Protein Labeling Market

Global Protein Labeling Market Size, Share & Trends Analysis Report, By Application (Immunological, Techniques, Protein Microarrays, Mass Spectrometry, Fluorescence Microscopy, Cell-Based Assays, and Other Assays), By Labelling Method (In-Vitro Labelling, and In-Vivo Labelling), By Product (Reagents, Kits, and Services) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

Global Protein Labeling Market is anticipated to grow at a CAGR of 13.1% during the forecast period. Increasing healthcare R&D expenditure is the key factor that driving the market growth. Researchers are exploring the proteomics market in universities, major hospitals, clinics, and research centres. As proteomics has moved out of the labs and into the market protein labeling products are in demand. Proteomic technologies are playing an important role in drug discovery, molecular diagnostics, and medicines which are creating significant demand for protein labeling applications and products. Increase in R&D expenditure for proteomics research is also driving the growth of the market. Apart from it, the increasing use of protein labeling in in-vitro labeling, and in vivo labeling techniques will provide opportunities for market growth during the forecast period.

Furthermore, in-vitro Labeling, and in-vivo Labeling techniques are based on genetic engineering which includes improved imaging technology and high sensitivity. Snap-tag and halo-tag are widely used method in these techniques. Halo-tag and snap-tag are significant tools for functional protein analysis based on the formation of the covalent bond between protein fusion tag and synthetic chemical ligand. However, technological advancement and upcoming innovation for protein labeling such as computer-controlled systems for fluorescence and laser-confocal microscopy are also creating the market demand during the forecast period. Growing competition in the Protein Labeling Market and lack of skilled professionals are restraining the market growth.

Segmental Outlook

The global Protein Labeling Market is segmented based on application, Labeling method, and product. Based on the application, the market is classified into immunological, techniques, protein microarrays, mass spectrometry, fluorescence microscopy, cell-based assays, and other assays. Based on the labeling method, the market is segregated into in-vitro labeling and in-vivo labeling. In-Vitro labeling is further classified into enzymatic labeling, dye-based labeling, co-translational labeling, site-specific labeling, and nanoparticle labeling. Moreover, in-vivo labeling is classified into photoreactive labeling, radioactive labeling, and biorthogonal labeling. Based on the product, the market is segmented into reagents, kits, and services. Additionally, reagents are classified into enzymes, monoclonal antibodies, proteins, probes/tags, and other reagents.

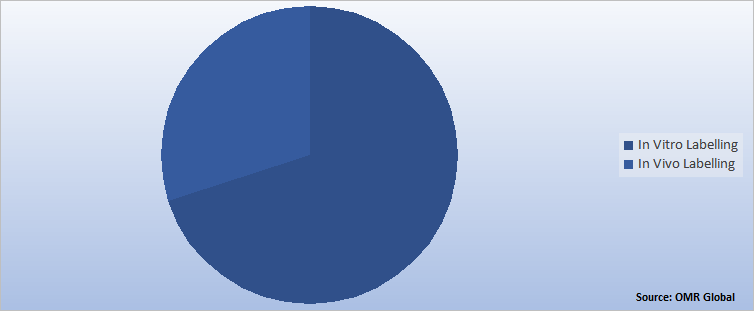

Global Protein Labeling Market Share by Labeling Method, 2020 (%)

In-Vitro Labeling segment is anticipated to grow significantly in the global protein labeling market

In-Vitro, the labeling method holds the largest share in 2020 and projected to grow at a significant CAGR during the forecast period. In-Vitro Labeling is further classified into enzymatic Labeling, dye-based Labeling, co-translational Labeling, site-specific Labeling, and nanoparticle Labeling. Among these various methods, enzymatic labeling dominated the market due to the highly specific action of the enzyme. Apart from it, the market growth is attributed to the growing consumption of in-vitro protein in biopharma companies and the increasing demand for continuous exchange in vitro protein synthesis. Growing R&D initiatives in in-vitro protein synthesis have expanded the adoption of in vitro protein expression systems.

Regional Outlooks

The global Protein Labeling Market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America accounted the highest market share across the globe due to ongoing projects on gene expression control, protein-protein interaction, in-vivo quantitative proteomics, and so on. The significant rise in research projects in universities, research centers, clinics, and hospitals triggered the demand for protein labeling products and methods. There is the huge adoption of global protein labeling products, application and labeling methods which are triggered by R&D projects, the rise in lifestyle-oriented diseases, development in proteomics & genomics and so forth. There are various major players are working on enhancing the portfolio in the protein Labeling in North America thus driving the growth of the market in the region.

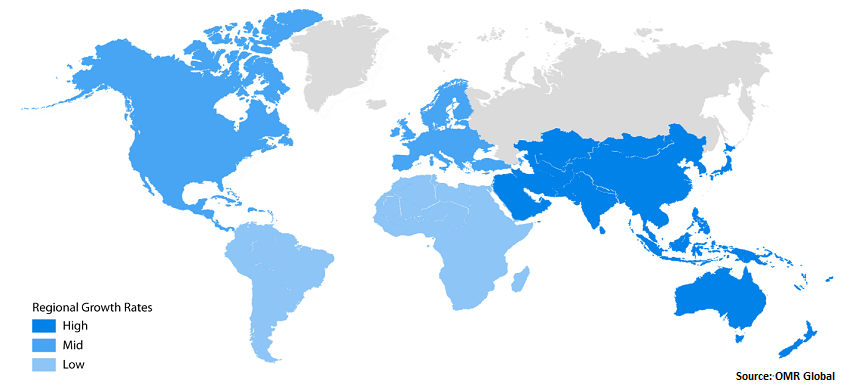

Global Protein Labeling Market Growth, by Region 2021-2027

Asia-Pacific projected to grow significantly in the global Protein Labeling Market

Asia-Pacific region is projected to grow at a considerable rate during the forecast period. The market is growing in the region due to improved healthcare expenditure, favorable government policies for protein labeling products and infrastructure development in the region. The market is also growing in the region due to ongoing research projects that drive proteomics-related research. The proteomics projects in Japan include the Structural Proteomics Project, Proteome Expression Database, Genome Medicine Database of Japan Proteomics, Chemotherapy and Cancer Proteomics Project, and Structural Genomics. Cell culture-based experiments, the rise in adoption of personalized medicines, the growth of flow Cytometry and tissue diagnostics are projected to create significant demand for protein labeling across the globe.

