Prediabetes Market

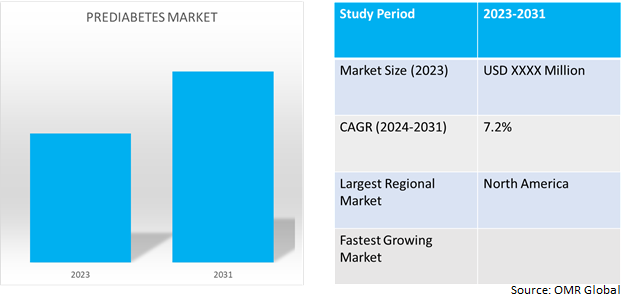

Prediabetes Market Size, Share & Trends Analysis Report by Drug Class (Diguanide, Thiazolidinediones (TZDs), Glucagon-like Peptide-1 Agonists (GLP-1), SGLT2 Inhibitors, DPP-4 Inhibitors, and Others), and by Age Group (Children, Adult, and Elderly) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Prediabetes market is anticipated to grow at a CAGR of 7.2% during the forecast period (2024-2031). Prediabetes refers to an intermediate stage of glucose dysregulation situated between standard glucose tolerance and diagnosed diabetes. It is a condition characterized by elevated blood sugar levels that are not high enough to be classified as Type 2 diabetes.

Market Dynamics

Growing innovation in the prediabetes market

Innovations in the prediabetes market are driving significant progress, with advanced diagnostic tools enabling early detection. Personalized treatment approaches and emerging therapeutics aim to cease disease progression. Digital health solutions enhance patient monitoring and engagement. These innovations are reshaping prediabetes management, improving outcomes, and reducing the risk of type 2 diabetes. Notably, when it comes to managing patients with prediabetes and borderline diabetes, the emergence of new technologies like painless glucose monitors, mobile health apps, and personalized digital coaching have significantly improved patient satisfaction and bridged the gap in care.

Rising adoption of continuous glucose monitoring (CGM) devices

Globally, the rising adoption of CGM devices, which provide real-time feedback on glucose levels and facilitate management actions, further strengthens market growth. These gadgets prove beneficial in overseeing diabetes among groups like toddlers, pregnant individuals, the elderly, and those with concurrent health conditions. For instance, in March 2023, according to the National Center for Biotechnology Information (NCBI), individuals with prediabetes experienced heightened postprandial glucose levels, and the utilization of CGM could trigger behavioral modifications, potentially postponing the onset of diabetes. The increasing adoption of technology for diagnosing prediabetes in turn is boosting the demand for its treatment.

Market Segmentation

Our in-depth analysis of the global prediabetes market includes the following segments by drug class and age group:

- Based on drug class, the market is sub-segmented into diguanide, TZDs, GLP-1, SGLT2 inhibitors, DPP-4 inhibitors, and others (Glucagon-like peptide 1 (GLP-1), Sulfonylureas).

- Based on age group, the market is bifurcated into children (aged 12 to 18 years), adults (aged 18 to 50 years), and elderly (above 50 years).

Diguanide is Projected to Emerge as the Largest Segment

Based on the drug class, the global prediabetes market is sub-segmented into diguanide and thiazolidinediones. Among these, the diguanide sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes diguanides as it is a class of drugs that includes metformin, and is widely used in the treatment of prediabetes and type 2 diabetes. For instance, in August 2023, according to the National Center for Biotechnology Information (NCBI), Metformin stands as the sole American Diabetes Association (ADA)-recommended medication for managing prediabetes in both adult and pediatric patients 10 or older.

Adults Sub-segment to Hold a Considerable Market Share

Increased adoption of unhealthy lifestyles is driving the growth of this age group segment. Older age, family history of diabetes, history of gestational diabetes, polycystic ovarian syndrome, history of hypertension, cardiovascular disease, history of dyslipidemia, high-risk race/ethnicity, and physical inactivity are increasing the risk of prediabetes. For instance, in 2021, the Centers for Disease Control (CDC) estimated that 96 million Americans-38% of the adult population had prediabetes demonstrating an increase in the percentage of the population that has prediabetes that had previously been stable.

Regional Outlook

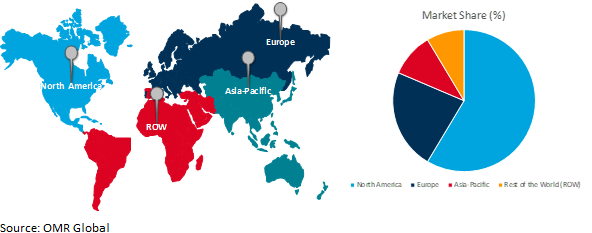

The global prediabetes market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in the prediabetes market

- France's collaborative efforts among healthcare stakeholders are pivotal in enhancing preventive measures and improving outcomes in prediabetes management along with increased investment in diagnostic technology.

