Polytetrafluoroethylene (PTFE) Market

Global Polytetrafluoroethylene (PTFE) Market Size, Share & Trends Analysis Report Market by Form (Granular, Fine Powder), By Application (Sheet, Coatings, Pipes, Films, Others), By End-User Industry (Electrical & Electronics, Chemical & Industrial Processing, Automotive & Transportation, Household Goods, Others (Medical)), Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The global polytetrafluoroethylene (PTFE) market is anticipated to grow at a CAGR of 4.8% during the forecast period. The increasing demand from the end-user industry and heat resistance and transparency of PTFE in comparison to other conventional polymer is a major factor to drive the growth of the global PTFE market. PTFE is a versatile and high-performance fluoropolymer made up of carbon and fluorine particles. High heat resistance, low coefficient of friction, electrical insulation power in hot and wet environments, strong anti-adhesion properties, high fatigue resistance under low stress are among the key features of the PTFE making it suitable for several applications.

PTFE coatings possess a very high surface resistivity, a low dissipation factor, and high dielectric strength,. Some formulations are available with metallic or carbon fillers to provide enough electroconductivity to enable dissipation of static therefore the PTFE sheets and coatings are highly suitable for the electrical insulation application. Additionally, the PTFE can withstand dry heat sterilization at 180°C, along with the ethylene oxide gas and gamma radiation. Hence, are suitable for application in the aviation industry. However, frequent price fluctuation of the PTFE compound is a major factor that may restrict the growth of the global PTFE market. The growing application of the PTFE in the medical industry is anticipated to create significant opportunities for the growth of the global PTFE market.

Segmental Outlook

The PTFE market is analyzed based on the form, applications, and end-user industry. Based on the form the PTFE market is classified into granular form and fine powder form. Owing to the high-water repellent characteristic, low coefficient of friction, low-temperature toughness, and superior chemical and temperature resistance the granular form of PTFE is anticipated to hold considerable market share based on form. Based on the application, the market is segmented into sheets, coatings, pipes, films, and others. Based on end-user the market is segmented into electrical & electronics, chemical & industrial processing, automotive & transportation, household goods, and others (medical). Automotive and Transportation are anticipated to be a considerable segment based on the end-user industry. The replacement of metal, thermosets, and bulk molding compounds (BMC) by the PTFE owing to its superior characteristics compared to other heavy material is anticipated to make considerable share to this market segment. Moreover, it's cost-effectiveness when compared to thermoset is a further contribution to its high usage in these applications.

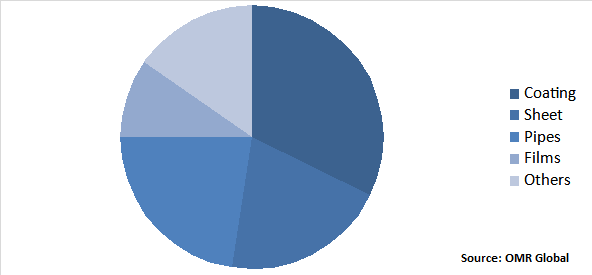

The coating will be the largest segment by Application

Based on the application, the coating is anticipated to hold considerable market share. Electrical insulation power in hot and wet environments, strong anti-adhesion properties, and high fatigue resistance under low stress are the key characteristics of the PTFE that makes it suitable for the coating of industrial machinery, and food handling. PTFE coating is resistant to a wide range of industrial chemicals, including ammonia, HCL acid, sulfuric acid, petroleum oils, amyl alcohol, sodium hydroxide, chlorine, dioxane, and sodium hypochlorite. As a result, machine parts last longer, as they're protected from the corrosive effects of various chemicals.

Polytetrafluoroethylene (PTFE) Market Share by Instruments, 2019 (%)

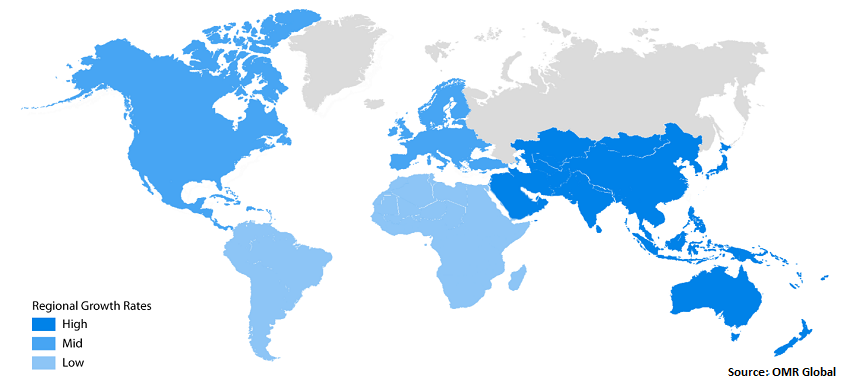

Regional Outlook

The PTFE market is further segmented based on geography including North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific region is anticipated to hold considerable market share in the global PTFE market. China is a major contributor towards the high share of the PTFE market in this region. China is the largest importer of oil and gas. Manufacturing of seal and packing components, such as O-rings, spring-energized seals, slipper seals, and piston rings requires the PTFE compound. The growing investment by the private sector to improve the oil and gas industry is expected to create the demand for the PTFE market in the country. Furthermore, the Japanese electrical and electronics industry is also anticipated to create huge demand for the PTFE market in the region.

