Printed and Chipless RFID Market

Global Printed and Chipless RFID Market Size, Share & Trends Analysis Report by Type (RFID Tag, RFID Readers, and RFID Middleware), By End-User Industry (Retail, Transportation & Logistics, Healthcare, BFSI, and others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global printed and chipless RFID market is estimated to grow at a significant CAGR of 27.5% during the forecast period. The major factor that is contributing to the growth of the market including the growing demand for various industry such as retail, transportation and others. RFID enables wireless data collection by readers from electronic tags attached to or embedded in objects, for identification and other purposes. RFID systems include software, network and database components that allow information to flow from tags to the organization’s information infrastructure where it is processed and stored, and systems are application-specific. Technological developments are focusing on increasing real-time information of business processes, improved business performance and improved security and privacy that further provide ample opportunity to the market.

Segmental Outlook

The global printed and chipless RFID market is classified on the basis of type and end-user industry. Based on type the market is classified into RFID tag, RFID readers, and RFID middleware. The RFID tag segment is projected to have significant growth in the market owing to the increasing demand RFID tags due to its availability in affordable cost. On the basis of end-user industry, the market is segregated into retail, transportation and logistics, healthcare, BFSI, and others (Aviation). The transportation & logistics segment is projected to have a significant growth in the printed and chipless RFID industry due to the high application of RFID readers and tags for logistics services.

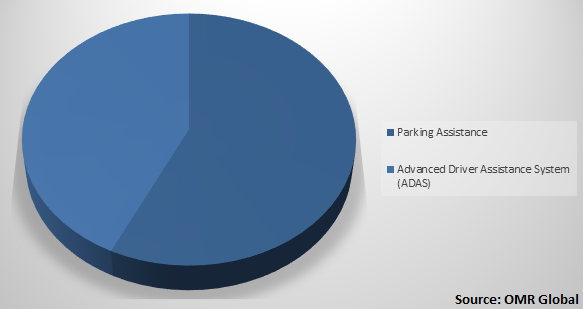

Global Printed and Chipless RFID Market Share by Application, 2018(%)

Global Printed and Chipless RFID market to be driven by the ADAS application

The ADAS application segment is projected to have significant growth in the global market during the forecast period owing to the increasing demand for ADAS in the automotive industry. With the incorporation of AI in automotive, self-driving or autonomous technology have advanced seemingly well. For instance, VisLab Intercontinental Autonomous Challenge, a 13,000 km trip for nearly three months that took place from Italy to China, is regarded as one of the major competitions which led to enhancement in the testing of self-driven vehicles which consequently assisted the market. the majority of the car manufacturing companies such as Audi, BMW are actively adopting AI in their autonomous driving efforts to keep up with the on-going trends. For instance, Audi is testing an AI-based system that employs smart cameras with image recognition software to test and identify tiny cracks in sheet metal that further augment the Printed and Chipless RFID market.

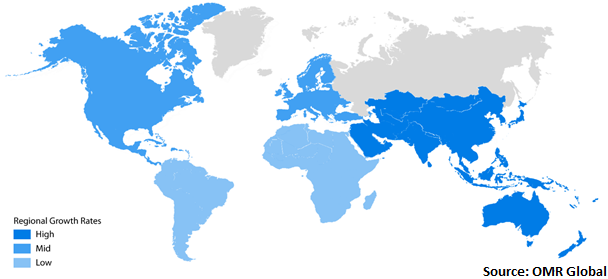

Regional Outlook

Geographically, the global Printed and Chipless RFID market is further classified into North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific is estimated to have a considerable share in the global market due to the increasing adoption of advanced electronics components such as a digital camera in the automotive sector, growing preference towards safety vehicles in the region.

Global Printed and Chipless RFID Market Growth, by Region 2019-2025

North America has a considerable share in the global Printed and Chipless RFID market

Geographically, North America is projected to have a significant market share in the global market due to the strict guidelines of safety in the vehicles and the growing adoption of autonomous cars in the region. Further, national initiatives to promote self-driven cars are driving the demand for advanced camera technologies automotive. The US has developed a number of smart car-related policies to promote the integration of intelligent vehicles and existing transportation systems. For instance, the US Transportation Secretary announced that they will render the test and application of automated driving in the capital and give $4 billion support in the next 10 years. At the same time, they will exempt the entire automotive industry, 2500 intelligent vehicles that comply with the relevant provisions of the existing traffic safety within two years.

Market Players Outlook

The key players in the Printed and Chipless RFID market contributing significantly by providing advanced technology-based products and increasing their geographical presence across the globe. The key players in the market include Aptiv PLC, Continental AG, DENSO Corp., Intel Corp. (MobileEye), Robert Bosch GmbH, Ambarella Inc., Clarion Co., Ltd, FICOSA Group, FLIR Systems, Inc., Hitachi, Ltd., OmniVision Technologies, Inc., Samsung Electronics Co., Ltd., among others. These market players adopt various strategies such as government contracts, product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in June 2019, Hitachi, Ltd. announced the collaboration with Suzuki Motor Corp. to provide its stereo camera for Suzuki’s EVERY light commercial vehicle and Every WAGON light passenger vehicle. With this contract, the company will enable to increase their revenue and sustain a significant position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Printed and Chipless RFID market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. 3M Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Alien Technology LLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Avery Dennison Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Honeywell International Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. NXP Semiconductors N.V.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Printed and Chipless RFID Market by Type

5.1.1. RFID Tag

5.1.2. RFID Readers

5.1.3. RFID Middleware

5.2. Global Printed and Chipless RFID Market by End-User Industry

5.2.1. Retail

5.2.2. Transportation and Logistics

5.2.3. Healthcare

5.2.4. BFSI

5.2.5. Others (Aviation)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Alien Technology LLC

7.3. Avery Dennison Corp.

7.4. Confidex Ltd.

7.5. Dai Nippon Printing Co., Ltd.

7.6. Honeywell International Inc.

7.7. iDTRONIC GmbH

7.8. Impinj, Inc.

7.9. Invengo Technology Pte. Ltd.

7.10. Molex, LLC

7.11. NXP Semiconductors N.V.

7.12. PolyIC GmbH & Co. KG

7.13. Siemens AG

7.14. Smartrac N.V.

7.15. Toppan Forms Co., Ltd.

7.16. Variuscard GmbH

7.17. VTT Technical Research Centre of Finland Ltd.

7.18. Vubiq Networks, Inc.

7.19. Xerox Corp.

7.20. Zebra Technologies Corp.

1. GLOBAL PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL RFID TAG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL RFID READERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL RFID MIDDLEWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

6. GLOBAL PRINTED AND CHIPLESS RFID IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PRINTED AND CHIPLESS RFID IN TRANSPORTATION AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL PRINTED AND CHIPLESS RFID IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PRINTED AND CHIPLESS RFID IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PRINTED AND CHIPLESS RFID IN OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

15. EUROPEAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

21. REST OF THE WORLD PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD PRINTED AND CHIPLESS RFID MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL PRINTED AND CHIPLESS RFID MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL PRINTED AND CHIPLESS RFID MARKET SHARE BY END-USER INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL PRINTED AND CHIPLESS RFID MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PRINTED AND CHIPLESS RFID MARKET SIZE, 2018-2025 ($ MILLION)