Million)

25. Asia-Pacific Polymerase Chain Reaction Market Research And Analysis By Product, 2023-2031 ($ Million)

26. Asia-Pacific Polymerase Chain Reaction Market Research And Analysis By End-User, 2023-2031 ($ Million)

27. Rest Of The World Polymerase Chain Reaction Market Research And Analysis By Region, 2023-2031 ($ Million)

28. Rest Of The World Polymerase Chain Reaction Market Research And Analysis By Application, 2023-2031 ($ Million)

29. Rest Of The World Polymerase Chain Reaction Market Research And Analysis By Product, 2023-2031 ($ Million)

30. Rest Of The World Polymerase Chain Reaction Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Polymerase Chain Reaction Market Share By Application, 2023 Vs 2031 (%)

2. Global Polymerase Chain Reaction For Research Application Market Share By Region, 2023 Vs 2031 (%)

3. Global Polymerase Chain Reaction For Clinical Diagnostics Application Market Share By Region, 2023 Vs 2031 (%)

4. Global Polymerase Chain Reaction For Forensic Application Market Share By Region, 2023 Vs 2031 (%)

5. Global Polymerase Chain Reaction For Other Application Market Share By Region, 2023 Vs 2031 (%)

6. Global Polymerase Chain Reaction Market Share By Product, 2023 Vs 2031 (%)

7. Global PCR Instruments Market Share By Region, 2023 Vs 2031 (%)

8. Global PCR Reagents And Consumables Market Share By Region, 2023 Vs 2031 (%)

9. Global PCR Software Market Share By Region, 2023 Vs 2031 (%)

10. Global Polymerase Chain Reaction Market Share By End-User, 2023 Vs 2031 (%)

11. Global Polymerase Chain Reaction For Pharmaceutical And Biotechnology Industries Market Share By Region, 2023 Vs 2031 (%)

12. Global Polymerase Chain Reaction For Clinical Diagnostics Labs And Hospitals Market Share By Region, 2023 Vs 2031 (%)

13. Global Polymerase Chain Reaction For Academic And Research Organizations Market Share By Region, 2023 Vs 2031 (%)

14. Global Polymerase Chain Reaction Market Share By Region, 2023 Vs 2031 (%)

15. Us Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

16. Canada Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

17. Uk Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

18. France Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

19. Germany Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

20. Italy Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

21. Spain Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

23. India Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

24. China Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

25. Japan Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

26. South Korea Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

28. Latin America Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Polymerase Chain Reaction Market Size, 2023-2031 ($ Million)