Power Engineering, Procurement, and Construction (EPC) Market

Power Engineering, Procurement, and Construction (EPC) Market Size, Share & Trends Analysis Report by Power Generation (Thermal, Hydroelectric, Nuclear and Renewables), and by Equipment (Gas Turbines, Steam Turbines, Boilers, Generators, Control System and Others) Forecast Period (2024-2031)

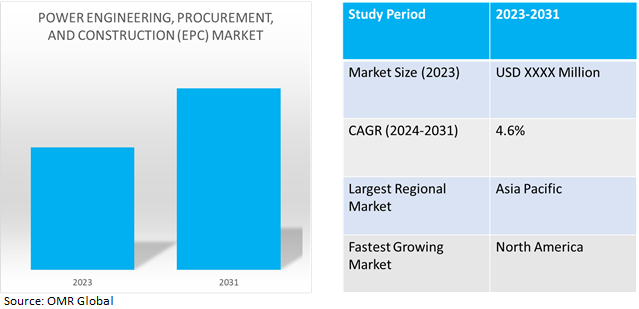

Power engineering, procurement, and construction (EPC) market is anticipated to grow at a moderate CAGR of 4.6% during the forecast period (2024-2031). Demand for the power EPC market is anticipated to be driven in the long run by factors like rising electricity generation, rising energy consumption, and shifting dynamics within the power generation industry.

Market Dynamics

Growing infrastructure development

A large scale infrastructure development is taking place in the developing area and in a number of different industries, such as manufacturing, transportation, and housing. It is a key factor driving the global market. Establishing dependable electricity infrastructure, such as power plants, transmission lines, and distribution networks, is necessary for this development. Furthermore, investments in power projects are fueled by efforts to electrify distant areas and enhance energy access, which creates opportunities for EPC businesses.

Rising Awareness of the Adverse Impacts of Fossil Fuels

There is a growing global awareness of the adverse impacts of fossil fuels on the environment, including greenhouse gas emissions and climate change. Governments, organizations, and individuals increasingly commit to reducing carbon emissions and transitioning to cleaner energy sources. Renewable energy, such as solar, wind, hydroelectric, and biomass, offers a sustainable and low-carbon alternative to fossil fuels, driving the demand for renewable projects.

The negative effects of fossil fuels on the environment, such as greenhouse gas emissions and climate change, are becoming more widely recognized. A growing number of people, businesses, and governments are making the commitment to cut carbon emissions and switch to greener energy sources. The demand for renewable projects is fueled by the availability of low-carbon, sustainable alternatives to fossil fuels, such as biomass, solar, wind, and hydroelectric power.

Market Segmentation

Our in-depth analysis of the global power engineering, procurement, and construction (EPC) market includes the following segments by power generation and equipment:

- Based on power generation, the market is sub-segmented into thermal, hydroelectric, nuclear and renewables.

- Based on equipment, the market is augmented into gas turbines, steam turbines, boilers, generators, control system and others

Renewable Energy is Projected to Emerge as the Largest Segment

Renewable energy technologies are becoming more and more competitive with traditional energy sources due to their huge cost reduction. The perpetual progress in solar panel efficiency, wind turbine technology, and energy storage technologies has enhanced the dependability, expandability, and economic viability of renewable energy initiatives. It increased investor confidence and increased the appeal of renewable energy to EPC firms.

Furthermore, using renewable energy can help improve energy security and lessen reliance on imported fossil fuels. Various countries understand how critical it is to diversify their energy sources and lessen their dependency on unstable geopolitical areas. Putting money into homegrown renewable energy initiatives boosts local economies, adds jobs, and increases a nation's energy independence.

Turbines and Generators Sub-segment to Hold a Considerable Market Share

Based on equipment, the market is divided into steam turbines, gas turbines, boilers, control systems, generators and others. The turbine segment and generators holds a considerable share in the market. The turbines are expected to grow at the fastest pace which is driven by the increasing demand for renewable energy sources, such as solar and wind. Businesses that support the objective of global sustainability are gaining priority among customers causing high demand of equipment in the energy value chain. Over 290 gigawatts of renewable power production infrastructure were built globally in 2021, according to a report by the International Renewable Energy Agency. This is a new record high that indicates the wind and solar industries are growing rapidly, which is fueling the demand for specialized EPC consulting.

