Process Gas Compressors Market

Global Process Gas Compressors Market Size, Share & Trends Analysis Report by Type (Centrifugal Gas Compressors, Reciprocating Gas Compressors, Screw Gas Compressors, and Others) and by End-Use Industry (Oil & Gas, Refinery Services, Petrochemical and Chemical Industry, Polyolefin Plants, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global process gas compressors market is growing at a significant CAGR of around 3.4% during the forecast period (2020-2026). The market is driven by the rising demand for energy-efficient gas compressors and increasing concerns towards industrial safety. Process gas compressors are primarily used to overcome the major challenge of the industry that is regular maintenance which results in a loss in operating hours of the manufacturing units. As per the US Department of Energy, 30% to 50% of compressed air power is lost during operation due to poor maintenance, inefficient energy uses, poor system design and others. Due to this, the demand for energy-efficient and less maintenance compressors always remain in the manufacturing industries.

Moreover, the increasing liquefaction capacity of gas, increasing energy demand especially for CNG and rapid industrialization in emerging economies are further offering growth to the process gas compressors market. The process gas compressors market comprises a widespread application in various industry, such as including oil and gas sector, chemical, manufacturing, and liquefaction of gases, among others. However, the challenges in the maintenance of process gas compressors will affect the market growth during the forecast period.

Segmental Outlook

The process gas compressors market is classified on the basis of type and end-use industry. Based on type, the market is segmented into centrifugal gas compressors, reciprocating gas compressors, screw gas compressors, and others. Based on end-use industry, the market is segregated into oil & gas, refinery services, petrochemical and chemical industry, polyolefin plants, and others.

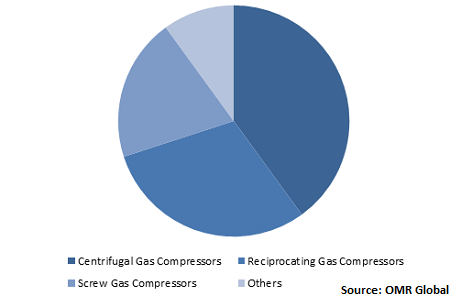

Global Process Gas Compressors Market Share by Type, 2019 (%)

Global process gas compressors market is driven by centrifugal gas compressors

Centrifugal gas compressors contribute significant share in the process gas compressors market. The growing application in chemical plants, refineries, onshore and offshore gas lift, and gas injection applications, gas gathering, and in the transmission and storage of natural gas is contributing to the market for the centrifugal gas compressors. In the gas and oil applications, multi-stage is applied, while single stage is implemented in low pressure to aid in the specific pressure requirement. Also, these are suitable for oil free projects as there is no related oil-lubrication and no gearbox. In addition, these types of compressors have fewer rubbing parts hence less friction and greater efficiency & energy efficiency. A high flow rate can be obtained in the centrifugal compressor and a variety of rotational speed can be obtained. These features of centrifugal gas compressors contribute its increasing demand across end-use industries, such as oil & gas industry.

Regional Outlook

The global process gas compressors market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is expected to project a considerable CAGR in the global process gas compressors market during the forecast period. The US plays the critical role in geographic contribution of North America in global process gas compressors market. High usages of the energy-efficient compressor, increased production of shell gas in the US are some of the major providing growth to the market in the region. The US has witnessed a steep increase in its natural gas production in 2018. According to the BP PLC, the country has reported an increase of 11.5% in its natural gas production over the 2017-2018 period. In 2015, the US natural gas production was 636.5 Mtoe which increased to 715.2 Mtoe in 2018 and is further estimated to escalate in the near future. The surge in natural gas production of the country reflects potential growth opportunities for the process gas compressors market.

