Polyurethane Market

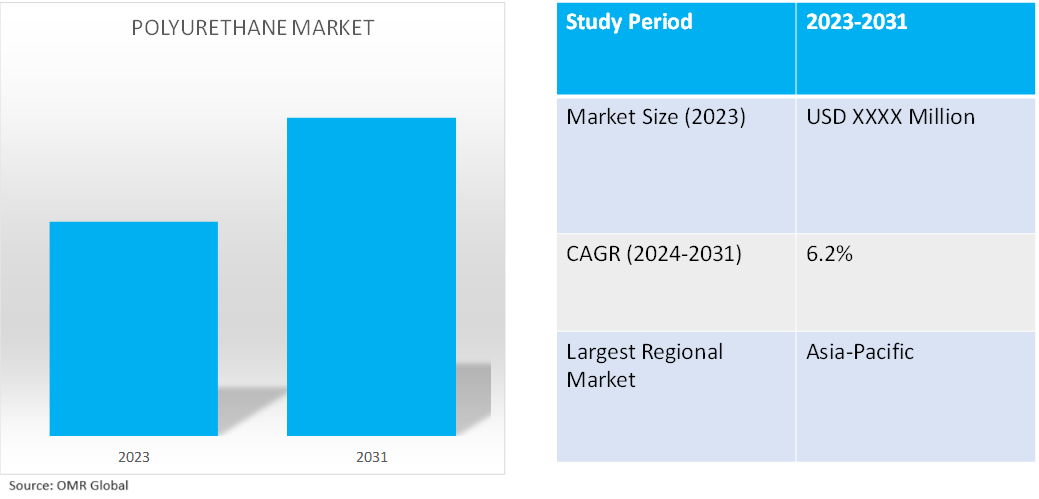

Polyurethane Market Size, Share & Trends Analysis Report by Raw Material (Toluene Diisocyanate, Methylene Diphenyl Diisocyanate, and Polyols) by Application (Rigid Foam, Flexible Foam, Coatings, Adhesives, Sealants, Elastomers, and Other), and by End-User (Automobile, Building & Construction, Furniture, Electronics, Footwear, and Other) Forecast Period (2024-2031)

Polyurethane market is anticipated to grow at a CAGR of 6.2% during the forecast period (2024-2031). Polyurethane refers to a class of polymers composed of organic units joined by carbamate links. In contrast to other common polymers such as polyethylene and polystyrene, polyurethane is produced from a wide range of starting materials. The high demand for polyurethanes from end-user industries owing to their benefits is a key factor driving global industry growth.

Market Dynamics

Growing Demand for Sustainable Materials

Polyurethanes are the most versatile materials. Polyurethane manufacturers are producing innovative, life-enhancing products and technologies that make it highly sustainable. Polyurethanes promote sustainability by reducing waste and achieving the United Nations Sustainable Development Goals (SDGs). For instance, rigid polyurethane used to insulate refrigerators lasts the lifetime of the refrigerator and flexible polyurethane in automotive seating lasts the life of the car.

According to the Food and Agriculture Organization (FAO) of the United Nations, estimation each year, one-third of all food produced for human consumption globally (around 1.3 billion tons) is lost or wasted. This includes 45.0% of all fruit and vegetables, 35.0% of fish and seafood, 30.0% of cereals, 20.0% of dairy products, and 20.0% of meat. Polyurethanes help people globally access a safe, adequate food supply to meet basic nutritional needs by offering applications in cold chain shipping. Additionally, polyurethane foam in major appliances stores pharmaceuticals and extends their shelf life, allowing for much-needed access to groundbreaking medicines and medical treatments worldwide to eradicate lethal diseases. Thus, the growing demand for sustainable materials across the end-user industries is a key factor driving the growth of the global polyurethane market.

