Pulse Protein Market

Global Pulse Protein Market Size, Share & Trends Analysis Report by Source (Beans, Peas, Lentils, and Others), by form (Isolates, Hydrolysates, and Concentrates) by Nature (Organic and Conventional) and by End-User (Food & Beverages, Pharmaceuticals, Feed, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global pulse protein market is anticipated to grow at a significant CAGR of around 4.5% during the forecast period. Increasing demand for clean-label and gluten-free food products among health-conscious consumers globally is augmenting the pulse protein market. The customers demand food products that are processed without any additives and should be protein-rich.In addition, rising awareness among consumers about plant-based proteins along with their increased applications in food product development as pulse protein offers improved flavor & mouth feel and digestive ease is, are positively helping in the growth of the market. Significant investment in protein-rich diets and supplements by the millennials in high disposable income countries aids in the growth of the pulse protein market. As per the CRN Consumer Survey on Dietary Supplements in 2019, 77 percent of Americans consume dietary supplements among which vitamins & minerals continue to be the most commonly consumed supplement category. Moreover, an average American spends $56 each month on supplementation. In fact, over 60% of the population spends more than $40 each month on their supplements. Around 97% of Americans admit to spending money on protein shakes every month. .

Rising collaborations among prominent players to fulfill the surging market demands further assist in market growth. For instance, In October 2021, Bühler Group and Hosokawa Alpine Group collaborated to accelerate and strengthen the production of healthier and sustainable plant protein solutions. The companies in partnership are able to offer their customer process technology and expertise along the complete field-to-fork pulses protein chain. Both the companies, Bühler's upstream pulses process, and Hosokawa’s company processes size reduction and classification, produce the highest yields of high protein concentrates that are rich in the source.

Impact of COVID-19 Pandemic on Global Pulse Protein Market

COVID-19 impacted pulse protein in processed food categories such as snacks, bakery and confectionery, breakfast cereals, and functional drinks has surged in increased sales during this period, hence offsetting the decline in the foodservice industry. Additionally, processed food products are been a majorly consumed area for pulse protein and resilience of this sector. As there was an increasing demand for immunity-boosting supplements the pulse protein was gaining traction owing to its rich in proteins value.?

Segmental Outlook

The global pulse protein market is segmented based on the source, form, nature, and end-user. Based on the source, the market is segmented into beans, peas, lentils, and others. Based on the form, the market is sub-divided into isolates, hydrolysates, and concentrates. On the basis of nature, the market is sub-classified into organic and conventional. Based on the end-user, the market is sub-divided into food & beverages, pharmaceuticals, feed, and others. Among the form segment, the concentrates segment is dominating owing to its nutritional benefits of pulses that are leading in demand for processing pulses into concentrates, starches, and flours. Pulse concentrates are majorly used as an ingredient in food and animal feed and are a key concentrate is a key source of proteins.?

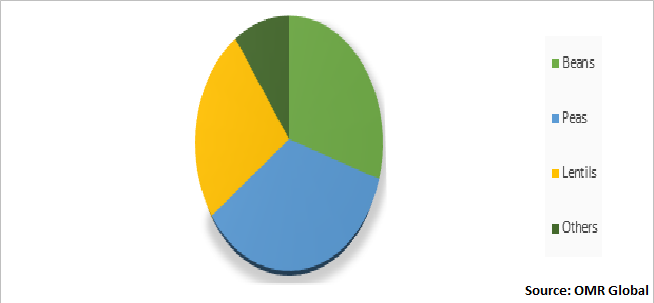

Global Pulse Protein Market Share by Source, 2021 (%)

The Peas Segment is Dominating the Global Pulse Protein Market

Several pulse proteins such as pea protein is seeking growth in the plant-based protein sector, on the back of its high protein concentration and no harmful effects side effects on the body that has further growing uses in numerous end-use industries among others. Peas pulse protein contains minerals such as iron, zinc, magnesium, and phosphorus, that help in the promotion of good health and provide proteins and energy to the body. Moreover, due to their high fiber content, pea pulse is considered in helping the reduction of cholesterol and the maintenance of blood sugar levels. The food driven by the pea pulse, such as pea starches, pea proteins, and pea flours, are used as primary ingredients in a variety of items, such as baked goods, sauces, soups, and other food products, and such factors are driving the global pea pulse protein market.

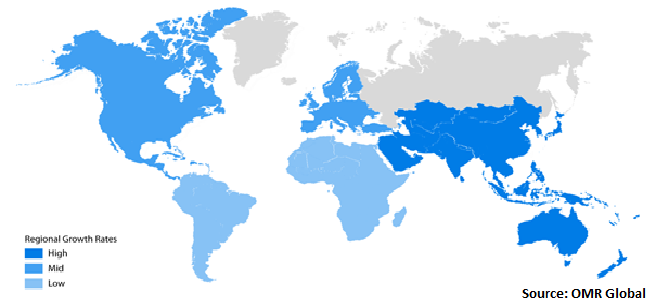

Regional Outlooks

The global pulse protein market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America is dominating owing to various factors such as increasing consumer awareness coupled with high nutrition intake, increasing consumer preference towards a healthy lifestyle, and the presence of key players with key their prime focus on new product development.?

