Probiotics Market

Global Probiotics Market Size, Share & Trends Analysis Report, By Ingredient Type (Bacteria and Yeast), By Application (Human Probiotics, Animal Feed Probiotics), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global probiotics market is anticipated to grow at a CAGR of 7.1% during the forecast period. The growing demand for functional food along with the nutrition health benefit offered by probiotics is anticipated to drive the growth of the market. Probiotics are beneficial to avoid/treat mental illness, digestive issues, neurological disorders and makes the immune system strong. Both human and animal probiotics are increasingly adopted across the globe owing to various health benefits and growing productivity in animals. Moreover, the growing demand for dietary supplements and food & beverages coupled with rising concerns regarding consumer health has contributed to the growth of the global probiotics industry.

Probiotics strengthen the immune system and hence prevent various chronic diseases and the cost associated with it. Thus, the increasing awareness regarding healthcare is projected to anticipate the growth of the market. Awareness of preventive healthcare is on rise owing to various factors such as improving the standard of living, rising number of the aging population, and growing disposable income. However, regulations for the use of probiotics in nutricosmetics, nutraceuticals, and dietary supplements are extremely stringent in the US that presents a major challenge, especially for the regional market players. Further, the complex testing methods and selection criteria during the production process may hamper the growth of the probiotics industry.

Segmental outlook

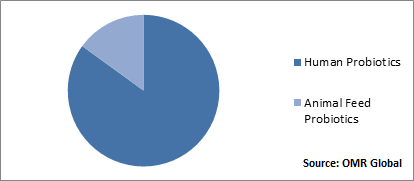

The global probiotics market is segmented on the basis of ingredient type and application. Based on ingredient type, the market is segmented into bacteria and yeast. The probiotics bacteria further include lactobacilli, Bifidobacterium, and streptococcus; while yeast includes Saccharomyces and Boulardii. Most of the probiotics are bacteria, specifically lactobacillus or lactic acid bacteria. These are primarily used in fermented food such as sauerkraut, kefir, yogurt, and kimchi. Bacterial probiotics are also used in dietary supplements. Further, on the basis of application, the market is bifurcated into human probiotics (food & beverages and dietary food supplements), and animal feed probiotics.

Global Probiotics Market Share by Application, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global probiotics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Danone SA

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Nestle SA

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Yakult Honsha Co. Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Chr. Hansen Holding A/S

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. BioGaia AB

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Probiotics Market by Ingredient Type

5.1.1. Bacteria

5.1.2. Yeast

5.2. Global Probiotics Market by Application

5.2.1. Human Probiotics

5.2.1.1. Probiotics Food & Beverages

5.2.1.2. Probiotics Dietary Supplements

5.2.2. Animal Feed Probiotics

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland Co.

7.2. Arla Foods

7.3. Bifodan A/S

7.4. Biogaia AB

7.5. Chr. Hansen Holdings A/S

7.6. Danone SA

7.7. Danisco A/S (A DuPont Company)

7.8. glac Biotech Group

7.9. Kerry Group PLC

7.10. Lallemand Inc.

7.11. Lifeway Foods Inc.

7.12. Morinaga Milk Industry Co., Ltd.

7.13. Nestle S.A.

7.14. Probi AB

7.15. UAS Laboratories LLC

7.16. Yakult Honsha Co. ltd.

1. GLOBAL PROBIOTICS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BACTERIA PROBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL YEAST PROBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PROBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL HUMAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ANIMAL FEED PROBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PROBIOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2018-2025 ($ MILLION)

10. NORTH AMERICAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

11. EUROPEAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN PROBIOTICS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2018-2025 ($ MILLION)

13. ASIA-PACIFIC PROBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC PROBIOTICS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC PROBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PROBIOTICS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD PROBIOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL PROBIOTICS MARKET SHARE BY INGREDIENT TYPE, 2018 VS 2025 (%)

2. GLOBAL PROBIOTICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL PROBIOTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PROBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)