Protein Chip Market

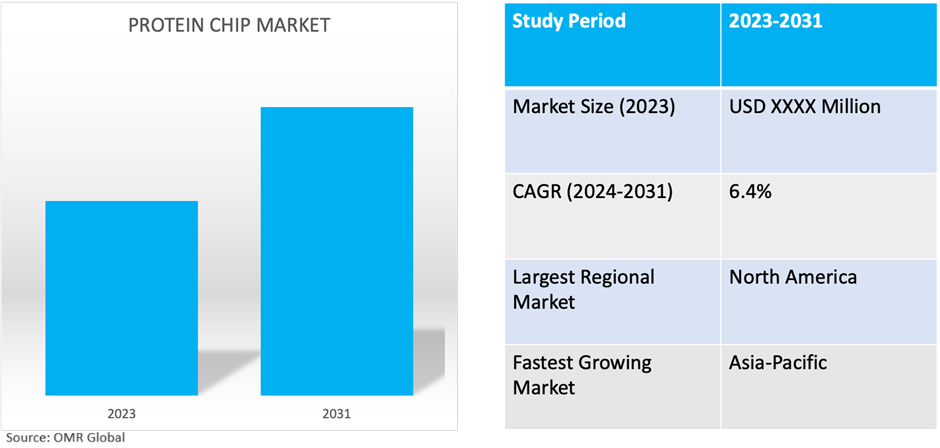

Protein Chip Market Size, Share & Trends Analysis Report by Type (Analytical Microarrays, Functional Protein Microarrays, and Reverse Phase Protein Microarrays), by Application (Antibody Characterization, Clinical Diagnostics, and Proteomics), and by End-Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories and Hospitals & Clinics), Forecast Period (2024-2031)

Protein chip market is anticipated to grow at a CAGR of 6.4% during the forecast period (2024-2031). Protein chip, also known as a protein microarray, is a high-throughput technology used in proteomics for the parallel detection and quantification of multiple proteins in a single experiment. It consists of a solid surface, typically a glass slide or a silicon chip, onto which specific capture molecules such as antibodies, peptides, or proteins are immobilized in an array format. Major factors supporting the protein microarray market growth are the increasing demand for personalized medicine and precision diagnostics, technological investments, and innovations.

Market Dynamics

Advancements in Protein Chip Technology: Revolutionizing Proteomics and Diagnostics

Technological advancements in protein chip technology have revolutionized the field of proteomics research and clinical diagnostics. These advancements encompass improvements in microarray fabrication, surface chemistry, and detection methods, leading to enhanced sensitivity, specificity, and multiplexing capabilities of protein chips. Advanced protein chip platforms enable the simultaneous analysis of thousands of proteins from complex biological samples, facilitating biomarker discovery, drug target identification, and pathway analysis with unprecedented speed and accuracy. These technological innovations drive the development of novel protein chip assays tailored for various research and clinical applications, fueling the growth of the global protein chip market. For instance, in December 2023, Theralink Technologies announced groundbreaking research conducted in collaboration with George Mason University and the University of California, San Francisco. Through the ISPY-2 trial, tumors from over 700 breast cancer patients were evaluated using Reverse Phase Protein Array (RPPA), uncovering novel therapeutic avenues for challenging breast cancers.

The Role of Protein Chips in Personalized Healthcare

Growing demand for personalized medicine is a significant driver shaping the trajectory of the global protein chip market. Personalized medicine aims to provide tailored therapeutic interventions based on individual patient characteristics, including genetic makeup, proteomic profile, and environmental factors. Protein chips play a crucial role in personalized medicine by enabling the identification of disease biomarkers, molecular signatures, and treatment responses at the molecular level. By analyzing protein expression patterns and signaling pathways in patient samples, protein chips empower clinicians to make informed decisions regarding patient care, treatment selection, and disease management strategies. As personalized medicine gains prominence in healthcare, the demand for protein chips as essential tools for molecular profiling and precision diagnostics continues to grow, driving market expansion and diversification of product offerings.

