Proteomics Market

Proteomics Market Size, Share & Trends Analysis Report by Product and Services (Instrumentation Technology, Reagents, and Software and Services), and by Application (Clinical Diagnostics, Drug Discovery and Development, and Others) Forecast Period (2024-2031)

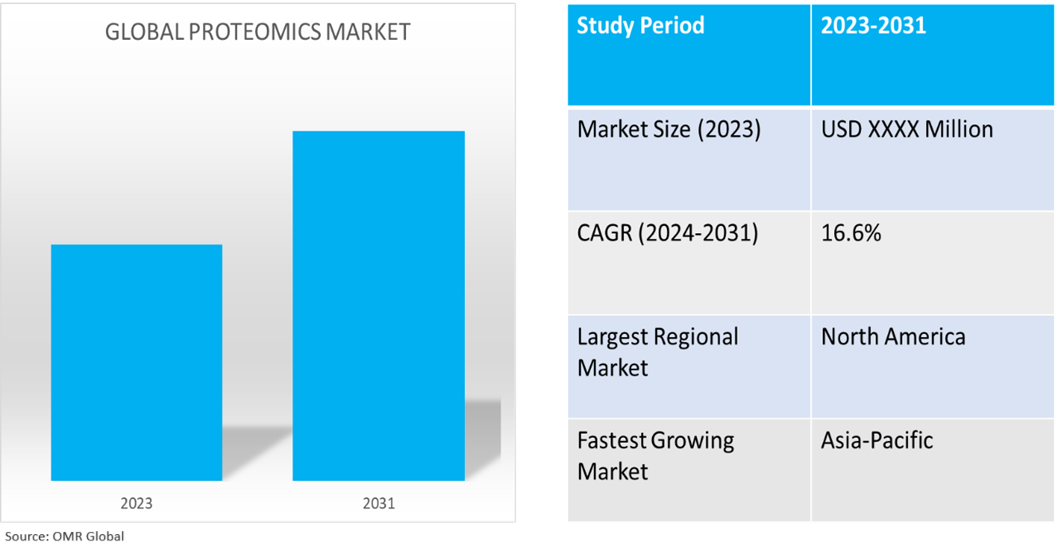

Proteomics market is anticipated to grow at a CAGR of 16.6% during the forecast period (2024-2031). The market is growing rapidly owing to technological advancements, increased R&D investments, and expanding biomedical research applications. Improvements in mass spectrometry, chromatography, and protein microarray technologies enhance the sensitivity, resolution, and throughput of proteomics analysis, while automation and robotics improve efficiency and reduce variability. Significant investments from governments, private sectors, and academic institutions drive research in biomarker discovery, drug development, and personalized medicine creating demand for the proteomics market.

Market Dynamics

Increasing Prevalence of Chronic Diseases

The demand for advanced proteomic diagnostic and treatment tools is rising as chronic diseases become more prevalent. According to the National Center for Chronic Disease Prevention and Health Promotion, in February 2024, an estimated 129 million individuals in the US are living with at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, as defined by the US Department of Health and Human Services. Over the past two decades, preventable and treatable chronic diseases have risen to five out of the top ten leading causes of mortality in the US. Currently, 42.0% of Americans manage multiple chronic conditions, with 12.0% affected by at least three, resulting in chronic diseases and mental health conditions accounting for approximately 90.0% of the annual $4.1 trillion health care expenditure.

Technological Advancements in Mass Spectrometry

Technological advancements in mass spectrometry, bioinformatics, and microarray technology have improved resolution, sensitivity, and high-throughput analysis for precise protein identification and quantification propelling the market growth. For instance, in May 2024, Seer, Inc. launched the Seer Technology Access Center (STAC) in Bonn, Germany, offering service programs and mass spectrometry technologies for deep, unbiased proteomic studies. The center aims to accelerate biomarker discovery and drug development by providing access to Seer's ProteographTM Product Suite and the latest technologies.

Market Segmentation

- Based on products and services, the market is segmented into instrumentation technology, reagents, and software and services. Instrumentation technology is further sub-segmented into spectroscopy, chromatography, electrophoresis, protein microarray, x-ray crystallography, and other instrumentation technologies.

- Based on the application, the market is segmented into clinical diagnostics, drug discovery and development, and others (research applications, agriculture, and animal proteomics).

