Polymeric Phosphonate Market

Global Polymeric Phosphonate Market Size, Share & Trends Analysis Report by Structure (ATMP, DTPMP, HEDP, and Others), by Application (Water Treatment, Textile, Detergency, Cosmetics, and Others) and Forecast 2019-2025

The global polymeric phosphonate market is expected to grow with a modest rate at a CAGR of 6.3% during the forecast period (2019-2025). Polymeric phosphonates and phosphonic acids are organic molecules that are based on phosphorus, carbon, oxygen, and hydrogen. A number of phosphonates occur naturally and can be synthesized also. Some of the properties due to which it is widely used in industries include high solubility in water, strong adsorption, and compatibility with other chemicals and components in detergents. Due to this, it finds a significant application in the detergent industry. It also possesses advantages such as resistance to corrosion and oxidation, and the ability to modify water hardness deposits. Moreover, it remains stable under the harsh conditions such as acidity or low and high temperature. As a result of this, it is widely used in industrial as well as municipal water treatment.

Segmental Outlook

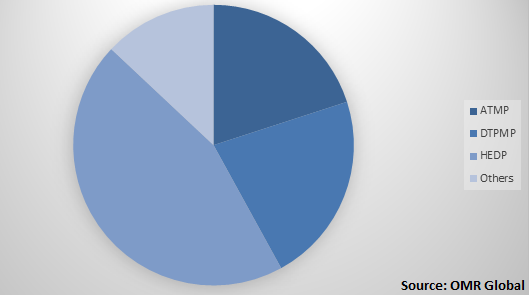

The global polymeric phosphonate market is segmented on the basis of structure, application, and region. On the basis of the structure, the market is further sub-segmented into ATMP (amino tris (methylene phosphonic acid)), DTPMP (diethylenetriamine penta (methylene phosphonic acid)), HEDP (Hydroxyethylidene Diphosphonic acid) and others. HEDP segment is expected to have a major market share during the forecast period. Commercially, HEDP is sold as Etidronic Acid and companies such as Sigma Aldrich Corp., Zschimmer & Schwarz, Inc., and Tokyo Chemical Industry Co., Ltd., trade in this chemical significantly. On the basis of application, the market is classified into water treatment, textile, detergency, cosmetics, and others.

Global Polymeric Phosphonate Market Share by Structure, 2018 (%)

Water Treatment Segment to Foresee Considerable Growth During the Forecast Period

During the forecast period, the water treatment segment will hold the major share as it is the key application of phosphonate. Polymeric phosphonates can be used in water treatment to prevent crystalline scale deposition. These compounds inhibit the development of scale-forming salts, which control the corrosion of steel. Scale inhibition is blocked in a ’sub-stoichiometric’ way, as phosphorus-containing compounds have the ability to adsorb onto crystal growth sites of sub-microscopic crystallites. This, in turn, interferes with the crystal growth and modifying the crystal morphology. Polymeric phosphonates are used to sequester certain metal ions, such as manganese, copper, iron, and zinc.

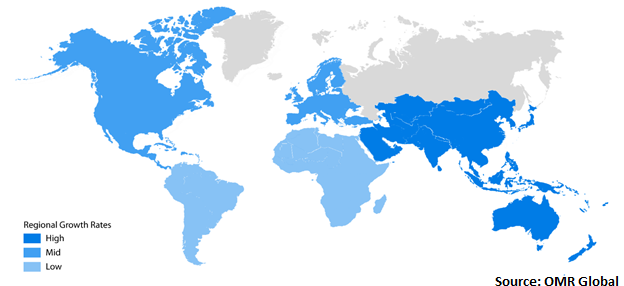

Regional Outlook

Geographically, the study of the global polymeric phosphonate market covers the analysis of four major regions including North America (the US and Canada), Europe (Germany, UK, Italy, France, Italy, Spain, and Rest of Europe), and Rest of the World (RoW). Developed regions such as North America and Europe are estimated to contribute a significant market share in the global market. However, stringent regulations in these regions are further expected to hamper the market growth. For instance, the use of polymeric phosphonates in detergent is banned or allowed in a limited proportion in these regions.