Bio-based polyurethanes offer Lucrative Opportunities

The increasing demand for bio-based polyurethane is anticipated to create lucrative growth opportunities for the global market. The key players are introducing advanced products, to meet the growing demand for bio-based polyurethanes. For instance, in September 2023, Covestro and Poland-based construction chemicals producer Selena Group collaborated to craft a more sustainable range of polyurethane (PU) foams for enhancing building thermal insulation. Further, in November 2022, Huntsman launched Acoustiflex VEF BIO — a visco-elastic foam containing up to 20.0% bio-based content derived from vegetable oils for molded acoustic applications in the automotive industry. This new solution can lower the carbon footprint of automotive carpet back-foaming by up to 25.0% compared with existing Huntsman systems for this application. The technology can also be used for dash and wheel arch insulation.

Market Segmentation

- Based on the raw material, the market is segmented into toluene diisocyanate, methylene diphenyl diisocyanate, and polyols.

- Based on the application, the market is segmented into rigid foam, flexible foam, coatings, adhesives, sealants, elastomers, and others (insulators).

- Based on the end-user, the market is segmented into automobile, building & construction, furniture, electronics, footwear, and other (medical devices).

Building & Construction Holds Major Share Based on End-User

Polyurethane is widely used in the building & construction industry owing to its excellent strength-to-weight ratio, insulation properties, versatility, and durability. In the construction industry polyurethane is used in attics, walls, floors, crawl spaces, roofs, doors, and windows for insulation purposes to reduce air leaks and increase energy efficiency. According to the US Environmental Protection Agency’s (EPA) Energy Star program estimates, by the addition of insulation and sealing air leaks, the average household could save 15.0% on heating and cooling costs.

Also, according to the Business of Council for Sustainable Energy, US energy productivity grew 17.6% over the past decade. The use of insulation products across the economy is a key contribution to energy productivity growth. Therefore, the growing demand for proper insulation in buildings with the growing trend of green building concepts has spurred the demand for polyurethanes across the building & construction industry. Thus, the growing construction sector globally is estimated to promote the market growth of the segment.

Regional Outlook

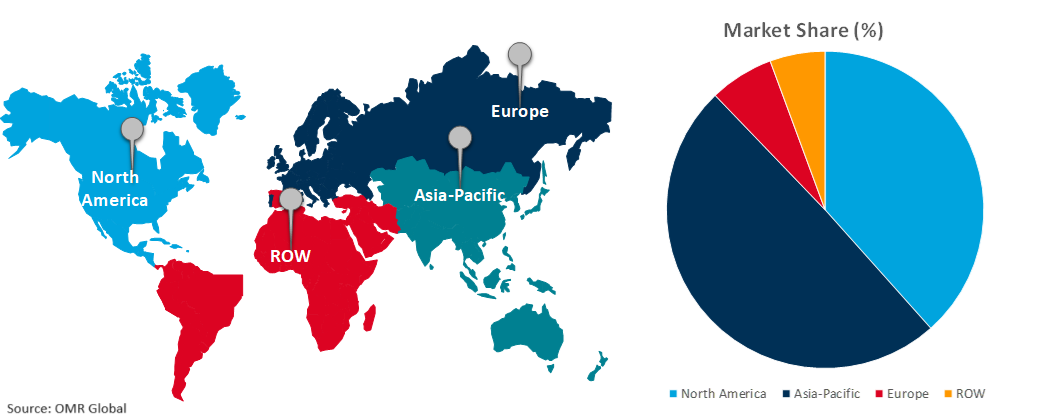

The global polyurethane market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Polyurethane Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific is both a major producer and consumer of polyurethane products. The regional market growth is driven by key market players across the region adopting different market strategies to meet the growing demand for polyurethane. For instance, in January 2024, BASF SE unveiled the inauguration of a cutting-edge thermoplastic polyurethane facility in Zhanjiang, China. The strategic establishment of this new facility is geared towards empowering BASF to effectively cater to the escalating demand in the Asia-Pacific region, particularly in key sectors such as industrial applications, e-mobility, and emerging energy solutions.

