Pressure Sensor Market

Pressure Sensor Market Size, Share & Trends Analysis Report byProduct Type (MEMS Pressure Sensor, Pressure Transducer/Transmitter and Other), and by Application Type (Consumer Electronics, Automotive, Medical, Industrial, Energy and Utilities, Aerospace and defense and Others) Forecast Period (2024-2031)

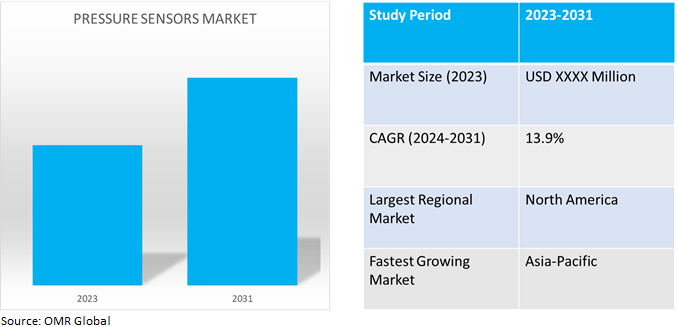

Pressure sensor market is anticipated to grow at a significant CAGR of 13.9% during the forecast period (2024-2031).The market growth is attributed to the increasing integration of pressure sensors in various applications such as 3D printing, air quality testing, automated testing systems, chemical monitoring, leak testing, nuclear power monitoring, pneumatic system monitoring, and water quality testing.Additionally, the increasing demand for differential pressure sensors in industrial applications suitable for differential pressure sensor measurement of oil tanks, water tanks, and pipelines in industries like petroleum fields, chemical plants, and others drives the growth of the pressure sensor market.

Market Dynamics

Increasing Integration of Wireless Connectivity

Increasing integration of wireless connectivity in pressure sensors results in minimal maintenance, broad compatibility, extended battery life, excellent anti-interference performance, and others. A wireless pressure sensor is a device that detects and measures pressure changes in liquids, gases, or solid materials, without the need for a physical connection to a data acquisition system. The sensor typically consists of a sensing element, a signal conditioning unit, and a wireless communication module. The wireless sensors offer overload protection and feature a digital intelligent circuit board with automatic temperature compensation algorithms, eliminating the need for frequent calibration and ensuring long-term reliability.

Increasing Advancement in MEMS Technology

Pressure sensors based on Microelectromechanical Systems (MEMS) have been in widespread use for many years.Also, new trends in pressure sensors have emerged, including improved multifunctionality, sensitivity, accuracy, and smaller chip and package sizes. Advancements in sensor materials, design, fabrication, and packaging techniques have been common in recent decades, driven by the need for performance improvement.

Market Segmentation

Our in-depth analysis of the global pressure sensor market includes the following segments product type and application type.

- Based on the product type, the market is sub-segmented into MEMS pressure sensors, pressure transducers/transmitters, and others (piezoelectric pressure sensors, optical pressure sensors, resonant pressure sensors, electromagnetic pressure sensors, and capacitive pressure sensors).

- Based on application type, the market is sub-segmented into consumer electronics, automotive, medical, industrial, energy &utilities, aerospace &defense, and others (marine, wastewater treatment, and management, infrastructure (smart city), and mining).

MEMS Pressure Sensor is Projected to Emerge as the Largest Segment

Based on the product type, the global pressure sensor market is sub-segmented into MEMS pressure sensors, pressure transducers/transmitters, and others (piezoelectric pressure sensors, optical pressure sensors, resonant pressure sensors, electromagnetic pressure sensors, and capacitive pressure sensors). Among these MEMS pressure sensor sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing use of MEMS pressure in various applications. MEMS pressure sensors are commonly used in automotive electronics, biomedicine, and other fields. For instance, in January 2024, Bosch introduced the smallest MEMS accelerometers for wearables and wearables. BMA530 tracks activities with its step counter and is especially suitable for wearables, and BMA580 targets wearables with voice activity detection. Bosch's current generation accelerometer (BMA253), the BMA530, and BMA580 have a 76.0% smaller footprint and have been reduced in height from 0.95 mm to 0.55 mm.

Industrial Sub-segment to Hold a Considerable Market Share

Based on application type, the global pressure sensor market is sub-segmented into consumer electronics, automotive, medical, industrial, energy and utilities, aerospace and defense, and others (marine, wastewater treatment, and management, infrastructure (smart city), and mining). Among these, the industrial sub-segment is expected to hold a considerable share of the market.Pressure sensors are increasingly used in manufacturing industrial applications to regulate critical processes and quality control roles in 3D printing, air quality testing, automated testing systems, chemical monitoring, leak testing, nuclear power monitoring, pneumatic system monitoring, water quality testing, and others. The increasing demand for MEMS pressure sensors continues to increase based on the need for more tightly controlled processes with their associated quality control requirements in the industrial sector. The key market players offering products in industrial pressure sensors include All Sensor Corp., Honeywell International Inc., Kistler Group, AVL Group, Omni Instruments, and others. For instance, Honeywell International Inc. offers industrial pressure sensors SPT Series designed for pressure applications that involve measurement of hostile media in harsh environments used in a wide variety of pressure sensing applications where corrosive liquids and gases testing are monitored.

