Process Automation Market

Global Process Automation Market Size, Share & Trends Analysis Report, By Technology (SCADA, HMI, DCS, PLC, ERP, and Others), By Component (Hardware and Software and Services), By End-User Industry (Oil and Gas, Electrical and Electronics, Chemical, Retail, Food and Beverage, Pharmaceutical and Life Sciences, Manufacturing, Automobile, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global process automation market is estimated to grow at a CAGR of nearly 7.5% during the forecast period. The major players contributing to the market growth include rising industrialization and emerging demand for robotic process automation. Growing industrialization has been witnessed in emerging countries owing to the government initiatives to promote the manufacturing sector. In May 2015, the Chinese government introduced Made in China (MIC) 2025 initiative which comprises a range of state-backed programs that aims to accelerate productivity, modernize the Chinese economy, and make innovations in industrial processes. The MIC 2025 plan signifies that the country’s manufacturing sector is large, however, it lacks in quality of industrial infrastructure, innovation capacity, degree of digitalization, and the effectiveness of resource utilization.

Under the plan, the Chinese government seeks to carry out the task of upgrade infrastructure and leverage technological developments. MIC 2025 aims to move China in the manufacturing value chain through smart manufacturing and advanced manufacturing technologies. The increasing focus on advances in process automation is leading to the emerging adoption of process automation technologies to increase productivity and efficiency in the manufacturing sector. Companies associated with the manufacturing sector is significantly implementing robots to conduct everyday production operations in the plant.

Robotic Process Automation (RPA) is software that is combined with business processes to automate some activities, reduce human errors, and accelerate productivity. Audi, a German automaker is focusing on developing software robots to perform monotonous tasks for employees at PC workstations. In the manufacturing plants of Audi, humans and machines have been working together over the years. Now, PC workstations employees are also getting support from robots in the form of a digital assistant referred to as Audi my Mate. The rising integration of human and machine to facilitate production and back-office work is driving the growth of the market. The advent of Industry 4.0 is offering an opportunity for market growth.

Market Segmentation

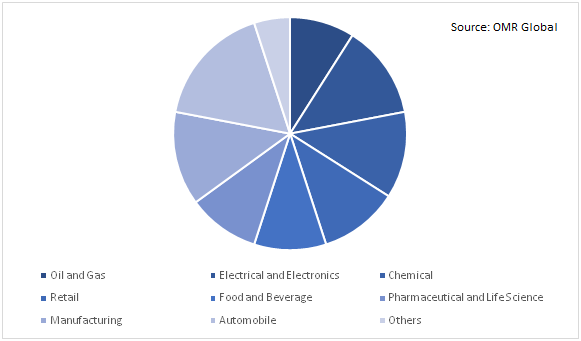

The global process automation market is classified into technology, component, and end-user industry. Based on technology, the market is classified into supervisory control and data acquisition (SCADA), human-machine interface (HMI), distributed control system (DCS), programmable logic controller (PLC), enterprise resource planning (ERP), and others. Based on the component, the market is classified into hardware and software and service. Based on end-user industry, the market is classified into oil and gas, electrical and electronics, chemical, retail, food and beverage, pharmaceutical and life sciences, manufacturing, automobile, and others.

Manufacturing industry is estimated to witness significant growth during the forecast period

Significant rise in paper and pulp and metal industry is expected to contribute significantly to the market growth during the forecast period. the World Steel Association forecasted on its release of Short Range Outlook in April 2019 that the global demand for steel will reach 1,735 million tonnes in 2019, a rise of 1.3% over 2018. This has led owing to the significant demand for steel products in several industries such as automobile, oil and gas, medical device, and construction industry. The rising demand for metal products has led the manufacturers to focus on automation in plants. Quality, economic efficiency, and reliability in the development of steel products can be achieved through automated production facilities.

Process automation technologies can support in several metallurgy applications, including hot and cold rolling, yard to melt shop, processing lines and to market. The use of distributed control system (DCS) enables to meet different customer needs from PLC functionality up to high-end rolling mill controller such as complete process integration, electrical and safety, technological controls, mathematical models and simulation packages, to attain superior results with fewer resources. DCS systems also offer advanced visualization and diagnostics to look for the complex needs in metals applications. This allows operators to access real-time data that supports faster decision-making and strategic action.