Further, in March 2024, BASF and Shandong Wiskind Architectural Steel Co., Ltd. (Wiskind) expanded their strategic partnership with sustainable polyurethane (PU) sandwich panels for cold chain applications. The collaboration was made to explore the further applications of PU sandwich panels, as well as to ascertain potential avenues for joint marketing. Such developments across the region are further aiding the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the polyurethane market include BASF SE, Covestro AG, Dow Co., Huntsman Corp., and Wanhua Chemical (Yantai) Sales Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In March 2024, Dubai-based Pearl Group, formerly recognized as Bayer Pearl and Pearl Covestro made substantial advancements in its operations within Saudi Arabia, effectively doubling its production capacity in the Kingdom. This expansion significantly bolsters its ability to meet the escalating local and regional demand for polyurethane products.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the polyurethane market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Covestro AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Dow Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Huntsman Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Wanhua Chemical (Yantai) Sales Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Polyurethanes Market by Raw Material

4.1.1. Toluene Diisocyanate

4.1.2. Methylene Diphenyl Diisocyanate

4.1.3. Polyols

4.2. Global Polyurethanes Market by Application

4.2.1. Rigid Foam

4.2.2. Flexible Foam

4.2.3. Coatings

4.2.4. Adhesive

4.2.5. Sealants

4.2.6. Elastomer

4.2.7. Other (Insulator)

4.3. Global Polyurethanes Market by End-User

4.3.1. Automobile

4.3.2. Building & Construction

4.3.3. Furniture

4.3.4. Electronics

4.3.5. Footwear

4.3.6. Other (Medical Devices)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Accella Polyurethane Systems LLC

6.2. American Polyfilm, Inc.

6.3. Anderson Development Co.

6.4. Baxenden Chemicals Ltd.

6.5. Capital Resin Corp.

6.6. Dsm N.V.

6.7. Evonik Industries AG

6.8. Gallagher Corp.

6.9. IMA Srl

6.10. Inov Polyurethane Group

6.11. NCFI Polyurethanes

6.12. PCI Urethanes, Inc.

6.13. Polyurethane Ltd.

6.14. The Shepherd Chemical Co.

6.15. Tosoh Corp.

1. Global Polyurethanes Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

2. Global Toluene Diisocyanate Based Polyurethanes Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Methylene Diphenyl Diisocyanate Based Polyurethanes Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Polyols-Based Polyurethanes Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Polyurethanes Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Polyurethanes For Rigid Foam Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Polyurethanes For Flexible Foam Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Polyurethanes For Coatings Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Polyurethanes For Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Polyurethanes For Sealants Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Polyurethanes For Elastomers Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Polyurethanes For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Polyurethanes Market Research And Analysis By End-User, 2023-2031 ($ Million)

14. Global Polyurethanes In Automobile Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Polyurethanes In Building & Construction Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Polyurethanes In Furniture Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Polyurethanes In Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Polyurethanes In Footwear Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global Polyurethanes In Other End-User Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Global Polyurethanes Market Research And Analysis By Region, 2023-2031 ($ Million)