Market Segmentation

- Based on type, the market is segmented into analytical microarrays, functional protein microarrays, and reverse-phase protein microarrays.

- Based on application, the market is segmented into antibody characterization, clinical diagnostics, and proteomics.

- Based on end-use, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and hospitals & clinics.

Functional Protein Microarrays is Projected to Emerge as the Largest Segment

The functional protein microarrays segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its versatility and utility in high-throughput protein analysis. Functional protein microarrays enable the simultaneous screening of thousands of protein interactions, protein-protein binding events, enzyme activities, and post-translational modifications in a single experiment. This high-throughput capability accelerates the discovery of novel protein functions, biomarkers, drug targets, and therapeutic compounds, facilitating advancements in basic research, drug development, and clinical diagnostics.

Clinical Diagnostics Segment to Hold a Considerable Market Share

The clinical diagnostics segment holds a considerable market share due to its critical role in advancing personalized medicine and precision diagnostics. Protein chips are increasingly utilized in clinical settings for the rapid and accurate detection of various diseases, including cancer, cardiovascular disorders, infectious diseases, and neurological conditions. By analyzing protein expression patterns and identifying disease-specific biomarkers, protein chips enable clinicians to diagnose diseases at early stages, predict treatment responses, and monitor disease progression with high sensitivity and specificity. For instance, in November 2023, Octave Bioscience, Inc. secured a $10.0 million grant from The Michael J. Fox Foundation to develop a multi-analyte protein biomarker test for Parkinson's disease, aiming to improve disease assessment.

Regional Outlook

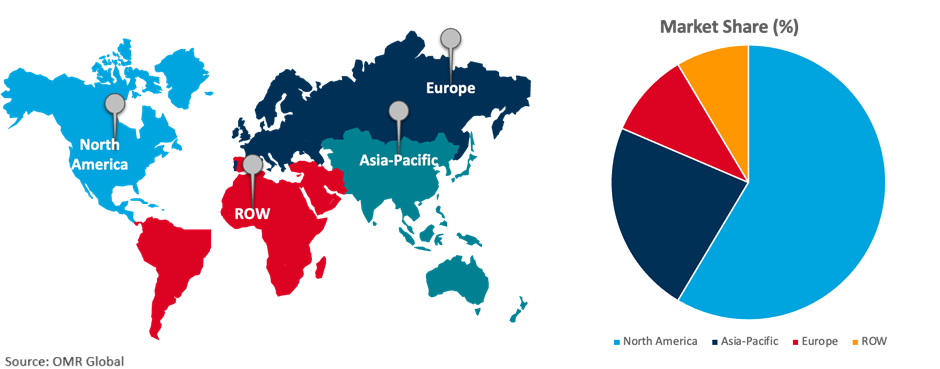

The global protein chip market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Empowering Precision Healthcare: Asia-Pacific's Rise in the Protein Chip Market

Asia-Pacific emerges as the fastest-growing market in the global protein chip sector due to several key drivers. The region's significant investments in healthcare infrastructure and research capabilities, propelled by economic expansion and government initiatives, foster the adoption of advanced technologies like protein chips. With a large and diverse population, including many affected by chronic and infectious diseases, Asia-Pacific offers a substantial market for protein-based diagnostic solutions, fueling demand for protein chips. Moreover, the region's increasing focus on precision medicine and personalized healthcare, coupled with collaborations between local and international players, further propels market growth. For instance, in February 2023, Sengenics introduced KREXTM technology to address challenges in efficiently producing fully functional proteins for clinical diagnostics, vaccine development, and drug discovery. Utilizing Biotin Carboxyl Carrier Protein (BCCP), this innovation enhances protein folding and solubility, enabling high-throughput expression of correctly folded proteins. Technology facilitates the simultaneous evaluation of numerous mutant proteins, offering insights into potential therapeutic interventions.

