Poultry Probiotics Ingredients Market

Global Poultry Probiotics Ingredients Market Size, Share & Trends Analysis Report By Product (Lactobacilli, Bifidobacterium, Streptococcus, Bacillus, Others) By Application (Broilers, Layers, Turkeys, Breeders, Chicks &Poults) Forecast 2022-2028 Update Available - Forecast 2025-2035

The global poultry probiotics ingredients market is anticipated to grow at a considerable CAGR of 5.6% during the forecast period. A poultry probiotic is referred to as a direct-fed microbial, a culture of a single bacterial strain, or a mixture of different strains, that can be fed to an animal to improve its health. The poultry probiotics can help in preventing pathogen colonization of the gut and reduce the incidence or relieve the signs and symptoms of numerous diseases. Moreover, lactobacillus, Bifidobacterium, are among the most commonly used probiotics microorganisms in human nutrition, whereas yeast plays a major role in ruminants, and bacillus and lactobacillus are more likely to be efficient in pigs and poultry. Further, poultry probiotics ingredients help the host animal in maintaining the gastrointestinal flora and improving the health of the animal, these ingredients also help in boosting the performance of animals. Poultry probiotics ingredients are largely used for turkeys, breeders, layers, and chicks and poults. Such factors are driving the global poultry probiotics ingredients market. Along with this, rising demand for meat and egg among the consumers to boost the immune system, increasing need for developing resistance against diseases in poultry animals, and continuous need for high yield healthy meat products are also expected to fuel demand in the global poultry probiotics ingredients market.

In addition, the increased feeding cost and raw material ingredients prices, along with their limited availability will negatively influence the growth of the industry and consumers' purchasing power. Moreover, increases in biogas and biofuel production will further decrease the availability of land for grain production and feed for the animal. This phenomenon will hinder the growth of the global poultry probiotics ingredients market.

Impact of COVID-19 Pandemic on Global Poultry Probiotics Ingredients Market

The COVID-19 pandemic has a disastrous effect on the production of bio-based & synthetic polyamides, the major lockdown leads to a sudden decline in the production of automobiles, textile products, consumer goods, and electrical and electronics, where bio-based polyamides are majorly used, leading to a drop in the demand of bio-based & synthetic polyamides. Moreover, the automobile industry has been negatively impacted due to the COVID-19 pandemic, impacting the overall bio-based polyamides market. Moreover, the restrictions imposed by the government resulted in postponements in the R&D activities and resulted in the reduction of bio-based & synthetic polyamides. However, the industry is predicted to observe steady growth over to forecast period owing to supportive government policies and stimulus measures taken to achieve green gas emissions standards.

Segmental Outlook

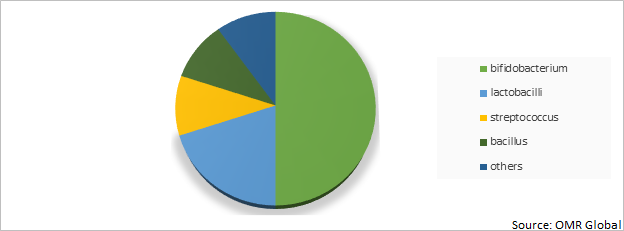

The global poultry probiotics ingredients market is segmented based on Product, application. Based on product the market is segmented into lactobacilli, bifidobacterium, streptococcus, bacillus, others. Based on application, the market is bifurcated into broilers, layers, turkeys, breeders, and chicks &poults. Based on application, broilers segment held the major market share, as they are broadly used to gain weight by consuming broiler chicken and used as a substitute for antibiotics growth promoter which propels the market growth. Moreover, aids in digestive function in broilers and tuning the intestinal environment, which helps in stimulating the broilers' growth.

Global Poultry Probiotics Ingredients Market Share by Product, 2022 (%)

The Bifidobacterium Holds the Major Share in the Global Poultry Probiotics Ingredients Market

Bifidobacterium is expected to be the major segment in the global poultry probiotics ingredients market. Owing to its wider benefits offered to humans and animals, it healthy bacteria found in the intestines that help digest fibers, prevent infections and produce important healthy chemicals in the body. Moreover, bifidobacterium in the form of probiotic supplements can increase the abundance in the gut and helps in preventing inflammatory bowel diseases, ulcerative colitis, chronic fatigue syndrome, and psoriasis. Further, bifidobacterium may help in reducing the weight and the risk associated with diabetes, heart diseases, and other chronic disorders, as they help in digesting the fiber and other complex carbs in the body, that can’t digest on their own. With its broader application and various benefits offered to humans and animals, the bifidobacterium is anticipated to fuel the growth of the market in the coming year.

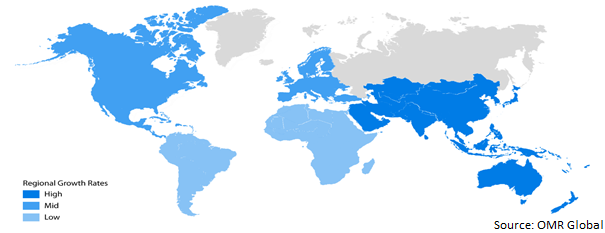

Regional Outlooks

The global poultry probiotics ingredients market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). Asia-Pacific poultry probiotics ingredients market is expected to hold a lucrative share in the region, the stringent government regulations to ban the use of synthetic antibiotics in animal feed products are anticipated to raise the product demand in the region. Moreover, the growing consumer needs the consume non-contaminated and fiber-rich quality meat will stimulate the market growth during the forecast period.