Global Polymeric Phosphonate Market Growth, by Region 2019-2025

Asia-Pacific Led the Global Polymeric Phosphonate Market in 2018

Asia-Pacific is estimated to have a major market share during the forecast period along with the significant growth rate. Countries that will contribute significantly to the market include China and India. As per World Economic Forum in 2018, each year 90% of the plastic in oceans enters just from ten rivers out of which nine are in Asia-Pacific. It is due to the high import of waste plastic of the developed economies by the countries of this region for recycling purposes. Hence, it will augment the need for water treatment plants in the region. China will be the major player in the Asia-Pacific polymeric phosphonate market. Several small manufacturers of the country are dealing in phosphonates such as Shandong Taihe Water Treatment Technologies Co., Ltd. and Changzhou Yuanquan Hongguang Chemical Co. Ltd. However, due to continuous safety and environmental inspections by the Chinese government, the chemical industry has been affected significantly. After an explosion at Jiangsu Tianjiayi Chemical Co. in March 2019, the safety measurements have been made stricter even further in the country.

Market Players Outlook

Some of the major players operating in the global polymeric phosphonates market include Zschimmer & Schwarz, Inc., Giovanni Bozzetto S.p.A., Sigma Aldrich Corp., a subsidiary of Merck KGaA, and others. These players adopt various organic and inorganic growth strategies such as mergers and acquisitions to strengthen their presence in the global market. For instance, in June 2016 Italmatch Chemicals SpA acquired Compass Chemical International, a phosphonates and additives manufacturer for water treatment and oil & gas market. By the acquisition, the company has further strengthened its position in the American market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global polymeric phosphonate market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Polymeric Phosphonate Market by Structure

5.1.1. ATMP (Amino tris (Methylene phosphonic Acid))

5.1.2. DTPMP (Diethylenetriamine Penta (Methylene Phosphonic Acid))

5.1.3. HEDP (Hydroxyethylidene Diphosphonic Acid)

5.1.4. Others (BHM (Barium Diphenylamine Sulfonate) and TMP (Trimethylolpropane))

5.2. Global Polymeric Phosphonate Market by Application

5.2.1. Water Treatment

5.2.2. Textile

5.2.3. Detergency

5.2.4. Cosmetics

5.2.5. Others (Agro-Chemistry)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acuro Organics Ltd.

7.2. Aquapharm Chemicals Pvt. Ltd.

7.3. Changzhou Yuanquan Hongguang Chemical Co. Ltd.

7.4. Excel Industries Ltd.

7.5. Giovanni Bozzetto SPA

7.6. Henan Qingshuiyuan Technology Co., Ltd.

7.7. Italmatch Chemicals SPA

7.8. Merck KGaA

7.9. Oakwood Products, Inc.

7.10. Qingshuiyuan Water Treatment Co.

7.11. Shandong Taihe Water Treatment Technologies Co., Ltd.

7.12. Tokyo Chemical Industry Co., Ltd.

7.13. Zeel Product

7.14. Zschimmer & Schwarz, Inc.

1. GLOBAL POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2018-2025 ($ MILLION)

2. GLOBAL ATMP POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL DTPMP POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HEDP POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

7. GLOBAL POLYMERIC PHOSPHONATE FOR WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL POLYMERIC PHOSPHONATE FOR TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL POLYMERIC PHOSPHONATE FOR DETERGENCY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL POLYMERIC PHOSPHONATE FOR COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL POLYMERIC PHOSPHONATE FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. EUROPEAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2018-2025 ($ MILLION)

18. EUROPEAN POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. REST OF THE WORLD POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2018-2025 ($ MILLION)

23. REST OF THE WORLD POLYMERIC PHOSPHONATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL POLYMERIC PHOSPHONATE MARKET SHARE BY STRUCTURE, 2018 VS 2025 (%)

2. GLOBAL POLYMERIC PHOSPHONATE MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL POLYMERIC PHOSPHONATE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

6. UK POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD POLYMERIC PHOSPHONATE MARKET SIZE, 2018-2025 ($ MILLION)