- The UK prediabetes market is projected to expand driven by factors like heightened awareness, advancements in diagnostic technology, and a focus on early diagnosis.

Global Prediabetes Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share, due to the high prevalence of prediabetes, increased adoption of disease-causing lifestyles, well-developed healthcare infrastructure, and emphasis on early disease detection. Increasing awareness about the importance of early detection and intervention for prediabetes, coupled with rising prevalence rates, is fueling market expansion.

For instance, according to the American Diabetes Association (ADA) in 2021, prediabetes was observed in 97.6 million adults aged 18 and above in the U.S. In addition, advancements in diagnostic technologies and therapeutic options are enhancing the effectiveness of prediabetes management strategies. In addition, due to important reasons such as the growing senior population, which increases demand for screening, diagnostic, and management solutions, the prediabetes market in the United States is leading the industry. Second, by enabling continuous monitoring and tailored therapies, technology innovations like wearables and digital health platforms are transforming the management of prediabetes. Furthermore, a trend is emerging towards comprehensive strategies for managing prediabetes, encompassing dietary adjustments and lifestyle adjustments.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global prediabetes market include Novo Nordisk A/S, Valbiotis, Resverlogix Corp., Aphaia Pharma, AstraZeneca, Bristol-Myers Squibb, and Boehringer Ingelheim International GmbH, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2021, Nestlé Health Science launched its first prediabetes program in Malaysia. The program comprises a novel food supplement that can be sprinkled over meals as part of a healthy diet to help maintain normal blood glucose after a meal. The accompanying digital platform enables an assessment of diabetes risks and provides tailored recommendations for prediabetes-friendly meal plans.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global prediabetes market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Novo Nordisk A/S

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Valbiotis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Resverlogix Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Prediabetes Market by Drug Class

4.1.1. Diguanide

4.1.2. Thiazolidinediones (TZDs)

4.1.3. Glucagon-like Peptide-1 Agonists (GLP-1)

4.1.4. SGLT2 Inhibitors

4.1.5. DPP-4 Inhibitors

4.1.6. Others (Glucagon-like peptide 1 (GLP-1), Sulfonylureas)

4.2. Global Prediabetes Market by Age Group

4.2.1. Children (12 to 18 Years)

4.2.2. Adult (18 to 50 Years)

4.2.3. Elderly (Above 50 Years)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aphaia Pharma

6.2. AstraZeneca

6.3. Boehringer Ingelheim International GmbH

6.4. Boston Pharmaceuticals

6.5. Bristol-Myers Squibb

6.6. Caelus Health

6.7. Dexcom, Inc.

6.8. DIABETOMICS, Inc.

6.9. Eli Lilly and Company

6.10. Johnson & Johnson Services, Inc.

6.11. Medtronic Private Limited

6.12. Merck KGaA

6.13. Sanofi Group

6.14. SciMar Ltd.

6.15. TeleMed2U Inc.

1. GLOBAL PREDIABETES MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2023-2031 ($ MILLION)

2. GLOBAL DIGUANIDE FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TZDS FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GLP-1 FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SGLT2 INHIBITORS FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DPP-4 INHIBITORS FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER DRUG CLASSES FOR PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PREDIABETES MARKET RESEARCH AND ANALYSIS BY AGE GROUP, 2023-2031 ($ MILLION)

9. GLOBAL PREDIABETES IN CHILDREN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PREDIABETES IN ADULT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PREDIABETES IN ELDERLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY AGE GROUP, 2023-2031 ($ MILLION)

16. EUROPEAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2023-2031 ($ MILLION)

18. EUROPEAN PREDIABETES MARKET RESEARCH AND ANALYSIS BY AGE GROUP, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC PREDIABETES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC PREDIABETES MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC PREDIABETES MARKET RESEARCH AND ANALYSIS BY AGE GROUP, 2023-2031 ($ MILLION)

22. REST OF THE WORLD PREDIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD PREDIABETES MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2023-2031 ($ MILLION)

24. REST OF THE WORLD PREDIABETES MARKET RESEARCH AND ANALYSIS BY AGE GROUP, 2023-2031 ($ MILLION)

1. GLOBAL PREDIABETES MARKET SHARE BY DRUG CLASS, 2023 VS 2031 (%)

2. GLOBAL DIGUANIDE FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL TZDS FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GLP-1 FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SGLT2 INHIBITORS FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DPP-4 INHIBITORS FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER DRUG CLASSES FOR PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PREDIABETES MARKET SHARE BY AGE GROUP, 2023 VS 2031 (%)

9. GLOBAL PREDIABETES IN CHILDREN MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PREDIABETES IN ADULT MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PREDIABETES IN ELDERLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PREDIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

15. UK PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)

27. THE MIDDLE EAST AND AFRICA PREDIABETES MARKET SIZE, 2023-2031 ($ MILLION)