21. North American Polyurethanes Market Research And Analysis By Country, 2023-2031 ($ Million)

22. North American Polyurethanes Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

23. North American Polyurethanes Market Research And Analysis By Application, 2023-2031 ($ Million)

24. North American Polyurethanes Market Research And Analysis By End-User, 2023-2031 ($ Million)

25. European Polyurethanes Market Research And Analysis By Country, 2023-2031 ($ Million)

26. European Polyurethanes Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

27. European Polyurethanes Market Research And Analysis By Application, 2023-2031 ($ Million)

28. European Polyurethanes Market Research And Analysis By End-User, 2023-2031 ($ Million)

29. Asia-Pacific Polyurethanes Market Research And Analysis By Country, 2023-2031 ($ Million)

30. Asia-Pacific Polyurethanes Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

31. Asia-Pacific Polyurethanes Market Research And Analysis By Application, 2023-2031 ($ Million)

32. Asia-Pacific Polyurethanes Market Research And Analysis By End-User, 2023-2031 ($ Million)

33. Rest Of The World Polyurethanes Market Research And Analysis By Region, 2023-2031 ($ Million)

34. Rest Of The World Polyurethanes Market Research And Analysis By Raw Material, 2023-2031 ($ Million)

35. Rest Of The World Polyurethanes Market Research And Analysis By Application, 2023-2031 ($ Million)

36. Rest Of The World Polyurethanes Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Polyurethanes Market Share By Raw Material, 2023 Vs 2031 (%)

2. Global Toluene Diisocyanate Based Polyurethanes Market Share By Region, 2023 Vs 2031 (%)

3. Global Methylene Diphenyl Diisocyanate Based Polyurethanes Market Share By Region, 2023 Vs 2031 (%)

4. Global Polyols Based Polyurethanes Market Share By Region, 2023 Vs 2031 (%)

5. Global Polyurethanes Market Share By Application, 2023 Vs 2031 (%)

6. Global Polyurethanes For Rigid Foam Market Share By Region, 2023 Vs 2031 (%)

7. Global Polyurethanes For Flexible Foam Market Share By Region, 2023 Vs 2031 (%)

8. Global Polyurethanes For Coatings Market Share By Region, 2023 Vs 2031 (%)

9. Global Polyurethanes For Adhesives Market Share By Region, 2023 Vs 2031 (%)

10. Global Polyurethanes For Sealants Market Share By Region, 2023 Vs 2031 (%)

11. Global Polyurethanes For Elastomers Market Share By Region, 2023 Vs 2031 (%)

12. Global Polyurethanes For Other Application Market Share By Region, 2023 Vs 2031 (%)

13. Global Polyurethanes Market Share By End-User, 2023 Vs 2031 (%)

14. Global Polyurethanes In Automobile Market Share By Region, 2023 Vs 2031 (%)

15. Global Polyurethanes In Building & Construction Market Share By Region, 2023 Vs 2031 (%)

16. Global Polyurethanes In Furniture Market Share By Region, 2023 Vs 2031 (%)

17. Global Polyurethanes In Electronics Market Share By Region, 2023 Vs 2031 (%)

18. Global Polyurethanes In Footwear Market Share By Region, 2023 Vs 2031 (%)

19. Global Polyurethanes In Other End-User Industry Market Share By Region, 2023 Vs 2031 (%)

20. Global Polyurethanes Market Share By Region, 2023 Vs 2031 (%)

21. US Polyurethanes Market Size, 2023-2031 ($ Million)

22. Canada Polyurethanes Market Size, 2023-2031 ($ Million)

23. UK Polyurethanes Market Size, 2023-2031 ($ Million)

24. France Polyurethanes Market Size, 2023-2031 ($ Million)

25. Germany Polyurethanes Market Size, 2023-2031 ($ Million)

26. Italy Polyurethanes Market Size, 2023-2031 ($ Million)

27. Spain Polyurethanes Market Size, 2023-2031 ($ Million)

28. Rest Of Europe Polyurethanes Market Size, 2023-2031 ($ Million)

29. India Polyurethanes Market Size, 2023-2031 ($ Million)

30. China Polyurethanes Market Size, 2023-2031 ($ Million)

31. Japan Polyurethanes Market Size, 2023-2031 ($ Million)

32. South Korea Polyurethanes Market Size, 2023-2031 ($ Million)

33. Rest Of Asia-Pacific Polyurethanes Market Size, 2023-2031 ($ Million)

34. Rest Of The World Polyurethanes Market Size, 2023-2031 ($ Million)

35. Latin America Polyurethanes Market Size, 2023-2031 ($ Million)

36. Middle East And Africa Polyurethanes Market Size, 2023-2031 ($ Million)