Global Poultry Probiotics Ingredients Market Growth, by Region 2022-2028

The Asia-Pacific Region Holds the Major Share in the Global Poultry Probiotics Ingredients Market

The Asia-Pacific region is anticipated to have the largest market growth, owing to natural prediction in between the consumer base which will drive the growth of the global poultry probiotics ingredients market. Moreover, rising in the activities related to agriculture and livestock, growing consumption of meat and egg in the region, and increasing consumer consciousness towards consuming high protein products and added fiber-rich supplements in the diet, is further fueled the growth of the market in the Asia-Pacific region. Additionally, rising disposable income and living standards of the people results in changing the preferences of the consumers and they are more inclined towards consuming meat, dairy, and processed foods.

The government initiatives for promoting the growth of the global poultry probiotics market in the region will significantly contribute to the market growth. For instance, in September 2021, the Department of Animal Husbandry and Dairying (DAHD) of India, has signed a multi-year memorandum of understanding with the Bill & Melinda Gates Foundation, to work together on sustainably improving India’s livestock unit, and support the nation’s food and nutritional security, and protect the economic wellbeing of small-scale livestock producers.

Market Players Outlook

The major companies serving the global poultry probiotics ingredients market are, Angel Yeast Co. Ltd., Chr. Hansen., CJ Cheil Jedang Corp., DuPont de Nemours Inc., Kerry Group Plc., Archer Daniels Midland Co., Bluestar Adisseo Co. Ltd., Lallemand Inc., Novus International Inc., Probi Ab., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Archer Daniels Midland Co. has expanded its broad portfolio of health and wellness products and solutions with an agreement by purchasing Deerland Probiotics & Enzymes. Moreover, this latest strategic investment helps to build a full-scale global health & wellness business to meet the fast-growing demand for food & beverages, and supplements that enhance the health and wellbeing of the consumers.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global poultry probiotics ingredients market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Poultry Probiotics Ingredients Market

• Recovery Scenario of Global Poultry Probiotics Ingredients Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. AngelYeast Co. Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Chr. Hansen

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. CJ CheilJedang Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. DuPont de Nemours Inc.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Kerry Group Plc

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Poultry Probiotics Ingredients Market, by Product

5.1.1. Lactobacilli

5.1.2. Bifidobacterium

5.1.3. Streptococcus

5.1.4. Bacillus

5.1.5. Others

5.2. Global Poultry Probiotics Ingredients Market, by Application

5.2.1. Broilers

5.2.2. Layers

5.2.3. Turkeys

5.2.4. Breeders

5.2.5. Chicks &Poults

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ab Agri Ltd.

7.2. Adisseo

7.3. Ajinomoto Co. Inc.

7.4. Alltech Inc.

7.5. Archer Daniels Midland Co.

7.6. Balchem Corp

7.7. BASF SE

7.8. Biocamp

7.9. Bluestar Adisseo Co. Ltd.

7.10. Cargill Inc.

7.11. DSM

7.12. Fermented Nutrition

7.13. Galcbiotech Co. Ltd.

7.14. Harvest Fuel Inc.

7.15. Kemin Industries, Inc.

7.16. Lallemand Inc.

7.17. Lonza Group Ltd.

7.18. Manna Pro Products LLC.

7.19. Nonozymes A/S

7.20. Novus International Inc.

7.21. Nutreco N.V.

7.22. Probi AB

7.23. Schaumann Agri Austria GmbH & Co. KG

1. GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2028($ MILLION)

2. GLOBAL LACTOBACILLI POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

3. GLOBAL BIFIDOBACTERIUM POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

4. GLOBAL STREPTOCOCCUS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

5. GLOBAL BACILLUS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

6. GLOBAL OTHERS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

7. GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

8. GLOBAL BROILERS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

9. GLOBAL LAYERS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

10. GLOBAL TURKEYS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

11. GLOBAL BREEDERS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

12. GLOBAL CHICKS & POULTS POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

13. GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

14. NORTH AMERICAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

15. NORTH AMERICAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2028 ($ MILLION)

16. NORTH AMERICAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY, APPLICATION , 2022-2028 ($ MILLION)

17. EUROPEAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

18. EUROPEAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2028 ($ MILLION)

19. EUROPEAN POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

20. ASIA-PACIFIC POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

21. ASIA-PACIFIC POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2028 ($ MILLION)

22. ASIA-PACIFIC POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

23. REST OF THE WORLD POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

24. REST OF THE WORLD POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2028 ($ MILLION)

25. REST OF THE WORLD POULTRY PROBIOTICS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET, 2022-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET BY SEGMENT, 2022-2028 ($ MILLION)

3. RECOVERY OF GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET, 2022-2028 (%)

4. GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY PRODUCT, 2022 VS 2028 (%)

5. GLOBAL LACTOBACILLI PPOULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

6. GLOBAL BIFIDOBACTERIUM POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

7. GLOBAL STREPTOCOCCUS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

8. GLOBAL BACILLUS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

9. GLOBAL OTHERS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

10. GLOBAL POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY APPLICATION, 2022 VS 2028 (%)

11. GLOBAL BROILERS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

12. GLOBAL LAYERS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

13. GLOBAL TURKEYS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

14. GLOBAL BREEDERS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

15. GLOBAL CHICKS & POULTS POULTRY PROBIOTICS INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

16. US POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

17. CANADA POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

18. UK POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

19. FRANCE POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

20. GERMANY POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

21. ITALY POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

22. SPAIN POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

23. REST OF EUROPE POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

24. INDIA POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

25. CHINA POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

26. JAPAN POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

27. SOUTH KOREA POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)

29. REST OF THE WORLD POULTRY PROBIOTICS INGREDIENTS MARKET SIZE, 2022-2028 ($ MILLION)