Global Process Automation Market Share by End-User Industry, 2019 (%)

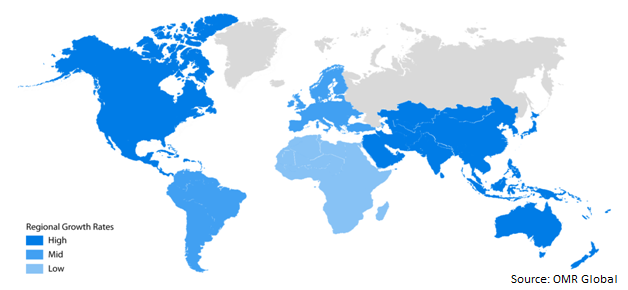

Regional Outlook

The global process automation market is segmented based on regions including North America, Europe, Asia-Pacific and Rest of the World (RoW). North America is expected to hold a significant share in the market owing to the considerable automation across the industries and the presence of major retailers, such as Walmart, Amazon, and Kroger in the region. These companies are expanding the use of robots to handle several repetitive tasks at stores. Walmart is using robots to perform functions including checking inventory, maintenance of the store, sorting products and meeting online orders, allowing store associates to spend more time to serve the customers on the sales floor. This, in turn, is contributing to the market growth in the region.

Global Process Automation Market Growth, by Region 2019-2025

Market Players Outlook

Some crucial players operating in the market include ABB Ltd., Dassault Systemes SE, Eaton Corp. plc, Emerson Electric Co., and Honeywell International Inc. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance,in February 2019, Emerson Electric Co. completed the acquisition of intelligent platforms from General Electric Co. with the addition of Intelligent Platforms PLC technologies will enable Emerson to augment its capabilities in machine control and discrete applications. With this expansion, Emerson is increasing opportunities across hybrid markets including food and beverage, metals and mining, packaging, and life sciences, as well as process and discrete industries.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global process automation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Dassault Systèmes SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Eaton Corp. plc

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Emerson Electric Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Honeywell International Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Process Automation Market by Technology

5.1.1. Supervisory Control and Data Acquisition (SCADA)

5.1.2. Human Machine Interface (HMI)

5.1.3. Distributed Control System (DCS)

5.1.4. Programmable Logic Controller (PLC)

5.1.5. Enterprise Resource Planning (ERP)

5.1.6. Others

5.2. Global Process Automation Market by Component

5.2.1. Hardware

5.2.2. Software and Services

5.3. Global Process Automation Market by End-User Industry

5.3.1. Oil and Gas

5.3.2. Electrical and Electronics

5.3.3. Chemical

5.3.4. Retail

5.3.5. Food and Beverage

5.3.6. Pharmaceutical and Life Science

5.3.7. Manufacturing (Metal and Paper and Pulp)

5.3.8. Automobile

5.3.9. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Advantech Co., Ltd.

7.3. Danaher Corp.

7.4. Dassault Systèmes SE

7.5. Eaton Corp. plc

7.6. Emerson Electric Co.

7.7. Honeywell International Inc.

7.8. Johnson Controls, Inc.

7.9. Mitsubishi Corporation (MC)

7.10. Omron Corp.

7.11. Phoenix Contact

7.12. Robert Bosch GmbH

7.13. Rockwell Automation, Inc.

7.14. Schneider Electric SE

7.15. Siemens AG

7.16. Tata Consultancy Services Ltd. (TCS)

7.17. Teledyne Technologies Inc.

7.18. Texas Instruments, Inc.

7.19. Toshiba International Corp.

7.20. Yokogawa Electric Corp.

7.21. Microsoft Corp.

1. GLOBAL PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

2. GLOBAL SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL DISTRIBUTED CONTROL SYSTEM (DCS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL PROGRAMMABLE LOGIC CONTROLLER (PLC) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ENTERPRISE RESOURCE PLANNING (ERP) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER PROCESS AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

9. GLOBAL PROCESS AUTOMATION HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PROCESS AUTOMATION SOFTWARE AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

12. GLOBAL PROCESS AUTOMATION IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL PROCESS AUTOMATION IN ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL PROCESS AUTOMATION IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL PROCESS AUTOMATION IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL PROCESS AUTOMATION IN FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL PROCESS AUTOMATION IN PHARMACEUTICAL AND LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL PROCESS AUTOMATION IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL PROCESS AUTOMATION IN AUTOMOBILE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

20. GLOBAL PROCESS AUTOMATION IN OTHER END-USER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

21. GLOBAL PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. NORTH AMERICAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

24. NORTH AMERICAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

25. NORTH AMERICAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

26. EUROPEAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

27. EUROPEAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

28. EUROPEAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

29. EUROPEAN PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

34. REST OF THE WORLD PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

35. REST OF THE WORLD PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

36. REST OF THE WORLD PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL PROCESS AUTOMATION MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

2. GLOBAL PROCESS AUTOMATION MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

3. GLOBAL PROCESS AUTOMATION MARKET SHARE BY END-USER INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL PROCESS AUTOMATION MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

7. UK PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD PROCESS AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)