Global Pulse Protein Market Growth, by Region 2022-2028

The Asia-Pacific Region is Emerge as Fastest Growing in the Global Pulse Protein Market

Due to extensive consumption of pulse proteins across the Asia-Pacific regions, the market is showing impressive growth. The highly developed processed food industry in the region’s major economiesis the another big reason the demand for pulse protein is increasing . The companies involved in food processing are increasingly utilizing nutrition-rich, plant-based ingredients in their product portfolio that are promoting the use of pulse protein. Furthermore, the lactose intolerant population in the region is continuously growing and along with this consumers are also avoiding gluten in their diets. Hence, pulse proteins are naturally lactose-free and gluten-free. These are the factors that are increasing the demand for pulse protein in the Asia Pacific.

Market Players Outlook

The major companies serving the global Pulse Protein market include AGT Foods, Axiom Food Inc., Cargill, Incorp., ErMats International Foods Ltd., Ingredion Incor., Kerry Group plc, NOW Health Group, Inc., Roquette Frère, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2020, PLT Health Solutions and Nutriati launched a new ingredient for plant-based, meat analog solutions such as hamburgers, meatballs and pizza toppings, chicken, fish, and pork products. The newly launched Artesa Textured pulse protein is a proprietary ingredient that has been manufactured to control final ingredient specifications on the products. The ingredient of the products enables product developers to better reproducible results that in meat analogs, also in formulation predictability, cleaner labels, and ultimately, a more meat-like experience.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Pulse Protein market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Pulse Protein Market

- Recovery Scenario of Global Pulse Protein Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. AGT Foods

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Cargill, Inc..

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ingredion Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kerry Group plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Roquette Frères

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Pulse Protein Market by Source

4.1.1. Beans

4.1.2. Peas

4.1.3. Lentils

4.1.4. Others

4.2. Global Pulse Protein Market by Form

4.2.1. Isolates

4.2.2. Hydrolysates

4.2.3. Concentrates

4.3. Global Pulse Protein Market by Nature

4.3.1. Organic

4.3.2. Conventional

4.4. Global Pulse Protein Market by End-User

4.4.1. Food & Beverages

4.4.2. Pharmaceuticals

4.4.3. Feed

4.4.4. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADM

6.2. Amano Enzyme Inc.

6.3. Artesa by Nutriati

6.4. Axiom Food Inc.

6.5. Bob's Red Mill Natural Foods, Inc.

6.6. Burcon

6.7. Eat Well Investment Group Inc.'s

6.8. ErMats International Foods Ltd.

6.9. Louis Dreyfus Company B.V.

6.10. Midcoast.

6.11. MORRE-TEC Industries

6.12. NOW Health Group, Inc.

6.13. Popular Pulse Products Pvt. Ltd.

6.14. Pulse Canada

6.15. Pulse Kitchen

6.16. PURIS

6.17. Soufflet Group

6.18. Targray Technology International Inc.

6.19. The Scoular Co.

6.20. Valency International Pte Ltd

1. GLOBAL PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

2. GLOBAL BEANS PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PEAS PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

4. GLOBAL LENTILS PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

5. GLOBAL OTHERS PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

6. GLOBAL PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

7. GLOBAL ISOLATES PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL HYDROLYSATES PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CONCENTRATES PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

11. GLOBAL ORGANIC PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CONVENTIONAL PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

14. GLOBAL PULSE PROTEINI IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL PULSE PROTEIN IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL PULSE PROTEIN IN FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL PULSE PROTEIN IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

21. NORTH AMERICAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

22. NORTH AMERICAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23. EUROPEAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. EUROPEAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

25. EUROPEAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

26. EUROPEAN PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

27. EUROPEAN PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC PULSE PROTEINMARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

33. REST OF THE WORLD PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

36. REST OF THE WORLD PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY NATURE, 2021-2028 ($ MILLION)

37. REST OF THE WORLD PULSE PROTEIN MARKET RESEARCH AND ANALYSIS BY END-USER,2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PULSE PROTEIN MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PULSE PROTEIN MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL PULSE PROTEIN MARKET, 2021-2028 (%)

4. GLOBAL PULSE PROTEIN MARKET SHARE BY SOURCE, 2021 VS 2028 (%)

5. GLOBAL BEANS PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL PEAS PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL LENTILS PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL OTHER PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL PULSE PROTEIN MARKET SHARE BY FORM, 2021 VS 2028 (%)

10. GLOBAL ISOLATES PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL HYDROLYSATES PULSE PROTEINMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL CONCENTRATES PULSE PROTEINMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL PULSE PROTEIN MARKET SHARE BY NATURE, 2021 VS 2028 (%)

14. GLOBAL ORGNIC PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL CONVENTIONAL PULSE PROTEINMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL PULSE PROTEIN MARKET SHARE BY END-USER, 2021 VS 2028 (%)

17. GLOBAL PULSE PROTEIN IN FOOD & BEVERAGES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL PULSE PROTEIN IN PHARMACEUTICALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL PULSE PROTEIN IN FEED MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL PULSE PROTEIN IN OTHERSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. GLOBAL PULSE PROTEIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22. US PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

23. CANADA PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

24. UK PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

25. FRANCE PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

26. GERMANY PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

27. ITALY PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

28. SPAIN PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF EUROPE PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

30. INDIA PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

31. CHINA PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

32. JAPAN PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

33. SOUTH KOREA PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF ASIA-PACIFIC PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD PULSE PROTEIN MARKET SIZE, 2021-2028 ($ MILLION)