Pulse electromagnetic field therapy devices Market

Global Pulse electromagnetic field therapy devices Market Size, Share & Trends Analysis Report by Device (High-frequency Devices, Mid-frequency Devices, and Low-frequency Devices) By End-user (Hospitals & Clinics, Home Care Settings, and Others), Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global Pulse electromagnetic field therapy devices market is anticipated to grow at a CAGR of around 7.6% during the forecast period. Pulsed Electro-Magnetic Field (PEMF) therapy uses technology to stimulate and exercise cells to help resolve cellular dysfunction and to support overall wellness. PEMF therapy sends magnetic energy into the body. The magnetic fields help you to increase electrolytes and ions. The market is expected to rise due to an increase in the global geriatric population and increased awareness of pulsed electromagnetic field (PEMF) therapy devices. The market position is also projected to grow by technological improvements such as the development of narrow, compact PEMF therapeutic devices using innovative materials. The PEMF therapy devices promote the healing of bones during treatment of failed spinal fusions, fracture nonunion, delayed unions, and fresh fractures. According to the International Osteoporosis Foundation, osteoporosis causes about 8.9 million fractures annually. PEMF therapy is a novel treatment option for several musculoskeletal problems. The FDA has approved PEMF devices for the treatment of non-union fractures as well as post-operative osteoarthritis, plantar fasciitis, discomfort, and edema. However, PEMF therapy's lack of experimental validation and lack of understanding of the mechanism of bone healing effect may hinder the market growth.

Segmental Outlook

The global pulse electromagnetic field therapy devices market is segmented into devices and applications. Based on devices, the market is segregated into high-frequency devices, mid-frequency devices, and low-frequency devices. Further based on end-user the market is segmented into hospitals & clinics, home care settings, and others.

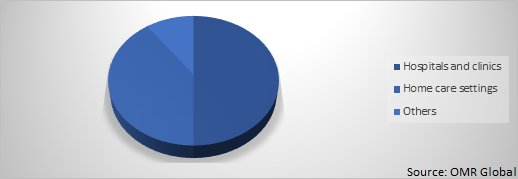

Global Pulse electromagnetic field therapy devices Market Share by End-User, 2021 (%)

The Hospitals & Clinics Segment is Projected to Have a Significant Share in the Global Pulse Electromagnetic Field Therapy Devices Market

Among end-user, the hospitals & clinics segment is estimated to have a considerable share in the Pulse electromagnetic field therapy devices market. The rising number of incidents of COVID-19 is a primary reason driving the segment's growth. In patients with COVID-19 disease, the severe acute respiratory syndrome coronavirus causes low oxygen saturation and respiratory failure. In a study of COVID-19 patients conducted in 2020, researchers discovered a substantial positive link between magnetic flux density, frequency, or temperature related to actual low-field thoracic magnetic stimulation (LF-TMS) and SpO2 levels in all COVID-19 patients. As a result, of this positive clinical data, hospitals are more likely to access pulse electromagnetic field therapy devices, which will encourage segmental growth. Moreover, fractures caused by accidents, sports injuries, and indications such as knee pain, joint pain, and arthritis are all driving factors in the segment's growth. As per the National Safety Council (NSC), in 2020 bicycling accounted for about 426,000 injuries, the most of any category of sports and recreation.

Regional Outlooks

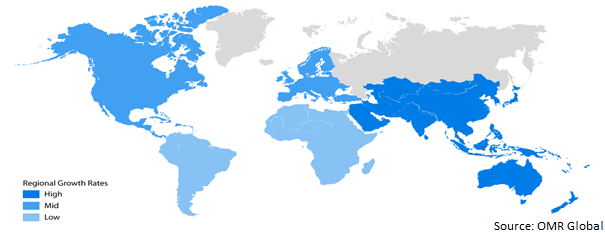

The global pulse electromagnetic field therapy devices market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is projected to have a considerable CAGR in the global market and the growth is attributed to rising patient awareness levels related to the commercial availability of PEMF therapy devices along with constant improvement in healthcare infrastructure are expected to accelerate the market growth. Moreover, the increased popularity of home healthcare, as well as the growing geriatric population in the various Asia Pacific developing economies, are likely to drive regional market growth.

Global Pulse electromagnetic field therapy devices Market Growth, by region 2022-2028

North America is projected to have a significant share in the global Pulse electromagnetic field therapy devices market during the forecast period.

Geographically, North America is estimated to have a considerable share in the global Pulse electromagnetic field therapy devices market during the forecast period. The increased number of patients with osteoporosis and osteoarthritis in the region is expected to increase the demand for pulsed electromagnetic field therapy device therapy. Furthermore, the region's growth is likely to be aided by the ongoing move to minimally invasive procedures. In addition, the presence of a well-developed healthcare system in the US is expected to promote product demand. Furthermore, the presence of well-established market players in the US contributes to the region's market growth. For instance, Orthofix Medical Inc, a company established in the US, has over 30 years of experience in treating patients, and it's bone development therapy devices are the most commonly prescribed bone growth stimulators in the country.

Market Players Outlook

The key players of the pulsed electromagnetic field therapy devices market are Bedfont Scientific, Orthofix Holdings, I-Tech Medical Division, OSKA, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in May 2018, Practical Pain Management launched a new technology column, offering clinical reviews of the latest pain management devices, mobile applications, and more. The product is called SKA Pulse, a pulsed electromagnetic field wearable device is an FDA-registered Medical Device Class 1 is a manufacturer that is indicated for acute or persistent pain due to injury in the knee, back, muscles, and joints.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pulse electromagnetic field therapy devices market

- Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Pulse electromagnetic field therapy devices Industry

• Recovery Scenario of Global Pulse electromagnetic field therapy devices Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pulse electromagnetic field therapy devices Market by Device

5.1.1. High-frequency Devices

5.1.2. Mid-frequency Devices

5.1.3. Low-frequency Devices

5.2. Global Pulse electromagnetic field therapy devices Market by End-User

5.2.1. Hospitals & Clinics

5.2.2. Home Care Settings

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Bedfont Scientific

7.2. Bemer, LLC

7.3. BioBalance PEMF

7.4. Curatronic Ltd.

7.5. EarthPulse

7.6. Greensea Systems, Inc.

7.7. I-Tech Medical Division

7.8. Magnus Magnetica, LLC

7.9. Medithera

7.10. Nuage Health Devices Pvt. Ltd.

7.11. Orthofix Medical Inc.

7.12. Oska Pulse

7.13. Owens & Minor, Inc.

7.14. Oxford Medical Instruments Health Store

7.15. Pulsed Energy Technologies LLC

7.16. Swiss Bionic Solutions Canada Inc.

1. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICE, 2021-2028 ($ MILLION)

2. GLOBAL ULTRA HIGH POWER (UHP) PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MID-FREQUENCY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LOW-FREQUENCY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL GRAPHITE ELECTRODEMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

6. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR HOME CARE SETTINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR OTHER END UERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

13. EUROPEAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICE, 2021-2028 ($ MILLION)

15. EUROPEAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. REST OF THE WORLD PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET, 2021-2028 (%)

4. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY DEVICE, 2021 VS 2028 (%)

5. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ULTRA HIGH POWER (UHP) PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL MID-FREQUENCY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL LOW-FREQUENCY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR HOSPITALS & CLINICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR HOME CARE SETTINGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES FOR OTHER END-USER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

15. UK PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

20. ROE PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

24. ASEAN PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD PULSE ELECTROMAGNETIC FIELD THERAPY DEVICES MARKET SIZE, 2021-2028 ($ MILLION)