Regional Outlook

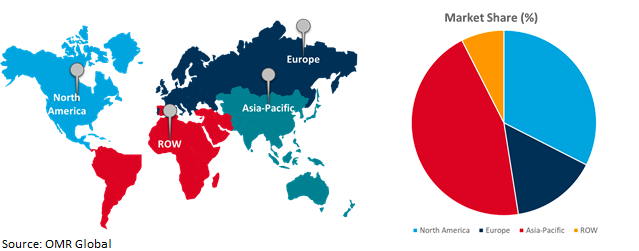

The global power engineering, procurement, and construction (EPC) market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America countries to invest in energy sector

- The growth of the North American market is due to the well-developed energy utilities sector and a numerous government initiative to support energy growth.

- North America is home of many leading EPC companies and there is also an increasing number of power generation and transmission projects which has caused the growth of the region.

Global Power Engineering, Procurement, and Construction (EPC) Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Strong economic growth is being witnessed throughout the Asia-Pacific region, which includes nations like China, India, Japan, South Korea, and Southeast Asian countries. This expansion boosted the development of infrastructure, urbanization, and industry, which in turn raised demand for new power projects and expanded the market for EPC services.The region's growing middle class, industrial growth, and rapid urbanization all contribute to the rising energy demand. To meet this need, significant investments are being made in the infrastructure for power generation, transmission, and distribution, which presents numerous opportunities for EPC businesses.

Furthermore, a number of Asia-Pacific nations have set aggressive goals for renewable energy in an effort to combat climate change, lessen reliance on fossil fuels, and improve energy security. To encourage the development of renewable energy, governments put in place advantageous laws, subsidies, and regulatory frameworks. As a result, the market for EPC companies is flourishing and there is a spike in renewable energy projects including hydroelectric, solar, and wind power.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global power engineering, procurement, and construction (EPC) market include Fluor Corp, Hyundai Engineering & Construction, Larsen & Toubro Limited, Wood PLC, Kiewit Corp and McDermott International Inc.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2022, Tata power solar commissioned 66 MW EPC project for vibrant energy. The project has produced 110,029 units of energy annually. The installation hasled to a reduction of carbon emissions up to 9 lakh tonnes. The project is spread over 191 acres comprising 1,27,268 solar modules and the project was completed within a record nine-month period.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global power engineering, procurement, and construction (EPC) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Fluor Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hyundai Engineering & Construction

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Larsen & Toubro Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Power Engineering, Procurement, and Construction (EPC) Market by Power Generation

4.1.1. Thermal

4.1.2. Hydroelectric

4.1.3. Nuclear

4.1.4. Renewables

4.2. Global Power Engineering, Procurement, and Construction (EPC) Market by Equipment

4.2.1. Gas Turbines

4.2.2. Steam Turbines

4.2.3. Boilers

4.2.4. Generators

4.2.5. Control System

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abengoa, S.A.

6.2. Wood PLC

6.3. Kiewit Corp

6.4. McDermott International Inc.

6.5. Bechtel Corp

6.6. Saipem SpA

6.7. KBR Inc

6.8. General Electric Company

6.9. Siemens Energy AG

6.10. ABB Ltd

6.11. Schneider Electric

6.12. Eaton Corp PLC.

6.13. Technip FMC

6.14. Bilfinger

6.15. Petrofac

6.16. TécnicasReunidas Group

6.17. Samsung E & A Co. Ltd.’

6.18. Daewoo Engineering & Construction Co. Ltd.

6.19. DL E & C

6.20. GS E & C Corp.

1. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET RESEARCH AND ANALYSIS BY POWER GENERATION, 2023-2031 ($ MILLION)

2. GLOBAL THERMAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HYDROELECTRIC POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NUCLEAR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RENEWABLES POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

7. GLOBAL GAS TURBINES FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL STEAM TURBINES FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BOILERS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL GENERATORS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONTROL SYSTEM FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OTHERS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY POWER GENERATION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY EQUIPMENT,2023-2031 ($ MILLION)

17. EUROPEAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY POWER GENERATION, 2023-2031 ($ MILLION)

19. EUROPEAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICPOWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY POWER GENERATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFICPOWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

23. REST OF THE WORLD POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY POWER GENERATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

1. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY POWER GENERATION, 2023 VS 2031 (%)

2. GLOBAL THERMAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HYDROELECTRIC POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NUCLEAR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL RENEWABLES POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHAREBY EQUIPMENT, 2023 VS 2031 (%)

7. GLOBAL GAS TURBINES FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL STEAM TURBINES FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BOILERS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL GENERATORS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONTROL SYSTEM FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OTHERS FOR POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

16. UK POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC POWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICAPOWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICAPOWER ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC)MARKET SIZE, 2023-2031 ($ MILLION)