Market Players Outlook

The key players of the protein labeling market F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Promega Corporation, PerkinElmer, Inc., Thermo Fisher Scientific, Inc., General Electric Company, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, and acquisitions, collaborations, and new product launch, to stay competitive in the market. For instance, in April 2019, Perkin Elmer completed the acquisition of Cisbio Bioassays to expand its DELFIA, Alpha, and LANCE assay technologies from Cisbio’s range of kits and reagents. Cisbio capabilities to Perkin Elmer will enable life science researches and also expand the product portfolio.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Protein Labeling Market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Protein Labeling Market by Application

5.1.1. Immunological Techniques

5.1.2. Protein Microarrays

5.1.3. Mass Spectrometry

5.1.4. Fluorescence Microscopy

5.1.5. Cell-Based Assays

5.1.6. Other Assays

5.2. Global Protein Labeling Market by Labeling Method

5.2.1. In Vitro Labeling

5.2.1.1. Enzymatic Labeling

5.2.1.2. Dye-Based Labeling

5.2.1.3. Co-Translational Labeling

5.2.1.4. Site-Specific Labeling

5.2.1.5. Nanoparticle Labeling

5.2.2. In Vivo Labeling

5.2.2.1. Photoreactive Labeling

5.2.2.2. Radioactive Labeling

5.2.2.3. Biorthogonal Labeling

5.3. Global Protein Labeling Market by Product

5.3.1. Reagents

5.3.1.1. Enzymes

5.3.1.2. Monoclonal Antibodies

5.3.1.3. Proteins

5.3.1.4. Probes/Tags

5.3.1.5. Other Reagents

5.3.2. Kits

5.3.3. Services

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agilent Technologies, Inc.

7.2. Bruker Corp.

7.3. Chemical Computing Group ULC

7.4. C. Gerhardt GmbH & Co KG

7.5. General Electric Co.

7.6. Geno Technology Inc.

7.7. HORIBA, Ltd.

7.8. HYCEL Medical

7.9. Kaneka Corp.

7.10. LI-COR, Inc.

7.11. Merck & Co., Inc.

7.12. Malvern Panalytical Ltd.

7.13. New England Biolabs

7.14. Promega Corp.

7.15. Perkin Elmer, Inc.

7.16. Randox Laboratories Ltd.

7.17. SeraCare Life Sciences, Inc.

7.18. Thermo Fisher Scientific, Inc.

7.19. VELP Scientifica S.r.l.

1. GLOBAL PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

2. GLOBAL IMMUNOLOGICAL TECHNIQUES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL PROTEIN MICROARRAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL MASS SPECTROMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL FLUORESCENCE MICROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL CELL-BASED ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER ASSAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY LABELING METHOD, 2020-2027 ($ MILLION)

9. GLOBAL IN VITRO LABELING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL IN VITRO LABELING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

11. GLOBAL IN VIVO LABELING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL IN VIVO LABELING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

13. GLOBAL PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

14. GLOBAL REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL REAGENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

16. GLOBAL KITS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. NORTH AMERICAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

20. NORTH AMERICAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY LABELING METHOD, 2020-2027 ($ MILLION)

21. NORTH AMERICAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

22. EUROPEAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. EUROPEAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

24. EUROPEAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY LABELING METHOD, 2020-2027 ($ MILLION)

25. EUROPEAN PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC PROTEIN LABELING MARKET RESEARCH AND ANALYSIS BY LABELING METHOD, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC PROTEIN LABELING MARKET RESEARCH AND ANALYSIS PRODUCT, 2020-2027 ($ MILLION)

30. REST OF THE WORLD FREEZE DRYING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

31. REST OF THE WORLD FREEZE DRYING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

32. REST OF THE WORLD FREEZE DRYING MARKET RESEARCH AND ANALYSIS BY LABELING METHOD, 2020-2027 ($ MILLION)

33. REST OF THE WORLD FREEZE DRYING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

1. GLOBAL PROTEIN LABELING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

2. GLOBAL PROTEIN LABELING MARKET SHARE BY LABELING METHOD, 2020 VS 2027 (%)

3. GLOBAL PROTEIN LABELING MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

4. GLOBAL PROTEIN LABELING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL IMMUNOLOGICAL TECHNIQUES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL PROTEIN MICROARRAYS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL MASS SPECTROMETRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL FLUORESCENCE MICROSCOPY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL CELL-BASED ASSAYS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL OTHER ASSAYS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL IN-VITRO LABELING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL IN VIVO LABELING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL REAGENTS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL KITS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL SERVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. US PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

17. CANADA PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

18. UK PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

19. FRANCE PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

20. GERMANY PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

21. ITALY PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

22. SPAIN PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

23. REST OF EUROPE PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

24. INDIA PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

25. CHINA PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

26. JAPAN PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

27. SOUTH KOREA PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

28. REST OF ASIA-PACIFIC PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)

29. REST OF THE WORLD PROTEIN LABELING MARKET SIZE, 2020-2027($ MILLION)