Power Tools Market

Global Power Tools Market Size, Share & Trends Analysis Report by Type (Material Removal, Drilling and Fastening, Demolition, and Sawing), by Power Source (Electric, and Pneumatic), and by End-User (Automotive, Construction, Residential, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global power tools market is anticipated to grow at a considerable CAGR of 5.9% during the forecast period. One of the core factors that is fueling the market is the rising demand from the construction industry owing to the development of advanced infrastructures which is propelling the sales of power tools. Power tools have been adopted in the construction industry owing to the increased efficiency and accuracy offered by these tools, along with the improved safety of the workforce. The growth of the construction industry resulted in the boosting demand for power tools, which leads to innovative advanced infrastructural developments. For instance, in June 2019, Bosch launched an innovative, cordless, power tool in the imaging, and measured categories. The construction industry is anticipating witnessing substantial growth across the globe.

The COVID-19 pandemic impacted negatively the power tools market across the globe owing to the implementation of lockdown in most the nations which halted the production and supply chain of power tools. It also halted the construction projects, woodworking, and metalworking industry which directly declined the demand for power tools. The market players faced a decline in sales, however, they tried to take some innovative steps to maintain their footing in the market. As per the annual report of Honeywell International Inc., 2020, the company stated that “COVID-19 spread from nation to nation, key end markets faltered, and we had to quickly adjust our cost base to maintain our footing. I frequently say to my team that while easy economic conditions are far more fun than what we had to go through in 2020, it’s the toughest conditions that test us the most and enable us to grow stronger as leaders. In the face of the pandemic – one of the most disruptive events ever to affect our business – I could not be prouder of Honeywell’s team and how we responded to extremely difficult circumstances.” However, as the situation normalized, the demand grew significantly and anticipated considerable growth during the forecast period.

Segmental Outlook

The global power tools market is segmented based on the type, power source, and end-user. Based on the type, the market is segmented into material removal, drilling and fastening, demolition, and sawing. Based on the power source, the market is sub-segmented into the electric, and pneumatic. Based on the end-user, the market is sub-segmented into automotive, construction, residential, and others. The above-mentioned segments can be customized as per the requirements. Based on type, the drilling and fastening segment is anticipated to hold the prominent share in the market owing to the increasing adoption of these power tools in the wind turbine installation operations and automotive assembly while based on the power source, the electric segment is anticipated to hold the prominent share during the forecast period owing to the innovations in the battery system and the rising adoption of cordless tools.

The Drilling and Fastening Segment Anticipated to Hold the Prominent Share in the Global Power Tools Market

Based on type, the drilling and fastening segment is anticipated to hold a prominent share in the market during the forecast period. The growth of the segment is attributed to the increasing adoption of these power tools in wind turbine installation operations and automotive assembly. The growth is reflected in the participation of market players in launching new drilling and fastening power tools in the market. For instance, in January 2022, Bosch launched its new hammer drill/driver and drill/driver beneath the PROFACTOR System to date the GSR18V-1330C and GSB18V-1330C. These newly designed power tool models offer users kickback control, high power, and leveling-angle control for accomplishing a range of heavy-duty tasks. Mostly, electric drilling and fastening tools are used by DIY consumers and professionals, while most pneumatic drilling and fastening tools are used in industrial environments such as aerospace and automotive manufacturing plants.

Regional Outlooks

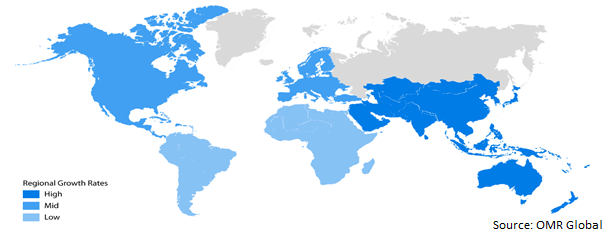

The global power tools market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is anticipated to grow at the fastest rate in the market, while North America is anticipating significant growth during the forecast period.

Global Power Tools Market Growth, by Region 2022-2028

The Asia-Pacific Region is Anticipated to Grow Fastest in the Global Power Tools Market

Based on region, the Asia-Pacific is expected to grow at the fastest CAGR in the global market during the forecast period owing to the rising road infrastructure and construction activities, especially in emerging economies such as China, India, Singapore, Japan, and others. For instance, in June 2022, the Government of China announced the construction of a new nation’s Tiangong space station. Moreover, the increasing government initiatives for enhancing infrastructural development and industrial manufacturing facilities in various countries in the region are expected to fuel the growth of the market during the forecast period.

Market Players Outlook

The major companies serving the global power tools market include 3M Co., Emerson Electric Co., Honeywell International Inc., Robert Bosch Gmbh, Stanley Black & Decker, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2021, Stanley Black & Decker, Inc. partnered with Eastman for advancing sustainability in the power tools industry. Stanley Black & Decker’s brand, BLACK+DECKER, released a new product line, namely revival, which provided the brand's first sustainability-led power tools that utilize Eastman's Tritan Renew copolyester.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global power tools market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Power Tools Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. 3M Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Emerson Electric Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Honeywell International Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Robert Bosch GmbH

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Stanley Black & Decker, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Power Tools Market by Type

4.1.1. Material Removal

4.1.2. Drilling and Fastening

4.1.3. Demolition

4.1.4. Sawing

4.2. Global Power Tools Market by Power Source

4.2.1. Electric

4.2.2. Pneumatic

4.3. Global Power Tools Market by End-User

4.3.1. Automotive

4.3.2. Construction

4.3.3. Residential

4.3.4. Others (Aerospace)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Apex Tool Group

6.2. Atlas Copco AB

6.3. Festool GmbH

6.4. Hilti North America

6.5. Husqvarna AB

6.6. Ingersoll Rand

6.7. Koki Holding Co., Ltd.

6.8. KYOCERA Corp.

6.9. Makita Corp.

6.10. Snap-On Inc.

6.11. Techtronic Industries Co. Ltd.

1. GLOBAL POWER TOOLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL MATERIAL REMOVAL POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL DRILLING AND FASTENING POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DEMOLITION POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SAWING POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL POWER TOOLS MARKET RESEARCH AND ANALYSIS BY POWER SOURCE, 2021-2028 ($ MILLION)

7. GLOBAL ELECTRIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL PNEUMATIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL POWER TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL POWER TOOLS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL POWER TOOLS FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL POWER TOOLS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL POWER TOOLS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL POWER TOOLS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY POWER SOURCE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. EUROPEAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. EUROPEAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY POWER SOURCE, 2021-2028 ($ MILLION)

22. EUROPEAN POWER TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY POWER SOURCE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC POWER TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27. REST OF THE WORLD POWER TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD POWER TOOLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD POWER TOOLS MARKET RESEARCH AND ANALYSIS BY POWER SOURCE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD POWER TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. RECOVERY OF GLOBAL POWER TOOLS MARKET, 2022-2028 (%)

2. GLOBAL POWER TOOLS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

3. GLOBAL MATERIAL REMOVAL POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL DRILLING AND FASTENING POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL DEMOLITION POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL SAWING POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL POWER TOOLS MARKET SHARE BY POWER SOURCE, 2021 VS 2028 (%)

8. GLOBAL ELECTRIC POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL PNEUMATIC POWER TOOLS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL POWER TOOLS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

11. GLOBAL POWER TOOLS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL POWER TOOLS FOR CONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL POWER TOOLS FOR RESIDENTIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL POWER TOOLS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL POWER TOOLS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

18. UK POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD POWER TOOLS MARKET SIZE, 2021-2028 ($ MILLION)