Global Protein Chip Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its robust healthcare infrastructure, research ecosystem, and leading pharmaceutical companies drive substantial demand for protein chips in applications like drug discovery and personalized medicine. Additionally, the region's emphasis on healthcare innovation and technological advancement, coupled with favorable government initiatives and funding support, further propels the market growth. With a large patient population, particularly those with chronic diseases, North America presents significant opportunities for protein-based diagnostic solutions. For instance, in January 2024, Agilent Technologies unveiled the ProteoAnalyzer system, an innovative automated parallel capillary electrophoresis system designed for protein analysis. This platform enhances efficiency and simplifies the analysis of complex protein mixtures, benefiting various sectors including pharmaceuticals, biotechnology, and academic research.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global protein chip market include Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd., and Randox Laboratories Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2022, Illumina collaborated with SomaLogic to integrate the SomaScan Proteomics Assay into Illumina's high-throughput next-generation sequencing (NGS) platforms. This partnership aims to cater to the rapidly expanding high-throughput proteomics market, facilitating significant scientific discoveries within the research community.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global protein chip market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Agilent Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bio-Rad Laboratories, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thermo Fisher Scientific Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Protein Chip Market by Type

4.1.1. Analytical Microarrays

4.1.2. Functional Protein Microarrays

4.1.3. Reverse Phase Protein Microarrays

4.2. Global Protein Chip Market by Application

4.2.1. Antibody Characterization

4.2.2. Clinical Diagnostics

4.2.3. Proteomics

4.3. Global Protein Chip Market by End-Use

4.3.1. Pharmaceutical & Biotechnology Companies

4.3.2. Academic & Research Institutes

4.3.3. Diagnostic Laboratories

4.3.4. Hospitals & Clinics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Arrayit Corporation

6.2. Biotech Support Group

6.3. Bruker

6.4. CapitalBio Technology Co, Ltd.

6.5. CDI Laboratories Inc.

6.6. Full Moon BioSystems Inc.

6.7. GE Healthcare

6.8. Gyros Protein Technologies

6.9. HORIBA, Ltd.

6.10. Illumina Inc.

6.11. Innopsys Inc.

6.12. Merck KGaA

6.13. OriGene Technologies Inc.

6.14. PerkinElmer

6.15. Randox Laboratories Ltd.

6.16. RayBiotech, Inc.

6.17. Sengenics Corporation LLC

6.18. Shimadzu Scientific Instruments

6.19. Surmodics Inc.

1. GLOBAL PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ANALYTICAL MICROARRAYS PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FUNCTIONAL PROTEIN MICROARRAYS PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL REVERSE PHASE PROTEIN MICROARRAYS PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL PROTEIN CHIP FOR ANTIBODY CHARACTERIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PROTEIN CHIP FOR CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PROTEIN CHIP FOR PROTEOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

10. GLOBAL PROTEIN CHIP IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PROTEIN CHIP IN ACADEMIC & RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PROTEIN CHIP IN DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PROTEIN CHIP IN HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. EUROPEAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD PROTEIN CHIP MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL PROTEIN CHIP MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ANALYTICAL MICROARRAYS PROTEIN CHIP MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FUNCTIONAL PROTEIN MICROARRAYS PROTEIN CHIP MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL REVERSE PHASE PROTEIN MICROARRAYS PROTEIN CHIP MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PROTEIN CHIP MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL PROTEIN CHIP FOR ANTIBODY CHARACTERIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PROTEIN CHIP FOR CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PROTEIN CHIP FOR PROTEOMICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PROTEIN CHIP MARKET SHARE BY END-USE, 2023 VS 2031 (%)

10. GLOBAL PROTEIN CHIP IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PROTEIN CHIP IN ACADEMIC & RESEARCH INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PROTEIN CHIP IN DIAGNOSTIC LABORATORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PROTEIN CHIP IN HOSPITALS & CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL PROTEIN CHIP MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

17. UK PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA PROTEIN CHIP MARKET SIZE, 2023-2031 ($ MILLION)