Potato Protein Market

Global Potato Protein Market Size, Share & Trends Analysis Report, By Type (Potato Protein Concentrate and Potato Protein Isolate), By Application (Food and Beverages and Animal Nutrition) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global potato protein market is estimated to grow at a CAGR of nearly 4.5% during the forecast period. Rising vegan population and increasing demand for sports nutrition products are primarily driving the growth of the market. An emerging shift towards vegan food culture has been witnessed over the years. As per the US Department of Agriculture (USDA), in 2017-2018, 15% of the global new product launches of vegan food and beverage witnessed in Germany. Nearly 35% of the German population witnessing the availability of vegan products as very important, and 63% of the country’s population are trying to decrease their consumption of meat. As a result, Germany is becoming one of the most vegetarian places across the globe.

Therefore, the food market in Germany witnessed faster growth for the development of vegetarian food and restaurants over the years. During the period, 2013 and 2018, the launch of new vegetarian ready-made foods has approximately tripled. This, in turn, has led the demand for plant-based nutritional foods to meet the demand for nutrition. As a plant-based protein, potato protein developed along with the potato starch. These are found in powder form and contains a high protein content (78%). A protein-rich juice is produced during the starch extraction process from potatoes. Later, the proteins are concentrated, purified and dried. Potato proteins have important amino-acids in considerable proportions as compared to proteins from animal origins or cereals-based proteins.

These amino acids perform essential functions in the body, including reducing blood pressure and supporting the body’s metabolism. These proteins hold several functional properties, they absorb fat, dissolve in water, and contain foaming abilities for incorporating air bubbles in baked products. It offers excellent foaming, emulsifying, and gelling properties and able to substitute animal proteins with rich nutritional content such as whey protein isolate, egg yolk, caseinate, egg albumen (egg white) and gelatin. In addition, better gluten-free bakery products can be attained using potato protein. Therefore, the rising number of vegan population is driving the demand for potato protein-enriched food and beverages.

Market Segmentation

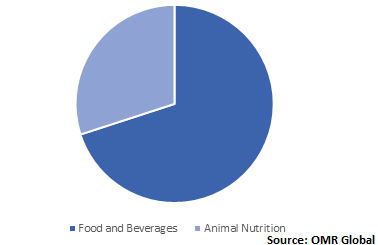

The global potato protein market is segmented into type and application. Based on type, the market is classified into potato protein concentrate and potato protein isolate. Based on application, the market is classified into food and beverages and animal feed. Food and beverages are further classified into the meat, bakery and confectionery, beverages, processed foods, and others.

Animal Nutrition to Witness Significant Growth During the Forecast Period

Animal nutrition is estimated to witness significant growth during the forecast period owing to the rising demand for high-quality protein source in animal feed. Potato protein is a very high-quality source of protein for animal feed, as it offers favorable amino acid pattern and high digestibility. It contains an average of 70 to 76% crude protein. The crude protein digestibility is very high, with 92% to 95%. Potato protein is primarily used by the compound feed industry as an easily digestible protein for the nutrition of broilers and piglets. As a partial replacement for skimmed milk powder, potato protein can be used potentially in calf milk. Potato proteins are also used by the pet industry for diet food. It is witnessing a highly appropriate replacement for dairy protein and fish meal. The potato protein quantity that can be added in the feed relies on the glycoalkaloids content.

Global Potato Protein Market Share by Application, 2019 (%)

Regional Outlook

Geographically, in 2019, Europe is estimated to hold a potential share in the market owing to the significant rise in vegan population and increasing launches of vegan food and drinks in the region. In addition, European potato protein manufacturers are expanding their production capabilities to meet the emerging demand for protein. For instance, in March 2018, Avebe, Dutch potato starch manufacturer is working to expand the production of potato starch in its Gasselternijveen plant that will allow the company to produce more Solanic potato protein. Owing to the emerging demand for vegetable protein such as potato protein, the company is unable to continue with the earlier production line for potato protein. The company has installed a second production line, to potentially doubling the production capacity. Both Solanic plants are situated in Gasselternijveen.

Global Potato Protein Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Coöperatie AVEBE U.A., Tereos Starch & Sweeteners Europe, AGRANA Beteiligungs-AG, AKV Langholt AmbA, and Roquette Frères S.A. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in November 2019, KMC A/S launched Protafy 130 potato protein concentrate to fortify both vegan and non-vegan foods. This launch is in response to the emerging adoption of plant-based proteins. Protafy 130 enables manufacturers of food products to leverage the nutritional quality of snacks and foods sustainably.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global potato protein market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Coöperatie AVEBE U.A.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Tereos Starch & Sweeteners Europe

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. AGRANA Beteiligungs-AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. AKV Langholt AmbA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Roquette Frères S.A.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Potato Protein Market by Type

5.1.1. Concentrate

5.1.2. Isolate

5.2. Global Potato Protein Market by Application

5.2.1. Food and Beverages

5.2.1.1. Meat

5.2.1.2. Bakery and Confectionery

5.2.1.3. Beverages

5.2.1.4. Processed Foods

5.2.1.5. Others

5.2.2. Animal Nutrition

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AGRANA Beteiligungs-AG

7.2. Agridient Inc.

7.3. AKV Langholt AmbA

7.4. Bioriginal Food and Science Corp.

7.5. Coöperatie AVEBE U.A.

7.6. Duynie Group

7.7. Emsland-Stärke GmbH

7.8. Kemin Industries, Inc.

7.9. KMC A/S

7.10. Meelunie B.V.

7.11. Omega Protein Corp.

7.12. PEPEES S.A.

7.13. PPZ SA w Niechlowie

7.14. Roquette Frères S.A.

7.15. Südstärke GmbH

7.16. Tereos Starch & Sweeteners Europe

1. GLOBAL POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL POTATO PROTEIN CONCENTRATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL POTATO PROTEIN ISOLATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL POTATO PROTEIN IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL POTATO PROTEIN IN ANIMAL NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. EUROPEAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. REST OF THE WORLD POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD POTATO PROTEIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL POTATO PROTEIN MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL POTATO PROTEIN MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL POTATO PROTEIN MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

6. UK POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD POTATO PROTEIN MARKET SIZE, 2019-2026 ($ MILLION)