Instrumentation Technology Sub-segment to Hold a Considerable Market Share

Academic-industry partnerships and international collaborations are essential for the development of new proteomics technologies and applications, enhancing knowledge sharing and technological advancements in the field that propel market growth. For instance, in June 2024, SPT Labtech and Olink Holding introduced an automation option for the Olink® Explore HT protocol for high-throughput proteomics, combining SPT Labtech's firefly® liquid handling platform. This allows for swift and precise execution of large-scale proteomics studies, enabling data-driven decisions and miniaturizing reactions without compromising accuracy.

Clinical Diagnostics Sub-Segment To Hold a Considerable Market Share

The rising prevalence of non-communicable diseases (NCDs) necessitates advanced diagnostic tools and technologies, with proteomics essential in identifying molecular processes. According to the World Health Organization, in September 2023, Noncommunicable diseases (NCDs) resulted in 41 million fatalities annually, which constitutes 74.0% of global fatalities. Premature fatalities from NCDs, occurring before age 70, total 17 million each year, with 86.0% of these occurring in low- and middle-income countries. Cardiovascular diseases lead to 17.9 million annual fatalities, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney disease fatalities caused by diabetes).

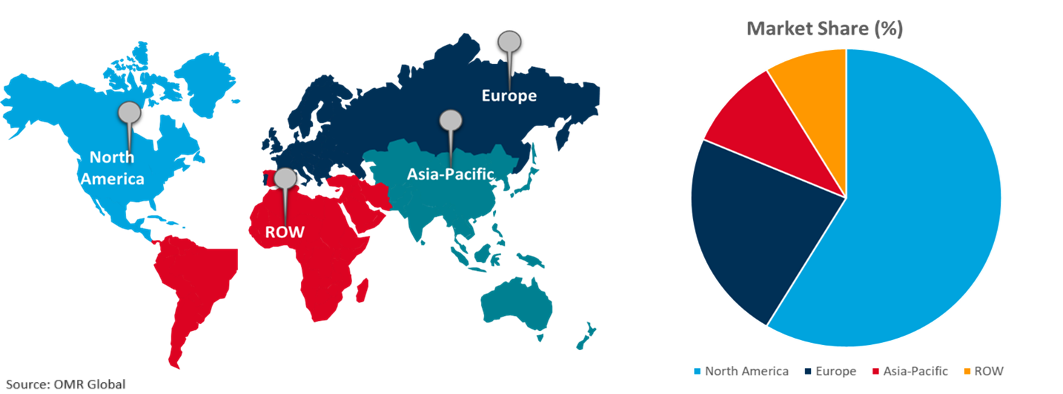

Regional Outlook

The global proteomics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Proteomics Market Growth by Region 2024-2031

North America Holds a Major Market Share

Regulatory support and market adoption of proteomics-based products ensure safety and efficacy while increasing adoption in academic research, clinical laboratories, and biotechnology companies drives market growth. For instance, in March 2024, Bruker Corp. significantly advanced immunopeptidomics, glycoproteomics at US HUPO, and other CCS-enabled 4D-proteomics workflows. These advancements complement other life-science tools for the post-genomic era, enabling post-genomic molecular and cell biology research. The company's latest developments include improved machine-learning de novo sequencing (Novor V2.0), a high-performance monitoring digital-twin software (TwinScape), a new glyco-PASEF method for high-sensitivity glycopeptide analysis, and access to Spectronaut 18 for Bruker ProteoScape users.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the proteomics market include Agilent Technologies, Inc., Bruker Corp., Danaher Corp., Merck KGaA, and Thermo Fisher Scientific Inc. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in July 2024, Thermo Fisher Scientific acquired Olink Holding AB. The acquisition expanded Thermo Fisher's Life Sciences Solutions segment, enabling scientists to accelerate discovery and scientific breakthroughs while delivering significant value to shareholders.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global proteomics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Agilent Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bruker Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Danaher Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Proteomics Market by Product and Services

4.1.1. Instrumentation Technology

4.1.1.1. Spectroscopy

4.1.1.2. Chromatography

4.1.1.3. Electrophoresis

4.1.1.4. Protein Microarrays

4.1.1.5. X-Ray Crystallography

4.1.1.6. Other Instrumentation Technologies

4.1.2. Reagents

4.1.3. Software and Services

4.2. Global Proteomics Market by Application

4.2.1. Clinical Diagnostics

4.2.2. Drug Discovery and Development

4.2.3. Others (Research Applications, and Agriculture and Animal Proteomics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Bayer AG

