Protein Hydrolysate Market

Global Protein Hydrolysate Market Size, Share & Trends Analysis Report, By Source (Plant Protein and Animal Protein), By Form (Dry and Liquid), By Application (Dietary Supplements, Sports Nutrition, Infant Formula, Food and Beverages, Animal Feed, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global protein hydrolysate market is estimated to grow at a CAGR of nearly 6.2% during the forecast period. Rising demand for sports nutrition and increasing demand for dietary supplements are driving the adoption of protein hydrolysate. The sports nutrition products are on the rise with the rising health consciousness in ordinary consumers and have started to integrate sports nutrition products into their everyday diets. In Europe, Germany, Spain, UK, and Italy, buy protein drinks to maintain their diet. This is leading to increasing demand for natural ingredients in the sports sector. The millennial population primarily driving the sports nutrition sector as they are highly aware of the benefits of nutrition for fitness.

Additionally, the increasing number of sports individuals is accelerating the need for sports nutrition products. As per the US Bureau of Labor, during the period, 2003 to 2015, average daily participation rates in sports and exercise increased by 3.6%. Increasing participation of women at sports events have led the demand for sports nutrition products to meet the nutritional needs of athletes, which has a significant impact on their performance. Proteins and amino acids are essential elements of a sports diet. Protein hydrolysate has gained significance in sports nutrition as it enables amino acids to be absorbed by the body more rapidly compared to intact proteins and thereby leveraging delivery of nutrient to muscle tissues.

Ingredia, Inc. offers PRODIET milk protein hydrolysates that are proteins with an optimized nutritional profile. It is highly relevant to sports nutrition for rapid release of amino acids in the blood flow, thereby supporting muscle mass development. Arla Foods offers Lacprodan HYDRO.PowerPro, whey protein hydrolysate, without the bitter taste. With the emerging consumers demand superior tasting functional products, whey protein hydrolysates make it difficult to enter the market as it has a bitter taste. Lacprodan HYDRO.PowerPro enables to serve up rapid-acting protein products with great taste. Whey protein hydrolysates offer the superior benefits of whey in a readily absorbed form that allows muscles rapid access to the amino acids that are the important building blocks of proteins. Therefore, emerging demand for sports nutrition is one of the key factors leveraging the adoption of protein hydrolysate.

Market Segmentation

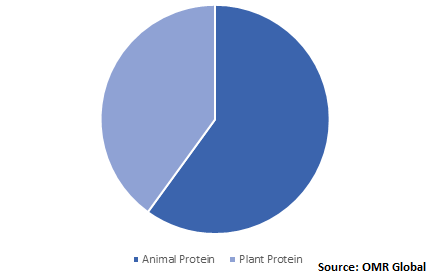

The global protein hydrolysate market is segmented into form, source, and application. Based on the source, the market is classified into plant protein and animal protein. Based on form, the market is classified into dry and liquid. Based on application, the market is classified into dietary supplements, sports nutrition, infant formula, food and beverages, animal feed, and others.

Plant-based Protein Hydrolysate Is Estimated to Witness Potential Growth During the Forecast Period

The rising vegan population is driving the demand for plant-based protein sources. As per the US Department of Agriculture (USDA), in 2017-2018, 15% of the global new product launches of vegan food and beverage witnessed in Germany. Nearly 35% of the German population witnessing the availability of vegan products as very important, and 63% of the country’s population are trying to decrease their consumption of meat. This, in turn, is offering an opportunity for the adoption of plant-based protein hydrolysate that is derived from a comprehensive range of plants, including pea, rice, wheat, soy, and others. It offers all the essential amino acids and supports in lowering the consumption of saturated fat and cholesterol.

Global Protein Hydrolysate Market Share by Source, 2019 (%)

Regional Outlook

Geographically, in 2019, Europe protein hydrolysate market has witnessed potential share owing to the increasing demand for sports nutrition products and significant health awareness regarding the benefits of protein hydrolysate. In addition, the presence of some crucial manufacturers of protein hydrolysate including Arla Foods and Koninklijke DSM N.V. is attributing to the increasing share of protein hydrolysate in the region. Asia-Pacific is estimated to witness potential growth during the forecast period owing to the significant presence of the millennial population and rising demand for infant nutrition in the region. Emerging food and beverage industry have further escalated the adoption of protein hydrolysate in the region.

Global Protein Hydrolysate Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Arla Foods amba, AMCO Proteins, Kerry Group plc, Koninklijke DSM N.V., and Glanbia PLC. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in March 2020, Kerry Group plc acquired Pevesa Biotech, the Spanish non-allergenic and organic plant protein company. Pevesa Biotech is a provider of non-GMO, non-allergenic plant proteins for the clinical, infant, and general nutrition markets. It offers a range of proteins that comprise rice protein, organic pea, and protein hydrolysates. This acquisition will enhance the position of Kerry in the hydrolyzed plant protein space and augments its capacity to serve the growing plant protein market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global protein hydrolysate market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Arla Foods amba

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. AMCO Proteins

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kerry Group plc

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Koninklijke DSM N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Glanbia PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Protein Hydrolysate Market by Source

5.1.1. Plant Protein

5.1.2. Animal Protein

5.2. Global Protein Hydrolysate Market by Form

5.2.1. Dry

5.2.2. Liquid

5.3. Global Protein Hydrolysate Market by Application

5.3.1. Dietary Supplements

5.3.2. Sports Nutrition

5.3.3. Infant Formula

5.3.4. Food and Beverages

5.3.5. Animal Feed

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. AMCO Proteins

7.3. Archer Daniels Midland Co.

7.4. Arla Foods Ingredients Group P/S

7.5. Ba'emek Advanced Technologies Ltd.

7.6. Brisk Bioscience

7.7. Carbery Food Ingredients Ltd.

7.8. Cargill Inc.

7.9. Chaitanya Biologicals Private Ltd.

7.10. Danone S.A.

7.11. FrieslandCampina

7.12. Glanbia PLC

7.13. Griffith Foods Worldwide, Inc.

7.14. Hilmar Cheese Co, Inc.

7.15. Ingredia, Inc.

7.16. Kerry Group plc

7.17. Koninklijke DSM N.V.

7.18. Leprino Foods Co.

7.19. Mead Johnson & Company, LLC

7.20. Nestlé S.A.

7.21. Parabel USA, Inc.

7.22. Tate & Lyle PLC

7.23. Tatua Co-operative Dairy Co. Ltd.

1. GLOBAL PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL PLANT PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ANIMAL PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

5. GLOBAL DRY PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL LIQUID PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL PROTEIN HYDROLYSATE IN DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL PROTEIN HYDROLYSATE IN SPORTS NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PROTEIN HYDROLYSATE IN INFANT FORMULA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PROTEIN HYDROLYSATE IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL PROTEIN HYDROLYSATE IN ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL PROTEIN HYDROLYSATE IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

18. NORTH AMERICAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. EUROPEAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

21. EUROPEAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

22. EUROPEAN PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

27. REST OF THE WORLD PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

29. REST OF THE WORLD PROTEIN HYDROLYSATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL PROTEIN HYDROLYSATE MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL PROTEIN HYDROLYSATE MARKET SHARE BY FORM, 2019 VS 2026 (%)

3. GLOBAL PROTEIN HYDROLYSATE MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL PROTEIN HYDROLYSATE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

7. UK PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD PROTEIN HYDROLYSATE MARKET SIZE, 2019-2026 ($ MILLION)