Regional Outlook

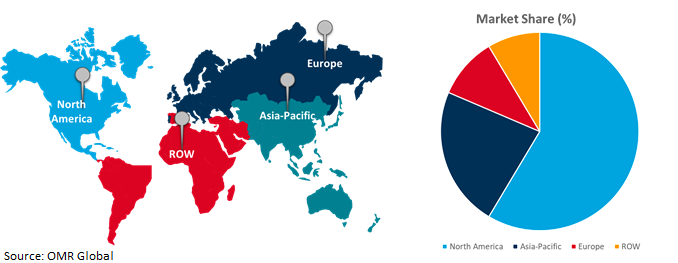

Global pressure sensor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Pressure Sensors in Asia-Pacific

- The adoption of piezoresistive pressure sensors in cars and passenger vehicles is increasing, for improved safety and emissions. Piezoresistive pressure sensors are reliable, fast to respond, and have a high frequency of operation, they are employed in many industrial and aeronautical applications in the region.

- The demand for pressure sensors in the region is being driven by the rising demand for consumer electronics like tablets, wearables, and smartphones in emerging countries such as,China, India, and South Korea.

Global Pressure Sensor Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of numerous prominent software technology companies and pressure sensorproviders in the region. The growth is mainly attributed to the growing adoption of precise pressure sensors and integrated digital communication capabilities in the region. Various pressure sensor offers precise monitoring capabilities and embrace the digitalization trends aligned with industry 4.0, providing an opportunity to improve combustion system performance and transform the operational dynamics for OEMs, end users, and system integrators. For instance, in June 2023, Honeywell introducedthe DG Smart Sensor, an innovative solution for optimizing combustion systems. The pressure transmitter is equipped with 4-20mA NAMUR Analog output and MODBUS TCP digital communication and is up to SIL3 capable via Safety Communication protocol.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global pressure sensormarket include Honeywell International, Inc., NXP Semiconductors N.V., Schneider Electric SE, STMicroelectronics N.V., and TE Connectivity Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2021, TWTG and Badotherm collaborated on LoRaWAN pressure sensor development.

Recent Development

- In April 2023, TDK Corp., invested in increased production capacity for TMR magnetic pressure sensors. The resulting expansion of production volume increases the output of sensor units by approx. two times. The new investment significantly increases the production capacity of TDK’s TMR magnetic sensors in response to growing demand from the automotive, consumer, and industrial sectors.

- In May 2022, Continental introduced new sensors to protect the battery of electrified vehicles. Continental has developed a pressure-sensor-based battery impact detection solution to make lightweight underfloor protection feasible. The system detects and classifies underfloor impact events to alert the driver if the battery integrity may have been breached.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pressure sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Honeywell International, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NXP Semiconductors N.V.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schneider Electric

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. STMicroelectronics International N.V.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TE Connectivity Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pressure Sensor Market by Product Type

4.1.1. MEMS Pressure Sensor

4.1.2. Pressure Transducer/Transmitter

4.1.3. Other (Piezoelectric Pressure Sensors, Optical Pressure Sensors, Resonant Pressure Sensors, Electromagnetic Pressure Sensors and Capacitive Pressure Sensors)

4.2. Global Pressure Sensor Market by Application

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Medical

4.2.4. Industrial

4.2.5. Energy and Utilities

4.2.6. Aerospace and defense

4.2.7. Others (Marine, Waste Water Treatment and Management, Infrastructure (Smart City) and Mining)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alps Alpine Co., Ltd.

6.2. Amphenol Advanced Sensors

6.3. Amphenol All Sensors Corp.

6.4. Emerson Electric Co.

6.5. Endress+Hauser Infoserve GmbH+Co. KG

6.6. Infineon Technologies AG

6.7. KELLER Druckmesstechnik AG

6.8. Kistler Group

6.9. Marquardt Management SE

6.10. MICRO SENSOR CO., LTD

6.11. Nidec Corp.

6.12. OMRON Corp.

6.13. Rockwell Automation, Inc.

6.14. Seed Technology Co., Ltd.

6.15. Sensata Technologies, Inc.

6.16. Sensirion AG

6.17. Siemens AG

6.18. TDK Corp.

6.19. Top Sensor Technology Co.,Ltd

6.20. TT Electronics

1. GLOBAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE,2023-2031 ($ MILLION)

2. GLOBAL MEMS PRESSURE SENSORMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PRESSURE TRANSDUCER/TRANSMITTER SENSORMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHER PRESSURE SENSORMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

6. GLOBAL PRESSURE SENSOR FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PRESSURE SENSOR FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PRESSURE SENSOR FOR MEDICALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PRESSURE SENSOR FOR INDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PRESSURE SENSOR FOR ENERGY AND UTILITIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PRESSURE SENSOR FOR AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PRESSURE SENSOR FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE,2023-2031 ($ MILLION)

16. NORTH AMERICAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

17. EUROPEAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE,2023-2031 ($ MILLION)

19. EUROPEAN PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

20. ASIA-PACIFIC PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICPRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE,2023-2031 ($ MILLION)

22. ASIA-PACIFICPRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

23. REST OF THE WORLD PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

1. GLOBAL PRESSURE SENSOR MARKET SHARE BY PRODUCT TYPE,2023 VS 2031 (%)

2. GLOBAL MEMS PRESSURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PRESSURE TRANSDUCER/TRANSMITTER SENSORMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER PRODUCT TYPE PRESSURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PRESSURE SENSORMARKET SHAREBY APPLICATION,2023 VS 2031 (%)

6. GLOBAL PRESSURE SENSOR FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PRESSURE SENSOR FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PRESSURE SENSOR FOR MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PRESSURE SENSOR FOR INDUSTRIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PRESSURE SENSOR FOR ENERGY AND UTILITIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PRESSURE SENSOR FOR AEROSPACE AND DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PRESSURE SENSOR FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PRESSURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

16. UK PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC PRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICAPRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICAPRESSURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)