6.2. Beckman Coulter, Inc.

6.3. Becton, Dickinson and Co.

6.4. Biognosys Inc

6.5. Bio-Rad Laboratories, Inc.

6.6. Evotec SE

6.7. GE Healthcare Technologies Inc.

6.8. GHO Capital Partners LLP

6.9. LUMITOS AG

6.10. Merck KGaA

6.11. PerkinElmer U.S. LLC

6.12. Promega Corp.

6.13. Proteome Sciences plc

6.14. SCIEX

6.15. Sciomics GmbH

6.16. Shimadzu Corp.

6.17. SomaLogic, Inc.

6.18. Thermo Fisher Scientific Inc.

6.19. Waters Corp.

1. Global Proteomics Market Research And Analysis By Product and Services, 2023-2031 ($ Million)

2. Global Instrumentation Technology For Proteomics Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Reagents For Proteomics Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Software and Services For Proteomics Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Proteomics Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Proteomics In Clinical Diagnostics Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Proteomics In Drug Discovery and Development Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Proteomics In Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Proteomics Market Research And Analysis By Region, 2023-2031 ($ Million)

10. North American Proteomics Market Research And Analysis By Country, 2023-2031 ($ Million)

11. North American Proteomics Market Research And Analysis By Product and Services, 2023-2031 ($ Million)

12. North American Proteomics Market Research And Analysis By Application, 2023-2031 ($ Million)

13. European Proteomics Market Research And Analysis By Country, 2023-2031 ($ Million)

14. European Proteomics Market Research And Analysis By Product and Services, 2023-2031 ($ Million)

15. European Proteomics Market Research And Analysis By Application, 2023-2031 ($ Million)

16. Asia-Pacific Proteomics Market Research And Analysis By Country, 2023-2031 ($ Million)

17. Asia-Pacific Proteomics Market Research And Analysis By Product and Services, 2023-2031 ($ Million)

18. Asia-Pacific Proteomics Market Research And Analysis By Application, 2023-2031 ($ Million)

19. Rest Of The World Proteomics Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Rest Of The World Proteomics Market Research And Analysis By Product and Services, 2023-2031 ($ Million)

21. Rest Of The World Proteomics Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Proteomics Market Share By Product and Services, 2023 Vs 2031 (%)

2. Global Instrumentation Technology For Proteomics Market Share By Region, 2023 Vs 2031 (%)

3. Global Reagents For Proteomics Market Share By Region, 2023 Vs 2031 (%)

4. Global Software and Services For Proteomics Market Share By Region, 2023 Vs 2031 (%)

5. Global Proteomics Market Share By Application, 2023 Vs 2031 (%)

6. Global Proteomics In Clinical Diagnostics Market Share By Region, 2023 Vs 2031 (%)

7. Global Proteomics In Drug Discovery and Development Market Share By Region, 2023 Vs 2031 (%)

8. Global Proteomics In Other Application Market Share By Region, 2023 Vs 2031 (%)

9. Global Proteomics Market Share By Region, 2023 Vs 2031 (%)

10. US Proteomics Market Size, 2023-2031 ($ Million)

11. Canada Proteomics Market Size, 2023-2031 ($ Million)

12. UK Proteomics Market Size, 2023-2031 ($ Million)

13. France Proteomics Market Size, 2023-2031 ($ Million)

14. Germany Proteomics Market Size, 2023-2031 ($ Million)

15. Italy Proteomics Market Size, 2023-2031 ($ Million)

16. Spain Proteomics Market Size, 2023-2031 ($ Million)

17. Rest Of Europe Proteomics Market Size, 2023-2031 ($ Million)

18. India Proteomics Market Size, 2023-2031 ($ Million)

19. China Proteomics Market Size, 2023-2031 ($ Million)

20. Japan Proteomics Market Size, 2023-2031 ($ Million)

21. South Korea Proteomics Market Size, 2023-2031 ($ Million)

22. Rest Of Asia-Pacific Proteomics Market Size, 2023-2031 ($ Million)

23. Latin America Proteomics Market Size, 2023-2031 ($ Million)

24. Middle East And Africa Proteomics Market Size, 2023-2031 ($ Million)