Global Polytetrafluoroethylene (PTFE) Market Growth, by Region 2020-2026

Market Players Outlook

The key players operating in the PTFE market include Arkema S.A., Honeywell International Inc., 3M Co., Mitsubishi Chemical Advanced Materials AG, The Chemours Co., Shandong Dongyue Polymer Material Co., Ltd, AFT Fluorotec Ltd., SABIC, Solvay S.A., Gujarat Fluorochemicals Ltd., and so on. These key players of the PTFE market are taking strategic initiatives such as collaborations, partnerships, and acquisitions to expanding their market presence by strengthening their geographical reach. For instance, In August 207, Daikin Industries, Ltd. acquired Heroflon S.p.A., an Italian manufacturer of fluoropolymer compounds. With this acquisition, the company intends to enter the compound business for fluoropolymers by utilizing its global network to expand the sales of Heroflon's fluoropolymer compounds and micro-powders across the globe.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global PTFE market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Arkema S.A.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. 3M Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mitsubishi Chemical Advanced Materials AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The Chemours Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Shandong Dongyue Polymer Material Co.,Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Polytetrafluoroethylene (PTFE) Market by Form

5.1.1. Granular

5.1.2. Fine Powder

5.2. Global Polytetrafluoroethylene (PTFE) Market by Application

5.2.1. Sheet

5.2.2. Coatings

5.2.3. Pipes

5.2.4. Films

5.2.5. Others

5.3. Global Polytetrafluoroethylene (PTFE) Market by End-User Industry

5.3.1. Electrical & Electronics

5.3.2. Chemical & Industrial Processing

5.3.3. Automotive & Transportation

5.3.4. Household Goods

5.3.5. Others (Medical)

6. Regional Analysis

6.1. North America

6.1.1. The US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. AFT Fluorotec, Ltd.

7.3. AGC Chemicals Americas, Inc.

7.4. Arkema S.A.

7.5. Daikin Industries, Ltd.

7.6. Dalau Ltd.

7.7. DowDuPont, Inc.

7.8. Gujarat Fluorochemicals, Ltd.

7.9. HaloPolymer, OJSC

7.10. Honeywell International Inc.

7.11. J.V.Corp.

7.12. Mitsubishi Chemical Advanced Materials AG

7.13. RTP Co.

7.14. SABIC Group

7.15. Shandong Dongyue Polymer Material Co., Ltd.

7.16. Solvay S.A.

7.17. SuKo Machine Tech Co., Ltd.

7.18. The Chemours Co.

7.19. Tristar Plastics Corp.

7.20. Zeus Industrial Products, Inc.

7.21. Zhejiang Juhua Co., Ltd.

1. GLOBAL PTFE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

2. GLOBAL GRANULARS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FINE POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

5. GLOBAL SHEET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL PIPES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FILMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PTFE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

11. GLOBAL ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CHEMICAL & INDUSTRIAL PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL AUTOMOTIVE & TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL HOUSEHOLD GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL PTFE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN PTFE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN PTFE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

19. NORTH AMERICAN PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

20. NORTH AMERICAN PTFE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

21. EUROPEAN PTFE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. EUROPEAN PTFE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

23. EUROPEAN PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

24. EUROPEAN PTFE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC PTFE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC PTFE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC PTFE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

29. REST OF THE WORLD PTFE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

30. REST OF THE WORLD PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

31. REST OF THE WORLD PTFE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

32. REST OF THE WORLD PTFE ) MARKET RESEARCH AND ANALYSIS END-USER INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL PTFE MARKET SHARE BY FORM, 2019 VS 2026 (%)

2. GLOBAL PTFE MARKET SHARE BY APPLICATIONS, 2019 VS 2026 (%)

3. GLOBAL PTFE MARKET SHARE BY END-USER INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL PTFE ) MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. THE US PTFE MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA PTFE MARKET SIZE, 2019-2026 ($ MILLION)

7. UK PTFE MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE PTFE MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY PTFE MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY PTFE MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN PTFE MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE PTFE MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA PTFE PTFE MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA PTFE MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN PTFE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC PTFE MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD PTFE MARKET SIZE, 2019-2026 ($ MILLION)