Purified Terephthalic Acid (PTA) Market

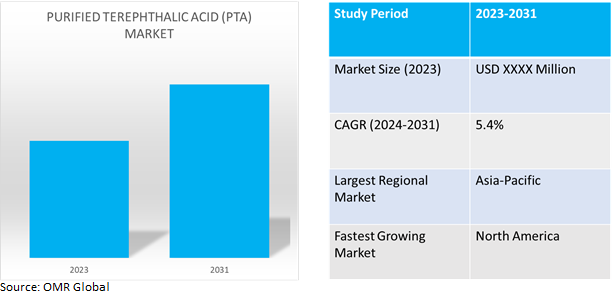

Purified Terephthalic Acid (PTA) Market Size, Share & Trends Analysis Report by Type (Polyester, Fiber & Yarn Grade, Polybutylene terephthalate (PET) Grade, Film Grade, Polybutylene Terephthalate (PBT), Plasticizers and Others), and by Application (Textile, PET Bottles, Packaging and Others) Forecast Period (2024-2031)

Purified terephthalic acid (PTA) market is anticipated to grow at a considerable CAGR of 5.4% during the forecast period (2024-2031).Purified terephthalic acid (PTA) is a polymer used in the production of polyester-coated resins for coil coatings, industrial repair, automotive components, and general metal processing. This material is utilized in the automotive industry for coating automobile parts. PTA, main advantages include its ability to remove greasy stains, clay, and dirt from surfaces.

Market Dynamics

Growing demand for bio-based terephthalic acid sector

More businesses are investigating the possibility of producing PTA from bio-based feedstocks rather than crude oil. This trend benefits the environment since it decreases greenhouse gas emissions and lessens the need for fossil fuels. With ongoing researches advancement in these techniques is anticipated to promote the market in near future.. There will probably be interest from stakeholders and companies attempting to be more sustainable. This indicates a shift toward environmentally friendly options, which may lead to increased opportunities and improved technologies down the road. Businesses in the bio-based terephthalic acid sector including Annellotech, Primus, Avantium, and Gevo can contribute to the market's growth with their creative manufacturing techniques and cutting-edge technology.

Rising demand for recycling polyethylene

The issue of plastic waste is being addressed in part by improved methods of recycling polyethylene terephthalate (PET) plastic. These techniques, which include depolymerization and chemical recycling, can recover valuable materials from used plastic. These recycling methods are becoming more and more common as more people choose to reuse items. This is increasing the market for recycling and promoting more environmentally friendly plastic production.For instance, BP introduced BP Infinia, an improved recycling technique that made it possible to create new, virgin-quality feedstocks from PET plastic trash that was not recyclable. PET used to make bottles is gathered for recycling in less than 60.0% of cases. This implies that future advances in this area are possible.

Market Segmentation

Our in-depth analysis of the global purified terephthalic acid (PTA)market includes the following segments by application, and end-user:

- Based on application, the market is sub-segmented into polyester, fiber & yarn grade, polybutylene terephthalate (PET) grade, film grade, polybutylene terephthalate (PBT), plasticizers, others.

- Based on end-user, the market is augmented into textile, pet bottles, packaging and others

Polyester is Projected to Emerge as the Largest Segment

The versatility of polyester makes it a popular material for many purposes. Compared to natural fibers like cotton and silk, it is less expensive to create.It is therefore favored in the apparel sector. It is robust and long-lasting. These characteristics make it perfect for sportswear and outdoor apparel. Polyester is more popular among urban dwellers and fashionistas. As a result, polyester applications are increasing in the market.

Regional Outlook

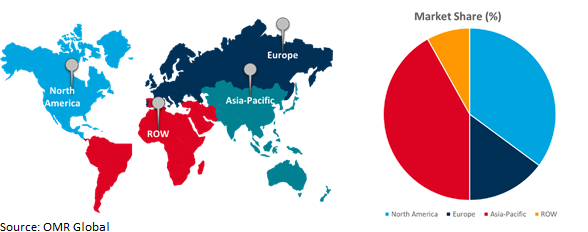

The global purified terephthalic acid (PTA) market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America countries has rising demand for PTA

- PTA production has helped the US businesses to become less reliant on foreign suppliers and strengthen their supply chains.

- PTA now be produced more affordably due to the use of ethane from shale gas by American producers.

Global Purified Terephthalic Acid (PTA) Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Due to the existence of developed downstream packaging, textile manufacturing, and food and beverage industries in nations like China and India, the Asia-Pacific region holds a dominant market share in the global PTA market. The development of these nations' downstream sectors is also driven by the low production costs and easy access to cheap labor. In terms of terephthalic acid production and demand, China is the global leader. Furthermore, China is expanding its terephthalic acid production capacity significantly in order to strengthen its position in the downstream markets.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global purified terephthalic acid (PTA) market include Mitsubishi Chemical Corp., Reliance Industries Ltd., Samsung Petrochemical Co. Ltd., Indorama Ventures Public Company Ltd., BP PLC,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2022, INEOS Aromatics reduced the CO2 emissions and increased the capacity with $70.0 million modernization of PTA facility in Merak, Indonesia. The installation of a larger oxidation reactor, reconfiguration of the reactor’s heat recovery system and revamp of the process air compressor train has reduced CO2 emissions per ton by 15.0% and increase the site capacity by 15.0%, from 500,000 tonnes to 575,000 tonnes per annum.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global purified terephthalic acid (PTA)market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Mitsubishi Chemical Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Reliance Industries Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Samsung Petrochemical Co. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Purified Terephthalic Acid (PTA) Market by Type

4.1.1. Polyester

4.1.2. Fiber & Yarn Grade

4.1.3. Polybutylene terephthalate (PET) Grade

4.1.4. Film Grade

4.1.5. Polybutylene Terephthalate (PBT)

4.1.6. Plasticizers

4.1.7. Others

4.2. Global Purified Terephthalic Acid (PTA) Market by Application

4.2.1. Textile

4.2.2. PET Bottles

4.2.3. Packaging

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alfa Group

6.2. BP PLC

6.3. DuPont Inc.

6.4. Eastman Chemical Company

6.5. Formosa Plastics Corp.

6.6. Indian Oil Corp Ltd.

6.7. Indorama Ventures Public Company Ltd.

6.8. Mitsui Chemicals Inc.

6.9. Samyang Corp.

6.10. Saudi Basic Industries Corp.

6.11. Sinopec Yizheng Chemical Fibre Company

1. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL POLYESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FIBER & YARN GRADE PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL POLYBUTYLENE TEREPHTHALATE (PET) GRADE PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FILM GRADE PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL POLYBUTYLENE TEREPHTHALATE (PBT) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) IN PLASTICIZERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER TYPE OF PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR TEXTILEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR PET BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFICPURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFICPURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD PURIFIED TEREPHTHALIC ACID (PTA)MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL POLYESTER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FIBER & YARN GRADEMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL POLYBUTYLENE TEREPHTHALATE (PET) GRADE PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FILM GRADE PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PURIFIED POLYBUTYLENE TEREPHTHALATE (PBT) MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR PLASTICIZERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHER TYPE OF PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR TEXTILEMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR PET BOTTLESMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR PACKAGINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL PURIFIED TEREPHTHALIC ACID (PTA) MARKET SHAREBY REGION, 2023 VS 2031 (%)

15. US PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

17. UK PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC PURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICAPURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICAPURIFIED TEREPHTHALIC ACID (PTA)MARKET SIZE, 2023-2031 ($ MILLION)