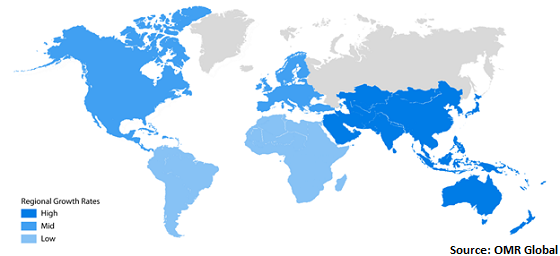

Global Process Gas Compressors Market Growth, by Region 2020-2026

Asia-Pacific contributes significantly in the global process gas compressors market

Asia-Pacific holds a significant share in the global process gas compressors market. Japan, Australia, South Korea, and Taiwan are the key regions that are growing at a significant rate owing to the growing gas production in the region coupled with the growing industrialization. According to the BP PLC, the natural gas production in Asia-Pacific stood at 481.5 Mtoe (millions of tonnes oil equivalent) in 2015 which substantially increased to 543.2 million tonnes oil equivalent Mtoe in 2018, accounting for an increase of around 12.8% over the period 2015-2018. The increasing natural gas production across economies of the region is among the key factors to promote the market growth in the region.

Moreover, the major factors that drive the growth of the process gas compressor market in China include the rapid industrialization in the country and substantial rise in the manufacturing sector in the country. Announced in 2015, the “Made in China 2025” is one of the ambitious projects aimed at increasing the competitiveness of Chinese manufacturing industries including electronics, chemical, automotive, and so on. As per Chinese media, this initiative was aimed to transform China from a manufacturing giant to global manufacturing power by 2049. For instance, the government of the country plans to achieve 40% of domestically manufactured basic components and basic materials by 2020 and 70% by 2025.The process gas compressors have wide utilities in manufacturing facilities, therefore, the presence of a large manufacturing industrial base in the country will create significant demand for energy efficient process gas compressors within the country.

Market Players Outlook

The key players in the process gas compressors market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global process gas compressors market include Burckhardt Compression AG, General Electric Co., Siemens AG, Atlas Copco Group, and Ingersoll-Rand PLC. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global process gas compressors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Burckhardt Compression AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Atlas Copco Group

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Ingersoll-Rand PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Process Gas Compressor Market by Type

5.1.1. Centrifugal Gas Compressors

5.1.2. Reciprocating Gas Compressors

5.1.3. Screw Gas Compressors

5.1.4. Others (Standard Screw Air Compressor)

5.2. Global Process Gas Compressor Market by End-Use Industry

5.2.1. Oil & Gas

5.2.2. Refinery Services

5.2.3. Petrochemical and Chemical Industry

5.2.4. Polyolefin Plants

5.2.5. Others (Hydrotreatment)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aerzener Maschinenfabrik GmbH

7.2. Ariel Corp.

7.3. Atlas Copco Group

7.4. BAUER COMPRESSORS INC.

7.5. BORSIG GmbH

7.6. Burckhardt Compression AG

7.7. Corken, Inc.

7.8. Ecolab Inc.

7.9. General Electric Co.

7.10. IHI Rotating Machinery Engineering Co., Ltd.

7.11. Ingersoll-Rand PLC

7.12. Jereh Oil & Gas Engineering Corp.

7.13. Kirloskar Brothers Ltd.

7.14. KOBE STEEL, LTD.

7.15. MAN Energy Solutions SE

7.16. NEUMAN & ESSER GROUP

7.17. Pneumofore S.p.A.

7.18. SIAD Macchine Impianti S.p.A.

7.19. Siemens AG

7.20. Sundyne

1. GLOBAL PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CENTRIFUGAL GAS COMPRESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL RECIPROCATING GAS COMPRESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SCREW GAS COMPRESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER GAS COMPRESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

7. GLOBAL PROCESS GAS COMPRESSOR IN OIL & GAS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PROCESS GAS COMPRESSOR IN PETROCHEMICAL/CHEMICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL PROCESS GAS COMPRESSOR IN REFINERY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PROCESS GAS COMPRESSOR IN POLYOLEFIN INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PROCESS GAS COMPRESSOR IN OTHER END-USE INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

16. EUROPEAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

22. REST OF THE WORLD PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD PROCESS GAS COMPRESSOR MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL PROCESS GAS COMPRESSOR MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL PROCESS GAS COMPRESSOR MARKET SHARE BY END-USE INDUSTRY, 2019 VS 2026 (%)

3. GLOBAL PROCESS GAS COMPRESSOR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

6. UK PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD PROCESS GAS COMPRESSOR MARKET SIZE, 2019-2026 ($ MILLION)